[ad_1]

Bitcoin (BTC) journey to $100k seems inevitable. However, that doesn’t mean it won’t have its ups and downs. Although the BTC price has repeatedly broken new all-time highs, on-chain data suggests that a correction may occur soon.

Understanding how profitable wallets and whales are can suggest that the BTC price may soon correct by 27%.

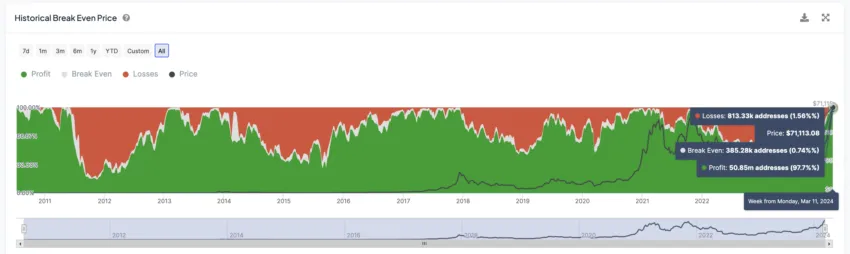

The number of profitable BTC holders is almost 100%

As a result of BTC’s recent surge, consistently setting new all-time highs, the ratio of holders enjoying profits has approached nearly 100%. This level of widespread profitability among BTC investors has not been seen since November 2021, when the benchmark rose to 93.8%.

After reaching that high, BTC underwent several price adjustments over the next five weeks. Its market price dropped sharply from $65,218 to $36,982, representing a significant drop of approximately 43.29%.

This trend suggests that many investors may soon prepare to secure their profits. This potential move by investors to liquidate their holdings could lead to a significant increase in selling pressure on Bitcoin. Such a dynamic shift in the behavior of Bitcoin investors could significantly affect BTC market stability, potentially leading to downward price movements.

Read more: Bitcoin Price Prediction 2024/2025/2030

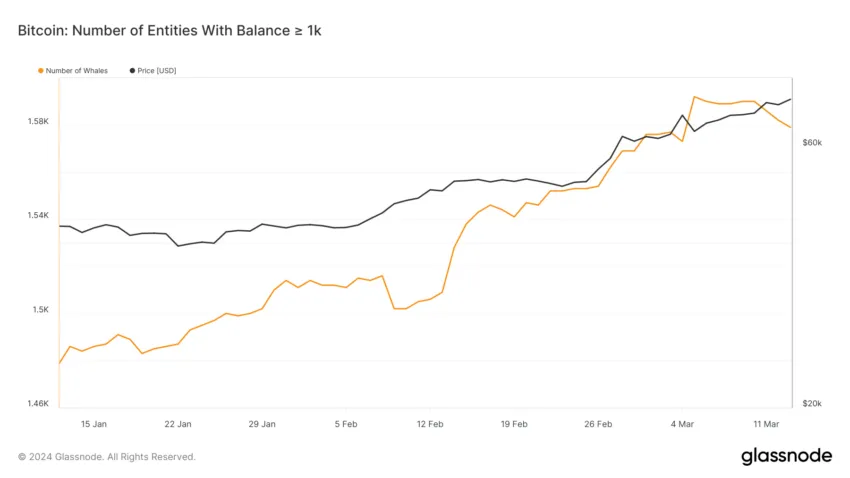

Some whales migrate

The count of Bitcoin addresses with at least 1,000 BTC gradually climbed from 1,486 on January 13th to 1,592 by March 5th. Nevertheless, a slight decrease was observed from March 5 to March 13, with the total dropping to 1,579 addresses.

The current count exceeds the number of whales spotted in January. Still, the latest drop in addresses with at least 1,000 BTC may indicate that these investors are starting to liquidate their positions. They may believe that Bitcoin has reached its current maximum value, at least for the short term.

While this shift in itself may not immediately trigger a widespread sell-off, it has the potential to affect the market sentiment of other investors. This change in perception about BTC’s short-term direction could be enough to cause a noticeable adjustment in the market.

The implication that these large holders are starting to sell could signal to the broader market that now may be a strategic point to consider taking profits. Consequently, this perception could lead to cautious trading behavior, further affecting BTC price stability and possibly ushering in a period of price recalibration.

BTC Price Prediction: EMA lines are still bullish

The BTC 4-hour price chart shows that all EMA lines are below the price line, which is usually bullish. Another bullish signal is that the long-term EMA (100 and 200) is below the short-term (20 and 50).

EMA (Exponential Moving Average) cross lines identify trends and potential turning points by plotting price data over specific time periods.

Read more: 7 Best US Crypto Exchanges for Bitcoin (BTC) Trading

When a shorter-term EMA crosses above a longer-term EMA, it is often interpreted as a bullish signal, suggesting an uptrend. Conversely, when a shorter-term EMA crosses below a longer-term EMA, it is seen as a bearish signal, indicating a potential downtrend.

However, this does not mean that a correction could not occur before the uptrend continues. If BTC’s price cannot maintain the $67k support, it could drop as much as $52k, a potential 27% correction. However, if BTC can continue its upward trend despite the decrease in the number of whales and the high percentage of profitable addresses, it may reach $75k or $80k soon.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news