On-Chain analysis was introduced to the crypto market in 2011, it is one of the first popular metrics, “Coin Days Destroyed”, it was introduced to track activity on the Bitcoin network.

In this article we will discuss:

What is On-chain analysis?

On-chain analytics is a research strategy that utilizes information found in the public blockchain with the goal of helping traders improve their crypto trading strategies.

On-chain data typically includes information about all transactions that occur on a given blockchain network. Details are, for example, transaction information such as sending and receiving addresses, transferred tokens or coins, transaction amount, transaction fee, and remaining funds for a given address. It also contains block data such as timestamps, mining fees, rewards and the smart contract code.

How does on-chain analysis work?

Metrics for network chain analysis can be broadly classified into three categories:

cryptography market cap HODL status of an asset Future outlook for cryptocurrency

market capitalization

The market capitalization of a cryptocurrency defines the net worth of the network blockchain. The total value of a network is defined as the multiplication of the crypto price by its total circulating supply. In addition to determining network equity, we can also use market capitalization to determine market size, adoption, and risks associated with the crypto-asset.

standby status

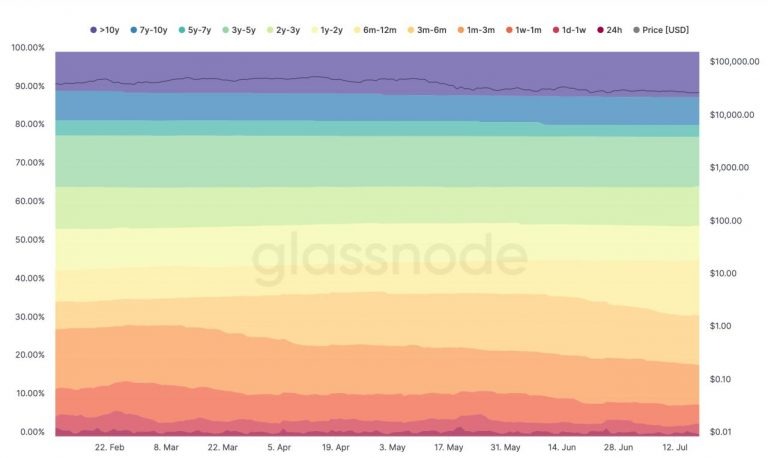

Analysts use a measure called the HODL wave to determine the market trend and the age of the user’s cryptocurrency. The HODL wave tells analysts whether traders are holding the asset or selling it quickly. This determines the mood of the market and the outlook for HODLers, i.e. whether they feel the price may fall or expect a rise.

Network analysts also use currency concentration metrics to determine the concentration of “whales” and large investors in the network. For example, let’s say there is an asset where some addresses hold a significant percentage of the token, this means that whales and big investors can easily manipulate the market by dumping the tokens. Therefore, analyzing the concentration of large token HODLers is very critical to reduce the risks of investing in encryption.

Future perspectives of a cryptocurrency

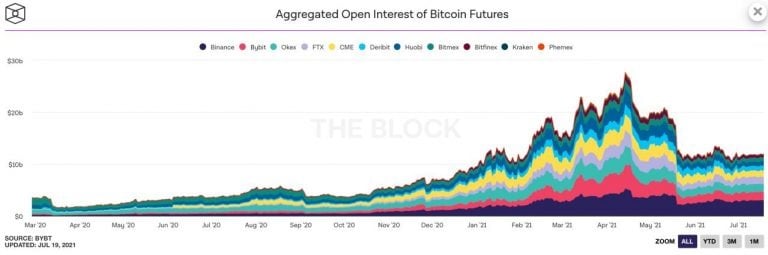

To understand whether a crypto-asset is gaining or losing traction among investors, the open interest futures contract can be analyzed. In addition, factors such as the correlation between the token and the Bitcoin price, as well as total foreign currency inflows and outflows.

Correlating the price of a token or altcoin with that of Bitcoin reduces risk for investors because it can help them reduce losses for cryptocurrencies most strongly associated with price declines. Bitcoin price🇧🇷 Furthermore, the inflow and outflow of certain tokens or coins from an exchange (over certain time periods) can help network analysts evaluate the asset’s adoption status, and act as an alarm signal for high-net-worth individuals. liquid and institutional trading activities.

How to use on-chain analysis for encryption?

Because cryptocurrency and blockchain data are transparent, it provides a great opportunity for on-chain analysts to form more comprehensive images of the encryption market based on hard data as well as a fundamentals-based approach, rather than just guided become through the overkill.

Predict market movements

By evaluating investor behavior and network health in real-time, on-chain analytics not only helps traders improve their strategies, but also allows them to better predict future market movements. For example, taking into account the number of active addresses and the number of transactions in a cryptocurrency, cryptocurrencies can predict whether interest in this cryptography will increase or decrease. If there is a sharp increase in the number of active addresses and transactions, it usually correlates with an increase in the price of cryptocurrency.

Study investor behavior

Network statistics also provide details of certain investor behavior. For example, network analysts can examine how long an address hasn’t moved a cryptocurrency and the number of investors holding the encryption. If the number of investors who HODL encryption increases, it could mean that the circulating supply of encryption is less. The on-chain analysis of this situation tells us that the price of this cryptocurrency is likely to rise if the demand is constant. In addition, it also shows confidence in the asset’s future performance.

Closure

In summary, on-chain analysis provides cryptographers with a fascinating tool to delve into the real-time insights of a blockchain network. This gives them the opportunity to capitalize on the benefits that a more abundant and transparent data encryption market offers.

Disclaimer: The views and opinions expressed by the author, or anyone mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing or trading cryptocurrencies carries a risk of financial loss.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news