Bitcoin’s rainbow chart is combined with a technical analysis of the weekly BTC price chart. In the first half of 2025, Bitcoin could set the cycle’s high water mark.

Bitcoin [BTC] prices have climbed higher since September 12. The uptrend had many pullbacks and stops, but the trend was evident on the higher time frame price charts.

Despite the many rumbles and failures in the crypto industry in 2022, the king stood strong.

The end of 2023 is near, and the next Bitcoin halving is estimated to happen in April 2024. Looking into the future is impossible, but that doesn’t mean we can’t plan for it. So what will 2024 and 2025 bring to the BTC markets?

What new highlights could we see? One strong contender for crystal ball status is the Bitcoin rainbow chart.

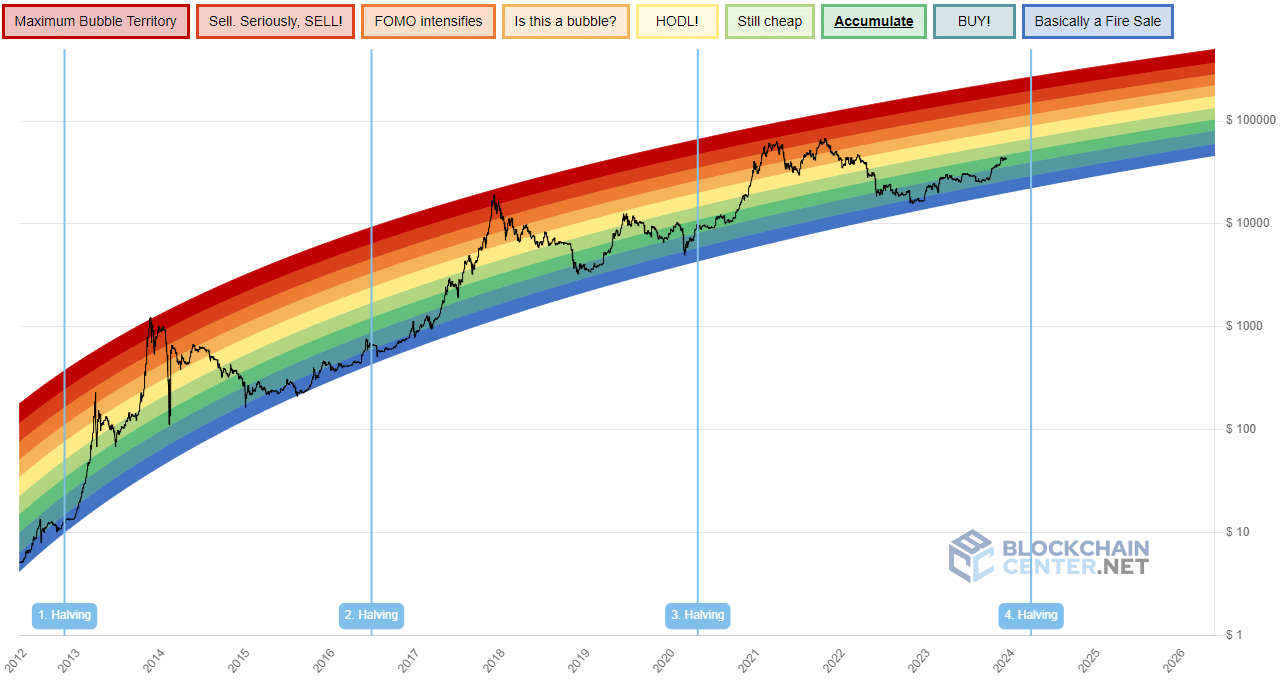

It’s a good time to buy BTC, according to the rainbow chart

Source: BlockchainCenter.net

The Bitcoin Rainbow Chart is a fun, colorful chart that shows where BTC is. Each color band has a meaning, a message for investors, although of course it is not financial advice. At press time, BTC is trading within the “Accumulate” zone.

The halving events are also marked, and the interpretation is quite simple. Buy Bitcoin when it is below yellow and sell when it reaches the orange or red zones.

This is especially useful for long-term investors who don’t have the time or inclination to track BTC prices daily or monitor multiple on-chain metrics.

In the past, the bull run came a year or later after the halving. Assuming the same for the next halving, we are likely to reach the peak of this cycle in 2025. But when, and what would those prices be?

Technical analysis can help answer the question of “where”.

