Cryptocurrency trading has become a popular investment opportunity, but it also comes with significant risks. With volatile market conditions and a steep learning curve, entering the world of crypto trading can be challenging for both new and experienced traders. This is where crypto paper trading and practice trading come in.

Crypto paper trading refers to a simulated trading environment that allows users to trade cryptocurrencies without using real money. Practice trading, also known as demo trading, is a type of cryptocurrency trading offered by some cryptocurrency exchanges, including OKX, where users can trade in a simulated environment that mimics real market conditions. This allows traders to develop and test their trading strategies, get a feel for the markets and practice their decision-making skills without the risk of losing any real funds.

In this article, we will take a comprehensive look at crypto paper trading, their benefits and how to get started.

Advantages of Crypto Paper Trading

There are several benefits to using cryptocurrency trading and practice trading, including:

Risk-free trading: One of the biggest advantages of cryptocurrency trading and practice trading is that it allows traders to test their strategies and make mistakes without risking real money. This makes it an ideal environment for novice traders to learn the ropes and gain experience before trading with real funds. Market Simulation: Practice trading environments simulate real market conditions, allowing traders to experience the ups and downs of the crypto markets without actually risking any money. Test Trading Strategies: Crypto paper trading and practice trading provide traders with a platform to test and refine their trading strategies without the risk of losing money. Improved confidence: By practicing in a simulated trading environment, traders can gain confidence in their decision-making skills and strategies before entering the real markets. This can lead to more informed and profitable trading decisions in the future. Access to market data: Many practice trading platforms offer access to real-time market data and trading tools, allowing traders to gain a better understanding of the crypto markets and how they work.

Getting Started with Paper Trading in OKX

A step-by-step guide on how to try crypto trading risk-free with OKX’s demo trading feature.

For users who want to learn how to trade BTC, ETH and other cryptocurrencies without losing real money, OKX’s Demo Trading allows users to practice in a simulated environment without dropping a single satoshi. Demo Trading lets novice traders who are just learning the ropes practice before diving head first into real cryptocurrency markets. Likewise, it also provides a playground for advanced traders to hone their skills and practice advanced strategies before applying them to their real market trading portfolios.

Try demo trading

Step 1: Switch to Demo Trading mode

Log in to your OKX account and navigate to Trade. Then click on Demo Trade to switch to the trading simulation mode.

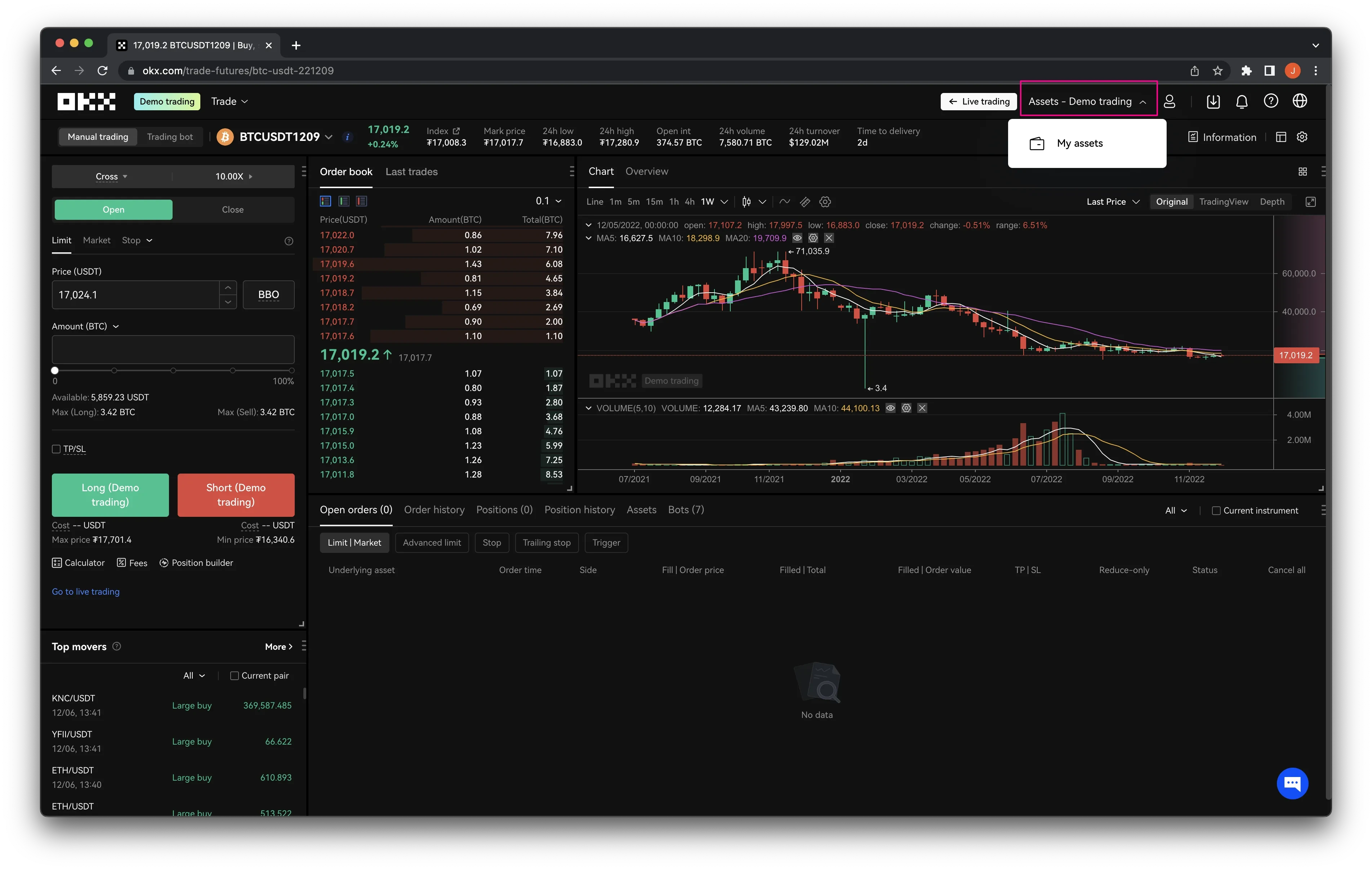

Now go to Assets – Demo Trading in the top right corner and click on My Assets.

