One of the biggest changes to the crypto market today compared to the last bear market is the different types of assets that exist.

Instead of choosing between Dash, Litecoin, Ethereum, Bitcoin, etc., people can invest in NFTs and pieces of digital land in the metaverse.

Common sense suggests that these new, experimental assets are riskier compared to BTC and ETH. Although it is difficult to measure risk objectively, we can use on-chain data to determine price volatility.

With the bear market in full swing, now is the perfect time to compare these assets and see what could be the ultimate blue-chip assets going forward: Crypto, NFTsor metaverse land.

Here we will compare three hypothetical investors: Abe, Bob and Cathy. One year ago, everyone was putting their money into a different asset class within the crypto space.

Abe’s portfolio: 50% BTC & 50% ETH.

Bob’s portfolio: 50% BAYC & 50% CryptoPunks.

Cathy’s portfolio: 50% Decentraland Land & 50% Sandbox parcels.

These comparisons are not 1-to-1 (buying 3 Bored Apes at $6,000 each one year ago is a very different move than investing $6,000 in a long-standing “safe” token like ETH.) So , we created 3 “reasonable” portfolios together. these 50/50 lines that are not exactly same. Will be explained later.

In this article, we’ll look at how each of these investors’ portfolios have performed and examine why some of these investments are more volatile than others.

Abe’s Token Portfolio

One of the advantages of investing in tokens instead of NFTs is liquidity and severability. We can put an exact USD dollar value on BTC and ETH on any given day, buy any amount we want, and receive a fair market rate.

On this day a year ago, June 28, 2021, BTC cost $35,867. For ease of calculation, we’ll round it to the nearest hundred—$35,900. ETH was $2,160—rounded to $2,200.

Our token investor chose an excellent time to jump in. After the enthusiasm of the Coinbase listing on April 13, 2021, and the Federal Reserve lowered interest rates to 0.25%. to stimulate the economy, the market roared. However, it was sent temporarily, mainly due to a wave of tight regulations in China, and it was about here when Abe broke in.

Afterwards, Abe bought the bottom of the cycle and put $50,000 in BTC and $50,000 in ETH (to get about 1.39 BTC and 22.7 ETH.)

The insane climb upwards continued until November 8, 2021, when Abe’s initial investment was worth $203,767.52.

But then speculative enthusiasm for cryptocurrencies began to wane as retail and investors cut back on risky assets.

From January to June, the Federal Reserve quickly raised interest rates by 75 basis points, the largest margin in 28 years.

In February, the war in Ukraine caused a downturn in macroeconomic conditions, leading to a bearish environment for the crypto market.

To top it off, the flash crash of Earth Moon in May looked like the start of a series of car wrecks in the blockchain industry.

All of these events have driven down the price of BTC and ETH – assets that to the vast majority of the non-crypto public stand in for the “price of crypto” itself.

On June 28, 2022, Abe’s 1.39 BTC and 22.7 ETH portfolio was worth $54,197.7, down 45.8%. The decline from the all-time high was 73.4%.

The NFT Portfolio

Although NFTs are not as liquid as BTC or ETH, they are unique and collectable. And when the market is in better condition, holders can also get a specific dollar value out of it.

What did the NFT market look like in June 2021?

Germination and construction period:

In June 2017, CrytoPunks, the world’s first NFT project, was officially born, bringing the NFT concept to its peak. Under the leadership of OpenSea, NFT trading has become more convenient and perfect, which makes NFT application areas gradually expand from games and artworks.

