[ad_1]

Over the past seven years, cryptocurrencies have soared from about $5.2 billion in market cap for the top 100 coins to nearly $1.7 trillion as of January 2022.

Cryptocurrencies now represent the fourth most popular type of investment among investors, behind only stocks, mutual funds and bonds. Bitcoin alone has a market capitalization that would be in the top 10 largest companies in the S&P 500.

(Click to enlarge)

There are a few important things to understand about the cryptocurrency universe up front: the different types of cryptocurrencies and how they are powered by different blockchains.

Although bitcoin is the most well-known cryptocurrency, there are numerous others available. The second largest cryptocurrency is ether, whose main difference from bitcoin is its purpose: where bitcoin’s construction is quite simple and is mainly intended to serve as an alternative currency, ether’s also contains the code for sales and purchases activate when certain criteria are met (known as “smart contracts”). And then there are “altcoins,” a category that includes all the other cryptocurrencies, like ripple and litecoin.

These cryptocurrencies are powered by the underlying technology of blockchains, which register every transaction and cannot be altered. For example, the permanence of this mechanism is how non-fungible tokens, or NFTs, obtain their certificates of authenticity. And different blockchains support different types of cryptocurrencies: Bitcoin, for example, lives on the bitcoin blockchain; ether exists on the ethereum blockchain.

As the cryptocurrency market has caught the attention of the rest of the investment world and shed some of the early skepticism surrounding its viability, we decided to take a deeper look at the forces driving its improbable rise. That effort culminated in the publication of Morningstar’s 2022 Cryptocurrency Landscape, the first of its kind.

