Author’s note: In the past week, the crypto industry and stablecoins themselves have come under intense regulatory scrutiny. Paxos, the issuer of BUSD, has been hit by the SEC, with the regulator ordering the company to stop trading BUSD. This is an ongoing matter that may affect the viability of BUSD in the future. However, this article still provides a good look at how the space has grown and the performance of various stablecoins over the past year. has

Introduction

Over the last 3 years we have seen many different iterations of stablecoins, each with very different mechanics and varying degrees of decentralization. Popular iterations include decentralized under-collateralized algorithmic (UST), decentralized over-collateralized asset-backed (DAI) to centralized 1:1-backed versions (USDC/USDT/BUSD).

No matter how they work behind the scenes, stablecoins are the unsung heroes of the crypto world. Their mission? Holding a 1:1 peg with an underlying asset, such as the US dollar. While many segments of crypto have seen their activity levels and general sentiment drop along with prices, it has become clear that stablecoins have strong product market fit and are a thriving crypto use case. The demand and use of stablecoins is reflected in the growth in their market caps and increase in on-chain volume over the past 2 years – a steady upward trend that has largely succeeded in reversing the bear market, with a relatively mild pullback in total market capitalization.

Stablecoins market cap on Ethereum

Stablecoins Monthly Volume on Ethereum

The safety and superiority of individual stablecoins is the subject of ongoing debate, with battle lines being drawn between the top contenders. Companies are taking sides in the never-ending argument, with Binance adopting a “walled garden” strategy to gain market share for BUSD by removing USDC trading pairs, while Coinbase now allows free exchanges from USDT to USDC.

However, after the events of 2022, trust in centralized entities is at an all-time low, and transparency becomes increasingly important. While we cannot fully investigate the inner workings of the centralized entities behind the two largest stablecoins, USDT and USDC, we can see how users use these tokens and gain insight into their largest wallets and on-chain activities. This allows us to gauge the health of these stablecoins in terms of chain volumes and individual address holders, giving us insight into how traders and investors react to the various issuers’ walled garden tactics.

In the rest of this article, we’ll use Nansen’s blockchain analysis tools to do a deep chain dive into four of the top stablecoins in the space today: USDT, USDC, BUSD, and DAI. Please note that this analysis only covers the ERC-20 versions of the stablecoins and will not include those on other chains.

Overview of the big four

Based on overall market cap, USDT is the largest stablecoin, followed by USDC, BUSD and DAI in a distant fourth place. However, if we consider only ERC-20 market caps, we see a different story. USDT was dominant until mid-January 2022, when confidence in Tether declined due to FUD and suspicion about its operations. USDC claimed the top market cap and has maintained its position ever since. It is worth noting that more than half of the USDT supply is on Tron, which is not covered here, with most of the remaining supply on ETH.

Over the past two years, BUSD and USDC have grown significantly, expanding approximately 1409% and 912% respectively. BUSD has grown alongside Binance, while USDC has positioned itself as the most regulatory compliant fiat-backed stablecoin in the market.

Looking at the volume of the chain, we see that despite its relatively small size, DAI has the highest velocity among the other coins, with a velocity ratio of 246.1x. Velocity is measured as 2022 chain volume versus its market cap at the start of 2023. However, in terms of the number of transactions, USDT and USDC have a significant lead over every other stablecoin.

USDT

The percentage of USDT supply on exchanges (24%) decreased slightly, -2% compared to May 22, but down 12% compared to the August 22 peak. This is driven in part by the collapse of FTX on November 22 and we have seen large ongoing outflows from exchanges in general. The percentage across other categories has fallen over the past 10 months.

The top holders of the token are largely CEXs and bridges, which is not surprising since 24% of USDT’s supply is held on CEXs. There is also a smaller percentage on bridges compared to USDC, which suggests that USDT’s adoption on chains like Optimism and Arbitrum has not been as rampant as USDC. However, as mentioned earlier, a large portion of USDT exists on the Tron network and is not covered in this analysis.

