The Ethereum price bounced back 5% in the last 24 hours to hit $2,411 as the cryptocurrency market as a whole actually fell 0.1%.

ETH’s move today means it’s now up 1.5% in a week and 7.5% in the past 30 days, with the biggest altcoin in the market also up 81% over the past year has.

These moves come as weekly Ethereum inflows top $29 million, according to the latest CoinShares data, making ETH the most popular altcoin among funds.

And with the market hoping for a big surge in the case of Bitcoin ETF approvals today, the Ethereum price could rise strongly very soon.

Ethereum Price Prediction As Inflows Rise To $29 Million – Could ETH Reach $5,000 This Month?

More than most other major coins, ETH really looks like it is poised to make strong price gains in the next few days.

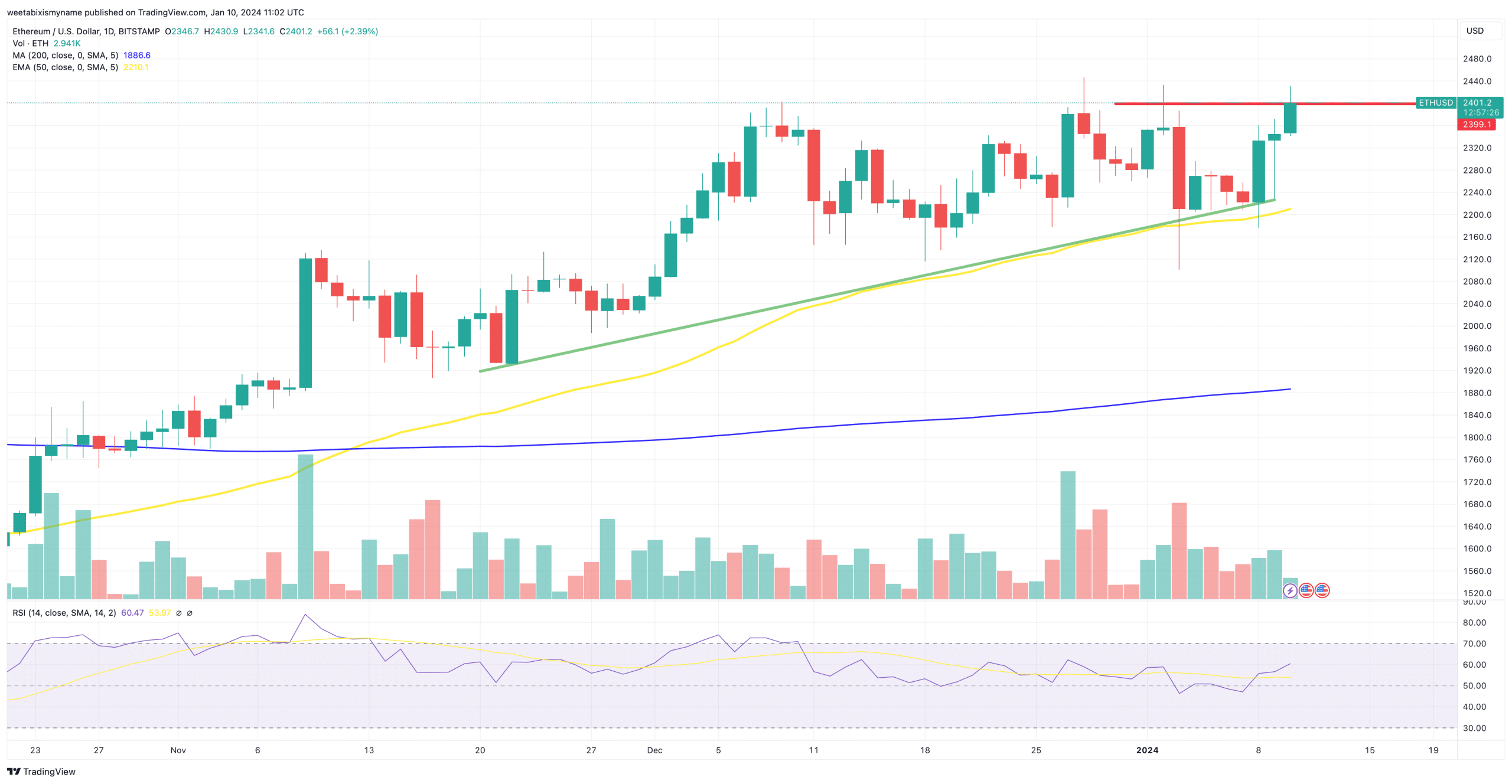

Its RSI (purple) has just risen back to 60, a sure sign of increasing momentum, especially after the indicator dipped below 50 a few days ago.