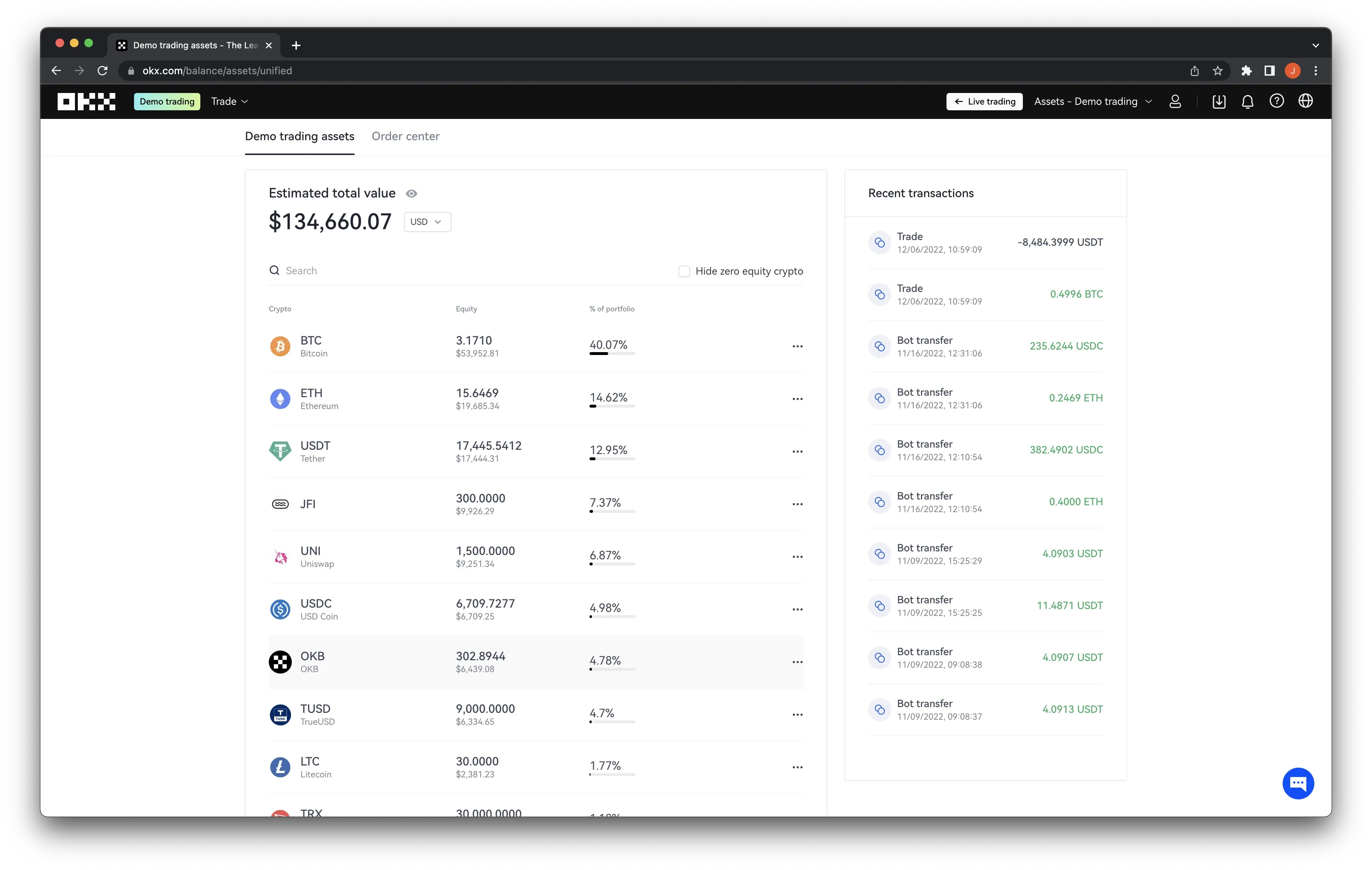

You will see the total amount of demo assets you can trade such as USDT, BTC, OKB and various other cryptocurrencies. (Remember, this is not real money – this is for simulated trading only!)

Your total virtual assets are automatically distributed across all of OKX’s trading products – spot, margin, futures, perpetual swaps and options – so you can try them all!

Step 2: Trade with virtual money

You are now ready to start simulating trading! You can choose any market that interests you.

