Dear Unbanked Nation,

In the back half of 2021, we heard the rumblings of a new market narrative: DeFi 2.0.

It was clear that projects under the DeFi 2.0 heading were built on the backs of blue-chip DeFi protocols such as Maker, Compound, Aave and others, but introduced new tokenomic designs that promoted greater capital efficiency, protocol ownership value and sound . liquidity.

The problem?

DeFi 2.0 has grown so fast and galaxy-brained protocol designs have scared away the retail investor from exposing themselves to these untested assets.

Some of us bought next generation DeFi tokens individually. Maybe you’ve heard of OHM and stuck with it. Or maybe you bought PERP. Maybe even MPL.

Or maybe you held DPI and hoped the wave of DeFi 2.0 would pump those pockets. It didn’t happen last year. In fact, compared to ETH, you lost.

So is DPI dead? Not at all. I think DeFi bluechips are making a comeback at some point. From a P/S ratio, many of them look both like value assets and growth assets with evolving tokenomics.

But blue chips don’t necessarily capture the latest innovation in the DeFi ecosystem.

GMI is a newly launched crypto index to solve this from the Index Coop and BanklessDAO.

This includes diversified exposure to some of the hottest DeFi projects on the market.

Lucas tells us how we’re all going to make it with GMI.

– RSA

“DeFi 2.0” was a big theme in 2021.

While the first generation DeFi protocols such as Uniswap DEXUniswap is a decentralized exchange to efficiently trade cryptocurrencies.View Profile” class=”stubHighlight”>Swap and ![]() Ghost DeFiAave is an open source lending protocolView Profile” class=”stubHighlight”>Aave has had a sluggish year in terms of price performance, new protocols like Olympus and Abracadabra have dominated the DeFi landscape. These emerging financial protocols are taking more aggressive designs, making use of new primitives like liquidity and token owned by protocol economic models similar to veCRV.

Ghost DeFiAave is an open source lending protocolView Profile” class=”stubHighlight”>Aave has had a sluggish year in terms of price performance, new protocols like Olympus and Abracadabra have dominated the DeFi landscape. These emerging financial protocols are taking more aggressive designs, making use of new primitives like liquidity and token owned by protocol economic models similar to veCRV.

The problem is that it is difficult to keep up with all these developments. Not only does crypto move at the speed of light, but it is also full of genius developers and economists designing advanced financial protocols.

If some of the terms above confused you, but you’re interested in gaining exposure to this emerging field in DeFi, we’ve got you covered.

Introducing the Bankless DeFi Innovation Index (GMI)

⚠️ DISCLAIMER: None of this is financial advice. Please do your own research. Monkeys at your own risk.

The Bankless DeFi Innovation Index (GMI) is a new index from the Index Coop in collaboration with BanklessDAO that aims to capture the emerging themes in Decentralized Finance.

The goal of GMI is to keep it updated with the latest and hottest DeFi protocols on the market.

Unlike the DPI, which aims to target the performance of “blue chip” DeFi protocols such as UNI, AAVE, MKR and others, GMI relaxes the considerations to target new, rising DeFi applications that are higher on the risk curve. Today, these projects are largely known as “DeFi 2.0”.

