The XRP price rose 1.5% in the past 24 hours, climbing to $0.5227 on a day when the cryptocurrency market as a whole is enjoying a 3% rise.

XRP is now up 3.5% in a week, but the major altcoin actually remains down 7% in the past 30 days, an underperformer relative to its peers.

Yet with the coin still up 30% in a year, and with the prospect of a final conclusion to the Ripple-SEC case this year, the XRP price could recover strongly in the coming months.

XRP Price Prediction as Technical Indicators Signal Bullish Turn – Boom Imminent?

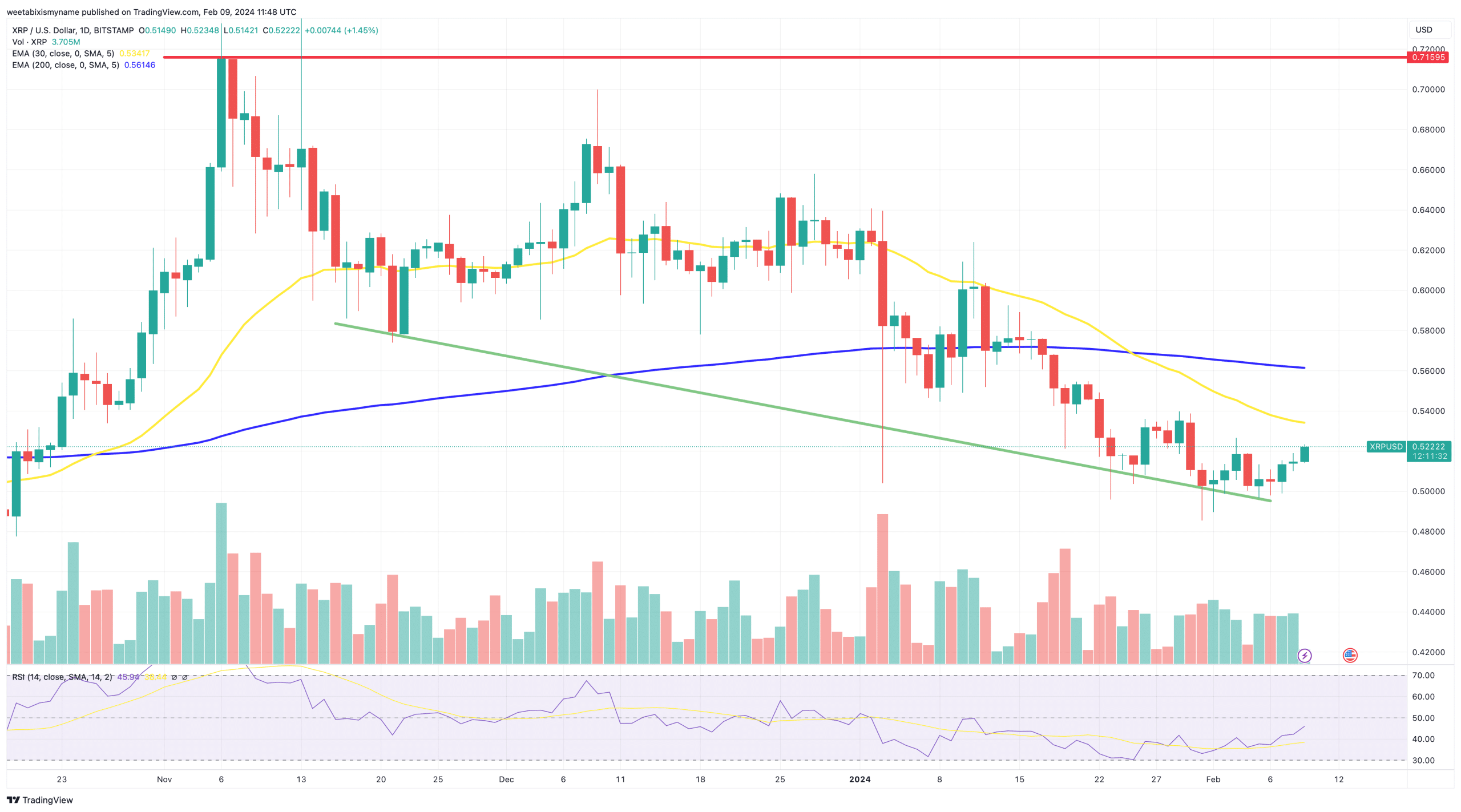

XRP’s indicators are finally showing some renewed momentum after weeks of decline, with the coin’s relative strength index (purple) close to 50 today.

Having stood at 30 as recently as late January, this recovery is encouraging as it points to incoming profits.

Likewise, XRP’s 30-day moving average (yellow) appears to be bottoming out relative to its 200-day moving average (blue), making the coin’s current price look like it will climb above both averages soon.

In other words, XRP could be entering an expansion period, with the coin’s discounted price very attractive to traders.

Its trading volume supports this view, rising from $500 million at the start of the week to more than $800 million today.

One negative, however, is that larger traders still seem to be sending XRP to exchanges, suggesting they are preparing to sell.

🚨 27,950,000 #XRP (14,453,307 USD) transferred from unknown wallet to #Bitstamphttps://t.co/KEZf4rWSHS

— Whale Alert (@whale_alert) February 8, 2024

What this could mean is that, after a brief rally, XRP will correct again soon after, with traders contenting themselves with short-term gains.

But in the longer term, XRP remains in a fundamentally sound position.

It will likely see a boost by the summer, which is possible when the SEC and Ripple reach a final settlement in their long-running case.

Such a settlement could result in a relatively hefty financial penalty for Ripple (ie forfeiture of any profits), but the company would then be able to carry on – and grow – as normal.

🚨RUMOR: Possibility of a $10 million settlement with the SEC this year. #XRP pic.twitter.com/Hkzl5rqHKs

— JackTheRippler ©️ (@RippleXrpie) February 8, 2024

Combined with a potential bull market (brought on in part by the next Bitcoin halving), this should see the XRP price rise strongly in the latter half of the year.

It could even reach $1 by the summer, before closing out 2024 near $2 or $3, depending on the market’s mood.

Smaller Cap Alts for larger rallies

XRP’s slowness to generate any kind of significant rally could be frustrating for some traders, with many likely better off exploring newer, smaller capital.

Such alts can be promising, with the best among them often rallying big when they first list on exchanges.

One example it is likely to do is Sponge (SPONGE)An ERC-20 cryptocurrency that just launched the second version of its token, SPONG V2, which is currently on Uniswap.

SPONGE V2, which runs on Polygon, replaces the first version of Sponge, which was originally listed in April 2023 – and went up.

One of the main reasons for the launch of SPONGE V2 is that the token’s new version features an improved staking model, which comes with a variable return that can increase significantly depending on the number of players and how much they have invested.

You haven’t seen anything yet! 🧽🧽#SPONGEV2 coming in hot 🔥#MemeCoin #BullMarket #Binance #Coinbase #Crypto #100x #Alts pic.twitter.com/db32pVByQ8

— $SPONGE (@spongoneth) February 7, 2024

Another key feature of SPONGE V2 is that it will be the native token for a soon-to-be-released P2E racing game set in the Sponge universe.

Players will compete to rank highest on a global leaderboard, with the best receiving higher rewards in SPONGE.

Although the game hasn’t launched yet, investors can already get their hands on Sponge V2 by visiting the official Sponge website.

They can also trade the token on Uniswap, where the token has risen more than 70% since listing on Monday.

Given this performance, SPONGE V2 is likely to soon list on other trading platforms, including centralized exchanges, where it could rise big.

Buy Sponge V2 here

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news