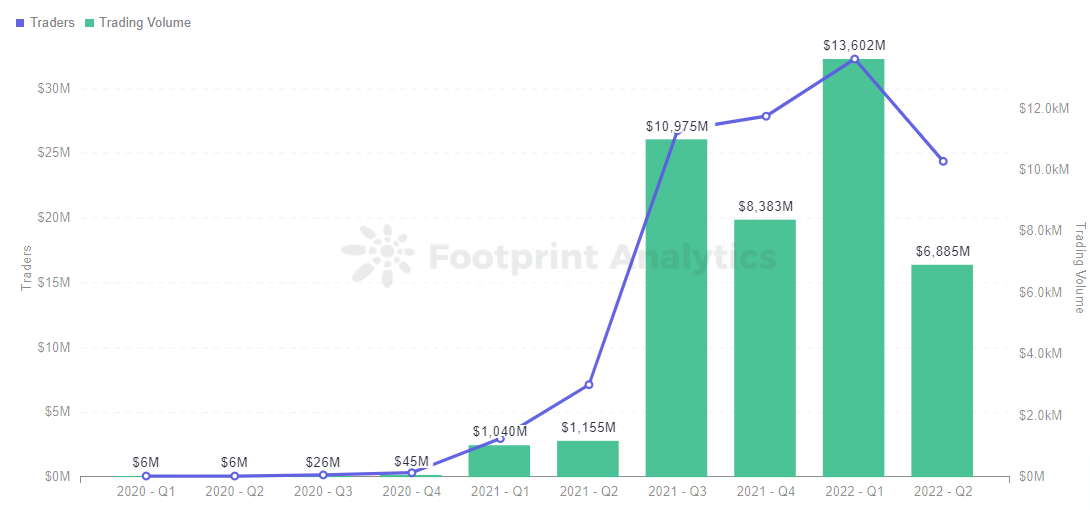

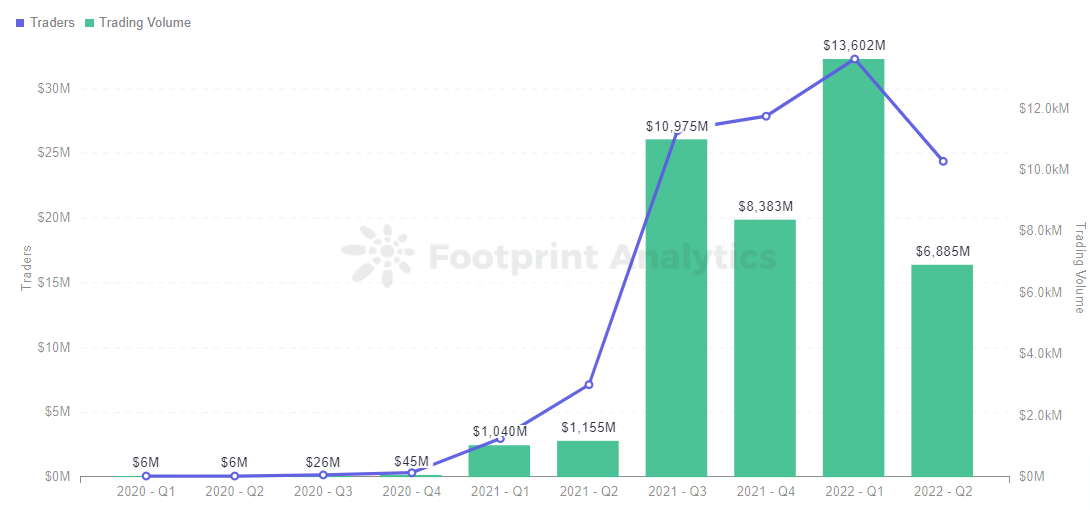

By 2021, Axie Infinity sales rose rapidly, driving the growth of the NFT market. The same year, BAYC was also founded and entered the public eye.

This is the perfect time for Bob to enter the market when NFTs are in their infancy. Because NFT adheres to a rule, the sooner its characteristics are rarer, the higher the value and the lower the price is more balanced (the NFT trading market is immature, and the transaction frequency is low).

