The explosion of FTX and the resulting tumult of the market has many in cryptocurrency referring to the importance of a core, original principle of blockchain technology: transparency. No other sector of the crypto ecosystem embodies transparency more than DeFi, where all transactions are visible and the code behind protocols is open for all to see. We developed Storyline to make that inherent transparency more accessible to web3 businesses, financial institutions and government agencies, and to promote the safety and security of the ecosystem.

With Chainalysis Storyline, organizations are able to understand, investigate and communicate the complex stories that are web3 transactions.

By the Numbers: Growth in DeFi

The web3 transformation is well underway. DeFi transaction volume grew more than 10 times from 2020 to 2021, reaching $5.8 trillion. While total transaction volume looks set to decline this year given the bear market, DeFi has driven nearly $3.7 trillion in transaction volume in 2022 — more than half of all chain volume. DeFi’s growth is also reflected in the composition of total transaction volume by currency type.

Bitcoin, which once dominated the cryptocurrency markets, now accounts for just over 10% of all crypto transactions. The decline of bitcoin transaction volume dominance is due to the rise of blockchains designed for decentralized computation. As DeFi grew, it changed how business and customers interacted with crypto. Bitcoin tends to be used as a currency and savings tool, while Ethereum and other DeFi protocols—smart contract systems-is used in a variety of ways, including dapps that provide services such as borrowing, lending, trading, gaming and collectibles (NFTs).

Some businesses have already embraced this revolution and others are still looking for ways to unlock the revenue potential. But both have the same need to manage risk, protect their customers and vet DeFi transactions.

Over the course of 2021, DeFi protocols became the target for hackers looking to steal cryptocurrencies, as criminals began using the complexity of smart contracts to disguise their activities. 2022 is on track to be the biggest year ever for hacking activity, with the most funds being stolen from DeFi protocols. In October 2022 alone, hackers stole over $700 million across 11 separate DeFi hacks.

New tool requirements for web3

As DeFi has exploded, so has the need for solutions to manage its risk, prevent illegal activity, and investigate complex transactions. We’ve heard from our customers that they don’t have the right tools to review, analyze and investigate complex smart contract transactions, making it difficult to participate in DeFi while also protecting their business and customers. It is clear that new solutions are needed to safely participate in the web3 revolution.

Introduction to Storyline: What it is and how to use it

Enter Chainalysis Storyline, the first blockchain analytics solution to specifically target this rapidly growing segment of cryptocurrency.

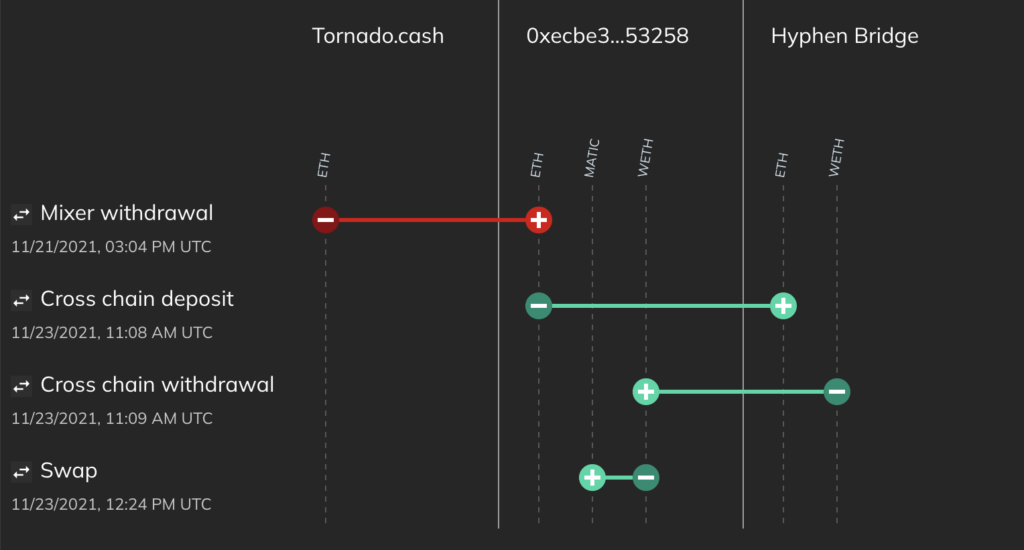

Customers can address the complex nature of DeFi and create clarity and transparency by using Storyline to track and review all types of smart contract interactions, from simple NFT transfers and DEX exchanges to cross-chain bridge transactions and much more. Visualizations are simplified. Instead of traditional cluster charts, where DeFi transactions can be complicated to analyze, Storyline uses a new timeline view that shows the movement of funds between addresses where users can look forward, backward and across chains to discover what happened with one or more transactions happen.

We’ve identified and built new, unique features that unpack the complexity of DeFi. With Storyline, users can:

Create clear temporal visualization to help tell the story and easily analyze the flow of funds—for NFTs, native tokens, ERC-20 tokens and across chains

Receive automatic interpretation of transactions, make common transactions easy to understand and highlight risky behavior

Add paired transactions for cross-chain exchange and bridges in one simple action

Generate simplified views of transaction outcomes, making it easier to understand smart contracts by examining balance changes

Hone in on what’s important using powerful filters that sort through cross-chain data to identify unusual or unexpected behavior

In addition, attributions from Chainalysis, ENS and other on-chain data allow users to identify key actors and quickly track funds.

Use Storyline to spot growth opportunities

With Storyline, businesses can track customer transactions, track where their assets come from and are sent to, and who they interact with. It helps organizations gather business insights—by tracking and analyzing just one or a group of transactions.

Storyline helps you track:

What is the risk of this transaction or address? Was this a false positive alert in our monitoring system?

What happened: Where did that asset come from? What is its history? Where did it go? How did that hack or scam work?

Where is the money now? Can our business use these insights to recover or freeze the funds?

Who is involved? Are there counterparties you should be aware of? Are transactions going to platforms you don’t want to interact with?

Can I find information that will identify the perpetrator? Can this information help us build a case? Can I prove their involvement?

See Storyline in action:

Track the flow of NFT transfers, keep track of customer transactions and interactions:

Track and understand a timeline of events for smart contracts that dig into the relevant counterparties:

Learn more about how Chainalysis Storyline delivers blockchain intelligence for the web3 era. You can also sign up for our Storyline introductory webinar below.

This website contains links to third party websites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the Site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

Chainalysis does not warrant or guarantee the accuracy, completeness, timeliness, suitability or validity of the information in this report and shall not be responsible for any claim attributable to errors, omissions or other inaccuracies of any part of such material.

All trademarks, logos and trade names are the property of their respective owners. All company, product and service names used on this website are for identification purposes only. Use of these names, brands and trademarks does not imply endorsement.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news