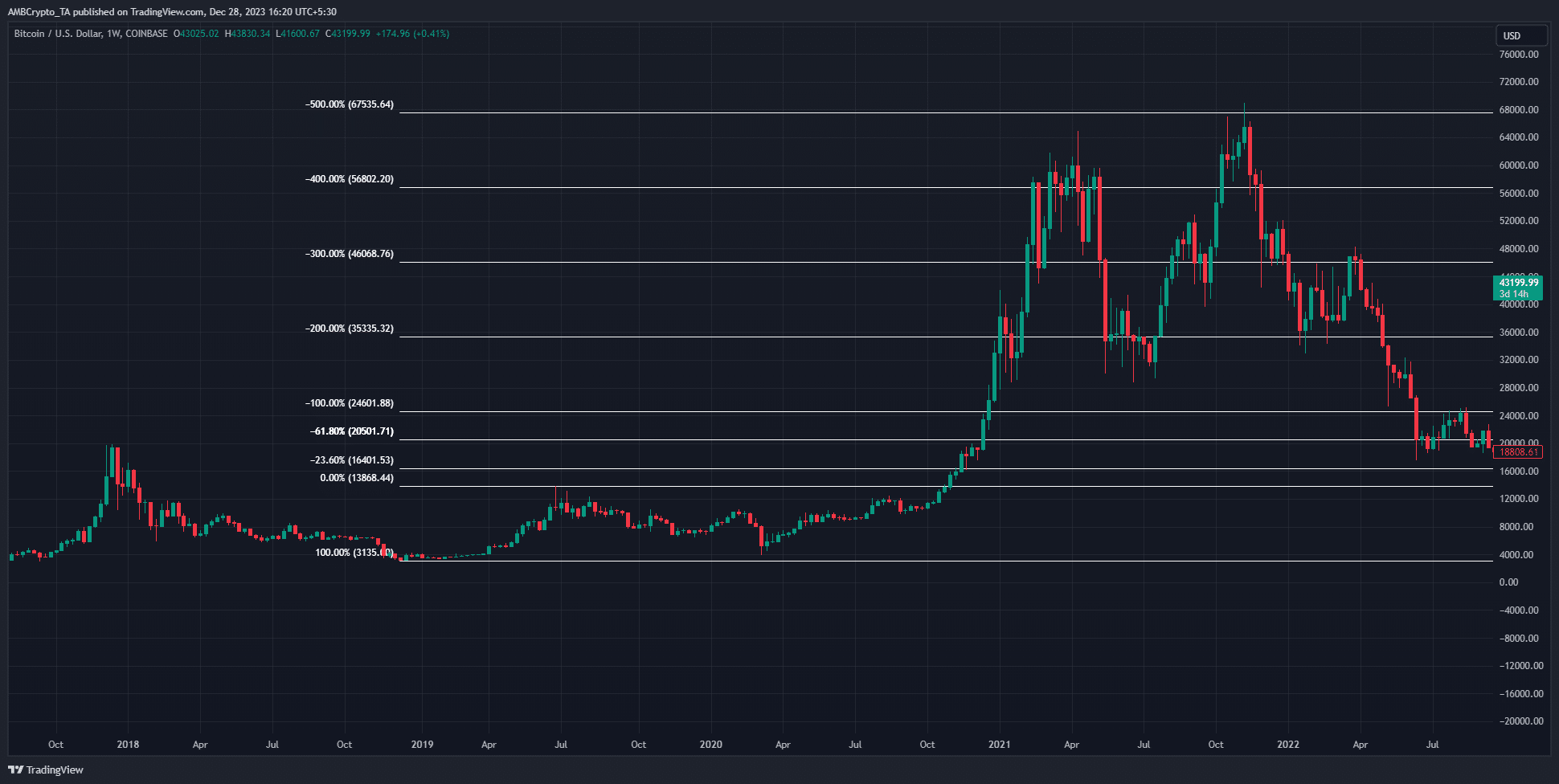

The Fibonacci retracement and extension levels are a well-known and widely used technical analysis tool.

They perform remarkably well over different time frames, but depend on the judgment of the user to decide the starting and ending points.

In our case, we will use a rally’s top and bottom, so that subjectivity can be excluded. There was a strong rally from $3135 to $13.8k years before Bitcoin’s 2020 halving. This move was used to plot the Fibonacci extension levels (white).

Source: BTC/USD on TradingView

The rally reached the 500% extension level 868 days after the initial move, or about 2.5 years later. This is information that may be valuable for another assessment.

Just like last time, BTC rallied strongly in the year leading up to its halving event.

We are not at the local top yet. Bitcoin has a strong bullish trend and the market structure on the one-day chart continued to favor the buyers.