USDT has the largest number of unique addresses that contain the token, currently sitting at nearly 4M addresses. There were ~4.5M unique addresses before FTX/Alameda started unraveling, and the number of unique addresses saw a particularly aggressive 10% drop on December 8 – 15, likely due to contamination fears. The relatively low volume on-chain, high number of transactions and high number of unique addresses for USDT indicate that most transactions were of low value and it was likely to be the preferred stablecoin for retail users throughout 2022. However, given the sharp drop in unique addresses, it remains to be seen whether USDT manages to maintain its lead among users.

USDC

The balances of USDC across all categories of wallets as a percentage of total supply have declined over time. CEXs continue to be the dominant category, holding more than 11% of supply.

Diving deeper into the 10 wallets with the largest holdings, half of them are stock-related wallets. MakerDAO’s PSM-USDC-A contract is the single largest holder with over 2B USDC. Stablecoins are essential components in every ecosystem and seeing large amounts of stablecoins being bridged to Polygon and Arbitrum is a reflection of the health of their respective chains.

The number of unique addresses holding USDC continues to rise despite the stablecoin’s market cap seeing a slight decline in recent months, suggesting continued adoption, but the average wallet has smaller balances.

BUSD

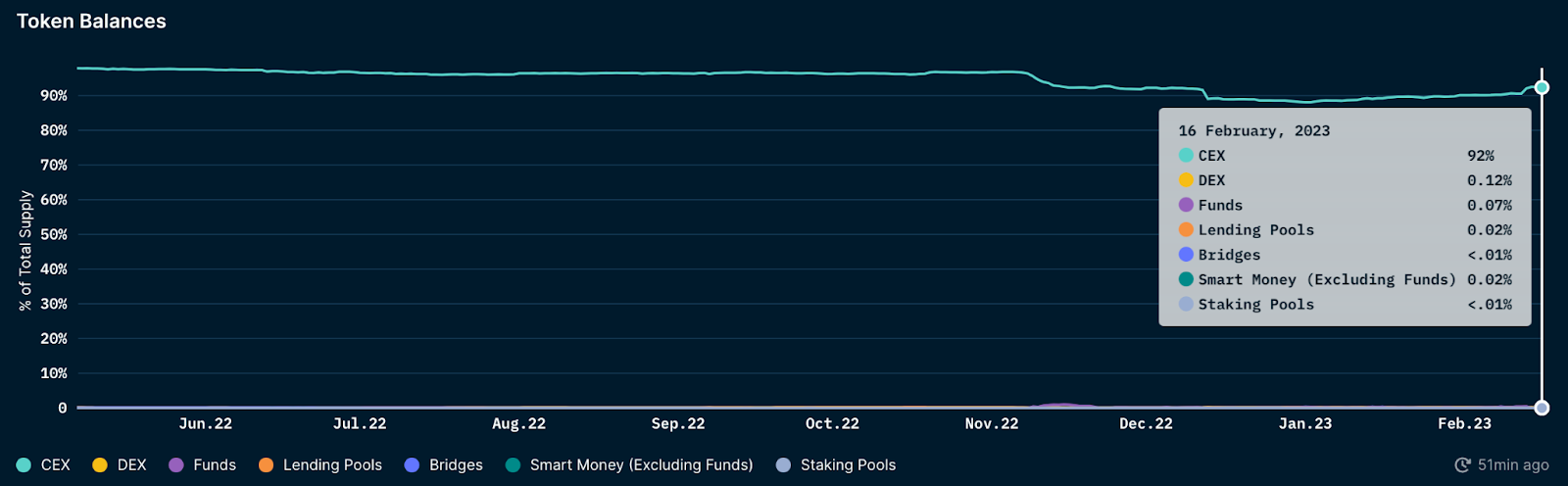

Despite being one of the largest stablecoins, BUSD is rarely used outside of Binance. About 92% of BUSD’s supply is on CEXs and over 97% of that is on Binance itself.

It’s no surprise that most of the top wallets are owned by Binance, in addition to Paxos which is the issuer of BUSD.

The token has the lowest number of unique addresses it contains, which is to be expected since most of the supply is on Binance. The low chain volume, number of unique addresses and the distribution of token holders reflect a lack of widespread adoption outside the Binance ecosystem despite its large market cap.

On February 13th, it was announced that the SEC intends to sue Paxos and that the minting of new BUSD tokens has been halted as a result. Since then, we’ve seen its market cap drop from $16.1 billion to $14.2 billion as existing holders start redeeming it for USD, burning the tokens.