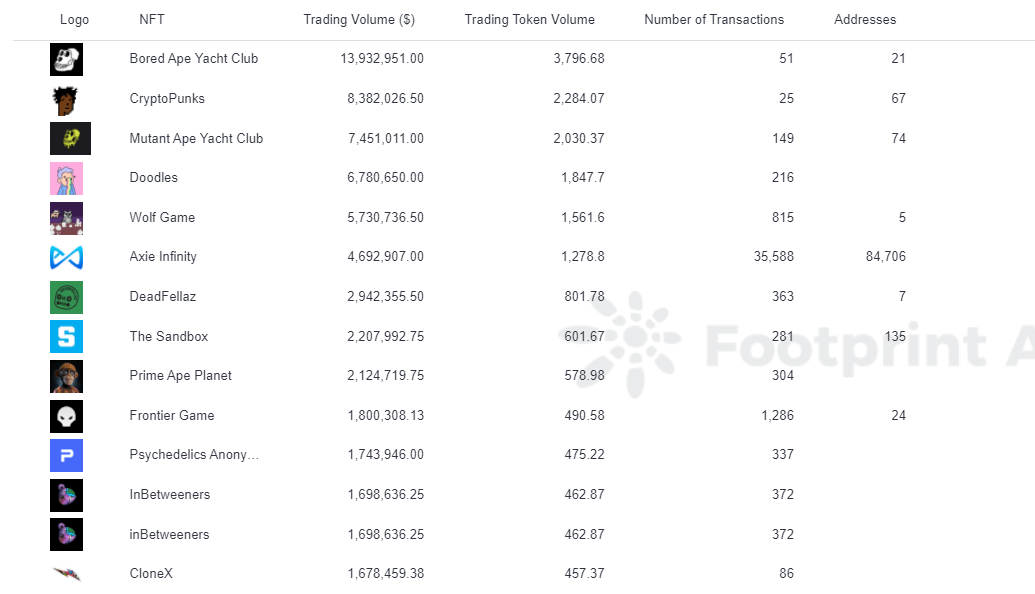

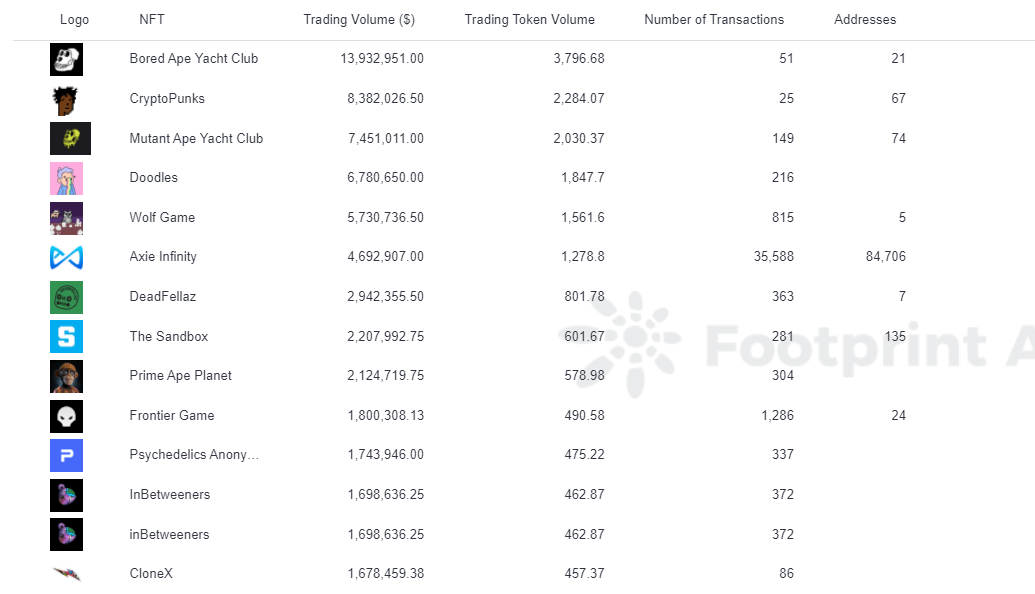

BAYC and CryptoPunks are among the top NFTs in terms of trading volume in 2021.

Suppose Bob buys 1 BAYC (3.5713 ETH) and 1 CryptoPunk (28.9191 ETH) on June 28, 2021 at an average price, his initial investment is worth $71,478.88 at that time.

In 2021, world economic development was severely affected by the epidemic, and fiscal easing in major economies brought inflation and currency devaluation, driving users to crypto markets such as artwork, NFT, and BTC. Trading activity in the NFT market continued to increase from August to March 2021.

If Bob followed ETH and sold it at its peak on November 8th (ETH at $4,826.25), when the average prices of BAYC and CryptoPunk were 43.8835 ETH and 98.5848 ETH respectively, his portfolio would be worth $687,587.63 has been, an increase of 95%861 .

