[ad_1]

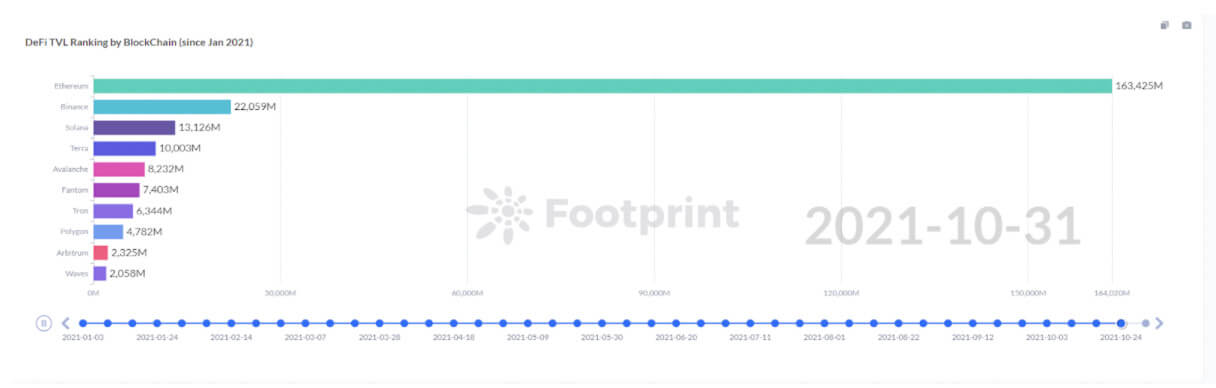

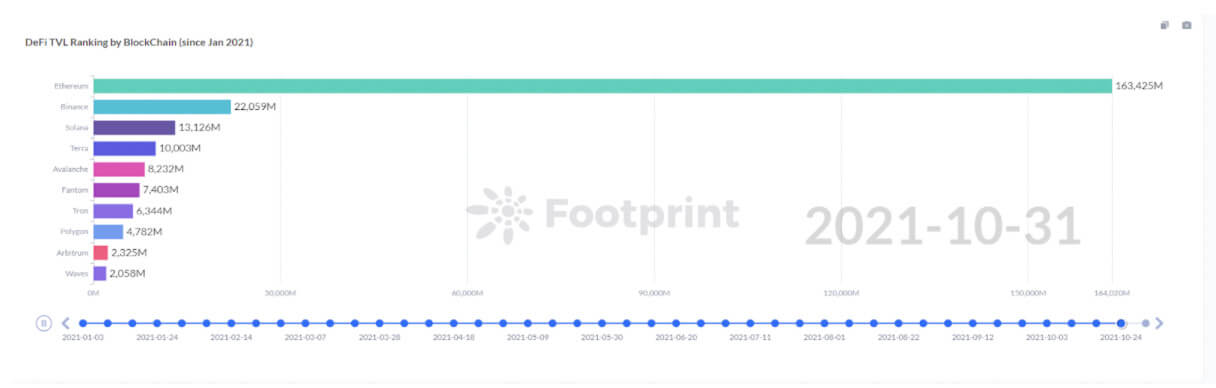

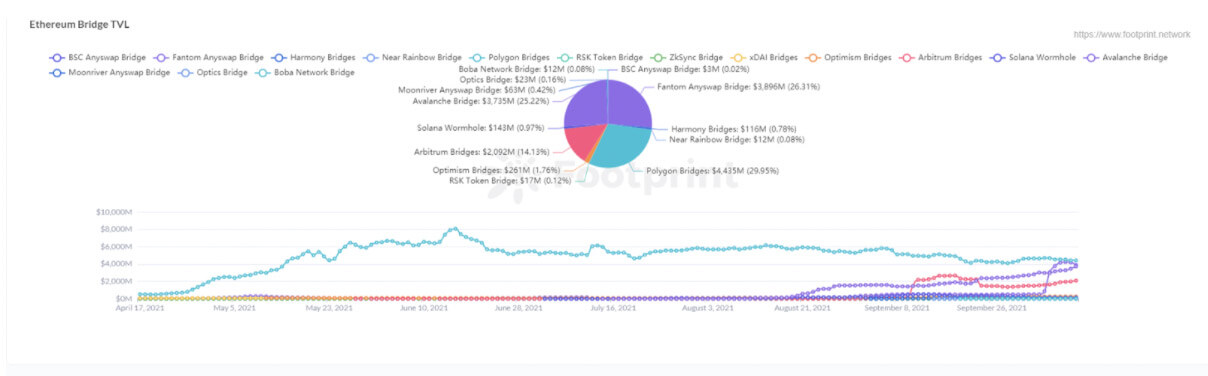

Gas fees make cross-chain transactions very expensive, hindering the free flow of crypto-assets. So it’s not surprising that cross-chain bridges have grown at an unprecedented rate—a TVL increase of 89% MoM in October—as DeFi transaction volume increases in the bull market.

However, did you know that cross-chain bridges solve other problems besides (essentially) crypto transaction fees?

As multichain projects and interoperability become key components of the industry, DeFi investors need to understand how cross-chain bridges work.

This article will look at the nature of cross chain bridges, specifically:

How does a cross chain bridge work Cross chain bridges’ market performance Problems addressed by cross chain bridges Choose a cross-chain bridge

What is a cross chain bridge?

A cross-chain bridge or a blockchain bridge enables the transfer of token assets, smart contract instructions or data between blockchains. Two chains may have different protocols, rules and governance models, but a cross-chain bridge connects these disparate blockchains together by working together securely.

A cross chain bridge enables users to:

Deploy digital asset transactions quickly and easily Enjoy low operational difficulty Take advantage of lower transfer fees on non-scalable blockchainsImplement dApps across multiple platforms

Here is an example of how cross-chain assets are transferred with a bridge:

