[ad_1]

Just yesterday, BeInCrypto reported that 2 on-chain indicators suggest the beginning of a mature phase of the bull market. But today, another indicator, the MVRV Z-Score, is entering a historically very important territory, which has been associated with an inevitable correction of the BTC price in every previous cycle.

If Bitcoin’s current cycle “rhymes” with previous ones, the price of the largest cryptocurrency could soon drop by 47%. This would involve a retest of the $32,000 area, the validation of which would be a very bullish event from a technical perspective.

Is The Bitcoin And Cryptocurrency Market Ready For A Correction? Or will Bitcoin hit a new all-time high (ATH) for the first time, fueled by the energy of institutional adoption and spot ETFs, even before the April halving?

MVRV Z-score signals impending correction

MVRV is otherwise known as the market value to realized value ratio. This is a long-term indicator of the Bitcoin market. Moreover, it gives an indication of when the price is below the so-called “fair value”.

Meanwhile, its derivative, MVRV Z-Score, assesses when Bitcoin is overvalued/undervalued relative to its “fair value.” The addition here is the standard deviation of all historical market capitalization data.

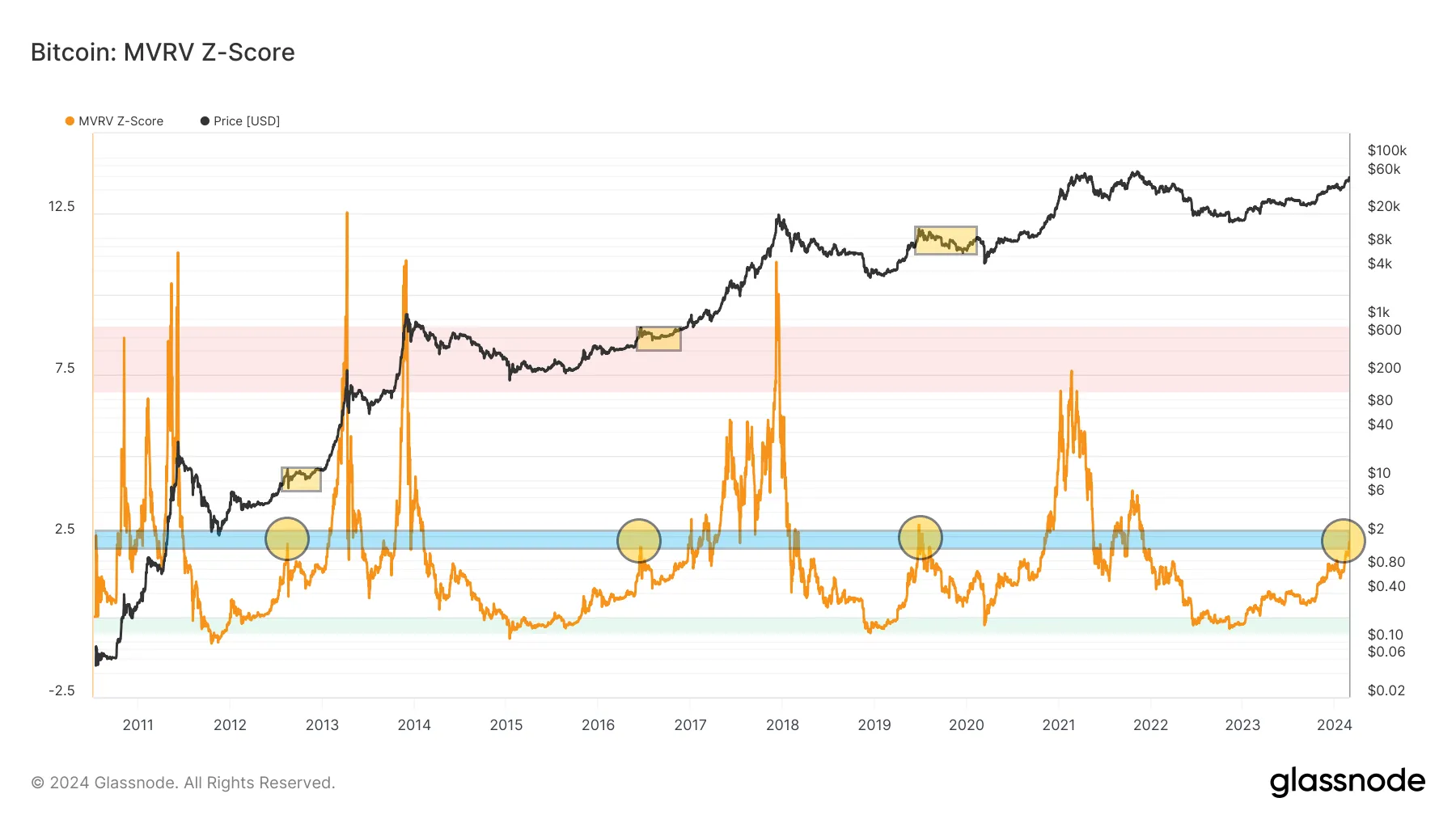

Typically, the MVRV Z-score moves in three ranges. However, sometimes it briefly moves out of them in extreme bull or bear market ending conditions:

green area between 0 and -0.5: interpreted as an indication of BTC price below “fair value” area between 0 and 7: neutral range of “fair value” the red area between 7 and 9 is interpreted as the BTC price index above ” fair value”

Read more: Bitcoin Price Prediction 2024/2025/2030

In the graph below, we see that the MVRV Z-score has currently entered area 2 (blue). This is happening for the first time in this cycle. Furthermore, in all previous cycles, the first reach of this area (yellow circles) was associated with an impending correction of the BTC price (yellow rectangles).

After the BTC price and the indicator’s decline corrected, both charts generated higher lows and continued to climb. If a similar situation happens this time, the next 6 months or so could be a period of accumulation in the Bitcoin market. It is worth adding that such accumulation can be an excellent opportunity for the growth of other cryptocurrencies and the beginning of the long-awaited altcoin season.

The achievement of this important territory by the MVRV Z-score was also noted by the well-known analyst @PositiveCrypto. However, he links this area to a bullish bias, suggesting that the Bitcoin market is still far from overheated.

“Still a long way to go before this cycle overheats. HODL” PositiveCrypto declares.

Will Bitcoin Price Test $32,000 Again?

Counting the depth of historical corrections and determining the area of support to which the BTC price may dive is now possible. On the long-term chart, plot the declines that occurred after the MVRV Z-score first reached the 2 region.

It seems that the correction was quite deep each time: 50% in 2012, 38% in 2016 and 53% in 2020. So, in the three previous cycles the average was 47%.

If one were to superimpose a potential BTC price correction on the current chart, interesting technical correlations emerge. A 47% drop in Bitcoin from the current $59,000 area would lead to support near $32,000 (green line).

First, this area is located almost exactly at the key 0.618 Fib retracement of the entire up move from the lows of the current cycle. This retracement is a common target for deepening corrections in financial markets.

Read more: 10 Best Crypto Exchanges and Apps for Beginners in 2024

Next, the $32,000 level has repeatedly acted as macro support and resistance since 2021 (blue arrows). In October 2023, the BTC price definitely broke above this area (blue circle). Since then, however, this has not led to its bullish validation as support.

If the Bitcoin market were to undergo a long-awaited correction in the next 6 months, the $32,000 level would be an excellent buying area. Both technical correlations and the on-chain MVRV Z-Score indicate this.

Click here for BeInCrypto’s latest crypto market analysis.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news