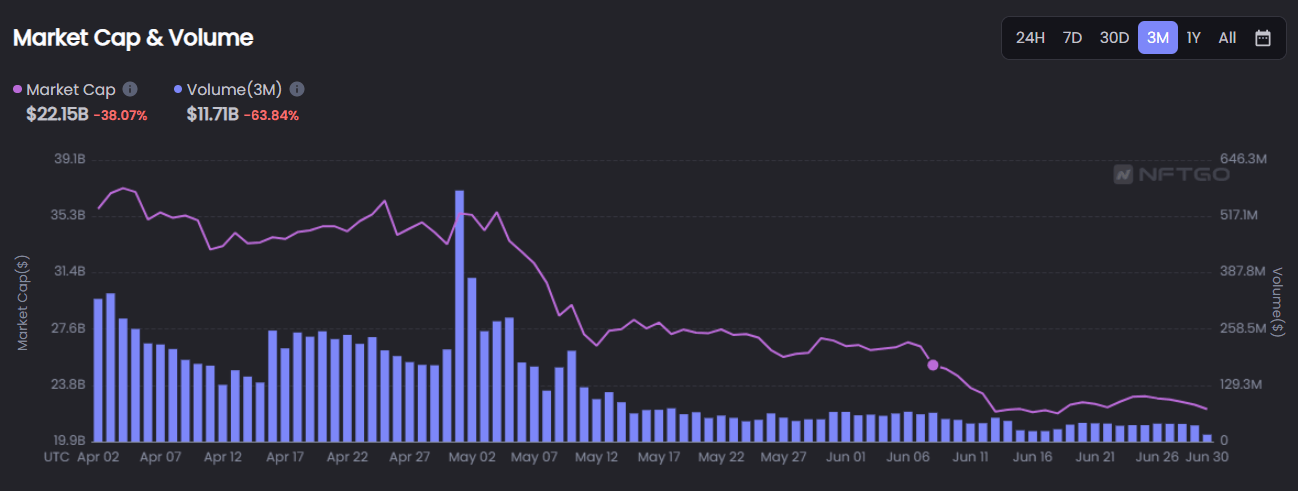

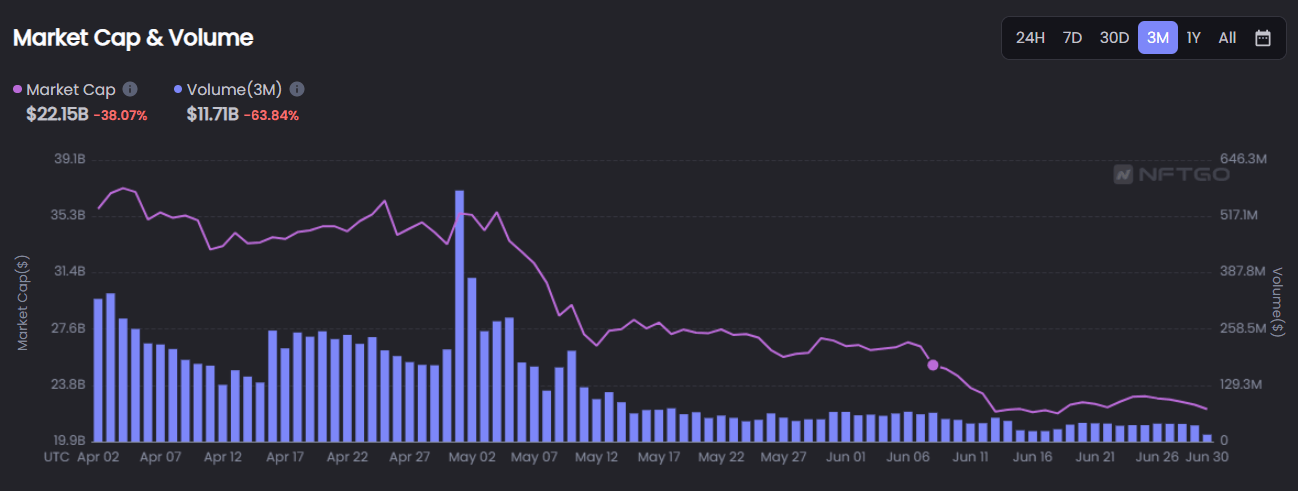

The collapse of the Crypto market led to a decrease in investor interest in NFT, which significantly affected its overall trading volume and market capitalization. Over the past 90 days, the total trading volume has fallen by 63.84% and the total market capitalization by 38.07%.

As of June 28, 2022, ETH is trading at $1,144, BAYC at 113.5035 ETH, and CryptoPunk at 77.6991 ETH. Bob’s portfolio is worth $218,735.77, up 206.01% year over year. It is down 68.19% from its all-time high.

It is clear that blue-chip NFTs, as of the beginning of summer 2022, are not as volatile as many people think compared to the so-called “safe” crypto-investments BTC and ETH.

*Since investing half of your portfolio in BAYC NFTs in June 2021 would have been quite insane, we are taking a different approach to 50/50 in this portfolio. Bob bought 1 Punk and 1 Monkey.

The Land Portfolio

By taking an interest in the metaverse in June 2021, Cathy can be considered an early adopter. At that time, the word “metaverse” had not yet become a household name.

Facebook’s rebrand to Meta was still four months away.

Was the metaverse a new version of Second Life? Did you need a VR headset to access it? Almost no one who wasn’t deep in the crypto death hole already knew.

But the rattle was there. On June 4th, Sotheby’s opened a virtual gallery in Decentraland, and the game made waves as the first to break 1 million in a metaverse land sale.

