Worldcoin’s price surged to a record high of $9 on February 22nd, up a staggering 336% in the past 10 days, as OpenAI’s SORA launch and NVIDIA earnings emerge as key drivers.

On February 22, Worldcoin (WLD) achieved unicorn status and crossed the $1 billion market cap milestone.

WLD’s rise on the crypto top gainers chart is largely attributed to bullish winds from NVIDIA’s stock performance and OpenAI’s recently shipped SORA generative AI video rendering model.

It remains to be seen whether Worldcoin’s underlying ecosystem growth can maintain the momentum or whether the rally will expand as the media hype cools.

Worldcoin Adds $840 Million Market Cap In 10 Days

On February 22, Worldcoin’s native WLD token extended its remarkable February 2024 price rally to a staggering 320%, adding $840 million to its market cap within a frenetic 10-day period.

After a tepid start to the month, Worldcoin’s price trend turned bullish on February 15 when OpenAI soft-launched its latest text-to-video AI model, Sora.

Between February 15 and February 19, WDL price rose 160%, from $3 to a global high of $8.

At the $8 area, a quick profit-taking wave pushed the WLD price back down to $6 on February 21 as investors got bullish on NVIDIA’s Q4 earnings.

However, the leading chipmaker posted record earnings on February 21, sending its share price to all-time highs. Along with other AI-related risk assets, the WDL price also surged further, hitting a high of $9, adding another 50% to its February gain.

Beyond the media hype, the Worldcoin project has seen increasing global adoption since the turn of the year.

Worldcoin funded addresses were on the rise before the rally

WLD’s price breakout of over 300% in the past 10 days has been credited to the developments around NVIDIA and OpenAI and for good reason.

However, looking past positive headlines, on-chain data trends show that Worldcoin has attracted steady growth in user base even before the latest frenzy.

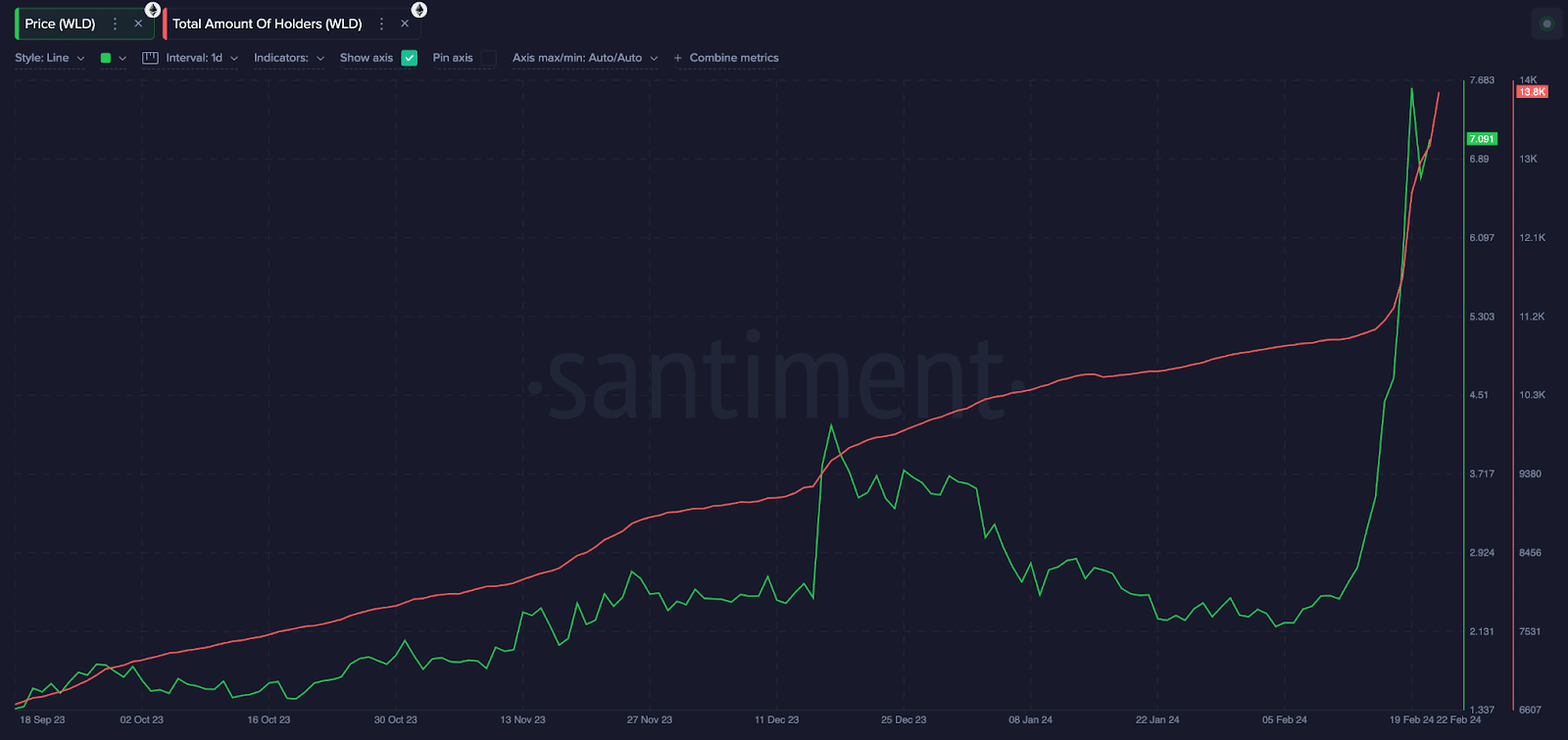

The Santiment chart tracks the number of unique addresses that contain units of a particular cryptocurrency. It shows that Worldcoin has attracted 3,608 new funded addresses since the turn of the year, bringing the total to 13,800 at press time on February 23.

