As Bitcoin (BTC/USD) hovers above the $62,000 mark, showing a 1.50% increase on Saturday, the cryptocurrency landscape is full of anticipation.

This pivotal moment makes 99% of Bitcoin addresses profitable, sparking a debate about the future trajectory of this digital asset.

Analysts, including the well-known PlanB, suggest we are on the verge of a bull market, predicting a 10-month period of explosive growth driven by intense FOMO and bolstered by recent advances such as the approval of spot Bitcoin ETFs.

With predictions placing Bitcoin’s price between $100,000 and $120,000 by Q4 2024, investors are keenly watching for signals in this consolidating market.

Bitcoin Bull Market Ignite: PlanB Predicts 10 Months of Explosive Growth

Bitcoin analyst PlanB predicts a bullish market, predicting a 10-month rally fueled by intense FOMO. According to PlanB, the end of accumulation indicates entry into the prime market, which is consistent with historical trends following Bitcoin’s halving events.

Cosmic Power Feed: Bitcoin analyst PlanB predicts 10 months of ‘face-melting fomo’ https://t.co/Fk6o2rmyEm https://t.co/QDsS9aHx9D pic.twitter.com/PEhXBKaIcZ

— Cosmic Force 🎮 Crypto Gold Rush ⛏ (@WavemStudios) March 1, 2024

Despite recent declines, the approval of spot Bitcoin ETFs has bolstered investor confidence, contributing to a 22% price increase over the past week.

Key Highlights:

10-Month Bull Market Predicted by PlanB Spot Bitcoin ETF Approvals Raise Investor Interest Bitcoin’s Price Could Reach $120,000 by Q4 2024

The transition of Grayscale’s ETF and the expected influx of passive ETF demand could propel Bitcoin to record highs, with projections between $100,000 to $120,000 by the end of 2024 and a peak market cap expected by 2025.

US Energy Officials and Crypto Miners Reach Agreement to Delete Mining Survey Data

In a landmark move, US energy authorities, along with the Texas Blockchain Council (TBC) and Riot Platforms, a notable Bitcoin mining entity, have agreed to halt a controversial survey targeting cryptocurrency mining operations .

The decision, which aims to address concerns about the survey’s intrusiveness and potential economic and innovation repercussions, results in the deletion of all previously collected data.

This resolution prevents further legal disputes by lifting the interim restraining order and alleviates the crypto mining community’s concerns about compliance costs and privacy violations.

The EIA settled its lawsuit with the Texas Blockchain Council and Riot Platforms and agreed not to use any data from the emergency survey on crypto miners or any future information from it. https://t.co/AYq4Etbs2W

— Cointelegraph (@Cointelegraph) March 2, 2024

Despite shelving the survey, the Energy Information Administration (EIA) retains the option to seek public feedback on revising survey parameters.

This agreement is an important moment for the US cryptocurrency mining sector, illustrating its ability to negotiate regulatory challenges while protecting its interests, potentially fostering a more stable environment for the industry’s future endeavors.

Michael Saylor’s bold Bitcoin bet paid off with a $1.2 billion profit

MicroStrategy’s Michael Saylor made a whopping $1.2 billion in just three days, thanks to a spike in Bitcoin price. Saylor’s strategy to acquire 193,000 Bitcoins since 2020 has paid off big in sending MicroStrategy to become a leading Bitcoin investor.

MicroStrategy’s Michael Saylor Made $1.2B in 3 Days After Bitcoin Boom #crypto #cryptocurrency https://t.co/k8XbLfvTVZ

— Crypto News 🌐⚡ (@CryptoAdHocNews) March 2, 2024

The recent increase in Bitcoin’s value to $63,918 not only doubled his initial investment, but also resulted in a 55% jump in MicroStrategy’s stock value.

Saylor’s total assets have now risen past $3.75 billion, reinforcing his confidence in Bitcoin’s financial promise.