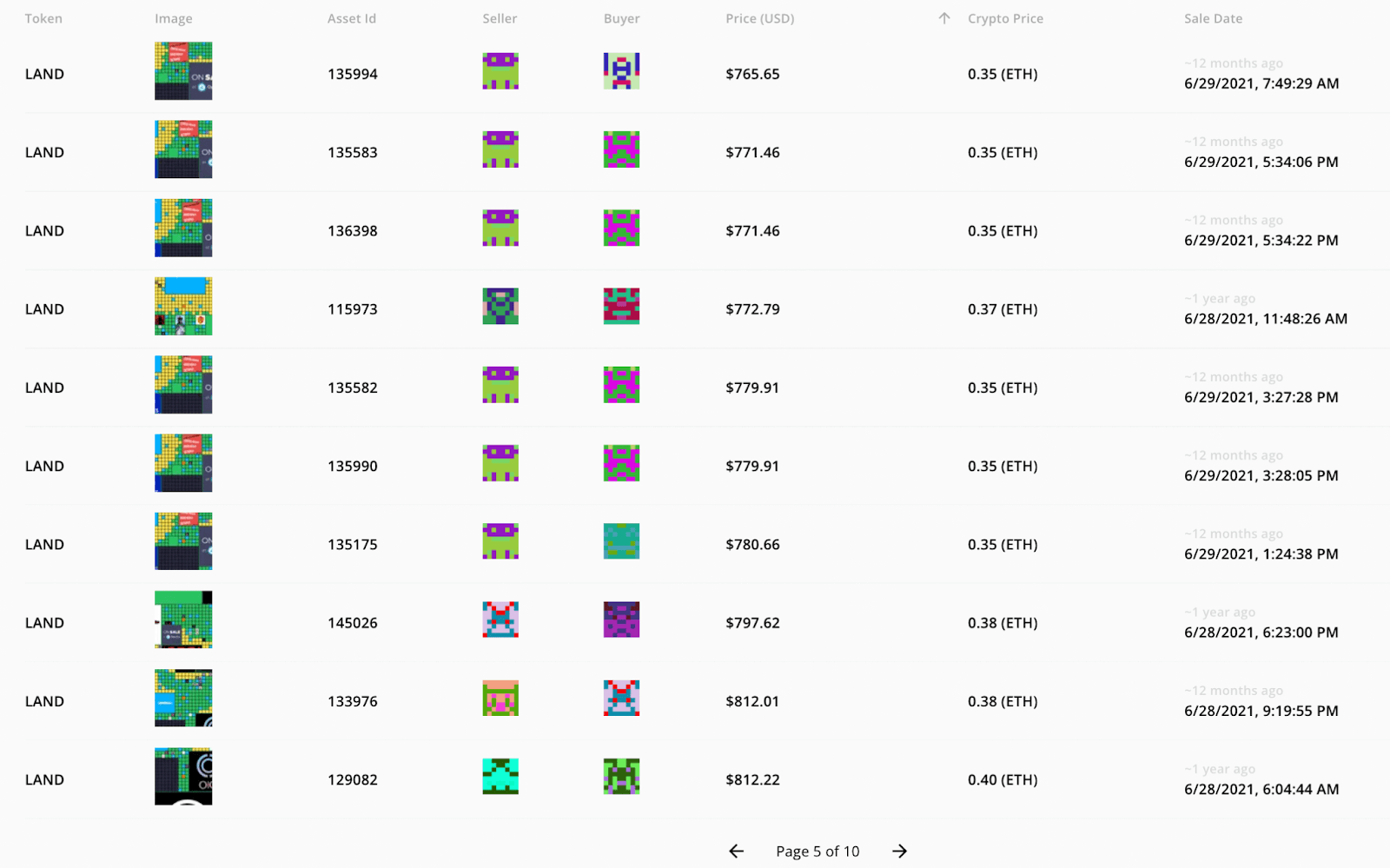

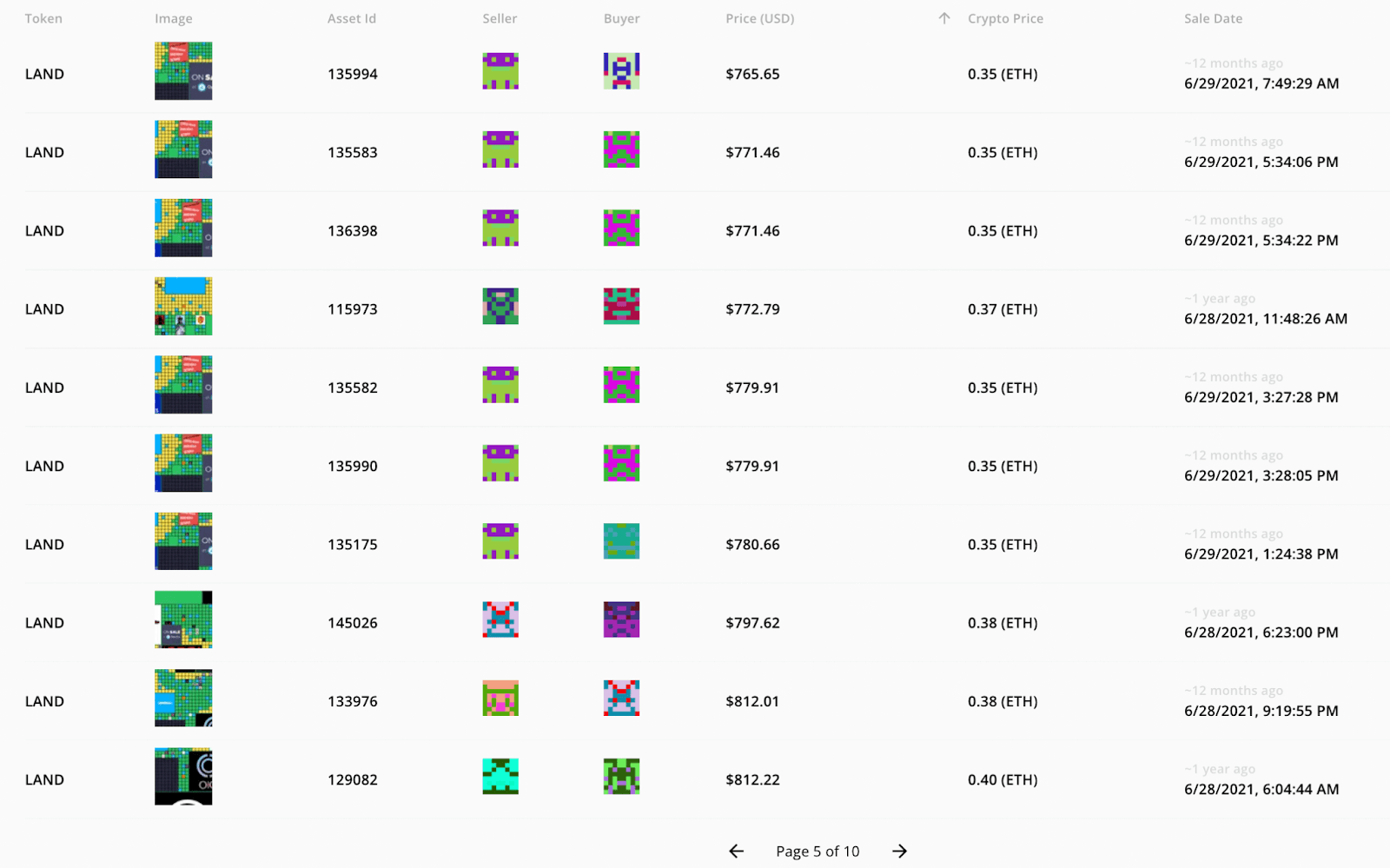

On June 28, 2021, Cathy became a metaverse landlord. Her purchase was one of 37 NFT sales in Decentraland, netting $148,500 in total.