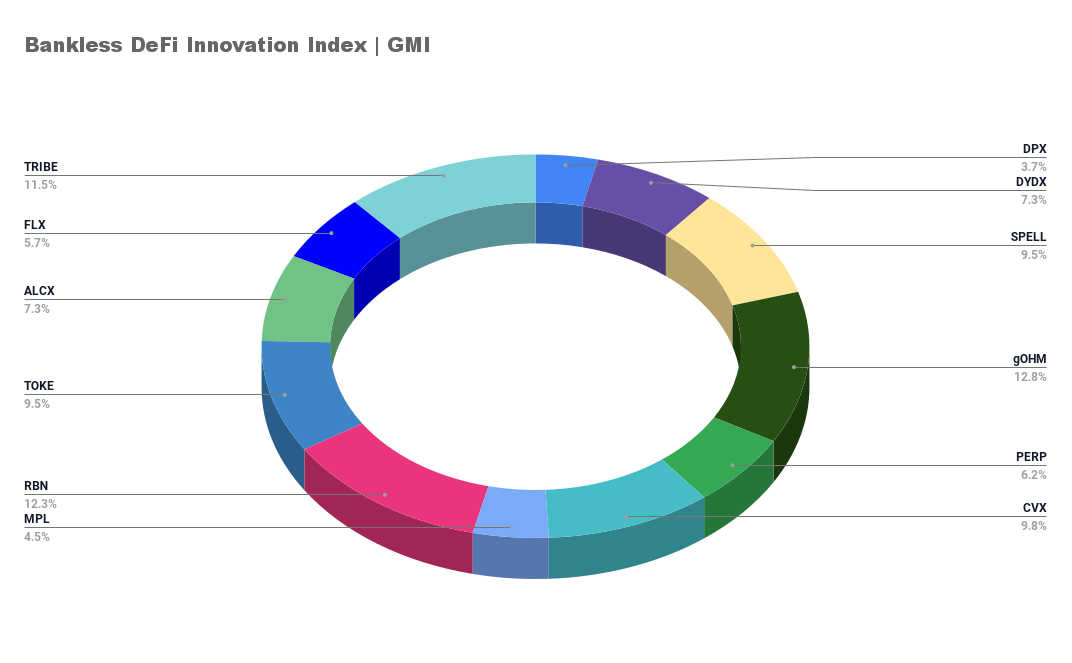

To give you an idea, here is the current weight of GMI:

GMI was launched earlier today. With the launch, there are a handful of market opportunities to get involved and start gaining significant exposure to one of crypto’s hottest sectors.

🐳 Looking for a large amount of GMI? Follow this mining guide.

💰 Bonus: Anyone who raises more than $50,000 from GMI will be refunded 2x the gas fees with INDEX and BANK. This program is available for a total of $250,000 GMI.

💭 Got questions about hitting? Email [email protected]