Spot trading

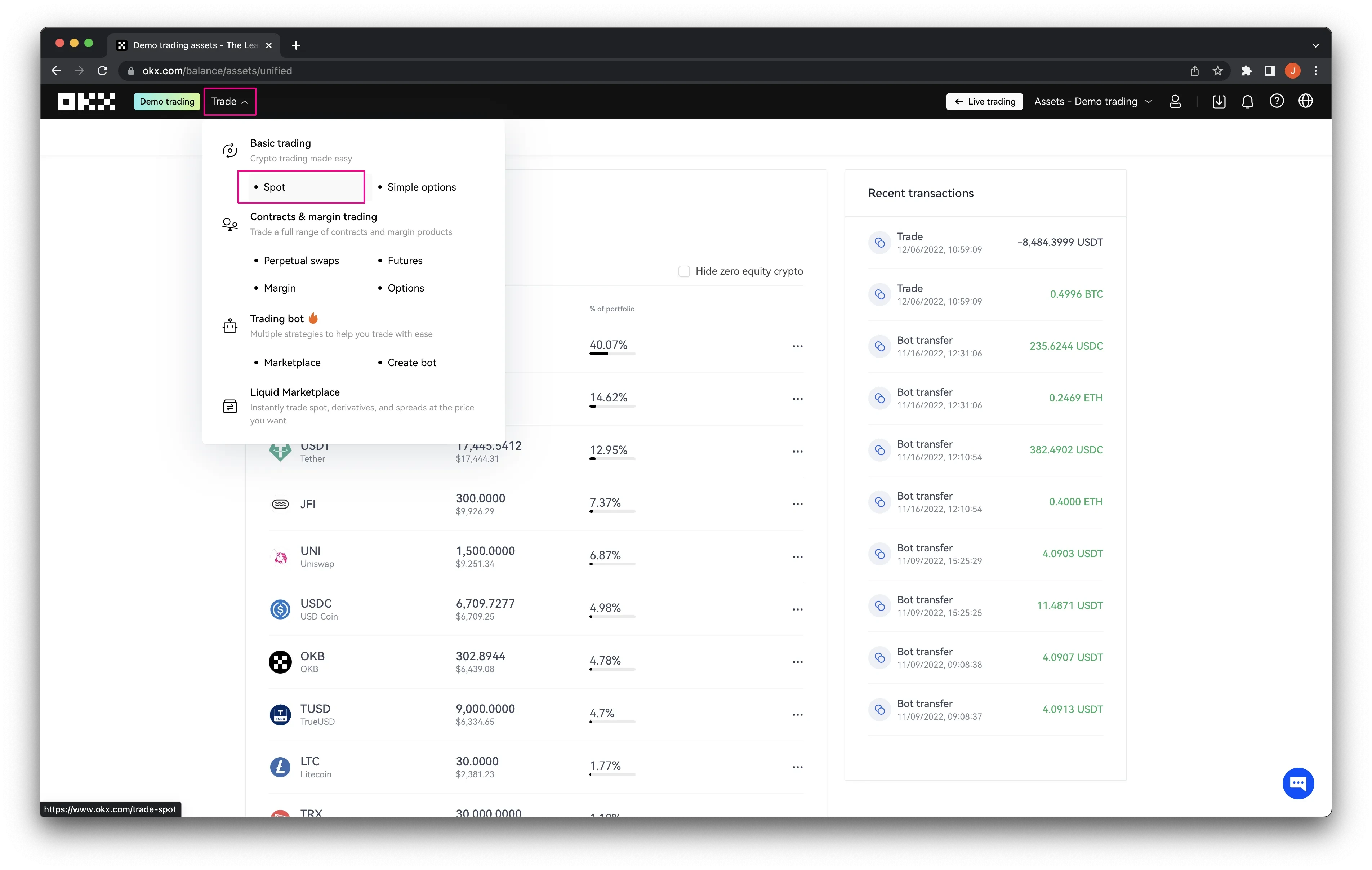

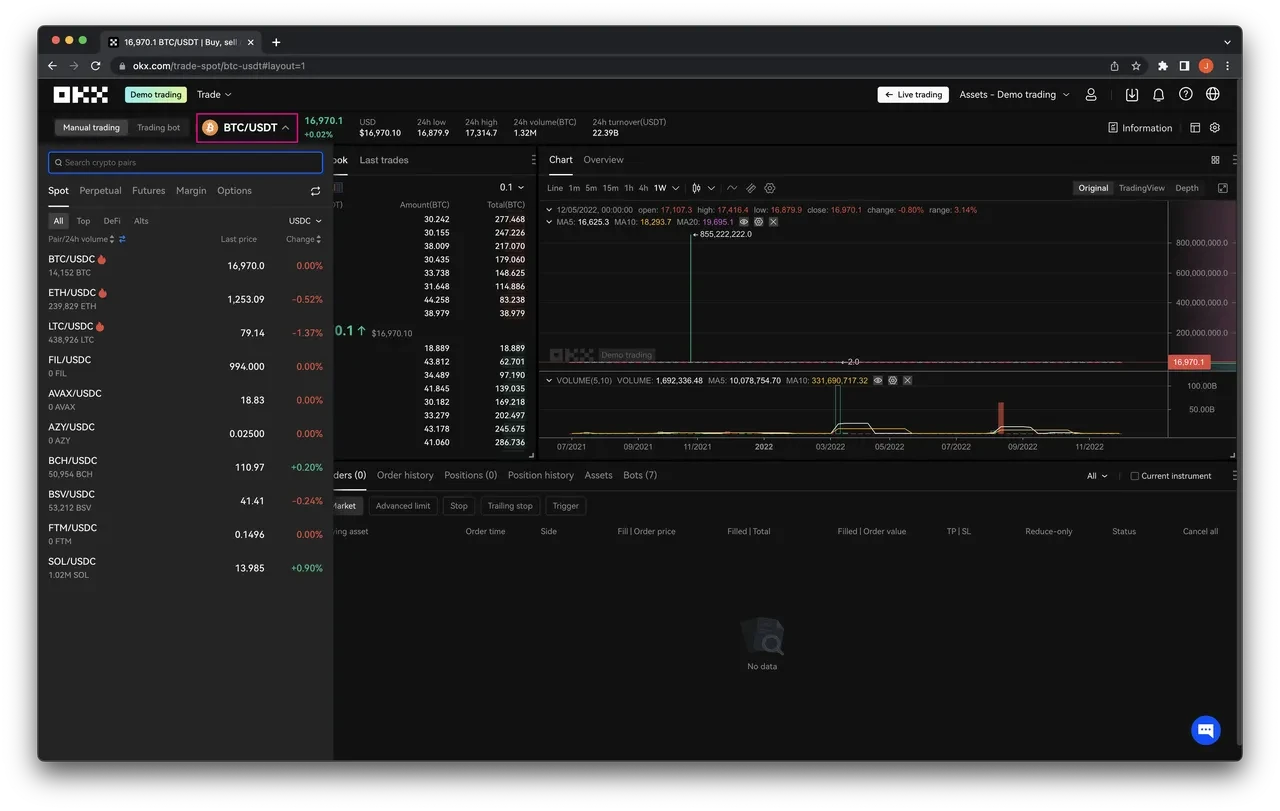

Let’s take BTC/USDT spot trading as an example. First go to Trading and then click Spot under Basic Trading.

