[ad_1]

Bitcoin’s price tumbled to a weekly low of $50,664 on February 21, narrowly avoiding massive liquidations; on-chain data analysis determines the likely causes of the recent withdrawals.

After a remarkable 27% surge in February that saw Bitcoin (BTC) hit a 3-year high of $52,985 on February 20, Bitcoin is struggling to maintain momentum.

With miners increasing profit-taking ahead of the upcoming halving event, a decline in ETF inflows threatens to derail the BTC price rally.

Bitcoin miners sold $8.2 billion worth of BTC in the previous 30 days

Bitcoin price fell by $50,664 on February 21, raising concerns of widespread liquidations as the bears were set to break below $50,000 for the first time since the Valentine’s Day rally. Market data shows the Bitcoin miners’ selling trend, and a slight flap in ETF inflows this week contributed to the pullback.

Bulls managed to stage an immediate pullback to $51,500 at press time on February 22, but a closer look at the on-chain data trace suggests that the bull rally is not yet back on track.

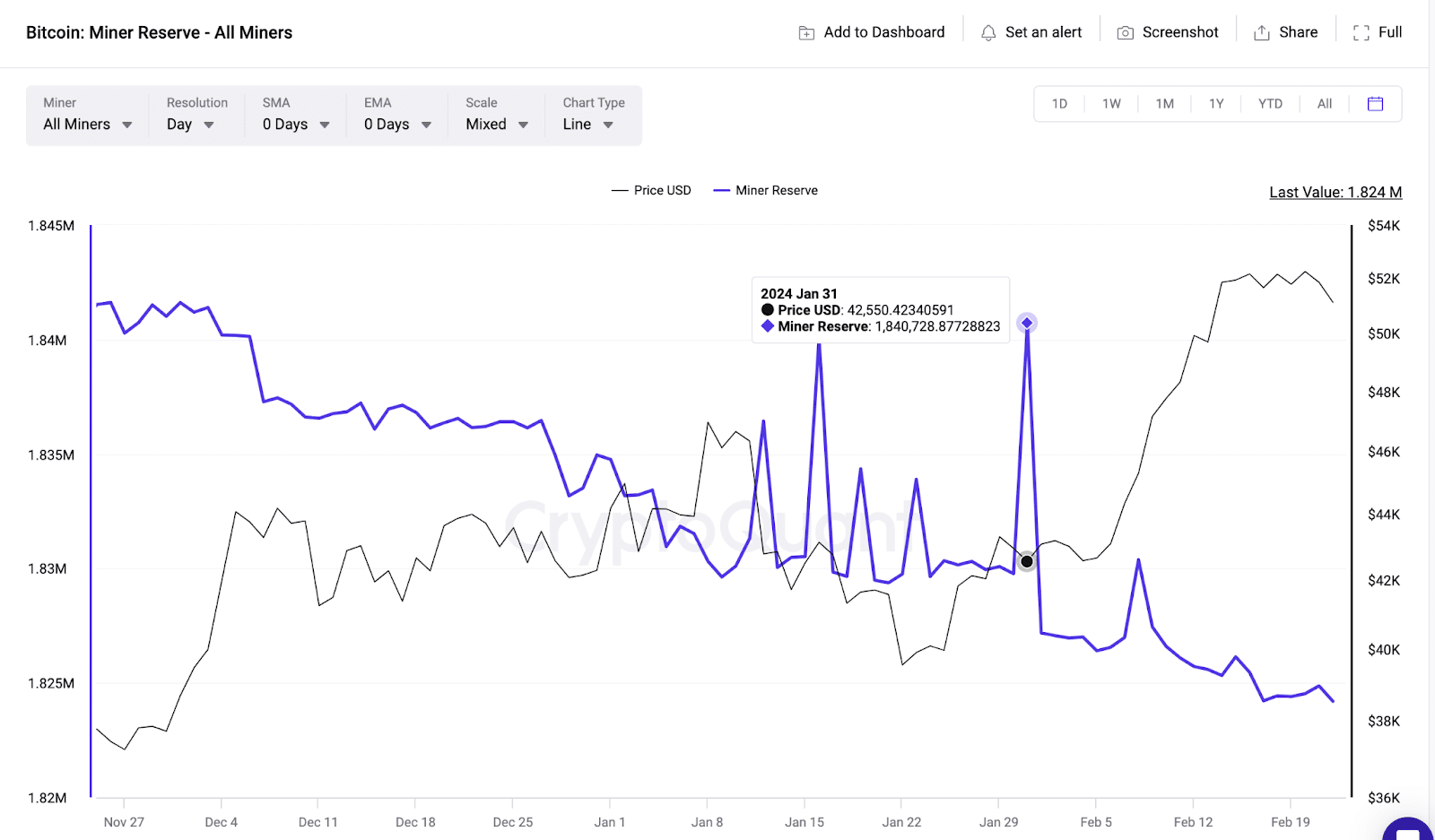

Cryptoquant’s mining reserves metric monitors real-time balances held by BTC miners. It shows that BTC validators have a cumulative balance of 1,824,201 BTC as of February 22nd, a 160,000 BTC drop from the balances held on January 31st.

