AI stocks have been in the spotlight for some time now, and after a stellar performance in January, they hit a roadblock in the markets. This was predicted by InvestingHaven in an article published on February 11, 2023 Leading indicators that confirm that a pullback is underway. Fast forward to today, broad markets look good, tech stocks look good, so as a result, AI stocks should present an epic opportunity. In this post, we check the answer to the last question.

Before we answer this last question, we need to go back to early February when markets did surprisingly well. We get short-term bearish, early February, it was a contrarian call at that time. Remember, there was no sign of a banking crisis at that time.

As expected, the pullback pushed all markets lower, including AI stocks. However, in the 2nd week of March, the banking crisis of 2023 began to look extremely scary, and a stock market crash seemed imminent. InvestingHaven was able to spot the trajectory of AI stocks before it happened. In an article published on February 12, 2023, they described how AI stocks would behave during the pullback: AI stocks: first a drop to support, then an attempt to break out.

Fast forward to today, AI stocks are coming back to life, and sector ETF BOTZ is working on a bullish reversal.

The first chart embedded below is the daily chart of the Global X Robotics & Artificial Intelligence ETF (BOTZ). The chart shows that BOTZ has been in a downtrend since November 2021.

The characteristics of this reversal indicate that it is a very powerful reversal. The chart analysis of BOTZ ETF shows a rounded pattern that is about to complete, indicating a strong bullish reversal. The rounded pattern that formed on the chart is a classic technical pattern that often precedes a trend reversal. The rounded pattern is characterized by a gradual rounding off of the price action, followed by a breakout above the previous resistance level. If the pattern is complete, it indicates that BOTZ is likely to move higher in the coming weeks and months.

Here’s the catch, look at the BOTZ ETF, the chart above. We look at the chart and apply our chart analysis to it. We look at the price axis, time axis, combine both and lead to actionable conclusions. More importantly, we can spot turning points in real time and make predictions about the intensity of the new trend before it happens.

However, if you look at this chart purely from a technical analysis perspective (not to be confused with chart analysis), you will end up with the following ‘observations’:

The MACD (Moving Average Convergence Divergence) indicator is still bearish, but it is starting to flatten, indicating that the momentum of the downtrend is slowing. Overall, while the trend is currently bearish, the rounded pattern and positive RSI deviation suggest that a bullish reversal could be in the works for BOTZ in the near future.

You can now see how chart analysis differs from technical analysis.

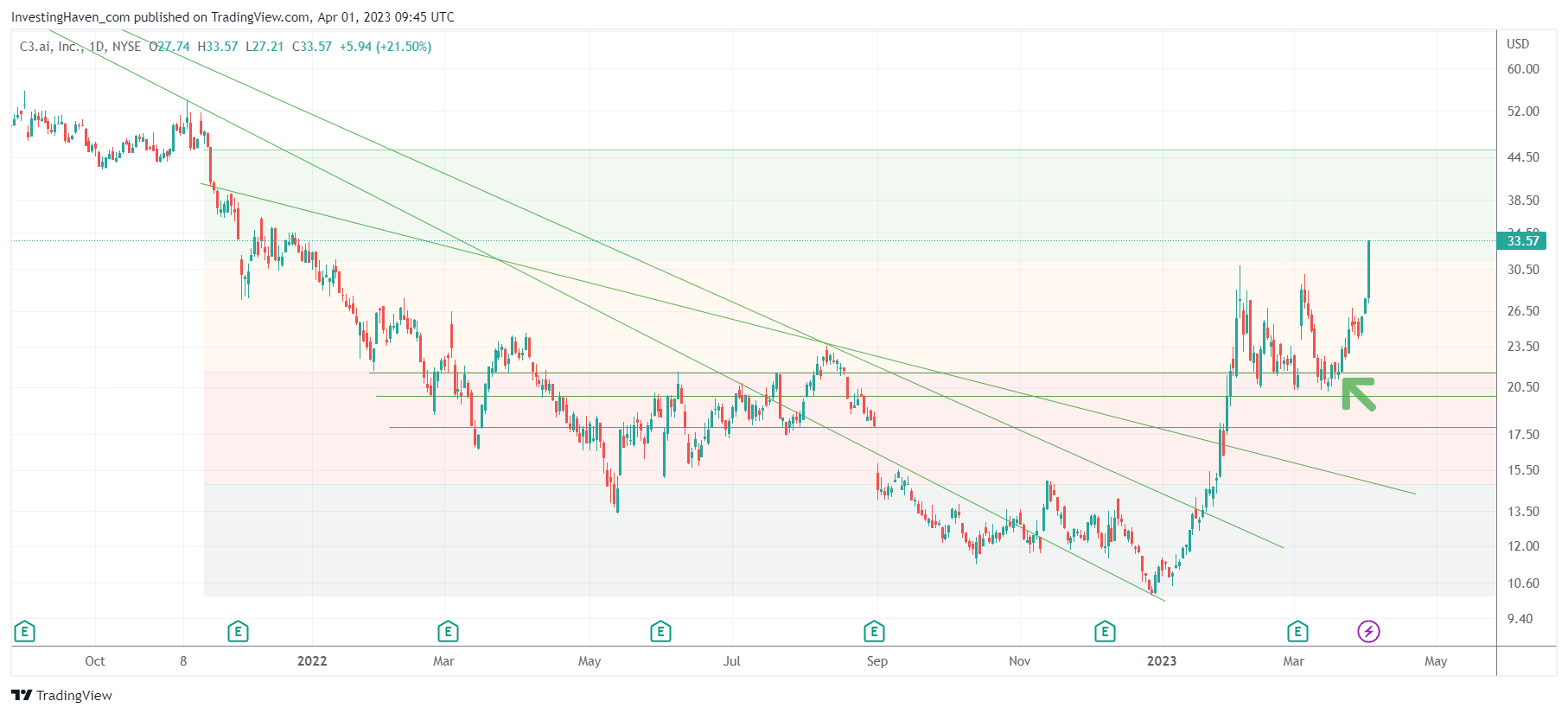

The same goes for one of the few pure AI stocks, also one listed in BOTZ ETF. Below is the graph of C3.ai (symbol AI).

Based on InvestingHaven’s forecasting methodology, their premium Momentum Investing members were able to go long right at the green arrow, right above 21 USD, in the depths of the banking crisis. This chart is now extremely powerful and one of the leaders of the AI sector, further reinforcing the bullish sentiment.

No technical analyst would buy at 21 USD simply because the trend was not positive at that time. Lagging indicators, which are the basis of technical analysis, think of moving averages and MACD or RSI indicators, will not flash a buy signal where we have initiated a position.

Again, at InvestingHaven we apply chart analysis, not to be confused with technical analysis. It’s not a big difference, it’s a big difference!

Take, for example, the warnings issued by officials and financial media in the week of March 13, in the depths of the banking crisis. This is one of many illustrations: IMF chief warns global financial stability at risk from banking turmoil.

This is what we wrote at InvestingHaven that same week: Markets hit downside target – now what:

It’s really quite simple: this current level must hold to qualify as a bullish reversal. In fact, IF this level holds, it will confirm the rounded pattern which is a bullish pattern that has a bullish outcome.

It is during that week that we initiated the position in AI, one that has 50% unrealized gains after Friday’s close.

Finally, AI stocks are working on a very strong bullish reversal, as evidenced by the Sector ETF BOTZ and C3.ai. Investors looking to capitalize on this trend should keep a close eye on the charts and consider investing in the AI sector.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news