Then select the market and the trading pair from the menu at the top of the Basic trading section.

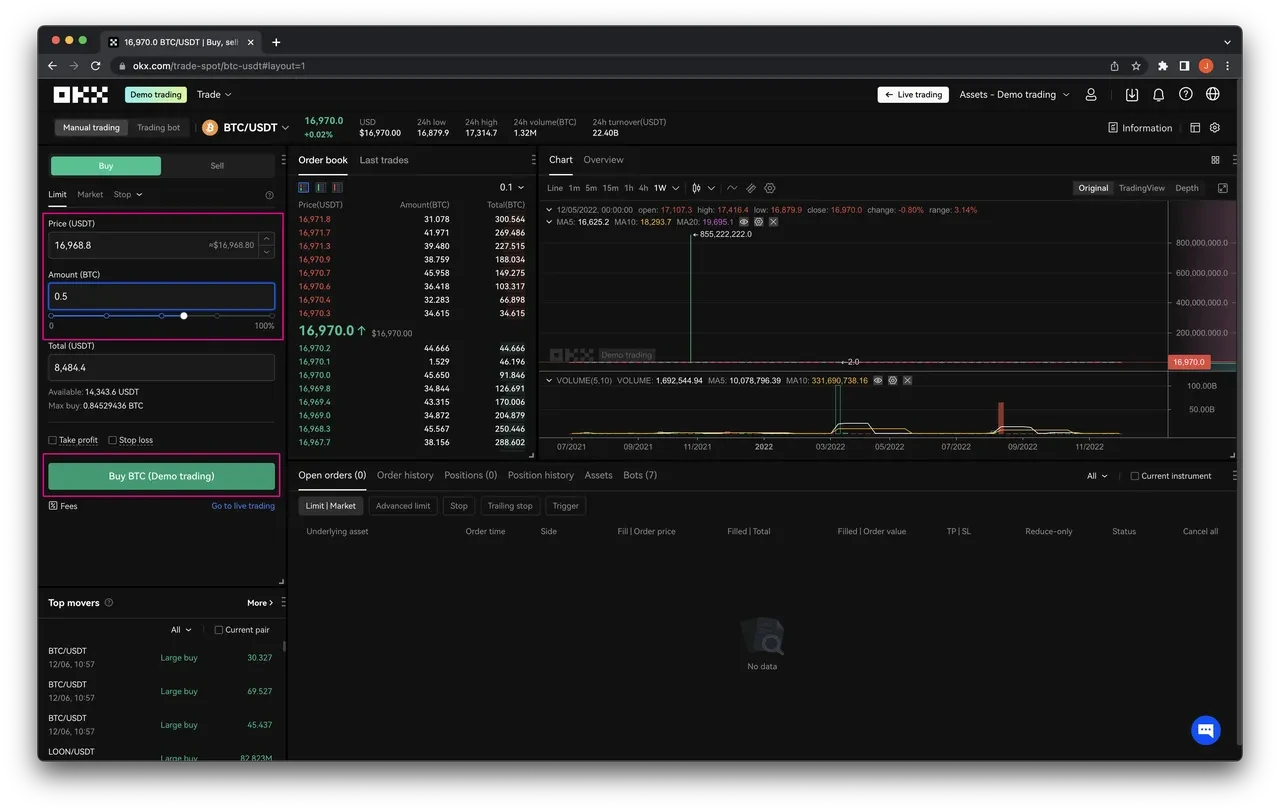

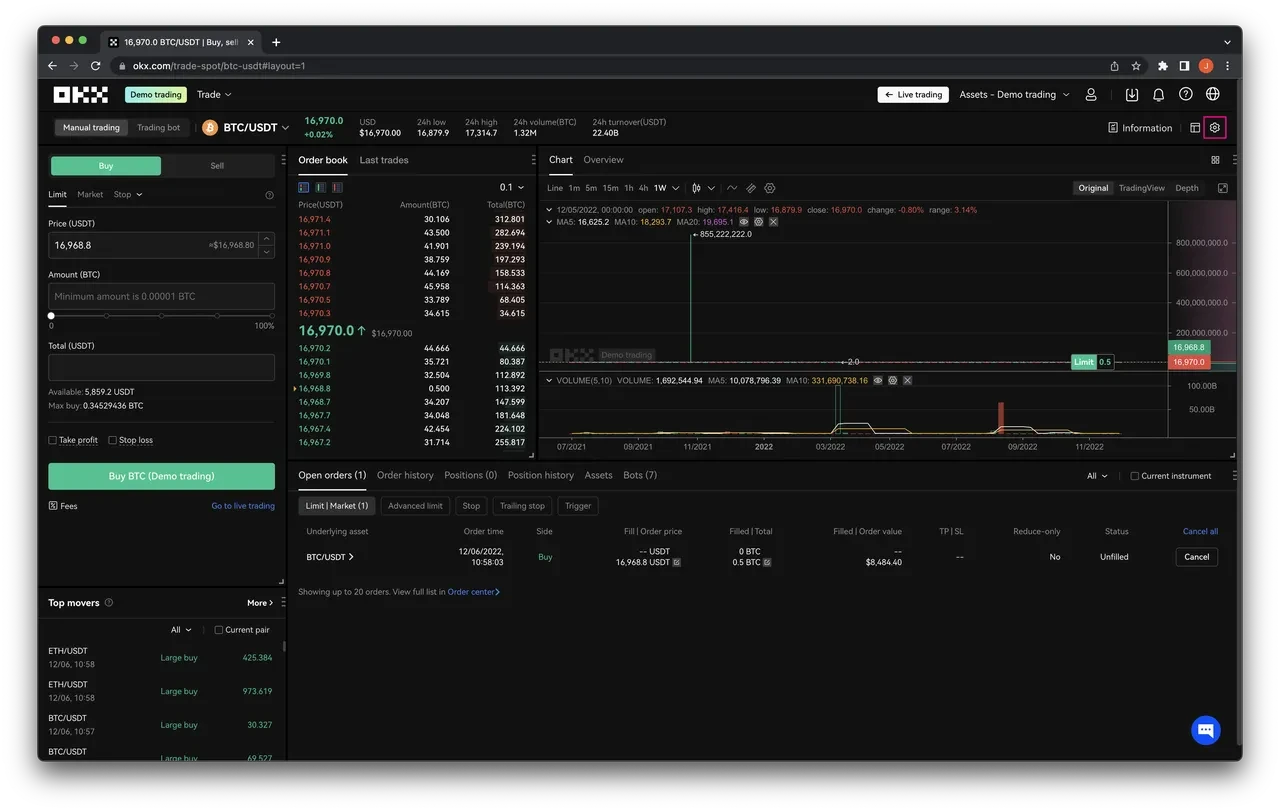

Select the order type, enter the price of BTC in USDT (if applicable) and the amount of BTC you want to buy, and click Buy BTC (Demo Trade). It’s as simple as that!