🤑 GMI market opportunities

Resources

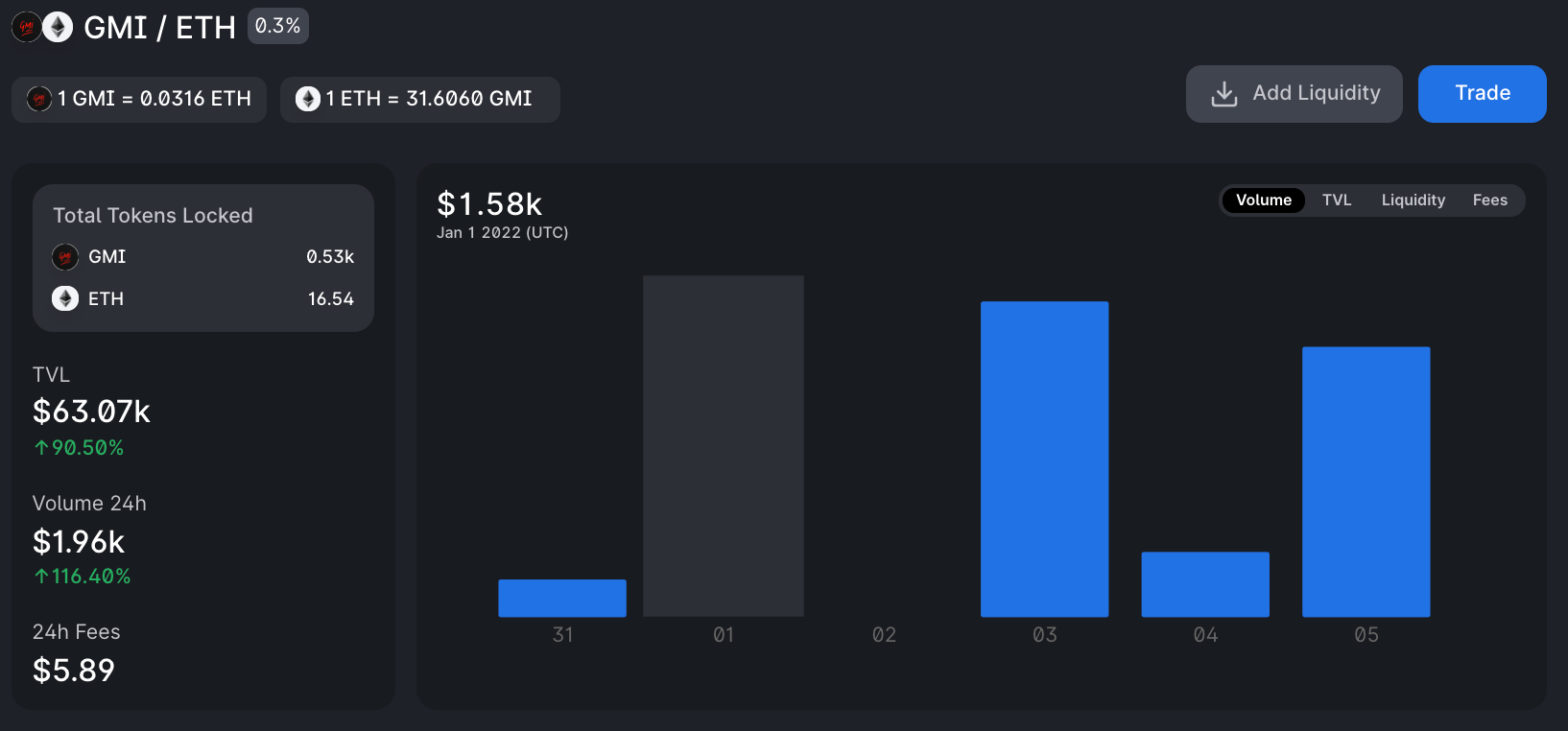

1. Provide liquidity to Uniswap V3

GMI needs liquidity! Rather than relying on a traditional liquidity mining program, GMI is testing a new approach with a handful of unique incentives.

First, anyone who provides Uniswap V3 liquidity for the GMI/ETH pair will earn 50% of the index’s streaming fees for 60 days. To qualify for the rewards, MPs will need to provide liquidity for the full 60 days.

GMI’s streaming fee is 1.95% per annum, which means that the bigger the index grows, the higher the rewards will be. For those interested, you can do some basic napkin math on potential rewards depending on the size of the index (in terms of $ market cap).

One can only guess how much trading volume to expect, but GMI is a hotly anticipated product.

The program cutoff date is January 8th, 12pm PST, and will end on March 8th at 12pm PST, which means there are ~48 hours left to qualify for the rewards before the cutoff time closes.

Anyone who LPs and qualifies in the next two days, but decides to remove the liquidity at any point before March 7th, will be disqualified and removed from the reward pool. Enter now!

🦄 Note: Although the streaming fees are a good incentive, don’t discount the trading fees as an LP on Uniswap V3!

Index Coop products displayed impressive APYs from trading fees alone. The DPI/ETH pool earns over 20% APY while the ETH2x-FLI pool earns over 50% depending on your tier!

🏆 Top 20 Uniswap V3 Liquidity Providers

In addition to the streaming fees, there is also an incentive program for the Top 20 Liquidity Providers!

Any 🐳 LPs in the Top 20 by amount of liquidity provided will also have the chance to win $25,000 from INDEX and a claim to this elite GMI hoodie. The same parameters apply as the streaming fees: LPs must provide liquidity for 60 days with only ~48 hours left to qualify!

How to provide liquidity on Uniswap V3

💡 Unfamiliar with Uniswap v3? Check out our guide here!

Go to the Uniswap Pool Click on “Add Liquidity” at the top right

You will be taken to the MP page. Note that it will automatically have the pair asset as WETH—you can change it to just normal ETH. From there you need to determine the range you want to provide liquidity. There can be volatility, so choose wisely!

👉 Reference: GMI is currently trading at 31 GMI per ETH with the current range for most liquidity somewhere between 15 GMI per ETH to 60 GMI per ETH.

Once you have determined your desired range, you will need to approve GMI and you can deposit. Click preview and submit the transaction on Ethereum. Once confirmed, you now earn trading fees, qualify for the streaming fee program, and maybe even a Top 20 MP.