Important points:

Saylor’s $1.2 Billion Profit From Bitcoin MicroStrategy Holds 193,000 Bitcoins Total Assets Exceed $3.75 Billion

US Crypto Regulatory Dilemma: Innovation Stifled in Regulatory Swamp

The current US regulatory framework for cryptocurrencies presents a paradox, embodying a Catch-22 where compliance becomes a complicated task due to conflicting regulations.

SEC Chairman Gary Gensler’s push for crypto entities to register is hampered by the scarcity of licensed exchanges, which limits trading options for registered coins.

Cosmic Force feed: The Catch-22 of US Crypto Regulation https://t.co/4hDkX45yXf https://t.co/QhvW3zK6Bq pic.twitter.com/C9fZ4TWzy7

— Cosmic Force 🎮 Crypto Gold Rush ⛏ (@WavemStudios) March 1, 2024

Fintech firms face similar obstacles, depending on banking partnerships for access to payment systems while navigating strict regulatory oversight. This lack of a federal licensing framework limits innovation, despite state laws that provide some relief.

Key point:

Conflicting regulations create compliance challenges. Lack of authorized exchanges limits trading options. Federal licensing absence hinders innovation. Congressional intervention needed for clear regulatory frameworks.

Congressional action is crucial to establish clear, supportive legislation for fintech and crypto, to ensure their growth and competitive advantage in the global marketplace.

Without resolution, the U.S. risks staying stuck in cryptocurrency development, which could potentially affect Bitcoin’s value amid regulatory uncertainty and limited trade avenues.

