BE[IN]CRYPTO is dedicated to equipping traders and investors with a comprehensive suite of tools that empower them to make well-informed choices.

Our latest addition to the Rankings product line, Price Prediction is a robust asset within our range, carefully crafted to serve as an invaluable compass for anticipating market shifts. Leveraging the latest data from over 5,000 cryptocurrencies across prominent exchanges, we have designed a predictive modeling tool capable of analyzing prevailing market trends.

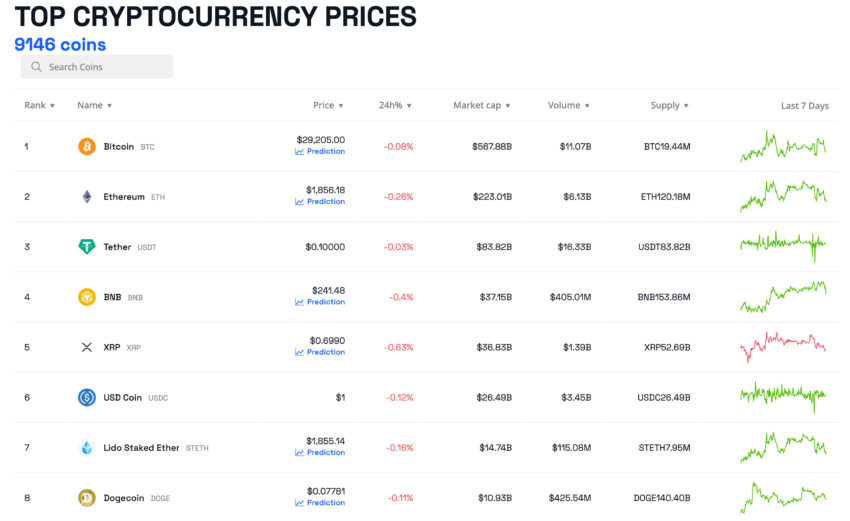

Our cutting edge proprietary algorithm seamlessly integrates over 200 Technical Analysis Indicators to generate precise and reliable price ranges. Users can use the Price Forecast feature to extrapolate current currency prices and anticipate potential price movements. For example, users can use this feature to scope current $BTC, $ETH and other 5000 traded currency prices and anticipate potential price moves.

Cryptocurrencies have caught the attention of traders and investors worldwide thanks to their volatile nature and potential for high returns. To help the crypto community make well-informed investment decisions, BE[IN]CRYPTO is proud to present its latest product, Price Prediction. This innovative tool uses advanced algorithms and crowd-sourced data to provide users with valuable insights into cryptocurrency price trends, enabling them to navigate the market with confidence.

Price forecast by BE[IN]CRYPTO is a leading crowd-based social tool designed to empower cryptocurrency enthusiasts with accurate price prediction. Using a large network of exchanges, independent sources, traders and analysts, this tool correlates data with existing market trends to predict potential trading thresholds for various cryptocurrencies within specific time frames. With its proprietary algorithm that analyzes data from over 5,000 cryptocurrencies across leading exchanges, Price Prediction provides users with realistic price ranges. The algorithm considers more than 200 Technical Analysis indicators to improve accuracy, ensuring reliable predictions for investors.

Price forecasting is emerging as an essential resource for market control

Price prediction calculators are common in the crypto industry; however BE[IN]CRYPTO emphasizes that they should be viewed as guidelines rather than guarantees of future performance. The inherent volatility of the cryptocurrency market presents unique challenges, making the Price Prediction Tool an invaluable resource for traders looking to estimate potential market movements. Users are strongly encouraged to conduct thorough research and analysis before making trading decisions to understand the risks involved.

Cryptocurrency, a leading digital asset class, has gained significant market recognition, currently considered one of the top cryptocurrencies by market capitalization. As the crypto industry evolves, the focus shifts to cryptocurrencies such as Bitcoin, Ethereum and others. We need to analyze various technical indicators and market trends to fully understand a cryptocurrency’s potential price rise.

One notable feature of Price Forecast is its ability to visually represent potential price increases over time. Using historical and current price data, this tool provides users with a clear visualization of the price points a particular cryptocurrency can reach within a given time frame. This visual representation allows traders to evaluate the potential growth of a particular cryptocurrency, empowering them to make more informed investment decisions.

Unveiling the Potential: A Deep Dive into Cryptocurrency Price Prediction and Technical Analysis

As developers, we appreciate the importance of data, algorithms and predictive models. Today we will explore a tool designed to predict the future prices of cryptocurrencies – an intriguing topic for everyone involved in the blockchain industry. Let’s dig deeper into cryptocurrencies and explore how this tool can improve our understanding of price behavior, allowing us to make more informed decisions.

To predict a cryptocurrency’s price trajectory, traders use a wide range of trading signals and technical indicators; in total, more than 200 individual measures are considered. Identifying support and resistance levels is crucial to understanding the market’s supply and demand dynamics and predicting trends. Some key indicators include the relative strength index (RSI), moving averages, and the moving average convergence divergence (MACD).

RSI: Measurement of cryptocurrency momentum

The relative strength index (RSI) measures the magnitude of a cryptocurrency’s price movements, providing insight into whether it is overvalued or undervalued. Readings above 50 indicate bullish momentum, while readings below 50 suggest bearish sentiment. Traders rely on the RSI as an important momentum indicator to inform their trading decisions.

Moving Averages: A Holistic View of Cryptocurrency Trends

Moving averages provide a comprehensive perspective on cryptocurrency price charts by calculating the average closing price over a specific period of time. The relationship between short-term and long-term moving averages indicates the direction of the trend. A bullish trend occurs when the short-term moving average moves above the long-term one and vice versa.

MACD: Improving Cryptocurrency Trend Predictions

The moving average convergence divergence (MACD), which uses simple moving averages (SMA) and exponential moving averages (EMA), provides a more accurate forecast of cryptocurrency trends. By analyzing the relationship between these two indicators, traders can determine the trend’s direction and make well-informed decisions.

Fundamental Analysis of Cryptocurrencies: Assessing Inherent Value

Fundamental analysis aims to evaluate the intrinsic value of an asset. When analyzing cryptocurrencies, it is essential to consider supply and demand dynamics. Key data points such as market cap and circulating supply are important for making reasonable assumptions about future prices.

Cryptocurrency Price Drivers: Revealing the Influencers

The price of cryptocurrencies is primarily influenced by market supply and demand dynamics. Their growing adoption within various industries strongly influences the demand for cryptocurrencies. Significant events such as protocol updates, hard forks, whale activity, institutional adoption and political regulations have a significant impact on cryptocurrency prices.

Although predicting the future value of any cryptocurrency involves several factors and is not always straightforward, using a combination of technical indicators and fundamental analysis can provide valuable insights. With its own algorithm and comprehensive data analysis, BE[IN]CRYPTO’s Price Prediction tool equips users with the necessary tools to anticipate market movements. However, users are reminded to conduct thorough research and analysis before making any investment decisions. By leveraging price prediction and their knowledge, traders can navigate the dynamic cryptocurrency landscape with greater confidence.

Disclaimer

In accordance with the Trust Project Guidelines, this opinion piece presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and maintaining the highest standards of journalism. Readers are advised to independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news

![BE[IN]CRYPTO’s state-of-the-art Crypto Price Prediction Tool BE[IN]CRYPTO’s state-of-the-art Crypto Price Prediction Tool](https://beincrypto.com/wp-content/uploads/2023/08/BiC-Price-Prediction-PR-e1691048831216.png)