At the same time, ETH’s 30-day moving average is climbing again sharply after easing in recent days, another indication that buying pressure is growing for the coin.

One of the encouraging signs regarding ETH is that its support level (green) has been rising consistently in recent weeks, implying that even if it is not rising continuously, it is not going to fall hard anytime soon.

And as the latest CoinShares report makes clear, ETH is the most popular alt in the market this week, with its inflows comfortably exceeding that of its closest competitor, Cardano (ADA).

2024 is off to a strong start, with US$151 million inflows! Total inflows since the Greyscale vs SEC lawsuit now stand at US$2.3 billion.

Notable asset inflows include:$BTC: US$113m inflow$ETH: US$29m inflow$ADA: US$3.7m inflow$AVAX: US$2m inflow$LTC: US$1.4m… pic.twitter.com/9wfshmqxsB

— CoinShares (@CoinSharesCo) January 8, 2024

It is possible that the market is getting excited about ETH because it could be one of the main beneficiaries in the event that the SEC approves Bitcoin ETFs today, which many think is likely.

If the regulator does approve Bitcoin ETFs, it is possible that Ethereum ETFs could follow sooner or later, something that would obviously be a big win for Ethereum.

Still, Ethereum’s fundamentals are so strong that it is more than capable of continuing to rise with ETFs.

It still accounts for more than half of the total value locked of the entire crypto sector, with the platform attracting the biggest adopters last year, including PayPal and Coinbase.

As such, 2024 is likely to be another good year for the Ethereum price, which could reach $3,000 in the next few months.

Other high-potential Altcoins for big profits

Traders looking for lower capital alternatives to ETH may be interested in looking at newer alts and presale tokens, which can often go up big when they first list on exchanges.

One coin that is likely to do this is Bitcoin ETF Token (BTCETF)a deflationary ERC-20 cryptocurrency that raised nearly $5 million in its presale, which has now closed.

Big players like @BlackRock , @ARKInvest , and more are adjusting their applications for a US #Bitcoin #ETF , now leaning towards cash redemption over in-kind transactions.

The #SEC’s stance signals a shift. What’s your take on this regulatory move? #BitcoinETF hits over the $4.8… pic.twitter.com/bxixnW8m3T

— BTCETF_Token (@BTCETF_Token) December 19, 2023

Despite being sold for only a short period of time, Bitcoin ETF Token was able to raise so much money due to its highly deflationary tokenomics.

Namely, the coin will burn 25% of its maximum supply over the course of its lifetime, burning this amount in five 5% installments, as well as through a transaction tax.

The first of these will come when an SEC-approved Bitcoin ETF reaches a trading volume of more than $100 million, and with the SEC likely to approve its first BTC ETF today, this milestone could come sooner rather than later.

By burning 25% of its supply, Bitcoin ETF Token will experience steadily rising demand, which could push its price ever higher.

#BitcoinETF Token Announcement! 📣

We are proud to announce that approximately 21 million #Tokens valued at over $100K have been burned through transaction tax!

This is also the equivalent of #Bitcoin’s total supply! 🌐 pic.twitter.com/D8z2nvj4rG

— BTCETF_Token (@BTCETF_Token) January 3, 2024

While the presale is now closed, participants can start claiming and staking their purchased tokens.

And since holders can hold BTCETF, it could end up being a very deflationary token, with much of its original stock being taken out of circulation.

In turn, its tokenomics could help it have one of the biggest IPOs of the year, so new investors are advised to act quickly once it does list.

Visit Bitcoin ETF Token Now

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and is not investment advice. You can lose all your capital.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news