While the popularity of GameFi continues to grow, there are still relatively few truly fun games among the 1,322 total.

In many cases, it is not enough to evaluate the potential of a project just by looking at screenshots or breakthroughs, because the playability of a game is a subjective point.

Instead, investors and analysts must go beyond the surface and consider the data behind a game. Here are three key metrics to look for when evaluating the health and potential of a GameFi project.

1. Number of users on the protocol

The number of users is the number of players in the GameFi program and is key to the healthy operation of the GameFi ecosystem. It also reflects the popularity of the game project among users.

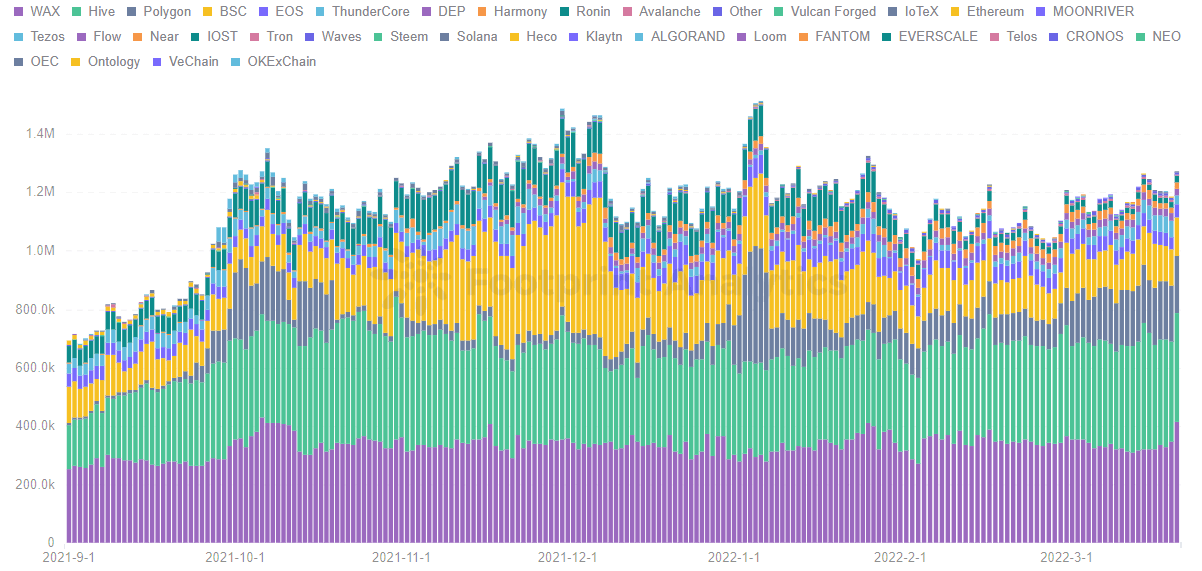

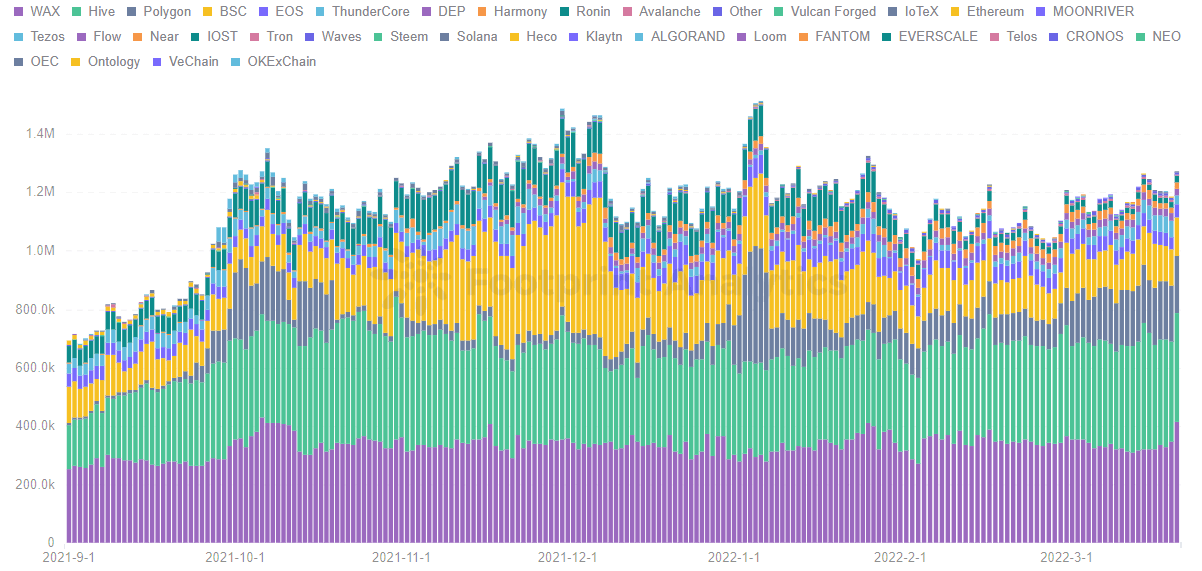

According to Footprint Analytics data, the number of GameFi users has been increasing and reaching a balance since April 2021. This is highly correlated with the rapid growth of many projects and the continuous development of the GameFi market.

The number of users on the chain shows that the public chains with more users in the last 3 months are mainly WAX, Hive, Polygon and BSC.

Among them, Splinterlands, like the Hive chain, has around 300,000 daily users and accounts for more than 98% of the users on the Hive chain. Splinterlands is one of the more popular gaming projects recently, with its native token SPS priced at less than $0.1, lowering the threshold for players to participate in the game through its low issue price.

There is also the WAX, which has been able to maintain a large number of users, which shows that the games in the WAX ecosystem are more tough compared to other blockchains. And players can play Alien Worlds for free on its chain and earn $10 to $15 for a few hours of play.