A closer look at the red trendline shows that while WDL price fell 50% from $4.21 to $2.20 between December 17 and February 5, it continued to attract steady growth in new investor addresses.

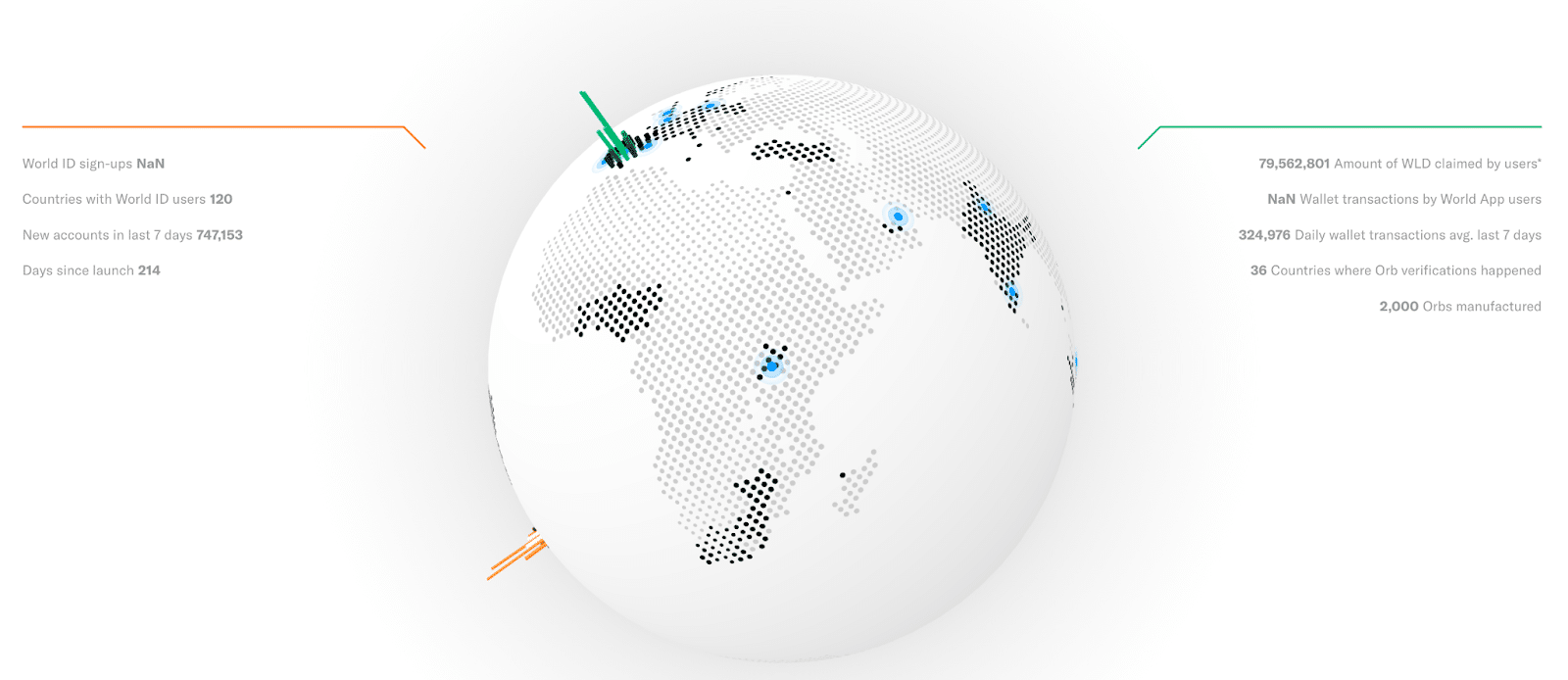

More data from the Worldcoin official website shows that 3.5 million people from 120 countries have now signed up for unique World IDs.

This remarkable growth within the on-chain WLD ecosystem came after the initial backlash surrounding its IRIS scanning and data harvesting concerns from critics.

However, it remains to be seen whether this growth translates into steady on-chain transactions and network activity sufficient to keep WLD on its current upward trajectory.

Worldcoin Price Prediction: $10 is the next major resistance

In terms of short-term price action, without another comparable bullish catalyst, Worldcoin’s price is likely to enter a pullback below $8 in the coming days.

With prices trending toward all-time highs, virtually every existing holder is sitting on unrealized profits. As the media fanfare surrounding SORA and NVIDIA subsides, some strategic investors may profit.

The upper and lower Bollinger bands are stretched to extremes, pointing in opposite directions. This rare market alignment occurs when an asset has reached overbought conditions and is ready for a pullback.

If this scenario plays out as predicted, the loss of the $8 support could trigger a free fall to the 20-day SMA price at $4.20, the previous high recorded before the lightning rally that occurred 10 days ago.

On the other hand, there is a chance that bullish investors may hold out for more gains, especially with the official launch of SORA yet to come. In this case, the bulls must first scale the $10 psychological resistance.

This week’s price trends show that WLD has seen a short-lived pullback every time the price approaches nominal milestones at $8 and $9 respectively. A repeat of this pattern could see the WLD price reject during the next rally from $10.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news