As Bitcoin celebrates a new all-time high, it’s time to take a closer look at one of the investment stories that is helping to drive renewed interest in the asset: Bitcoin L2s.

Bitcoin is the oldest blockchain and of course the most tested crypto. His biggest drawback? Slow and expensive transactions, especially during periods of high activity. Lightning Network, a payment channel protocol in Bitcoin’s scaling scene, is a serious and interesting effort here, but it has so far failed to achieve breakout traction due to UX and liquidity issues.

That said, the arrival of Ordinals NFTs in January 2023 kicked off a huge resurgence of interest in building Bitcoin, and that resurgence led to a resurgence of existing scaling efforts like Stacks and also to a surge of new efforts with ‘ a series of different approaches.

As a result, one of the next big frontiers in crypto is this newly resurgent Bitcoin Layer 2 (L2) scene, so let’s catch you up on some of the rising contenders aiming to improve Bitcoin’s capabilities.

Here are 8 Bitcoin L2 projects you should know about

Bison Network 🦬

Bison Network, developed by Bison Labs, is a zero-knowledge (zk) rollout solution using ZK-STARK technology. It is designed to significantly increase transaction throughput, reduce fees and integrate smart contract functions around BTC.

By using Ordinals for data storage, Bison ensures that all transactions and smart contracts are as secure and immutable as the underlying Bitcoin blockchain. Its infrastructure includes the Bison operating system for managing transactions and token contracts and a Bison token for generating zero-knowledge tokens.

This setup paves the way for more Bitcoin DeFi experiments and allows users to independently verify transactions quickly and efficiently.

Stacks 🪙

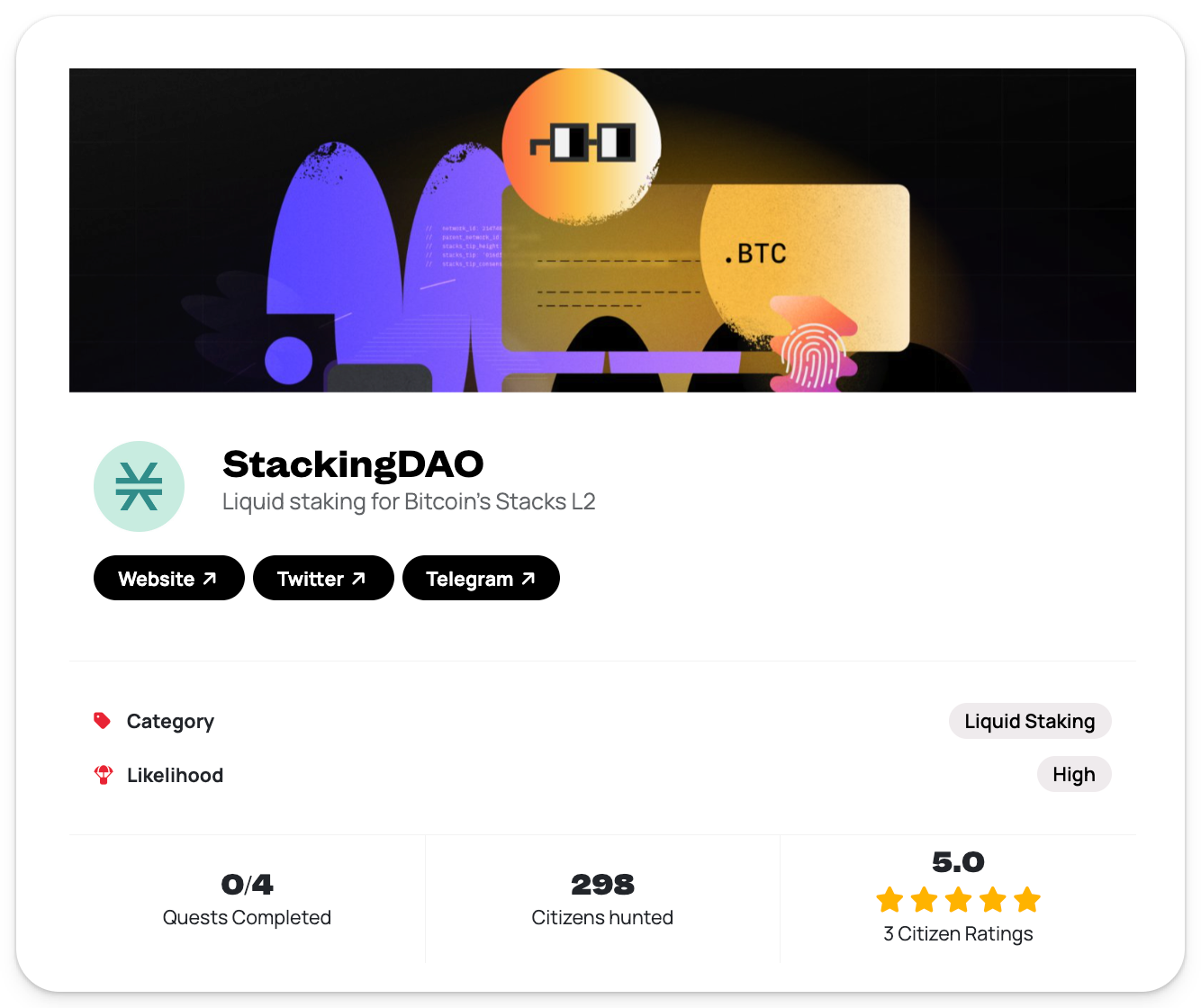

Stacks stands out in the Bitcoin L2 scene for its distinctive approach to extending Bitcoin’s functionality, primarily through its integration of smart contracts directly on top of Bitcoin. It operates on a unique consensus mechanism known as Proof of Transfer (PoX), which fundamentally ties its operations and security directly to Bitcoin.