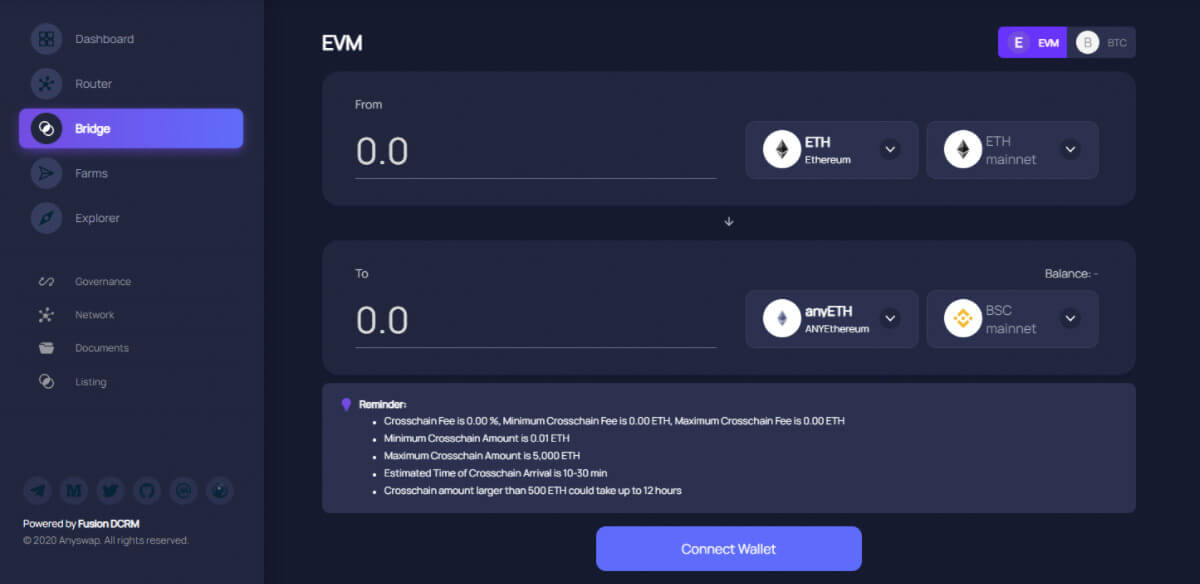

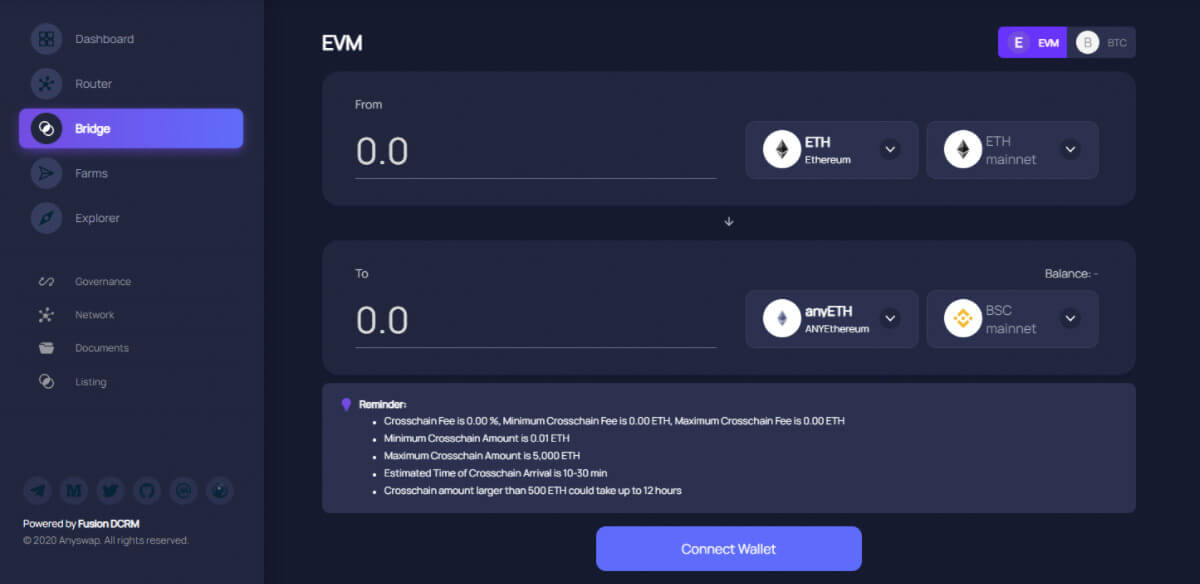

When a user needs to convert an asset such as an ERC20 A token on Ethernet into another asset such as BEP20 A token on the BSC chain via AnySwap, the ERC20 A will be locked on the source chain and then in the bridge notify to generate the BEP20 A on the BSC chain before sending it to the user.

In this example, the entire operation of the cross-chain bridge takes about five to 20 minutes, with an approximate gas fee in the range of $10 to $20, depending on the pre-congestion conditions in Ether at the time.

How has Crosslink Bridge been doing recently?

The market is currently mostly dominated by Layer 2 scale-out cross-chain bridges, which are mainly built on Ethereum for better interconnection and interoperability.

