After reaching a new ATH, Bitcoin closes the week again below $69,000. Let’s analyze the future outlook for BTC price together.

Bitcoin (BTC) Situation

After reaching an all-time high at $73,800, Bitcoin experienced a decline that counteracted the recently established purchasing power. Indeed, this drop has formed a bearish structure, pulling BTC’s price back to around $63,500. This roughly represents a 14% decline from its all-time high (ATH). At the time of writing, the Bitcoin price is trading around $63,500. So it’s below the main value zone, which is about $67,000. The value zone below that price is around $63,000 – $62,000. Below that, we can highlight the support zone around $60,000.

Of course, the gap appears to be rebalancing with the 50-day moving average, as well as the oscillators, indicating readjusted market dynamics.

The current technical analysis was done in collaboration with Elie FT, an investor and trader of passion in the cryptocurrency market. Today a trainer at Family Trading, a community of thousands of own traders active since 2017. It offers lives, educational content, and mutual assistance regarding financial markets in a professional and warm atmosphere.

Focus on Derivatives (BTCUSDT)

Not surprisingly, open interest in BTC/USDT contracts has been revised downward. We can see that this decline was accompanied by mainly buyer liquidations and a decrease in the funding rate, suggesting a semblance of buyer capitulation. It is important to note that a decrease in the funding rate can be viewed positively as soon as it is considered excessively high. Indeed, this may signal a return to equilibrium between the market and its underlying asset, thereby helping to reduce the selling pressure that can be applied to these contracts.

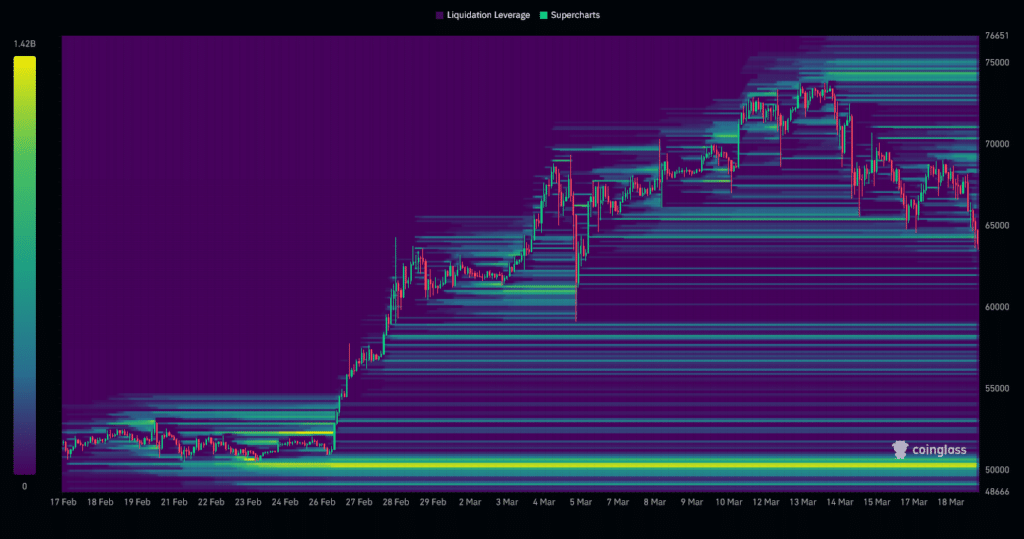

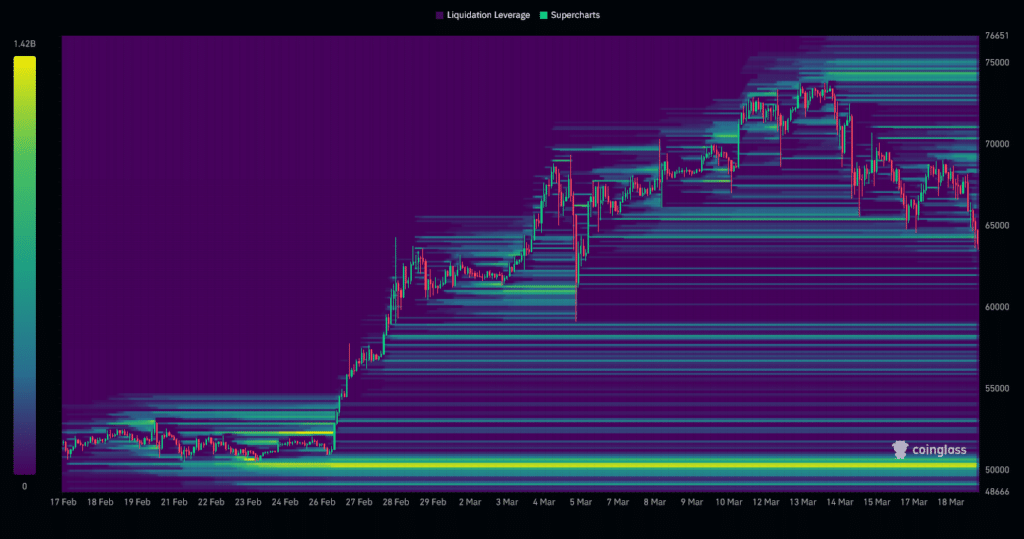

The liquidation heatmap for BTC/USD shows that its price recently crossed a significant liquidation zone around $70,500. The fact that the Bitcoin price remains above this level is evidence of persistent buying interest. Currently, the most marked liquidation zones are on either side of the current price: above, the $74,000 zone stands out, and below, the $50,000 zone where a concentration of orders is located. However, a more subtle liquidation zone can be noted in the price range around $58,000 to $56,000, and above the current price, between $71,000 and $69,000. As the market approaches these levels, we could see a massive trigger of orders, potentially increasing the volatility of the cryptocurrency. These zones therefore represent important points of interest for investors.

Scenarios for the Bitcoin (BTC) Price

If Bitcoin’s price manages to hold above $62,000, we can consider a new increase to $69,000. The next resistance could be $70,000 or possibly $71,000. Furthermore, the next resistance could be above the ATH, which is above $74,000. Reaching this last level would be an increase of around +16%. If Bitcoin’s price fails to hold above $62,000, we can consider support from buying interest in the $60,000 zone. The next level to consider if the downward move continues would be around $58,000 or possibly $56,000. At this point, this would represent a drop close to -11%.

Closure

Bitcoin recently underwent a significant 14% correction from its all-time high, and is now trading around $63,500, below key value zones, while technical indicators show signs of market stabilization. However, it will be crucial to carefully observe the price reaction at different key levels to confirm or refute the current assumptions. It is also important to remain vigilant in every scenario against potential “false cutouts” and market “pinches”. Finally, let’s remember that these analyzes are based solely on technical criteria, and the price of cryptocurrencies can otherwise move quickly based on more fundamental factors.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for every article you read and access exclusive rewards. Join now and start reaping benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

Family Trading is a community of own account traders active since 2017 that offers lives, educational content and mutual assistance around the financial markets, including that of cryptocurrencies with Elie FT, a passionate investor and trader on the crypto -market.

Disclaimer:

The content and products mentioned on this page are in no way endorsed by Cointribune and should not be considered its responsibility.

Cointribune strives to provide readers with all relevant information available, but cannot guarantee its accuracy or completeness. Readers are urged to make their own inquiries before taking any action regarding the company, and to accept full responsibility for their decisions. This article is not investment advice or an offer or invitation to buy any products or services.

Investing in digital financial assets involves risks.

Read more

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news