2. GMI Unilateral Strike

📅 Single Side Strike will go live on January 10th at 12pm PST. You can find it here.

While providing liquidity is important, and the trading fees on Uniswap V3 can be quite lucrative during times of high volume, GMI is also launching a one-sided strike contract where users can earn INDEX for staking their GMI.

Index Coop allocated a total of 18,750 INDEX to a 60-day unilateral strike program. The first month will distribute 12,500 INDEX while the second month will distribute 6,250 INDEX.

In total, this represents over $350,000 in rewards for the 60-day program. APYs vary depending on the amount of GMI leveraged on the contract, so stay tuned!

How to play GMI

If you are interested in getting involved in the unilateral strike program, follow these steps.

Get GMI via Uniswap or minting Head to the Index Liquidity Mining Page Once available on Monday, January 10, there will be an option for GMI stake, click “stake” and confirm all the transactions on your wallet. Once approved, you can deposit and you will start earning INDEX rewards!

3. Win a GMI Loot Pack

If you’re a fan of GMI, there’s an opportunity for five lucky people to win a GMI Loot Pack! This includes the GMI Hoodie, an exclusive NFT, and a GMI token.

All you have to do is help spread the word of GMI across the cryptosphere.

How to enter to win the GMI Loot Pack

Fill in the entry ticket. From there you will be asked to create your banner image for Twitter. Share this article on Twitter with a short sentence that tells everyone you’re GMI. Link to your Twitter profile + tweet in the form You will be asked to provide your email as contact information. That’s it! You will be notified if you were one of the lucky winners.

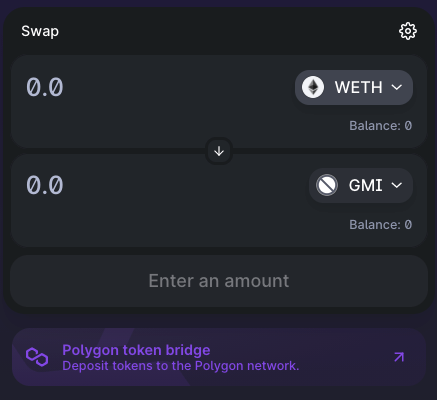

4. Bonus: GMI on polygon

For those who hate the gas fees  Ethereum L1Ethereum is a global platform for decentralized applications and finance.View Profile” class=”stubHighlight”>Ethereum Layer 1 (I think we all do), we’ve got you covered! GMI is available on Polygon.

Ethereum L1Ethereum is a global platform for decentralized applications and finance.View Profile” class=”stubHighlight”>Ethereum Layer 1 (I think we all do), we’ve got you covered! GMI is available on Polygon.

How to get GMI on Polygon

To get GMI on Polygon, go to Uniswap and connect to the ![]() polygon L2Polygon is a framework for creating custom blockchain solutions on Ethereum.View Profile” class=”stubHighlight”>Polygon network. From there, add the GMI contract address to the “exchange” field and enter the token. (GMI contract address: 0x7fb27ee135db455de5ab1ccec66a24cbc82e712d)You beware of the races! layer 🙂

polygon L2Polygon is a framework for creating custom blockchain solutions on Ethereum.View Profile” class=”stubHighlight”>Polygon network. From there, add the GMI contract address to the “exchange” field and enter the token. (GMI contract address: 0x7fb27ee135db455de5ab1ccec66a24cbc82e712d)You beware of the races! layer 🙂

🇺🇸 Bonus: You can buy via the Dharma mobile app! New US users using this link will get $50 in ETH for purchasing at least $500 worth of GMI.

Closure

While the DeFi Pulse’s DPI targets DeFi blue chips, Bankless’ GMI aims to capture the performance of emerging DeFi protocols that use more aggressive designs and use new primitives.

Many of the DeFi 2.0 protocols were top performers in 2021, and it only made sense to launch an index to capture this rising sub-sector in the crypto-economy.

Importantly, the GMI will be actively managed by top methodologists in the space, including Alpha Lemonade and Ben Giove, to ensure that the index always contains the top DeFi 2.0 protocols on the market.

The only question that remains is: Are you GMI?

Action steps

Resources for protocols in GMI

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news