Bitcoin Price Prediction

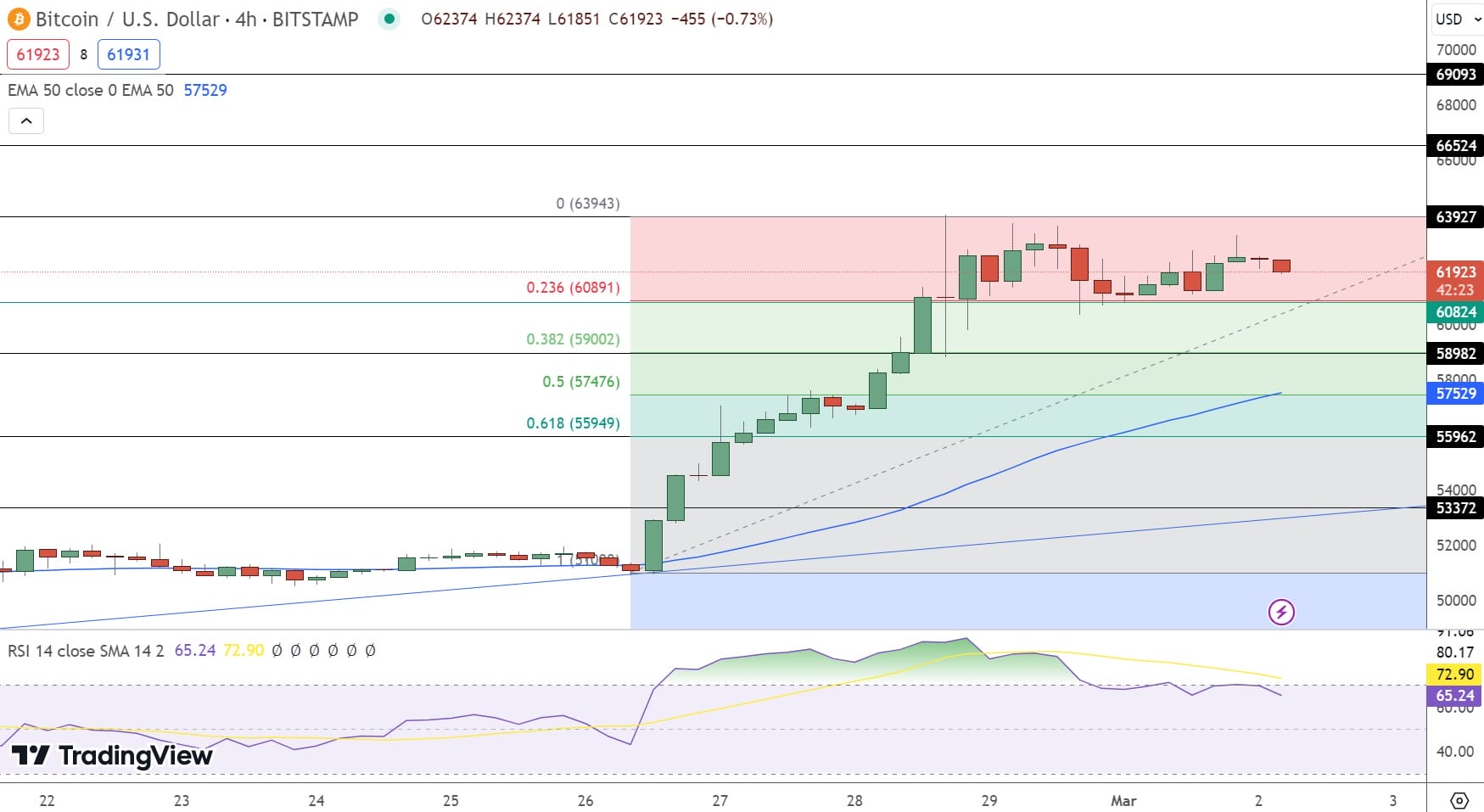

On March 2, Bitcoin (BTC/USD) displays a compelling technical outlook, navigating between bullish and bearish territory. The pivot at $60,824 serves as a critical support point, with resistance and support levels determining potential market directions.

Immediate resistance lies at $63,927, suggesting a cap on upside moves, while support at $58,982 offers a retracement in bearish scenarios.

📈 #BitcoinAnalysis: BTC/USD hovers around pivot of $60,825, with resistance at $63,925 to $69,095 and support at $58,980 to $53,370. RSI at 69 indicates cautious optimism. Trading above 50 EMA ($57150) indicates bullish sentiment. Look for breakouts or supports for trends. pic.twitter.com/BorUmGCFru

— Arslan Ali (@forex_arslan) March 1, 2024

The relative strength index (RSI) at 69, flirting with overbought conditions, and the 50-day exponential moving average (EMA) at $56,307 indicate continued buying interest.

The market’s current stance, oscillating between $63,350 to $60,800, suggests cautious optimism.

A break above $63,500 could signal further gains, while the slide below this range could trigger a retest of lower support levels, putting Bitcoin in a bullish position above $60,825.

Green Bitcoin: Embrace Eco-Friendly Crypto with Gamified Staking

Green Bitcoin is emerging as a pioneer in the crypto world, fusing environmental stewardship with the dynamic nature of digital currencies. With the launch of Gamified Green Staking, this initiative not only promises tempting rewards, but also offers a double token bonus, emphasizing eco-awareness in every transaction.

Pre-sale (40%): The pre-sale starts the business and lays the foundation for what is poised to be a dynamic market entry. Staking Rewards (27.50%): A significant reserve to meet the commitment of stakeholders, ensuring the long-term health of $GBTC. Marketing (17.50%): A dedicated fund to create influential campaigns, essential for maintaining the currency’s global footprint. Liquidity (10%): An essential provision for smooth trading, strategically allocated to strengthen $GBTC’s presence across exchanges. Community Rewards (5%): A nod to the core supporters that recognizes and encourages community engagement.

The ‘Green Card’ outlines a clear trajectory for Green Bitcoin, starting with a value-driven presale and progressing through strategic initiatives that energize the community and strengthen the token’s market position.

Take the leap into Green Bitcoin’s realm where your investment does more than generate returns – it supports a sustainable financial ecosystem. Stake your claim today and be part of an eco-responsible future.

Get Green Bitcoin Here

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news