Compare this to Axie Infinity on the Ronin chain, where the average number of daily users has dropped from 120,000 to around 20,000 over the past 6 months. The difference in this number is that most of the game users’ activities are performed off-chain, and only transactions involving game props are settled on-chain. Therefore, the high gas fees for on-chain and inefficient on-chain transactions are the reasons for the decline in its user base.

Across various successful projects, 3 things stand out:

Should be applicable to all crypto users and have a low threshold in addition to game types that appeal to users. The Play to Earn model is also an important indicator of high user popularity. To have low gas fees and efficient capacities.

If the project does not focus on the growth of the number of users, even if the content richness of the game project gradually increases, it will become worthless without users.

2. Transactions per capita

Since GameFi requires more capabilities from the network than traditional games, protocols supporting these projects require cheaper gas fees and fast transactions. As a result, many blockchains are deploying dedicated chains specifically for gaming applications and improving capabilities to facilitate more project use and user transactions.

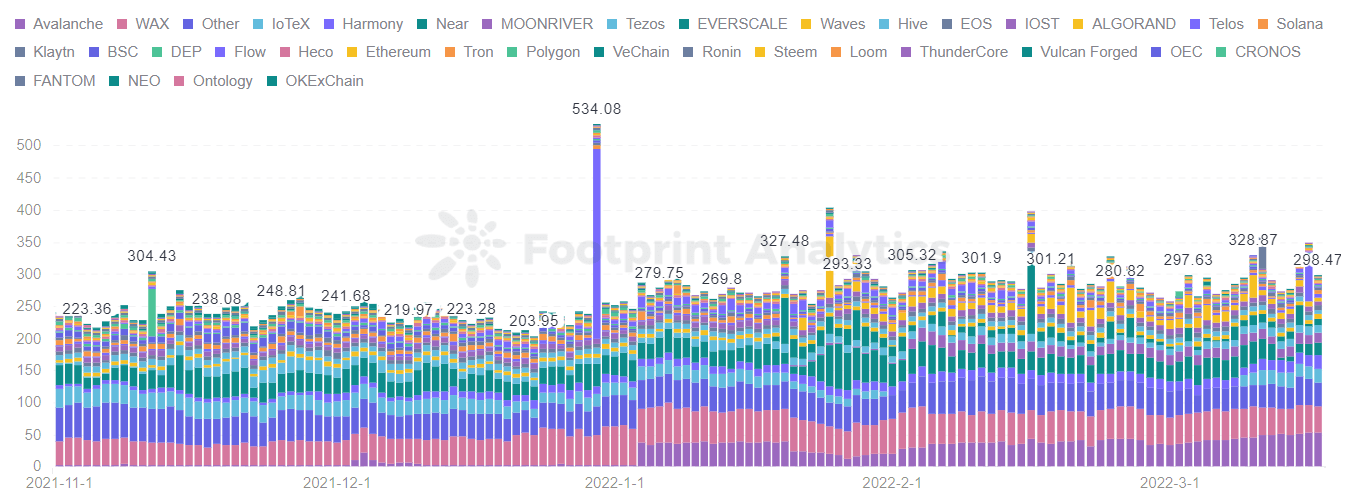

According to Footprint Analytics, the number of transactions per capita on the WAX chain has been relatively stable since April 2021, at around 35 to 50 transactions per day, and WAX relies on projects such as Farmers World and Alien Worlds, which account for more than half of the transactions the WAX.

