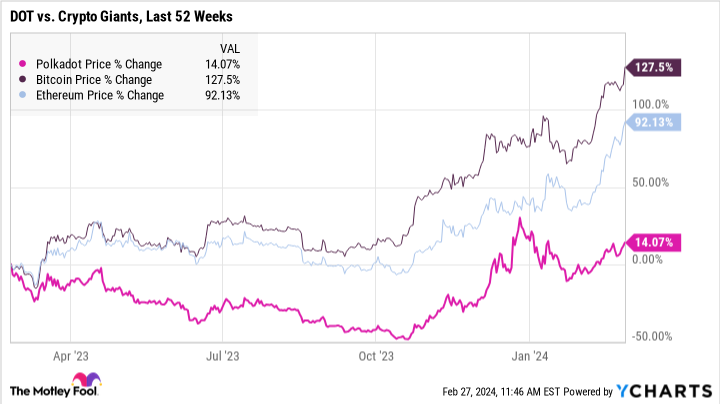

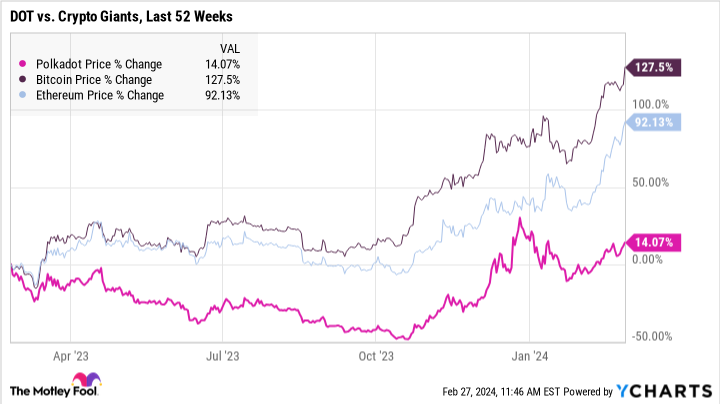

Cryptocurrencies are waking up after another long slumber. Ethereum (CRYPTO: ETH) gained 92% over the past year, while Bitcoin (CRYPTO: BTC) climbed 128% higher. From the launch of new crypto-based investment vehicles to the upcoming halving of Bitcoin mining rewards, many forces have combined to thaw the latest crypto winter.

But not every cryptocurrency has been invited to the party yet, even if their growth prospects look at least as promising as Bitcoin’s or Ethereum’s. In particular, Polkadot (CRYPTO: DOT) looks undervalued and poised to break out in a market rally. The official blockchain network of the Web3 Foundation is not getting the market respect it deserves.

Polkadot’s low price sticks out like a freshly stopped toe if you agree that a decentralized and personal internet is the future.

I’m not saying you should sell all your Bitcoin and Ethereum to reinvest it in Polkadot today. A diverse portfolio always makes more sense, even in the uncharted waters of the crypto industry.

But if you haven’t considered adding a little Polkadot yet, let me explain why this token is in a great position to beat both the stock and crypto markets over the next few years.

What is Polkadot anyway?

Polkadot is a blockchain network designed to solve a fundamental problem of the crypto world: different blockchains cannot easily talk to each other. Imagine a world where your Apple iPhone couldn’t connect directly to a Samsung Galaxy device – that’s the old blockchain reality. Polkadot acts as a translator and bridge, allowing blockchains with different purposes and designs to seamlessly communicate and share data.

The Web3 vision for the Internet is all about decentralization and user control. Polkadot makes this possible by enabling custom blockchains (so-called “parachains”) to plug into its network. These parachains can be customized for specific uses such as gaming, finance or social media, creating an interconnected ecosystem where value and information flow freely.

Story continues

This programming ecosystem supports fast and easy development of applications and programs that take advantage of the best features in many different blockchains. Polkadot makes it easy to store monetary value in Bitcoin, execute Ethereum’s smart contracts, collect real data from Chainlink (CRYPTO: LINK)and more.

And the DOT token (commonly referred to as Polkadot) is the lifeblood of this decentralized system, passing data between different blockchain networks with ease while ensuring the security of data transfers. Additionally, its multichain design enables many transactions to be processed quickly, avoiding the bottlenecks of less scalable blockchains.

How the DOT blockchain makes money

Executing transactions through Polkadot’s proof-of-stake ecosystem generates a small fee for the validation nodes that process each request. This toll for travel on the next generation information highway serves as an incentive to help the system work.

In this way, the increased use of the Polkadot network translates directly to a greater demand for DOT tokens, as they are needed to pay transaction fees. As the ecosystem grows and more value flows through Polkadot, the underlying DOT token becomes more valuable.

The current reward rate for staking your Polkadot tokens stands at 17.3%. This is quite high to motivate more DOT owners to stake their tokens and take a more active role in the system. Less than 53% of all DOT tokens are placed into play today, below the target rate of 60%. The reward rate can therefore change over time as the portion placed in the game grows or shrinks. Strike also allows DOT holders to participate in network management, further affecting the value of their holdings.

Additionally, this is the raw reward rate for people running their own nodes on the DOT network under ideal conditions. The rate will be lower if your chosen crypto trading service keeps a part of the input income for itself. For example, my Coinbase (NASDAQ:COIN) account currently shows a 6.9% earning rate for the strike of DOT tokens.

These mechanisms ensure that DOT’s value is tied to the growth and success of the Polkadot network.

Polkadot has room to grow, but many market makers haven’t noticed it yet

DOT’s 14% gain over the past year pales in comparison to Bitcoin and Ethereum’s returns. Yet those bigger crypto names operate in different, often less dynamic market segments.

With its interoperability focus, Polkadot sits at the forefront of Web3 innovation. Market capitalizations are often imperfect measures in rapidly evolving industries, and DOT’s $10.5 billion market value should grow much larger in 2024 and beyond.

This seems like a gross understatement given Polkadot’s pivotal role in the emerging decentralized internet. Smart investors may see this mispricing as a chance to buy into a leading Web3 infrastructure play at a significant discount.

Should you invest $1,000 in Polkadot now?

Before you buy stock in Polkadot, consider:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy right now…and Polkadot wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the coming years.

Stock Advisor offers investors an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. The stock advisor service has more than tripled the return of the S&P 500 since 2002*.

See the 10 stocks

*Stock advisor returns from February 26, 2024

Anders Bylund has positions in Bitcoin, Coinbase Global, Ethereum and Polkadot. The Motley Fool has positions in and recommends Apple, Bitcoin, Chainlink, Coinbase Global and Ethereum. The Motley Fool has a disclosure policy.

Forget Bitcoin and Ethereum: This Cryptocurrency is Poised for an Incredible Run was originally published by The Motley Fool

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news