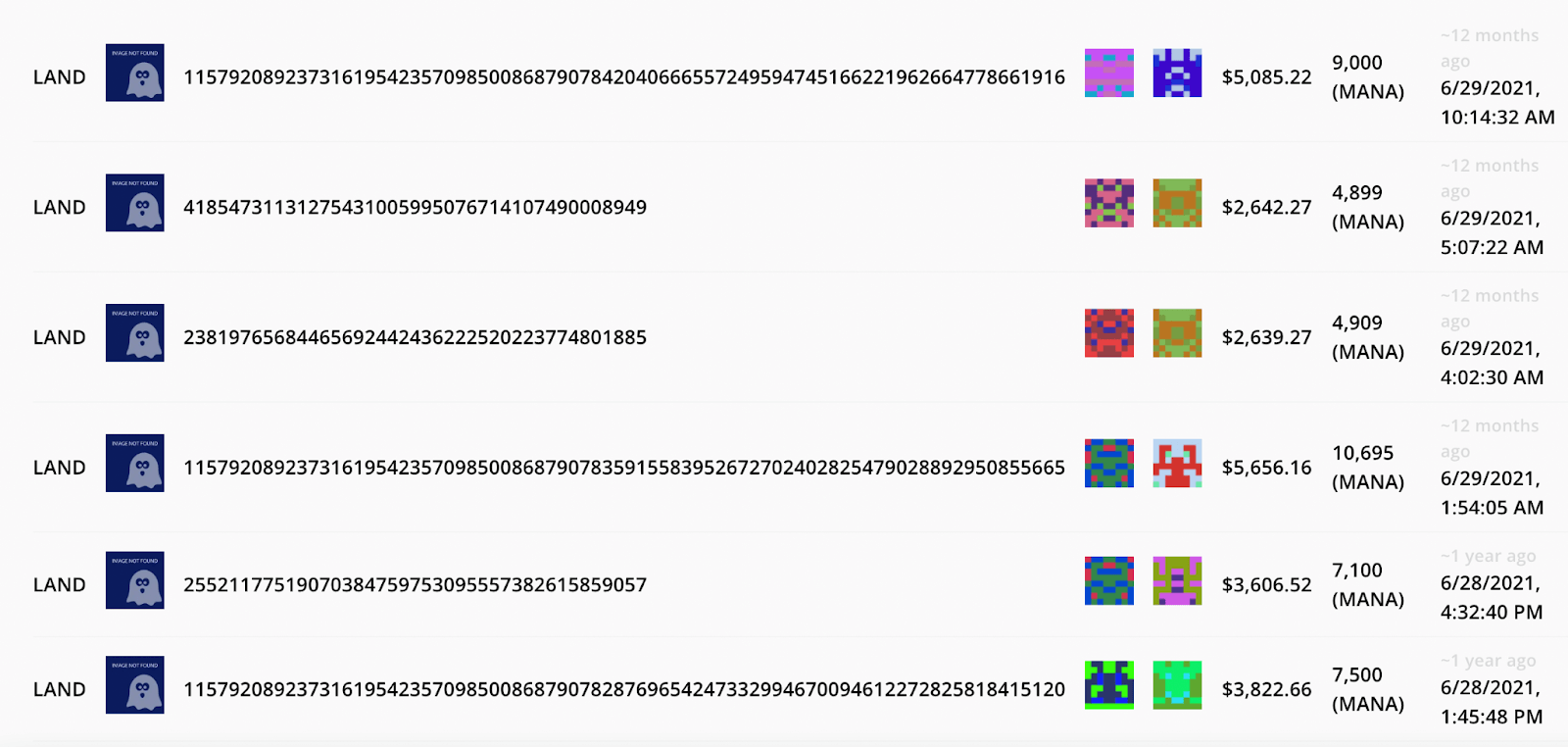

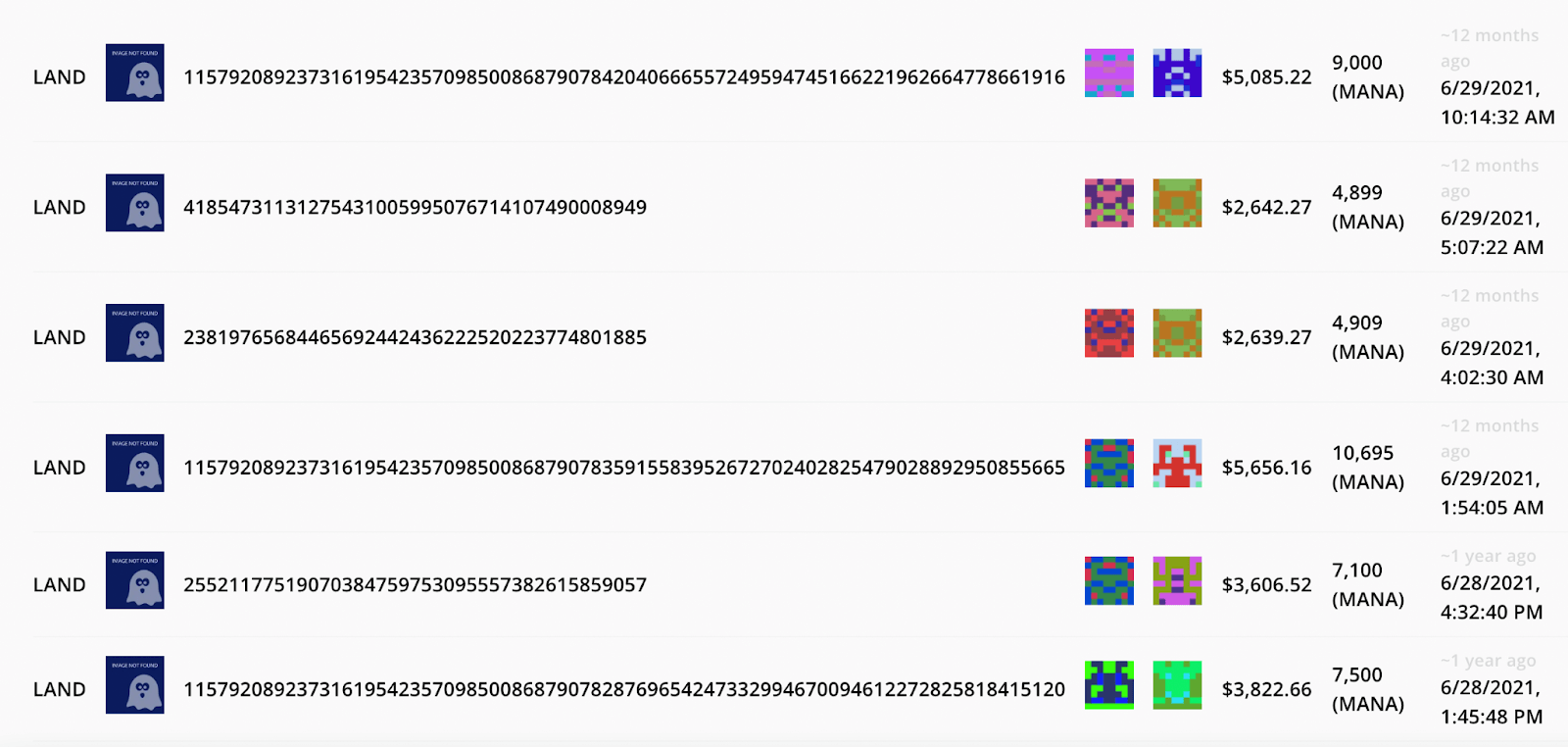

Because all the transactions on the blockchain are on a public ledger, we can actually see and analyze all the LAND sold on this date.

The average sale price on June 28 was around $4,000, which seems like a reasonable valuation after these sales. (That is, if there was a single sale at an astronomical price, that would make the average a bad measure of how much Cathy could have paid.)

So, with her toes in the metaverse, Cathy bought one piece of land for $4,000—perhaps this one:

She also added a pack in The Sandbox. At that time, the search term “Sandbox” barely brought to mind the metaverse title that would take over news headlines within a few months for the 3842% jump in its token price.

On June 28, 46 NFTs were sold, bringing in $43,500, an average price of $945. This is a few hundred higher than the median price for the day, but is still accurate enough to do a general analysis.

So, to maintain an almost 50/50 allocation in the two largest products in the asset category, Cathy bought one piece of Decentraland land at $4,000 and 4 Sandbox lands at $945 each – a total metaverse land portfolio of $7,780 .

Her judgment would be visionary. By November 8, 2021, when ETH BTC peaked, the average selling price in Decentraland increased by 3.0469 ETH to $14,705. The average price of The Sandbox land soared to $6,096, an increase of 734.62% percent.

If we just go by averages, her 1 Decentraland Plot and 4 Sandbox Packs would be worth $39,089.

If we instead look at the actual asset shown above that cost just under $4,000 on June 28, 2021, it has increased by $59,135. It flipped for $55,313 on November 15, 2021, the closest sell to the ETH peak.