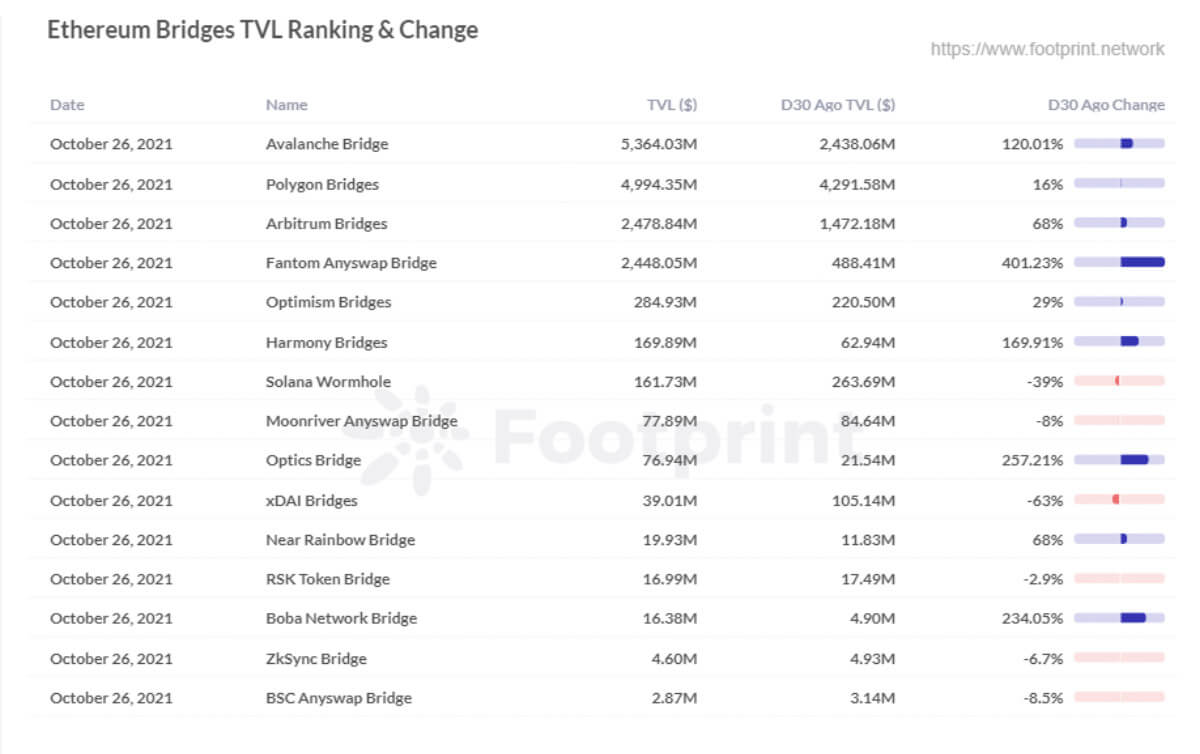

According to Footprint, the TVL of cross-chain bridges was $16.2 billion as of October 26, an increase of more than 72.25% in the past 30 days. The four largest cross-chain bridges, namely Avalanche Bridge, Polygon Bridge, Arbitrum Bridge and Fantom Anyswap Bridge, account for 95.61% of the entire cross-chain bridge, with its highest monthly increase of 401.23% last month.