Valued at around $51,500 per coin, the recently traded 160,000 BTC is worth around $8.2 billion. In particular, the chart illustrates how the miners intensified the selling frenzy by $102 million after BTC’s price hit a local high of $52,858 on February 15.

Typically, a selloff among miners indicates bearish sentiment among a significant group of stakeholders. With around 10% of the total circulating supply in their custody, the BTC miners significantly influence Bitcoin price action.

Without a commensurate increase in demand, it is not surprising that the latest wave of miners’ sales coincided with Bitcoin prices tumbling to a weekly low.

Bitcoin ETFs did not keep up with last week’s demand

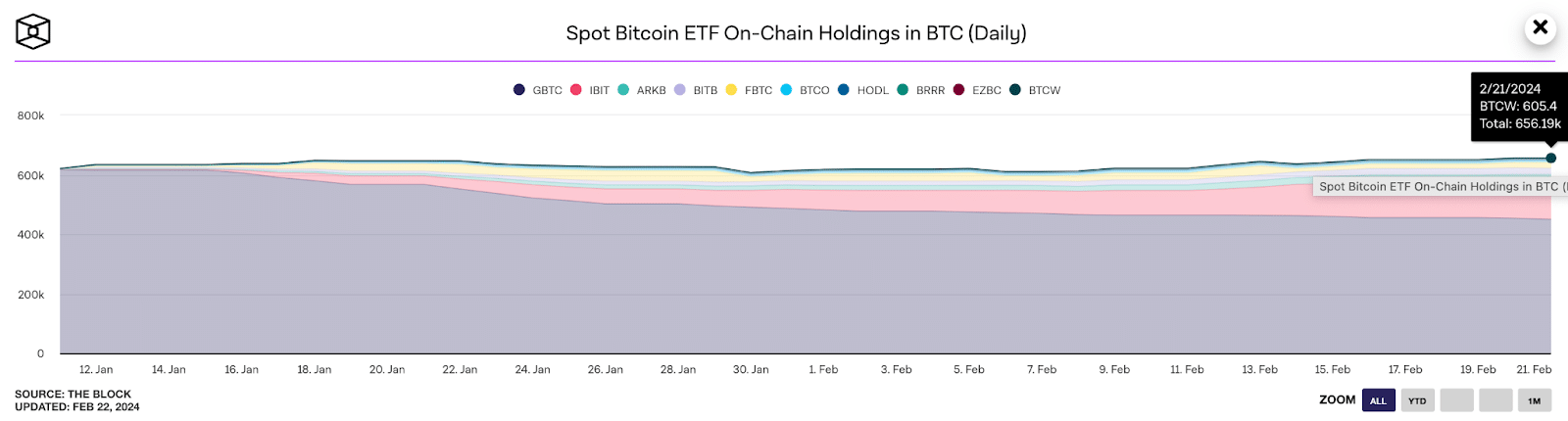

The BTC price rally in the first half of February was attributed to the Bitcoin ETF making record-breaking inflows.

Ahead of the ETF’s weekly trade open on February 19, BTC hit a new 2024 peak in the early GMT hours as strategic investors eyed potential gains if the ETFs pick up the buying trend from where they left off in the previous week. . But it didn’t happen.

For context, TheBlock’s ETF chain flowchart above shows historical changes in BTC balances held by Bitcoin ETF.

Unlike last week’s 17,480 BTC rally, Bitcoin ETFs slowed the buying trend by 73%, gaining only 4,680 BTC between February 19th and February 22nd.

In summary, there has been a decline in ETF demand this week as miners step up their selling spree ahead of the halving.

The two critical factors were decisive for BTC price tumbling towards $50,000 rather than breaking out to a new high above $60,000 as the bulls expected, with the rapid accumulation ahead of the ETF trading hours on February 19.