In terms of capabilities, WAX not only supports high-frequency transactions, but can also process up to 8,000 transactions per second, which is fast.

Notably, the average number of transactions on Avalanche has increased since January, reaching as high as 50 transactions on March 16. Avalanche originally held an important position in the DeFi field, with the popularity of GameFi, and gradually moved to GameFi. For example, Crabada is a game where players can explore the kingdom of Crabada while earning income through mining, looting, breeding, fighting, exploration, and crafting. It accounts for most transactions.

Avalanche is an EVM-compatible L1 chain that focuses on speed and low transaction costs, achieving transaction throughput of over 4500 TPS and transaction completion times of less than 2 seconds. It aims to solve the scalability problems that Ethereum faces.

As you can see from the data, other blockchains like Near and Moonriver are basically less than 30 transactions per capita.

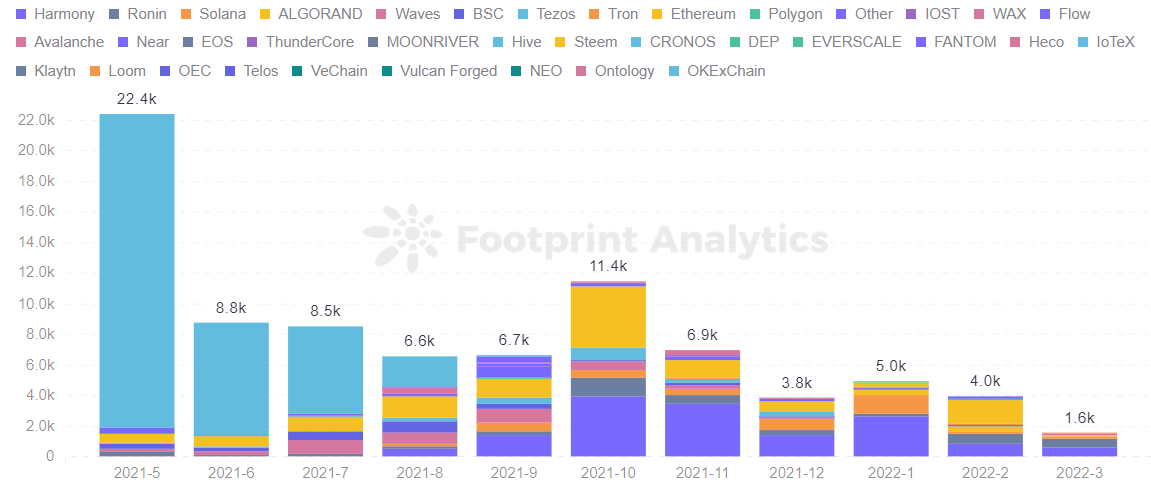

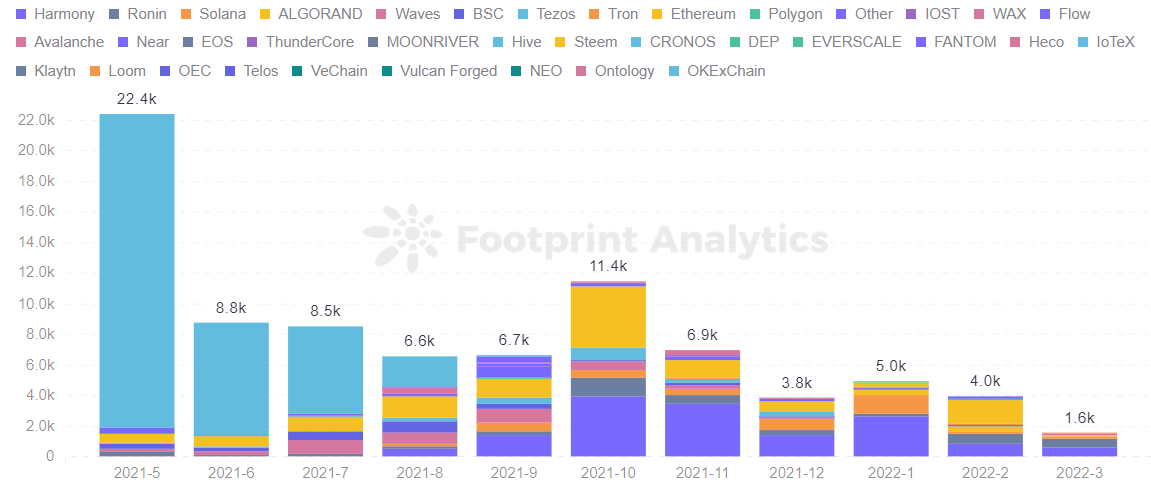

3. Transaction volume per capita

Transaction volume per capita refers to the average amount of funds transferred per user. This is a crucial metric to analyze GameFi projects because it reflects the level of user engagement and the health of the product and tokenomics design. As an investor, you should look at the continued stability of a program’s per capita transaction volume trends, specifically looking for sustainable growth in user data and an increase in agreed revenue for game-based programs.