As Bitcoin Loses Market Share, Newer Entrants Drive Krypto Growth

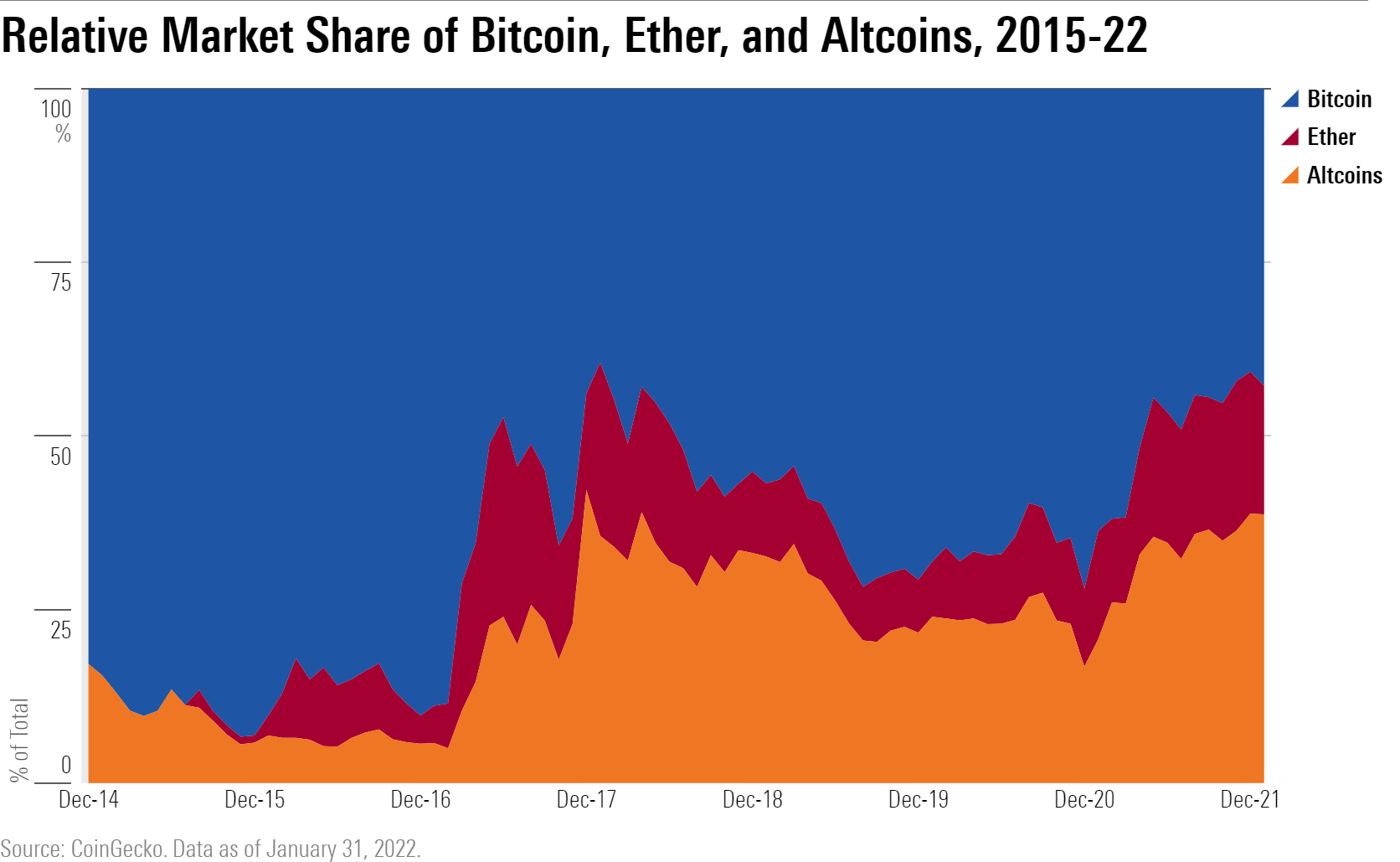

We weren’t surprised to discover that bitcoin was responsible for most of the growth of the cryptocurrency market in total during its early history, but it was surprising to see bitcoin rapidly gain market share from these other cryptocurrencies in recent years. lost currencies.

As shown in the chart below, a market cap-weighted index of the 100 second-largest cryptocurrencies from January 2017 to January 2022 outperformed bitcoin by more than 75 percentage points year over year.[2] Even as it returned an average of 103% each year, bitcoin’s share of the cryptocurrency market tumbled from nearly 90% in December 2016 to less than 43% as of January 2022, as ether and altcoins expanded.

Ether is responsible for the first leg of that crooked growth. And while altcoins are often overlooked, their market share has grown significantly over the past five years.

(Click to enlarge)

Ether has experienced sharp spikes and tumbles in its price as enthusiasts have speculated on a wide variety of applications for the ethereum blockchain. However, since January 2021, ether has consistently hovered between 15% and 20% of the market, while bitcoin’s market share has steadily declined from 70% to nearly 40%, even as it has achieved a cumulative return of 32%.

This is because so many users have flocked to ethereum that it has become prohibitive to trade on that network.

Enter the unloved cryptocurrencies: altcoins. Like all other cryptocurrencies that aren’t bitcoin and ether, altcoins like solana have developed blockchains that undercut ethereum on transaction costs while still offering comparable applications (especially decentralized financial services) and as a result have taken market share away from ether.

Altcoins, in turn, are typically more specialized than either bitcoin, a cryptocurrency with hardly any derivative projects (that is, products whose value relies on an underlying asset), or ether, a cryptocurrency whose blockchain offers so much flexibility that programmers can use it for virtually any derivative project.

For example, the altcoin terra exists on a blockchain that only creates stablecoin tokens, a class of cryptocurrencies backed by assets such as the US dollar or gold. The altcoin polkadot, on the other hand, transports information or assets between other blockchains.

Specialization has dampened investor interest in the past, but as the cryptocurrency market matures, we expect diversity among altcoins to become a key force for the asset class, breaking apart the historically close correlations we’ve observed between bitcoin and other digital assets break.