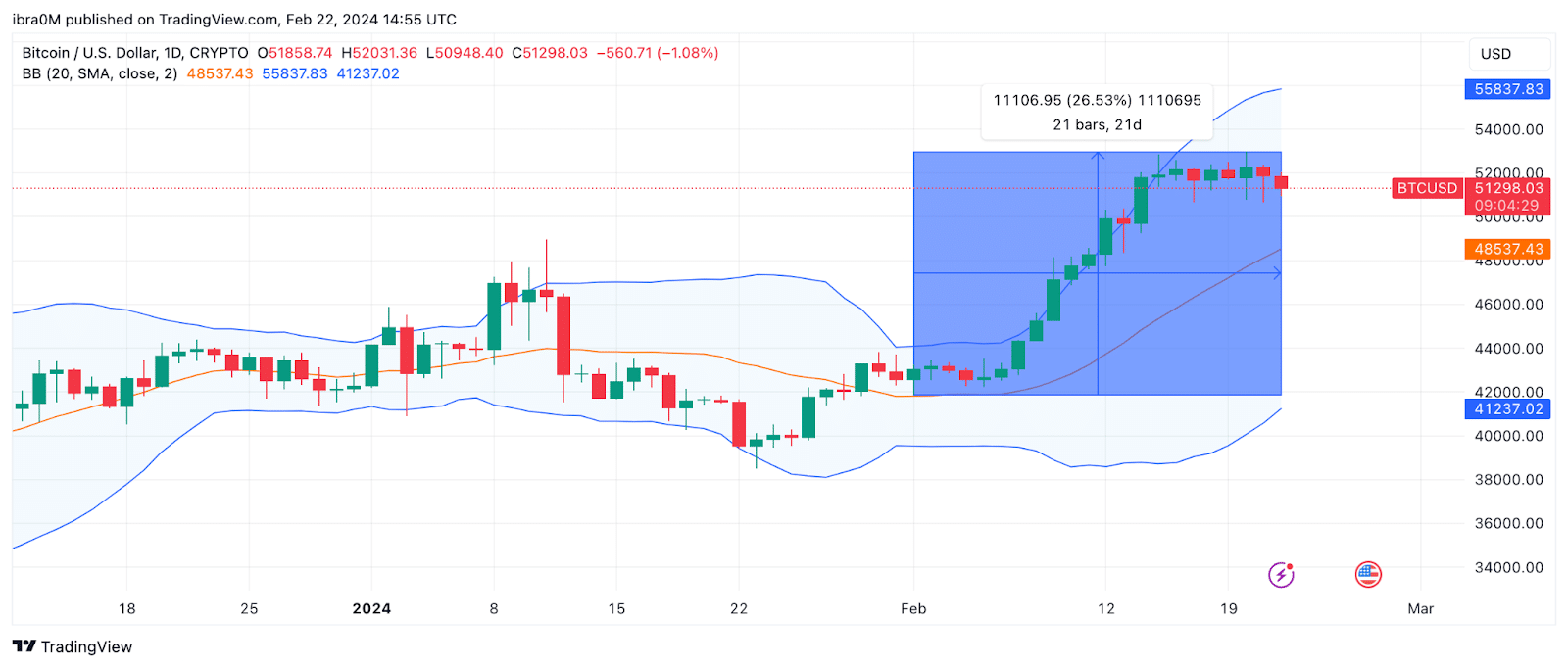

Price Prediction: Bitcoin Can Hold Above $48,500

Amid falling ETF demand and miners’ increasing selling frenzy, BTC price seems likely to hold above $48,500 if it loses the $50,000 psychological support level in the short term.

The Bollinger Band technical indicator further underscores these prospects by providing insights into possible support and resistance levels for Bitcoin’s short-term price movement.

With the 20-day Simple Moving Average (SMA) price currently at $48,560, this is an important support level below the $50,000 threshold.

This suggests that if the price were to break below $50,000, the $48,560 level could act as a significant support area, possibly halting further downward momentum.

If bullish momentum prevails and Bitcoin regains the $53,000 level, the upper Bollinger band indicates that the bears may re-emerge, establishing a selling wall at around $55,830.

This indicates a key resistance level that could impede upward movement, potentially leading to a consolidation phase or a pullback.

Given these technical dynamics, strategic swing traders may consider setting short-term stop-loss orders around the $45,000 area to manage risk in case of a breakdown below the $48,560 support level.

Conversely, bullish traders can target take-profit orders around the $55,000 mark, anticipating potential resistance near $55,830 and seeking to capitalize on any further upward movement.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news