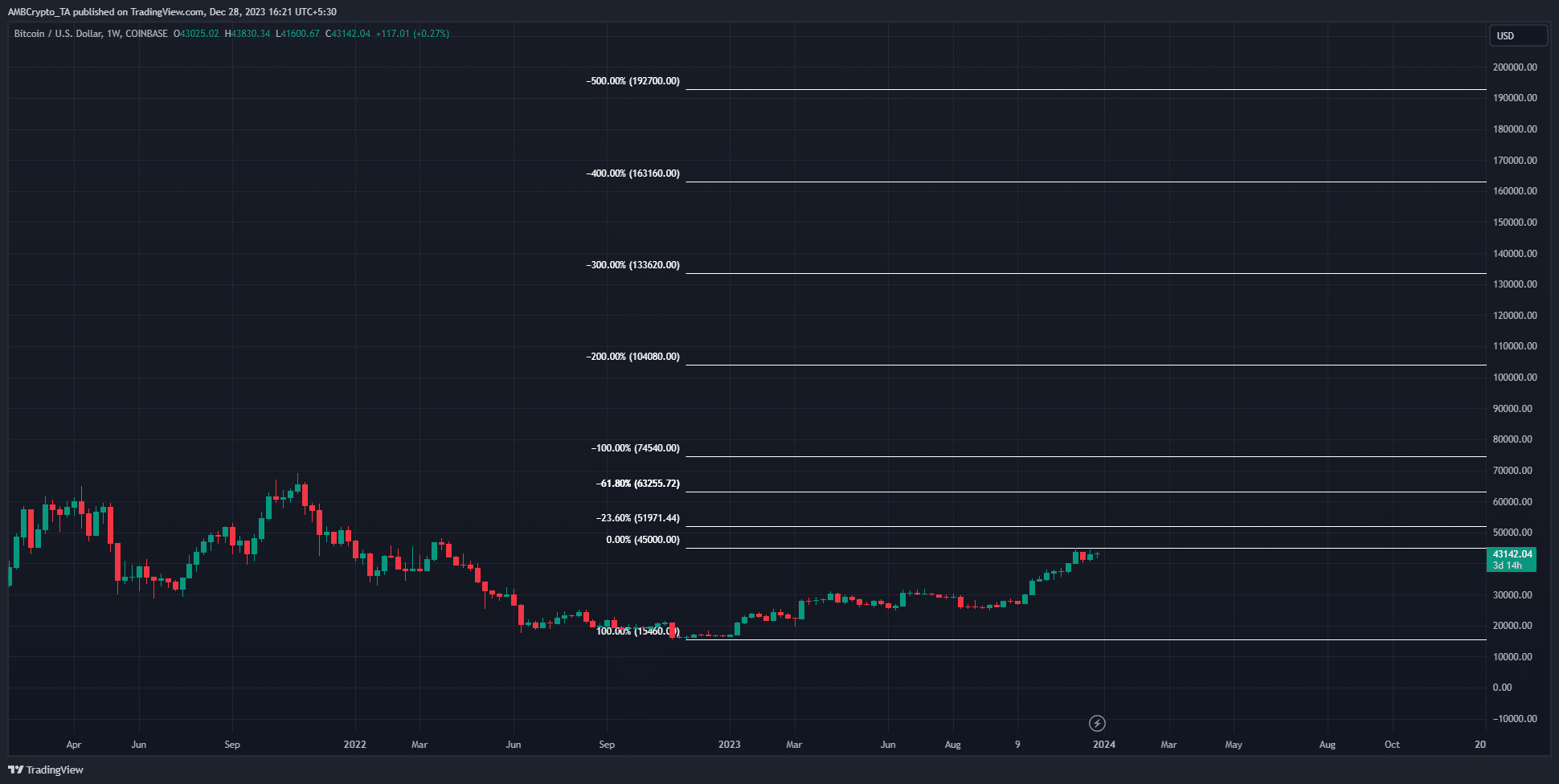

However, we can similarly plot the Fibonacci expansion levels to find out where the 500% expansion level would be.

Source: BTC/USD on TradingView

Assuming the $45k mark which is the price reached on December 5th is this run’s top, the 500% extension level comes out to $192.7k.

Given the current bullish outlook for BTC on the one-day chart, $45k may not be the local top.

Going back to the rainbow chart, we see that the previous cycle BTC reached the lower red band in the bubble zone. Therefore, we can assume that $192k in 2025 would be roughly in the same band.

It is expected to be on the rainbow map in February 2025.