With great returns comes great volatility

From ether’s historic 9,500% streak in 2017 to Solana’s 11,100% tear in 2021, much of the interest in cryptocurrencies has been a self-fulfilling prophecy. Investors see staggering profits and enter the market, resulting in further upward pressure on prices. But every breathtaking rally has heralded an equally punishing crash on the other side, and cryptocurrencies don’t have a fundamental anchor like the par value of a bond or a stock’s discounted cash flow. Ether lost almost 90% of its value between December 2017 and December 2018, while solana lost more than half of its value between November 2021 and January 2022.

Taken together, the volatility of cryptocurrencies has no parallel to any other measurable asset class.

From January 2015, when regular price data begins, to January 2022, the MVIS CryptoCompare Digital Asset 100 Index showed a standard deviation more than double that of the second most volatile index we identified and more than five times as volatile as the MSCI wash. ACWI Index.

Incredibly, this measure includes stablecoins, which often connect to a fixed pin. This means that unlinked cryptocurrencies in aggregate are likely to fluctuate even more than this figure indicates.

(Click to enlarge)

Crypto Performance is in a league of its own

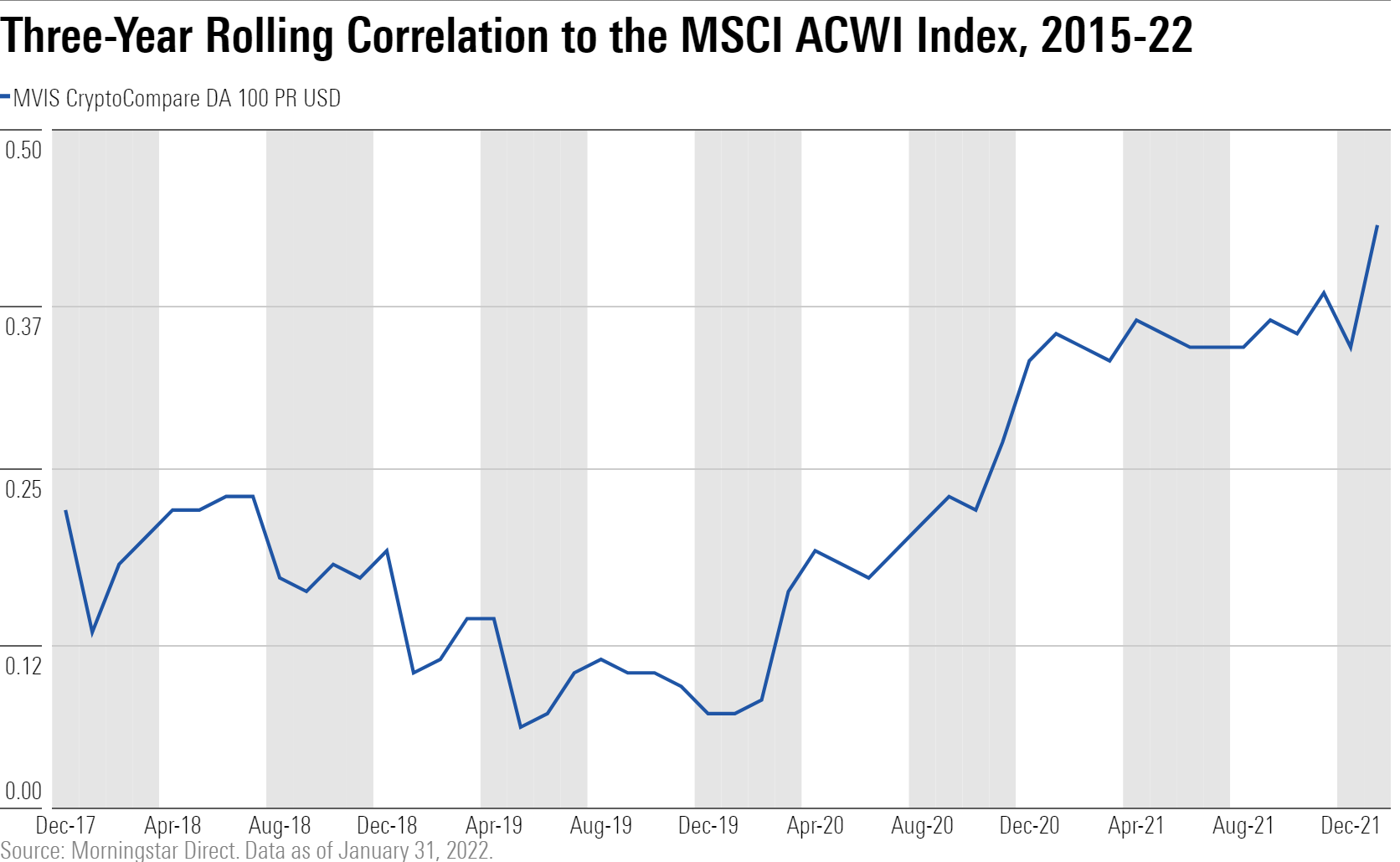

Even beyond its volatility, the cryptocurrency market does not behave like any other investment, fueling the interest of institutional investors looking to increase their exposure to uncorrelated returns.

Over its history, the crypto market’s price returns have had the most in common with international developed-market stocks, but with a correlation of just 0.28, there is still plenty of daylight between the pair compared to other asset classes.

That said, the correlations of cryptocurrencies with risky assets have drifted upward in recent years, especially after the stock market crashed in 2020.

(Click to enlarge)

However, it is important to examine those numbers in context. Cryptocurrencies are far from alone in experiencing tighter correlations with global market capitalization. In fact, the sensitivity of several key sub-segments of the bond market has risen with cryptocurrencies in the same period.

This is not surprising. Correlations for all asset classes tend to rise during periods of market stress when liquidity is squeezed, and those relationships usually relax once fairer winds are present. Higher correlations tend to persist as long as the measurement window captures the stress event and then rolls off. In relative terms, cryptocurrencies still have virtually no correlation with stocks.