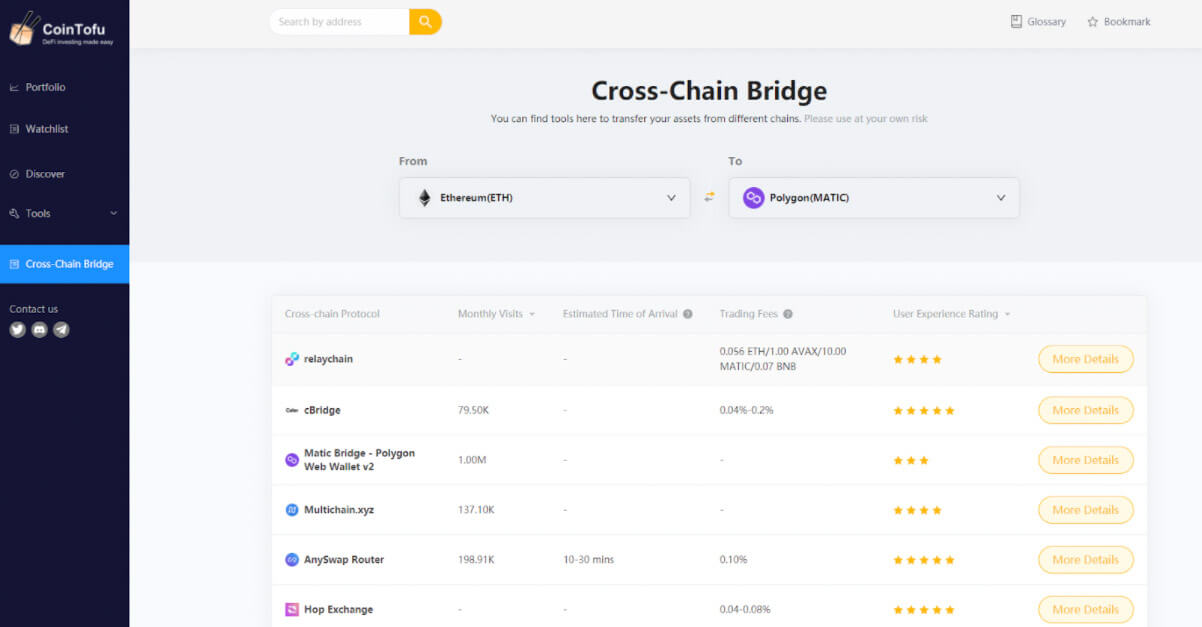

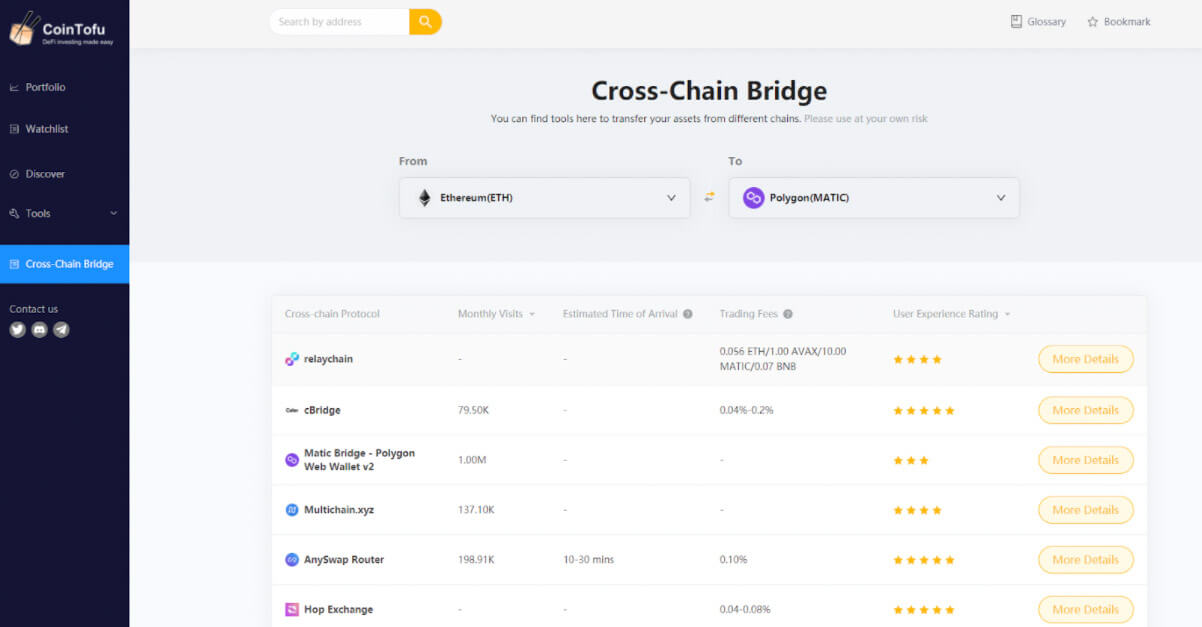

Data from CoinTofu Cross-ChainBridge tool, reveals that these four cross-chain bridges also have excellent user experience ratings.