Eternal trade

Let’s take futures trading as another example. First, click on the Settings cog in the top right corner.

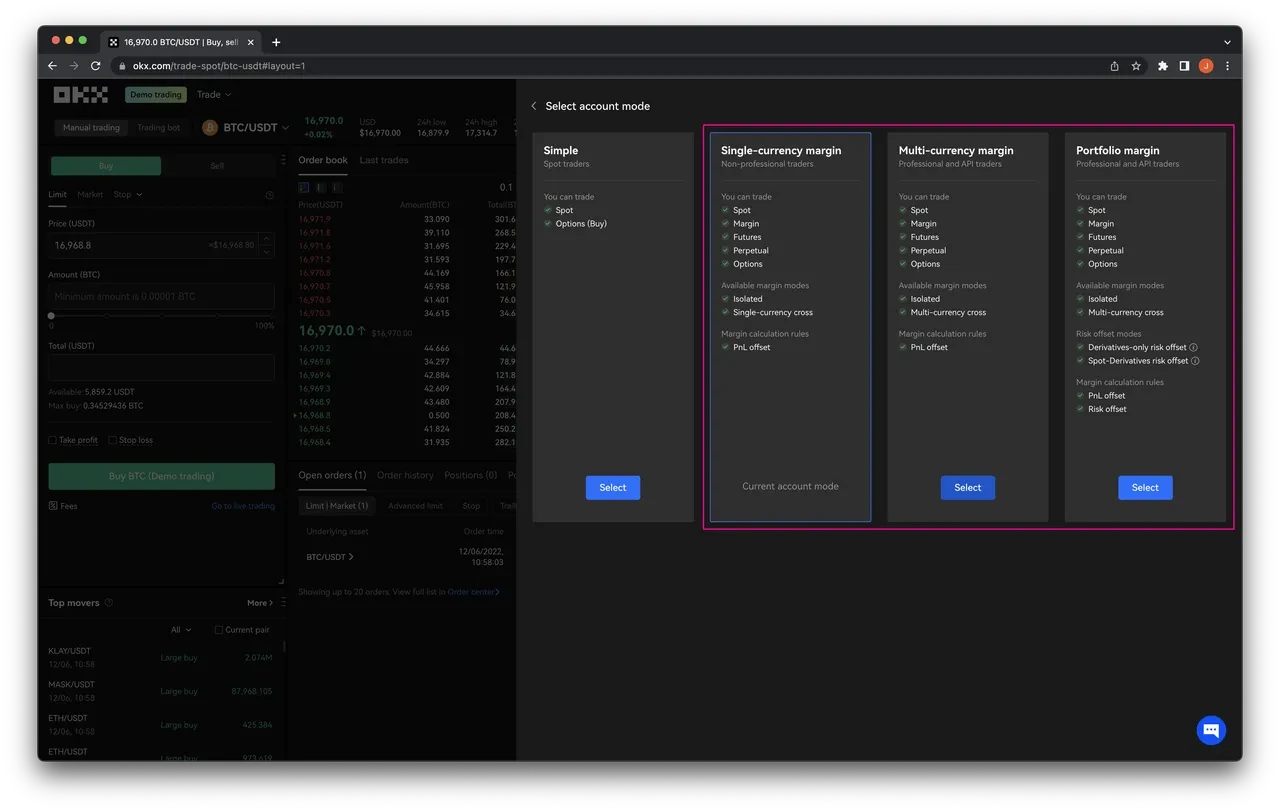

Then click on the account mode in the Settings menu.

Then select Single-Currency Margin, Multi-Currency Margin or Portfolio Margin to enable futures, perpetual and options trading.