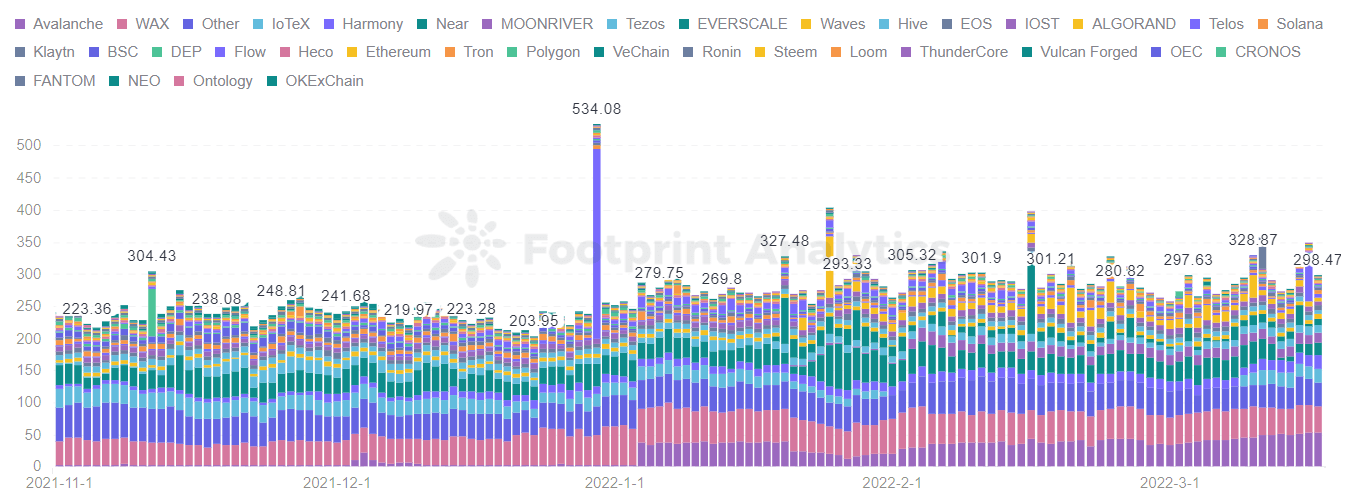

One of the more notable declines is OKExChain, which went from a peak of $20,487 per capita in May 2021 to almost no volume after October.

The development of OKExChain chain games is relatively slow, and the popularity of the projects planned is relatively low.

As of February, the Harmony, Ronin, and Ethereum blockchains are currently the main battlegrounds for GameFi’s per capita transaction volume, with most of the explosive chain tours on these chains ranging from $800 to $4,000 per capita.

To evaluate whether a GameFi project has potential, one must look at what protocol model it uses. If it uses a protocol model like the one on OKExChain, it is less likely to succeed because its chain ecosystem is developing slowly and no further plans are in place; if it uses a protocol model on Hive or WAX, it has more potential because it focuses on user experience and maintaining a good user growth rate.

Summary

The GameFi industry is in an early, highly volatile stage – making it easy to lose all your money if you back the wrong horse. Therefore, it is crucial to look at underlying data when analyzing projects.

Date and author: March 26, 2022, Vincy

Data source: Footprint Analytics – GameFi data by chain

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the young world of blockchain. Here you will find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news