Over the next year, the prices of metaverse land fell sharply as the volume in Decentraland and The Sandbox decreased to ATLs by 76.81% and 79.03% respectively.

On June 28, 2022, Cathy’s portfolio was down $14,811 from ATH (-62%). A big hit, but still far from her original investment. Metaverse land is clearly extremely volatile and can still be called a Hail Mary play rather than a safe blue-chip.

Summary

While the bull market has seen enormous gains for NFTs and metaverse land, the on-chain data for top projects indicates that prices are not as volatile as many believe relative to “safe” assets like BTC and ETH.

In this article, we created three hypothetical portfolios and found that the safe crypto bet had a steeper decline in ATH (as of June 28) than investments in NFTs and metaverse land. The gains over the bull market would also have been significantly higher for the latter two “riskier” assets.

While there are several possible explanations for this (e.g., more difficult for institutions to push down the prices of NFTs and land), this data supports the idea thesis that the top NFTs and metaverse land projects have performed exceptionally well throughout the past year —trees, busts, collapses and all.

Date and author: July 7, 2022, Vincy

Data Source: Footprint Analytics – BTC & ETH Trend Analysis

This piece is contributed by the Footprint Analytics community.

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the new world of blockchain. Here you will find active, diverse voices supporting each other and driving the community forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news