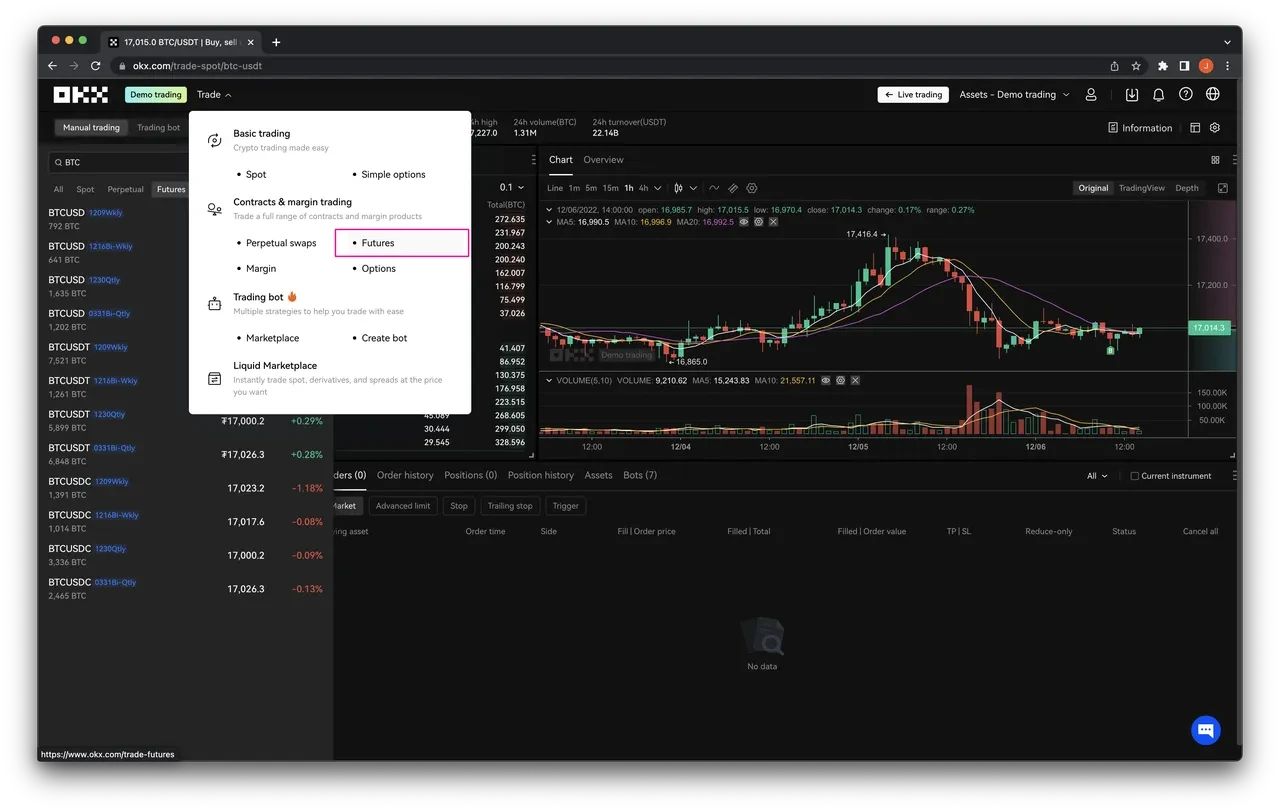

Then navigate to Trading and then click Futures under Contracts & Margin Trading.

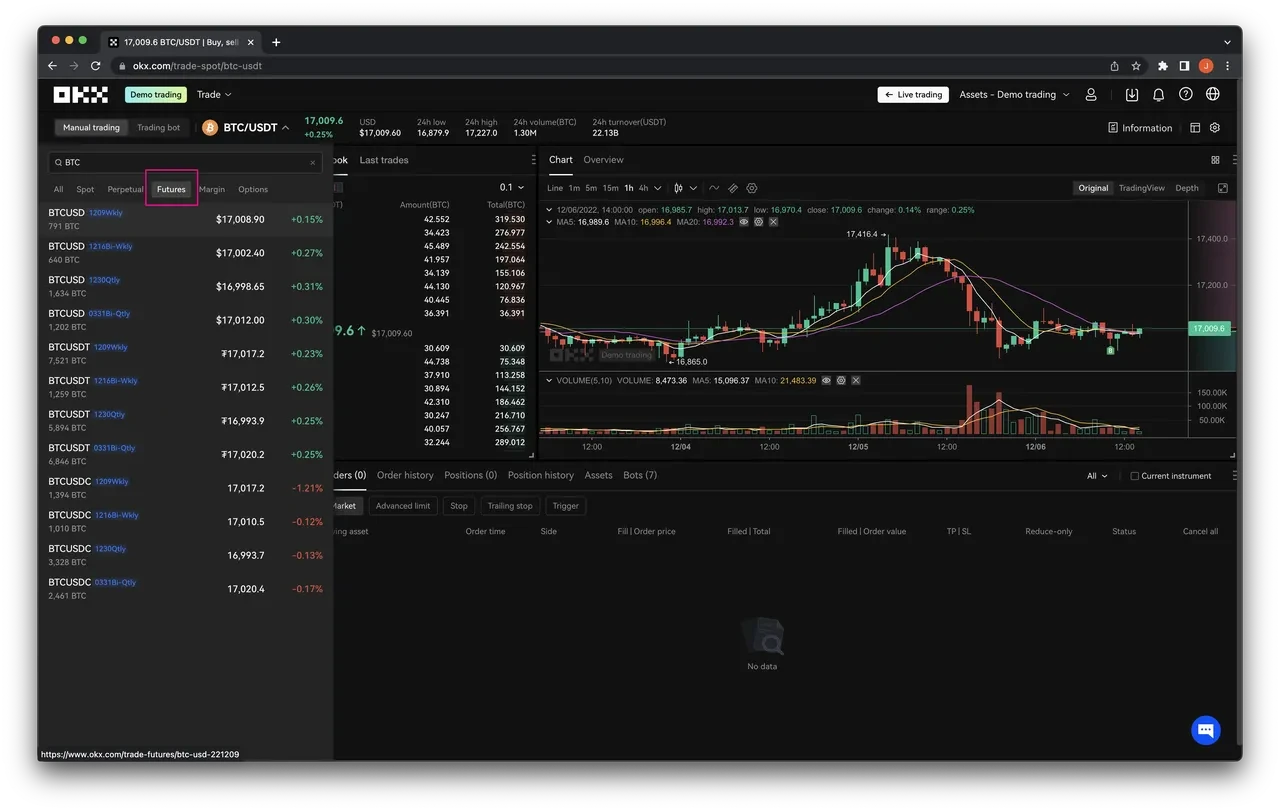

You can also select Futures and choose from the market and the trading pairs in the menu.