A key feature that sets Stacks apart is how users can stake STX tokens to earn BTC. This approach not only stimulates participation within the Stacks ecosystem, but also strengthens the bridge between Stacks and Bitcoin, strengthening the value proposition of both networks.

The upcoming Nakamoto upgrade is poised to further solidify Stacks’ position by turning it into a proper L2 by fully inheriting Bitcoin’s security. This upgrade will also introduce faster block production times on Stacks, independent of Bitcoin’s block times, while still achieving 100% Bitcoin finality. This means that once a transaction is confirmed on Stacks, it will inherit the same level of irreversibility as a Bitcoin transaction.

BitVM 💻

BitVM introduces a new approach to smart contracts on Bitcoin without necessitating changes to Bitcoin’s existing rules. This system allows for the verification rather than the execution of calculations on Bitcoin, drawing parallels with the concept of optimistic rollups on Ethereum.

At its core, BitVM uses a unique system of hashlocks, timelocks, and large root trees for performing universal computations. This design allows the offchain execution of programs with minimal onchain footprint, requiring only onchain actions in case of disputes.

While BitVM is currently in its infancy, its potential to enable advanced functionalities such as two-way pins with sidechains and rollups on Bitcoin represents a promising way to extend the OG blockchain’s capabilities without the need for a soft fork.

Botanix 🕸

Botanix Labs pioneered the Spiderchain design, a new L2 format to allow seamless two-way attached sidechains with Bitcoin without changing Bitcoin’s base layer. The ongoing Botanix protocol is the first implementation of this new approach and is integrated with the Ethereum Virtual Machine (EVM) to bridge the gap between Bitcoin’s robustness and Ethereum’s versatile smart contract ecosystem.

At the core of the Spiderchain design philosophy is a network of Orchestrators that manage multisig wallets, facilitating the switching in and out processes between Bitcoin and the Spiderchain. These Orchestrators manage both a Bitcoin node and a Spiderchain node, and Orchestrators are randomly selected based on Bitcoin block hashes to ensure fair and secure operations.

Chain track ⛓️

Another rising force in the Bitcoin L2 scene, Chainway is backed by prominent VCs such as Galaxy Digital and Delphi Ventures. The team released the BitcoinDA data availability adapter for connecting rollups to Bitcoin, and they also began work on Citrea, a zk rollup solution that writes its evidence to Bitcoin using the BitVM.

Designed as a “Type 2 zkEVM” for Bitcoin, Citrea uses zero-knowledge proofs to group transactions, then ensures validity with concise proofs. This approach allows for easy authentication and access to Citrea’s full state by anyone running a Bitcoin node. Citrea uses $BTC as its native token ($cBTC within Citrea) and will offer the OG crypto broader transaction capabilities.

Kasar Labs 🔶

Kasar Labs, a Starknet engineering and research team, is working to integrate Starknet’s zk rollup capabilities with Bitcoin. Recently, in collaboration with Taproot Wizards, they launched a data availability adapter that allows developers to anchor rollups to Bitcoin.

Kasar’s work also notably includes Barknet, a new Bitcoin hash that uses Starknet’s Madara sequencer and the Cairo VM to harness the power of Starknet’s advanced cryptographic proofs.

Merlin Chain 🧙

Another EVM-compatible zk rollup, Merlin Chain, was built by the Bitmap Tech team as an L2 that allows for scaling a range of different Bitcoin native protocols, including Atomicals, Bitmaps, BRC-20s, Stamps, and more. Merlin Chain recently launched its mainnet and kicked off a staking campaign aimed at distributing its upcoming $MERL management token as a fair launch. As a result, since February 9, Merlin Chain has added $2B in TVL.

Ark ⛵️

Ark is a new L2 designed to improve Bitcoin’s transaction scalability. Unlike traditional methods that rely on state channels or summaries, Ark introduces a unique approach with its Virtual Transaction Outputs (VTXO), which enables anonymous, offchain payments. These VTXOs must be used or “refreshed” within four weeks to prevent decay.

At its core, Ark facilitates transactions through trustless intermediaries known as Ark Service Providers (ASP), which are always-on servers that provide liquidity, much like Lightning Network service providers, but without users having to manage liquidity themselves. This setup allows users to send and receive payments anonymously, preserving their privacy without the complexities of onboarding setups such as obtaining incoming liquidity.

Key to Ark’s operation is a process called “lifting”, where users can convert their onchain UTXOs to offchain VTXOs in a trustless manner. Furthermore, Ark’s design allows transactions to be carried out without direct links between senders and receivers, significantly reducing one’s onchain footprint compared to traditional methods such as the Lightning Network.

The big picture

Today, Bitcoin’s market cap is over $1.3 trillion, but much of the capital on the network remains idle for now due to programmability and scalability limitations.

Emerging as a strategic response to these limitations, the renewed Bitcoin L2 ecosystem has gained a second wind thanks to the rise of Ordinals and growing inspiration from Ethereum’s increasingly layered architecture.

This L2 evolution, coupled with booming institutional interest via the premier Bitcoin ETFs in the US, is paving the way for a resurgence in Bitcoin adoption. As these developments unfold, BTC is poised to transition from a predominantly passive store of value to an active, programmable crypto, a shift that could redefine its role in the broader crypto-economy and open new horizons for innovation and growth unlock!

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news