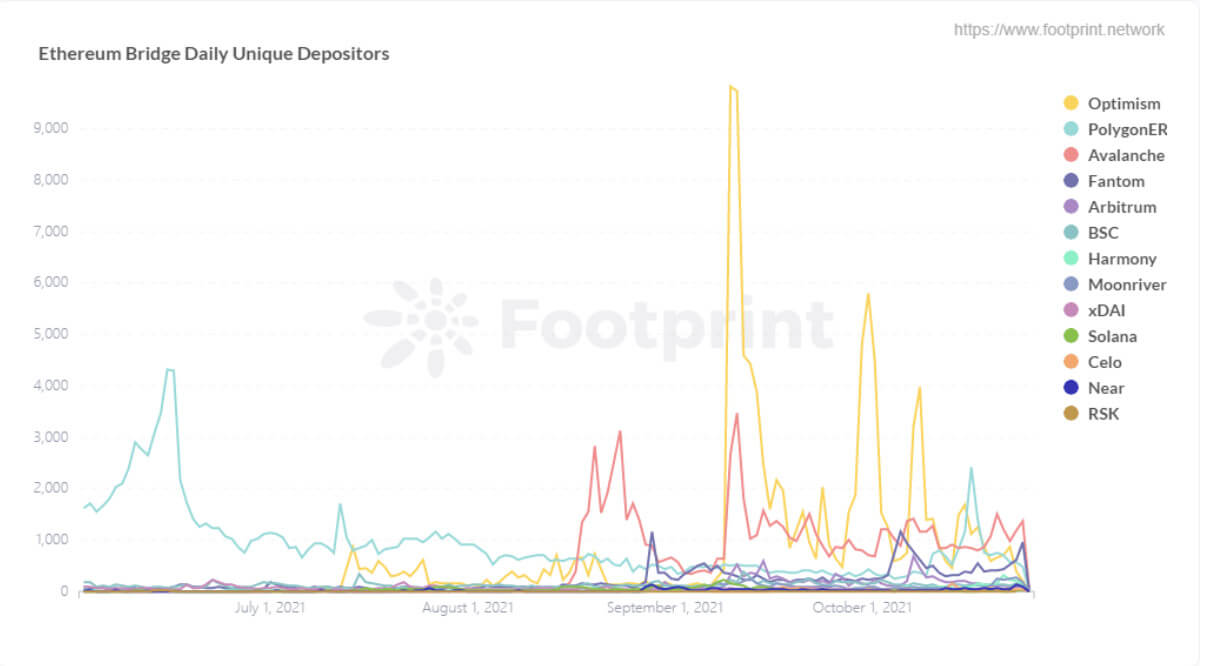

The chart above shows that Optimism had the most active deposits from early September to today, followed by Avalanche. Current transfer fees are as low as $0.25 (according to L2 fees) and their transfer fees are variable, but with relatively small changes.