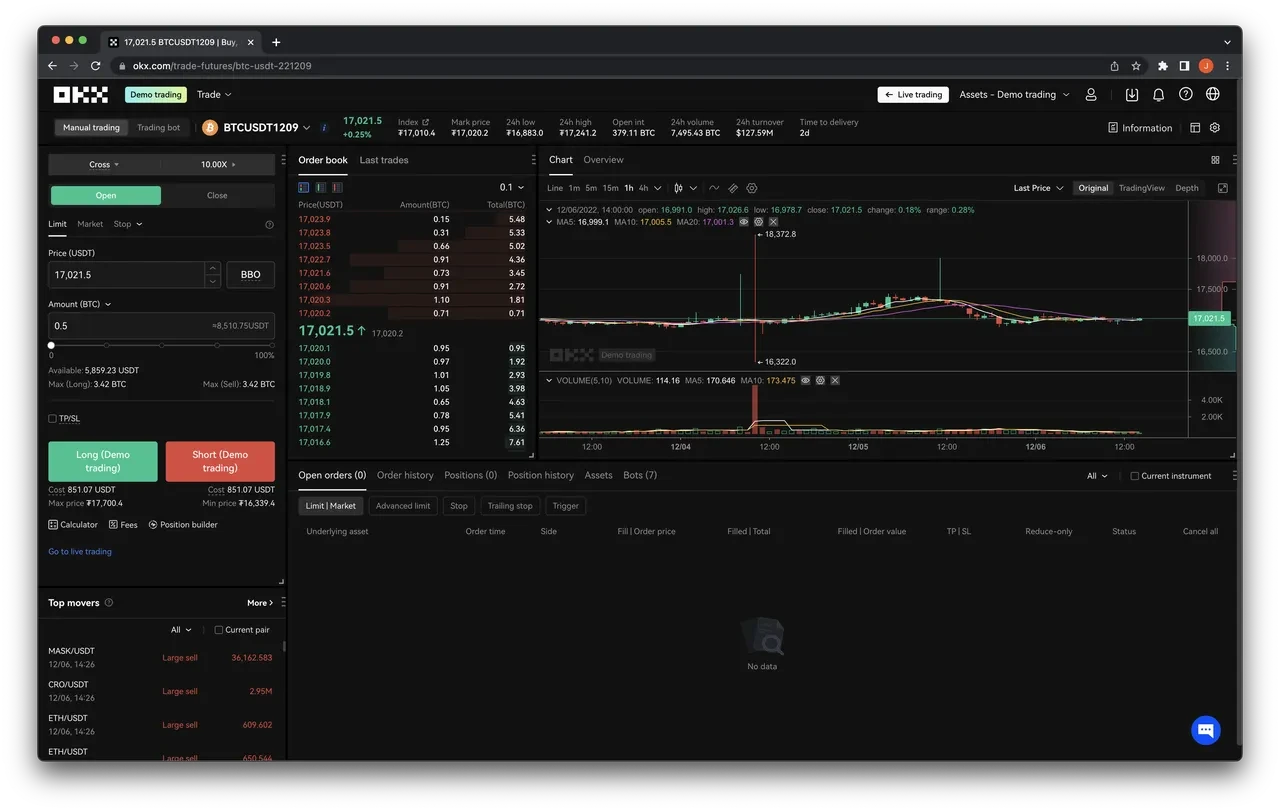

Enter the price of BTC in USDT (if applicable) and the amount of BTC you want, and click Long BTC (Demo Trade).