DAY

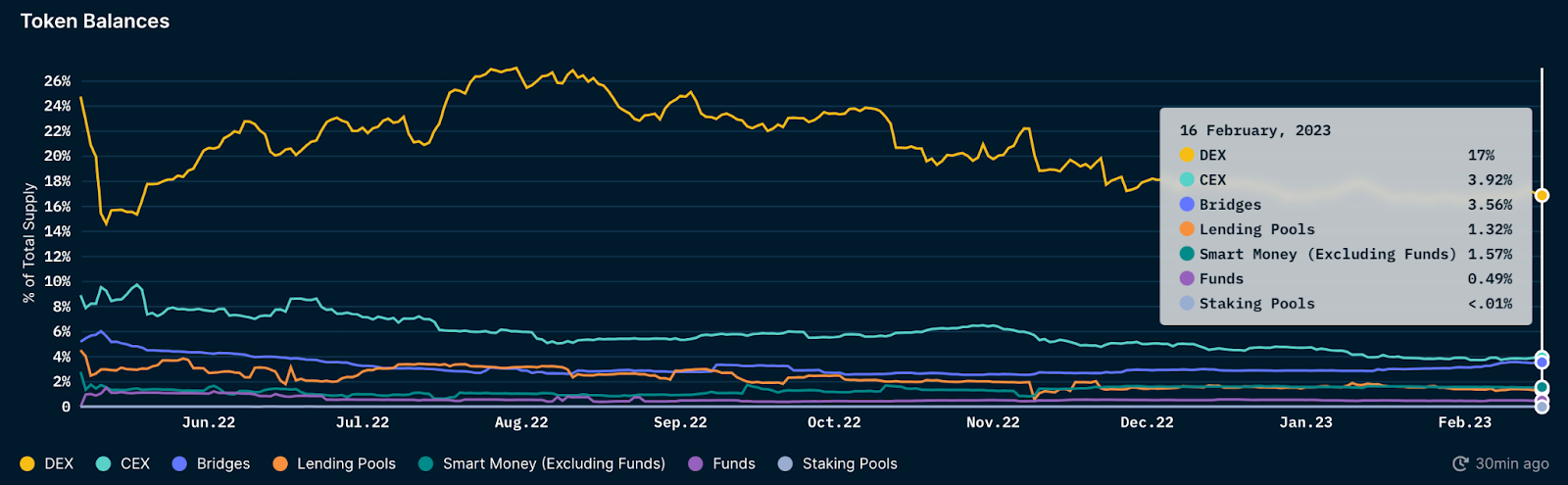

DAI is the only decentralized stablecoin we are going to analyze in this piece. Although DAI has the smallest market cap by a margin, it punches well above its weight when it comes to chain volume. Unlike the other stablecoins mentioned, DAI lives mainly on DEXs. 17% of DAI’s supply is on DEXs, more than 3 times higher than its closest competitor, USDC, which has 5%.

DAI’s top holding list is the most diversified of the group, with a strong presence in various liquidity pools, bridges and even in a treasury.

DAI had 3.6M transactions in 2022 that facilitated over $1.2T in volume, which is an extremely high amount of volume per transaction. The token is probably the preferred stablecoin among crypto-native individuals and protocols. Overall adoption for DAI has grown over time, despite a decline in its market cap, unique addresses for the token are at an all-time high (486k).

Closure

Despite a slowdown and in some cases a decline in market capitalization of the largest stablecoins, mainstream adoption is on the rise. The increase in the number of unique addresses for most of the stables discussed in the article is a reflection of the increase in adoption. There is a clear relationship between the degree of decentralization of a stablecoin and its on-chain velocity, showing a clear preference for decentralized solutions by crypto-native users. For users venturing into more experimental mechanisms, it will be useful to use on-chain analysis tools such as Nansen to keep an eye on key points of failure.

Although there is an ongoing war between the top stables that seems to be increasing as time goes on, there is probably room for multiple stablecoins of different mechanisms to co-exist and cater to different users. However, there are still outstanding questions for the sector. Will non-USD stablecoins ever see significant uptake? And will an algorithmic stablecoin ever break through to achieve sustained market share? These are just a few factors that are poised to shape the market in the coming years.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news

.png)