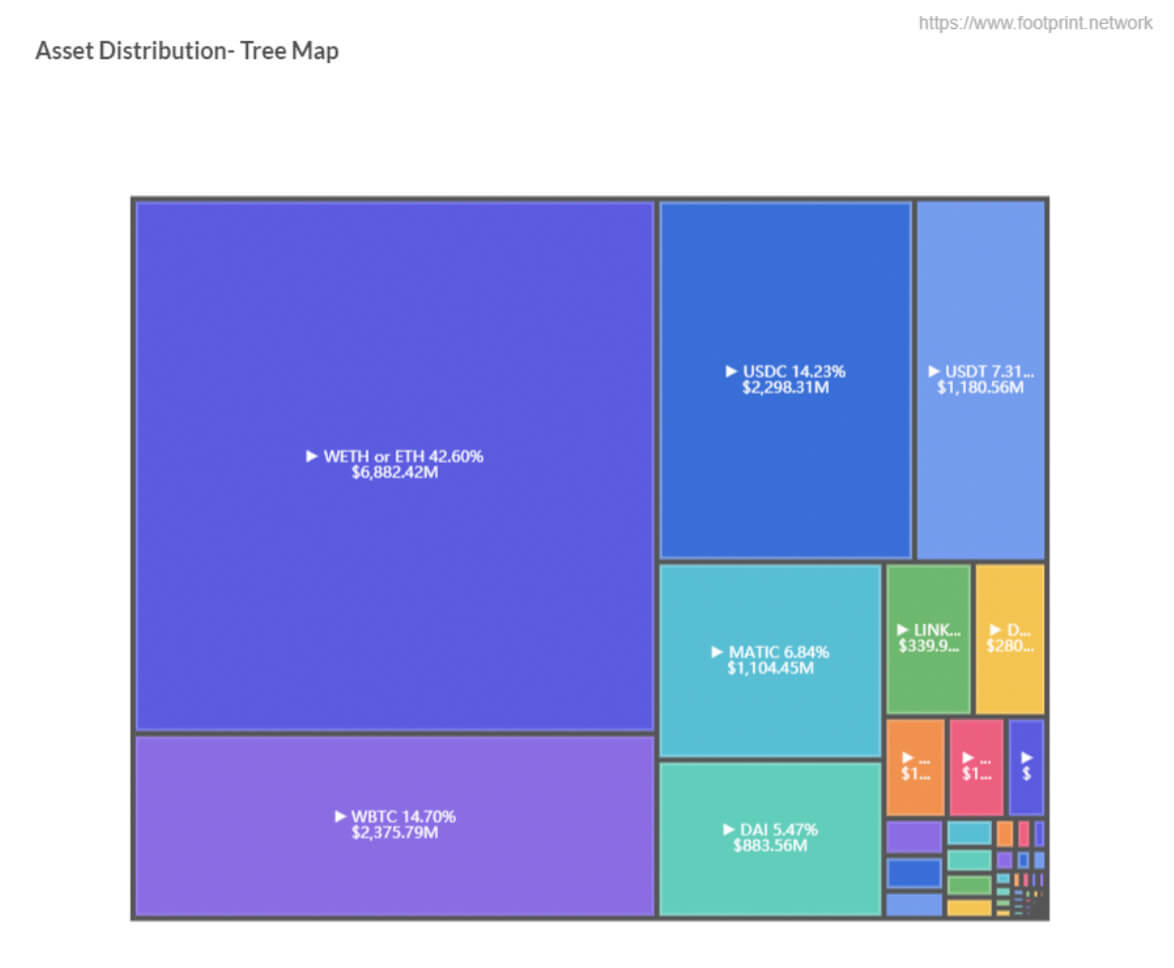

The main asset traded on cross-chain bridges is ETH (WETH), with total ETH locks on the 15 cross-chain bridges worth $6.882 billion on October 26. It represents about 42.6% of the total locks and the most used asset by investors, followed by WBTC and stablecoin USDC.

What problems do cross chain bridges address?

Cross chain bridges create growth across chains (reflected by Phantom and Avalanche prices—which hit gains of 12% and 18% respectively in the first week of November) that offer diverse asset interoperability, high level of security and better asset delivery.

Without a bridge, investors must go through different exchanges and incur higher fees instead.

Cross chain bridges also address the following:

Lower gas costs with increased transaction speedUser assets can be freely interacted with for a high user experienceImproved productivity and usability of existing crypto-assetsHigher security, better privacy

The use of cross chain bridges is appropriate in the following scenarios:

Token transfers between Ether and a Layer 2 network, with assets interoperable across chains, such as faster and easier deposit of funds, withdrawal of assets and exit times to reduce operational complexityHigh fees and use in times of Ether congestionThin assets supported by single chains and more assets supported by cross-chain bridgesInvestors can use cross-chain bridges when investing in new chains to get to the main mine faster, but must assess the full mechanics of the new chain and its security.Arbitrage deals with the DEX on Optimism, Arbitrum and Polygon, etc.

How to choose the right cross-chain bridge

Consider the following criteria when choosing a cross chain bridge:

A stable TVL of more than USD$1 billion with a good cross-chain mechanism and a credible execution environment reflected by gradual changes instead of sudden fluctuations. Verification method of cross-chain information and management method of cross-chain funds should also be considered.Reasonable transfer costs (from USD$1 to USD$5) across the chain and interaction speed with an estimated arrival time of 10 to 30 minutesSecurity to ensure against hackers taking advantage of vulnerabilities

In addition, there are also a number of aggregation tools that provide a one-stop cross-chain bridging solution, of which CoinTofu has a better overall experience in terms of reaching the crosschain page with one click and displaying the benefits of supported crosschain bridges, estimated arrival times, transaction fees and user experience ratings.

Closure

With the development of the DeFi industry, cross-chain bridges have become more popular than traditional exchanges. They enable interoperability and mutual integration of blockchain applications to support project owners, various blockchains and investors and address the problem of capital flow and lower transaction costs to users.

The above content above is for reference only and does not constitute investment advice. If you notice any errors, feedback is welcome.

This report is brought to you by Footprint Analytics.

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Mentioned in this article

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news