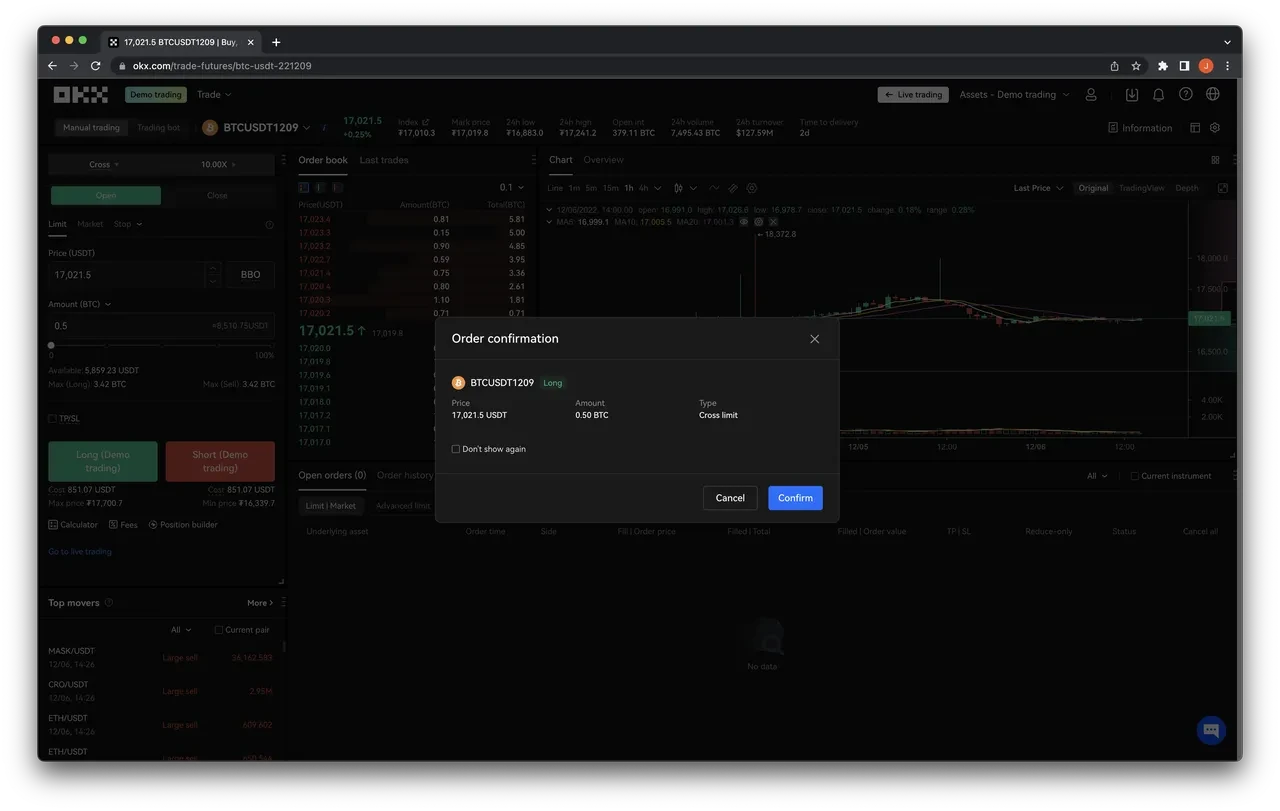

Once you are satisfied with the parameters, click on Confirm to place your order.

After practicing with Demo Trading, you can navigate to Assets – Demo Trading and then Trade in Real Market to test out your new skills! You can also read more in our beginner’s guide to trading or our tutorial on crypto derivatives. Ready to put your skills to real use?

Start trading

Closure

Crypto paper trading is a powerful tool for anyone looking to enter the world of cryptocurrency trading. Whether you are a beginner trader just learning the ropes or an advanced trader looking to test new strategies, these simulated trading environments provide a risk-free environment to hone your skills and gain valuable experience.

By using cryptocurrency trading, traders can gain confidence in their decision-making skills, refine their trading strategies and prepare for real trading in the cryptocurrency markets. So if you are ready to start crypto trading, consider trying paper trading.

If you’re interested in trying crypto paper trading for yourself, OKX API provides a user-friendly platform to get started. OKX API allows you to test your trading strategies in a simulated environment, giving you the opportunity to refine your approach before diving into the real market. Don’t miss this chance to sharpen your skills and explore the world of crypto trading. Go to OKX API today and start your paper trading journey!

Frequently Asked Questions

Q: What is cryptocurrency trading?

A: Crypto paper trading is a simulated trading environment that allows users to trade cryptocurrencies without using real money.

Q: What is practice trading?

A: Practice trading, also known as demo trading, is a type of crypto paper trading offered by some cryptocurrency exchanges, where users can trade in a simulated environment that mimics real market conditions.

Q: What are the benefits of using cryptocurrency trading and practice trading?

A: The benefits of using cryptocurrency trading and practice trading include risk-free trading, market simulation, testing of trading strategies, improved confidence and access to market data.

Q: Why is risk-free trading important for beginner traders?

A: Risk-free trading allows novice traders to learn the ropes and gain experience before trading with real funds.

Q: How does practice trading simulate real market conditions?

A: Practice trading environments simulate real market conditions using real-time market data and trading tools, allowing traders to experience the ups and downs of the crypto markets without risking real money.

Q: Can experienced traders benefit from using crypto paper trading and practice trading?

A: Yes, experienced traders can benefit from using cryptocurrency trading and trading by testing and refining their trading strategies without the risk of losing money and gaining confidence in their decision-making skills before entering the real markets.

Q: What is the first step to get started with cryptocurrency trading and practice trading?

A: The first step to start crypto paper trading and practice trading is to find a platform that offers these services, such as OKX, and sign up for an account.

Q: How does one switch to Demo Trading mode on OKX?

A: After logging into your OKX account, navigate to the “Trading” section and click on “Demo Trading”. This will switch you to the trading simulation mode.

Q: What assets are available for demo trading on OKX?

A: OKX offers demo trading with a range of cryptocurrencies such as USDT, BTC, OKB and many others. It is important to remember that these are virtual assets for simulated trading only and do not represent real money.

Q: How does one trade in demo mode on OKX?

A: Once you have switched to Demo Trading mode on OKX, you can select any market of interest and start placing trades with the virtual money allocated to your account. Detailed steps for both spot trading and futures trading are provided in the OKX guide.

Q: What type of trading can I simulate with OKX’s demo trading feature?

A: OKX’s demo trading feature allows you to simulate a variety of trade types, including spot, margin, futures, perpetual swaps and options trading.

Q: What is the difference between spot trading and futures trading in demo mode?**

A: Spot trading in the demo mode allows you to practice buying or selling a cryptocurrency directly. On the other hand, futures trading allows you to enter into contracts to buy or sell a certain amount of cryptocurrency at a specified future date and price.

Q: How can I transfer from demo trading to real market trading on OKX?

A: After practicing with demo trading on OKX, you can navigate to “Assets – Demo Trading” and then “Trading in Real Market” to switch to real market trading.

Q: How can crypto paper trading help improve my confidence?

A: Crypto paper trading allows you to practice your decision making skills and strategies in a simulated environment. By experiencing the process without the risk of losing real money, you can build confidence in your abilities before entering the real markets.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news