[ad_1]

Chainlink (LINK) price hit a new 2023 peak of $16 on November 9, before the bears force a pullback from last week’s euphoric highs. However, recent data trends in the chain show that Chainlink investors remain optimistic about a quick recovery.

Chainlink’s bulls have fiercely defended the $14 price support level this past week. Will LINK price recover or return?

Majority of Chainlink (LINK) Investors Continue

LINK price fell 13% to a daily low from weekly low of $14. Amid the neutral market sentiment, recent chain movements suggest that most LINK holders remain positive.

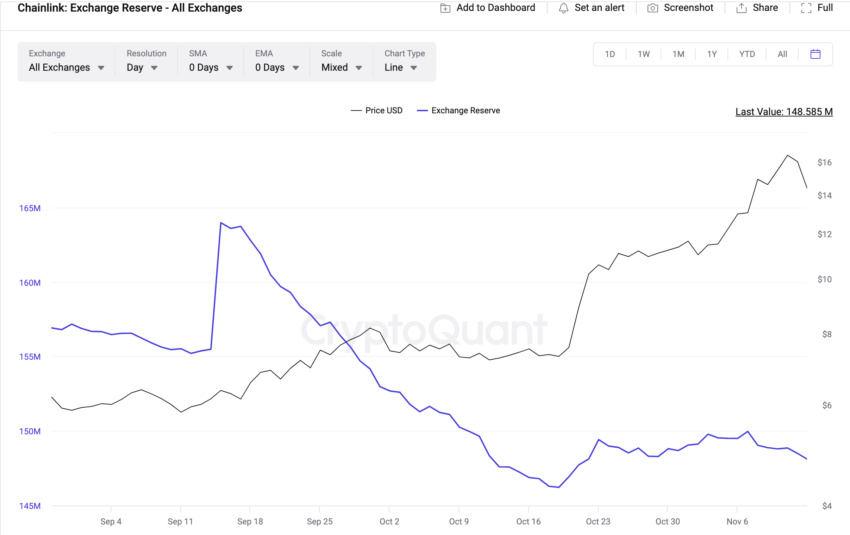

As depicted in the CryptoQuant chart below, Chainlink investors held a total of 149.9 million LINK tokens in wallets on offer. Interestingly, the figure has now dropped to 148 million LINK. Essentially, investors reduced their LINK exchange deposits by 1.4 million tokens this week, cooling concerns about a large-scale selloff.

The Exchange Reserves metric tracks real-time changes in the number of LINK tokens deposited into wallets offered on crypto exchanges and trading platforms. A sustained decline in foreign exchange reserves is considered a bullish indicator as it causes a decrease in spot market supply. At the current price of $14.20, the withdrawal of 1.43 million LINK tokens means a reduction of $20 million in LINK spot markets this week.

Read more: What is Chainlink (LINK)?

Furthermore, when investors opt for long-term cold storage during a price correction, it indicates that they are holding out for an early recovery, rather than exiting.

Despite falling prices, Chainlink continues to attract new users

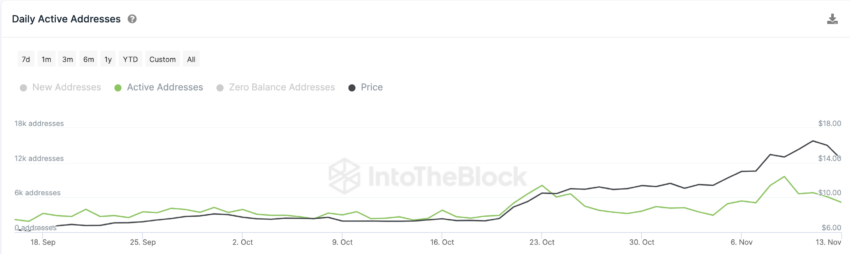

Chainlink price has been in a downtrend since it bounced back from the yearly high of $16 last week. However, on-chain data trends show that this has not deterred new users and investors from entering the ecosystem. On November 9, Chainlink active addresses reached an annual high of 9,630 wallets. The chart below illustrates that it has consistently remained above 5,000 addresses since then.

The daily active addresses metric tracks the daily number of unique wallets that perform economic transactions. When a network records a consistently high number of active users, it often puts upward pressure on price. Not surprisingly, this has helped LINK price defend the $14 support over the past week.

Read more: 14 Best No KYC Crypto Exchanges in 2023

Finally, investors moving out of the market, and the steady pace of network usage, suggest that LINK is in an excellent position for a recovery if the broader market sentiment shifts.

LINK Price Forecast: Further Consolidation Ahead of $20 Rally

Inferring from the on-chain metrics analyzed above, Chainlink could return to $20, if the bulls can last through the ongoing consolidation phase.

The Global In/Out of the Money (GIOM) data, which groups the current LINK token holders according to their entry prices, also confirms this prediction.

This shows that the bulls have mounted a formidable wall of support around the $12 area. As depicted below, 52,840 holders bought 51.3 million LINK at the average price of $12.24. If that investor stands firm, they can trigger an immediate recovery as predicted.

But if the bears topple, that buying wall could drop LINK price to $10.

However, if Chainlink’s price scales $15, the bulls may regain control of the market. But in that case, the 55,130 holders who bought 35.5 million LINK at the minimum price of $15.19 could mount a resistance selling wall. But if that resistance gives way, Chainlink will likely rise to $20.

Read more: How to buy Chainlink (LINK) and everything you need to know

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news