Still, while the increase in correlations may feel like a blip to an investor used to the rough financial markets, it does suggest that unlinked cryptocurrencies are a poor substitute for fiat money.

Unlike financial securities, safe havens like cash don’t tend to behave like the rest of the market when it goes down. Just the opposite: fiat currencies are designed to hold up best during market stress, due to consumer confidence instilled over centuries of liquidity when economies become overdrawn.

All That Glitters: Is Bitcoin Moving With Gold?

Which brings us to another asset that the market has compared to bitcoin: gold. Dubbed “digital gold”, bitcoin’s fixed supply and decentralized nature have attracted the attention of those who believe it could act as a viable competitor to the bars stored in bomb shelters by doomsday planners.

The argument does have intellectual merit, but in the near term, Morningstar analysts agree that bitcoin is unlikely to eclipse gold. People have been using the metal to do business since at least 600 BC, while bitcoin has only been around for 14 years.[3]

Gold’s alternative use cases buffer the metal during periods of market stress so that it does not depend solely on market sentiment to create liquidity. We believe that bitcoin, relative to gold, does not have enough outside applications to outweigh the impact of market events on its price, limiting its usefulness as a store of value.

Moreover, the first transaction denominated in bitcoin only happened in 2010, which means we only have 11 years of price data to study. During the one market correction in our time horizon, gold’s correlation with stocks remained low, while bitcoin’s followed the cryptocurrency market on an upward trend.

(Click to enlarge)

What we expect now

With $1.7 trillion in total market cap, cryptocurrencies can no longer hide in the shadows of Reddit forums. The asset class’s astonishing growth warrants as much caution as excitement.

While cryptocurrencies today have spawned entire parallel economies from scratch in just 14 short years (no mean feat), cryptocurrencies’ decentralized infrastructure still poses significant barriers to real-world use cases.

As a result, cryptocurrencies are still a brand new, highly concentrated and highly volatile investable security. Rather than a rapid takeover, we expect that integration with existing systems across financial services and other sectors is likely to drive future adoption rates in the space. If that path unfolds, the opportunities for investors will increase at a rate only commensurate with the potential risks.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news