[ad_1]

The crypto bull run in 2024 is one of the strongest in Bitcoin’s history. What evidence supports this claim? Let’s find out.

After its rise to $73,750 on March 14, Bitcoin (BTC) entered a phase of price consolidation, trading within the $68,000 to $72,000 range in subsequent sessions. This surge has sparked conversations about whether the crypto bull run has begun.

The rise in Bitcoin’s price is closely linked to the upcoming BTC halving scheduled for April 19-20. During this event, the block reward for miners will be halved from 6.5 BTC to 3.25 BTC, which has historically affected Bitcoin’s supply and consequently its price.

According to James Check, a leading on-chain analyst at Glassnode, the crypto market is transitioning from an “enthusiastic bull” phase to a potentially euphoric phase. This shift began in October 2023 and gained momentum when BTC rose to its all-time high earlier this year.

Check suggests that the current bull market is among the strongest in Bitcoin’s history, with minimal corrections throughout the rally.

Moreover, the boom in crypto prices is not only affecting trading, but also job markets within the industry. Despite the bearish stagnation observed in previous years, the number of vacancies in the crypto industry reached an annual high in March.

Similarly, data from CryptoJobsList shows a huge increase in job postings and applicants, reaching an annual record in March with 5,843 job applicants.

What is really happening? Has the crypto bull run of 2024 officially begun? Let’s find out.

What is crypto bull run?

A crypto bull run refers to a period of sustained upward movement in the prices of crypto assets, particularly Bitcoin and other major digital assets.

During a bull run, investor confidence and buying activity increases, driving prices higher. This surge often leads to new all-time highs for various cryptos and attracts large-scale attention from both retail and institutional investors.

The current bull run is fueled by positive market sentiments, such as the US SEC’s approval of spot BTC ETFs and the anticipation surrounding the upcoming BTC halving.

However, it is important to note that bull runs are not indefinite, and they are often followed by periods of price correction or consolidation.

Crypto bull run history

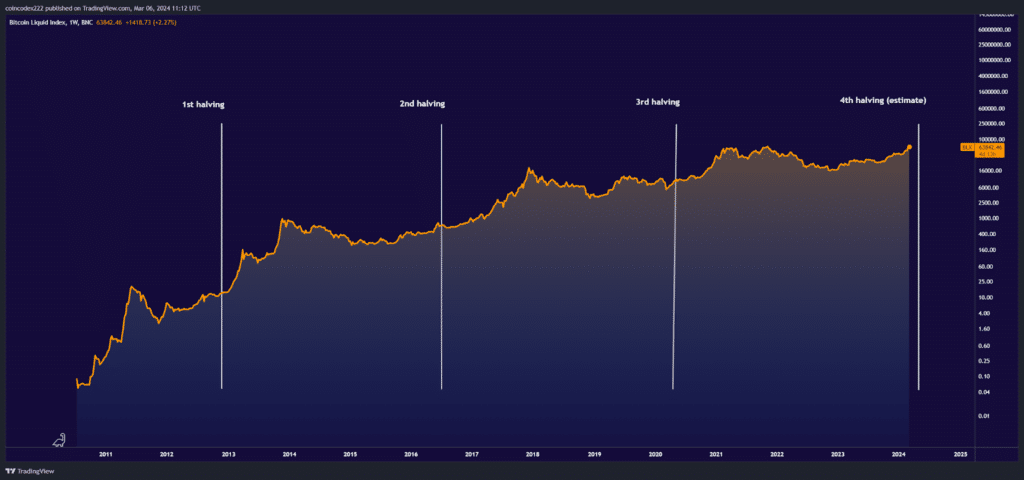

The first notable bull run occurred after Bitcoin’s first halving in 2012. This event reduced the block reward from 50 to 25 BTC for the first time, reducing the rate at which new Bitcoins entered circulation.

Despite Bitcoin’s relatively low profile at the time, its price rose from double digits to over $1,000 in 2013, capturing mainstream attention and marking the beginning of its journey into the financial spotlight.

However, this rise was followed by a quick correction, with prices falling back to around $200 by 2015.

The second bull run also coincided with Bitcoin’s second halving event in 2016. As the block reward halved from 25 to 12.5 BTC, Bitcoin’s price showed bullish behavior, climbing from around $430 to over $750 by early June 2016.

Despite some volatility leading up to the halving, Bitcoin eventually rose to new highs, surpassing $19,000 by December 2017.

The third major bull run occurred after the 2020 halving event, against the backdrop of the COVID-19 pandemic.

Despite global economic uncertainty, Bitcoin’s price had a bullish momentum after the halving, reaching around $15,000 by November 2020 and finally peaking near $69,000 in November 2021.

Throughout these years, Bitcoin’s price patterns have adhered to established crypto-bullish cycles, characterized by spikes leading to halving events, followed by corrections and consolidation phases before reaching new all-time highs.

Indications that we are in the next crypto bull run

Let’s dig into the clues that signal the start of the crypto bull market in 2024 and its implications.

Inflows into spot BTC ETFs

Since their inception in January 2024, spot BTC ETFs have experienced rapid growth, reaching a staggering market cap of $81 billion as of April 10.