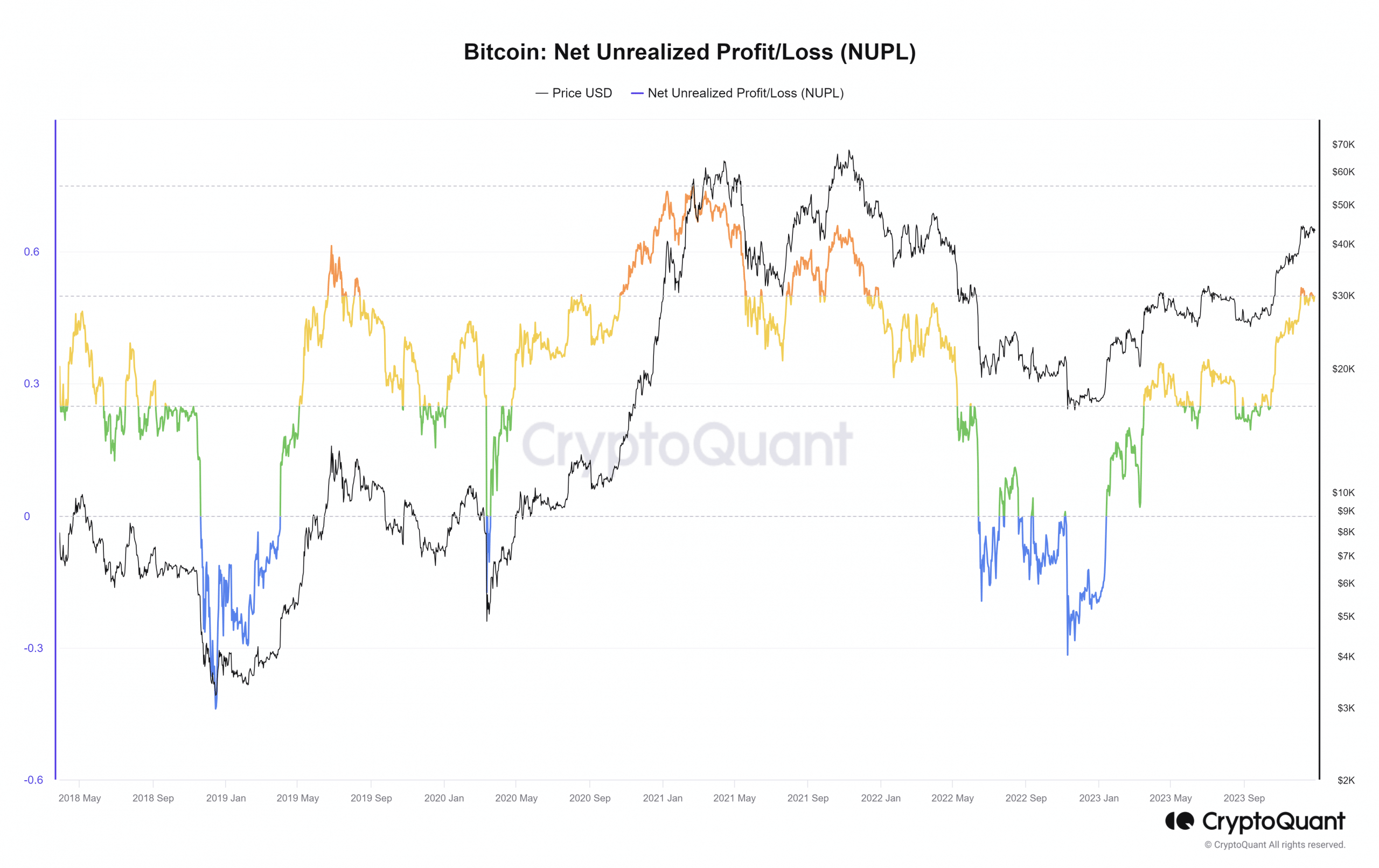

So there you have it, a neat Bitcoin price prediction for the next cycle. For readers who want to assess some on-chain statistics, the NUPL chart may be of interest.

Additional on-chain statistics to monitor

The Bitcoin Net Unrealized Profit/Loss metric measures the overall profit or loss of BTC investors. Values above ‘0’ indicate that holders are in profit, and the upward trend of the past few months has highlighted that more and more investors are taking profit.

Source: CryptoQuant

The previous cycle saw this metric touch 0.748 on February 21. Interestingly, the 2019 rally to $13.8k saw the NUPL reach 0.61.

Read Bitcoins [BTC] Price Forecast 2023-2024

The benchmark was at 0.49 on December 27, but a reading of 0.5 or higher would mean that the current move is likely nearing its end.

Again, these inferences are made on the assumption that history would repeat itself. Sometimes, instead of repeating, it simply rhymes. Therefore, investors and traders must be alert and ready to incorporate new information into their plans.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news