Leaders are Grayscale Bitcoin Trust (GBTC) and BlackRock iShares Bitcoin Trust (IBIT), which together control more than 70% of assets under management (AUM).

This large inflow into BTC ETFs indicates a growing interest and confidence among investors in BTC, portraying a bullish sentiment.

Moreover, the consistent increase in inflows, coupled with mild volatility, indicates a strong appetite for BTC investment, further reinforcing the story of a bull run.

Price stability

Another prominent indicator that signals the onset of a bull run is the perceived price stability in BTC.

Despite market fluctuations, BTC has maintained a relatively tight trading range, with prices consistently staying above $65,000 since peaking.

Notably, BTC has repeatedly tested the $69,000 to $70,000 mark in recent weeks, finding strong support levels and potential for further upside.

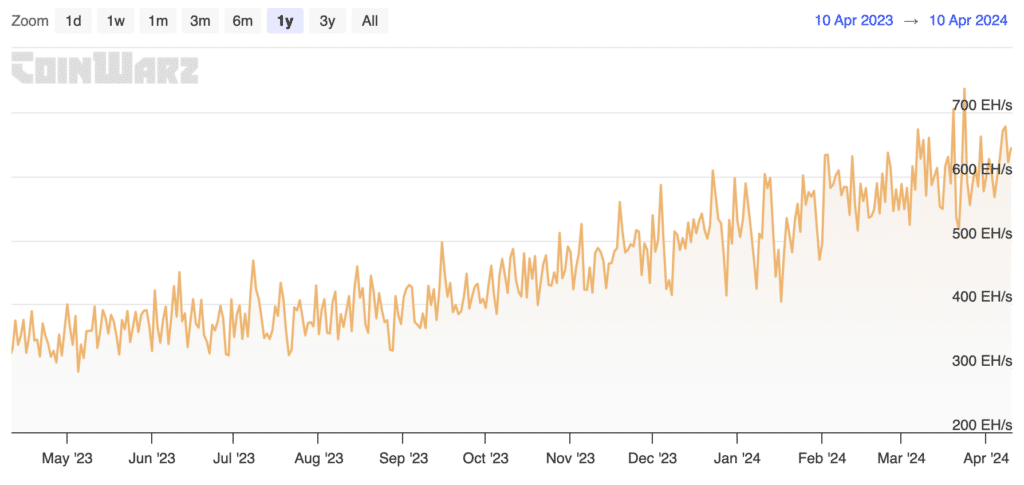

BTC hash rate

The anticipation surrounding the upcoming BTC halving event adds further fuel to the bullish narrative.

With the BTC hash rate steadily climbing and reaching 653 EH/s as of April 10, the impending halving event is gaining significance.

As a result, the growing hash rate coupled with the impending halving event reinforces the bullish outlook for BTC.

Fear and greed index

The BTC Fear and Greed Index consistently registering above 75, even touching 90 at the time of BTC’s all-time high in March, serves as another compelling indicator of the prevailing bullish sentiment.

High levels of investor optimism, as reflected by the fear and greed index, often correlate with upward price trends.

Rise in crypto share prices

The rise in prices of crypto-related stocks, such as Coinbase (COIN), Marathon Holdings (MARA) and Microstrategy (MSTR), further strengthens the bullish outlook for the crypto market.

These stocks have seen strong gains, with MSTR up more than 300% in the past six months alone and COIN up more than 200%, highlighting the underlying bullish sentiment prevailing in the market.

Crypto bull run prediction: what do experts think?

According to Michael van de Poppe, Bitcoin’s surge to all-time highs before the halving is a positive sign. He suggests the continuation of the four-year cycle, which indicates upside potential for the market.

Van de Poppe also suggests that if Bitcoin maintains its momentum, altcoins could also experience significant growth.

Another analyst highlights the continued strength of BlackRock’s spot Bitcoin ETF, as growing interest from long-term investors.

With over 500K BTC held by new investors and 250K by IBIT, there is a shift to a long-term investment approach spanning decades. He envisions it as a multi-decade bull run in the making.

Although these predictions are encouraging, it is essential to approach them with caution. Market fluctuations and unforeseen events can affect the direction of crypto-assets.

You should do thorough research and seek advice from financial professionals before making investment decisions. Never forget the golden rule of investing: never invest more than you can afford to lose.

Frequently Asked Questions

How long does a crypto bull run last?

Crypto bull runs can vary in duration, but they usually last for a few months to a few years. Although the exact duration of a bull run is difficult to predict, it is influenced by factors such as market sentiment, investor activity and external events.

Why is the crypto bull run every four years?

The crypto bull run often coincides with Bitcoin halving events. This process occurs every 210,000 blocks, roughly every four years, gradually reducing the rate at which new Bitcoins are created. The scarcity created by halving events has historically led to increased demand and upward pressure on Bitcoin’s price, contributing to the occurrence of bull runs.

What Causes a Crypto Bull Run?

Several factors can contribute to the onset of a crypto bull run. Positive market sentiment, driven by factors such as regulatory clarity, institutional acceptance, technological advances and macroeconomic conditions, often plays a key role. However, it is essential to note that bull runs are not indefinite and are typically followed by periods of price correction or consolidation.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news