According to Footprint analysis data, if of 7 Feb, Ethereum burned 1,778,834 ETH since the London upgrade in August, equivalent to $5.5 billion at curental prices. polygon also announced the implementation of EIP-1559 in an upgrade to the main network on January 18.

EIP-1559’s primary goal is to get rid of the first-price auction mechanism in favor of a base fee plus a priority fee. The base fee fluctuates based on network conditions, making gas charges more visible, while the base fee will be burned.

The base fee will be tied to the fire contract on Polygon and the priority fee will be paid directly to the validators. The fire will start on Polygon and end on Ethereum. Polygon provides a public interface that allows users to monitor the burn and start a burn once the cumulative MATIC to be burned exceeds 25,000. Polygon has currently burned 545,903 MATIC.

Why did Polygon launch a burn mechanism

Polygon is a sidechain of Ethereum and aims to solve its scaling problems such as high fees, low TPS and poor user experience.

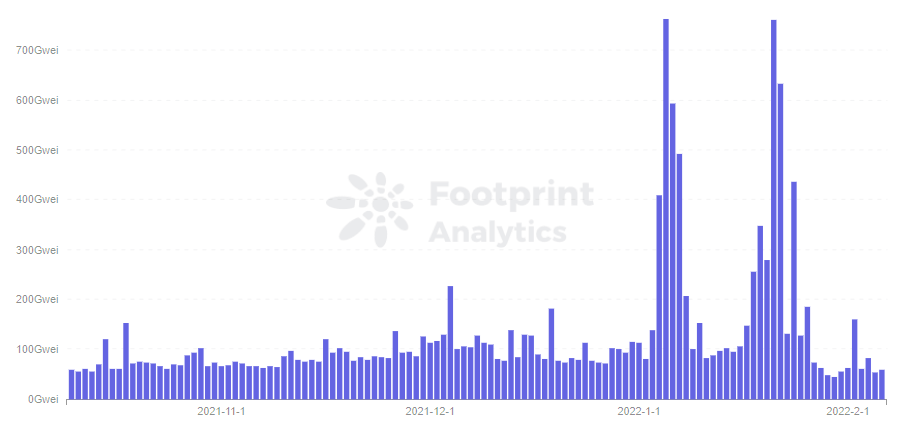

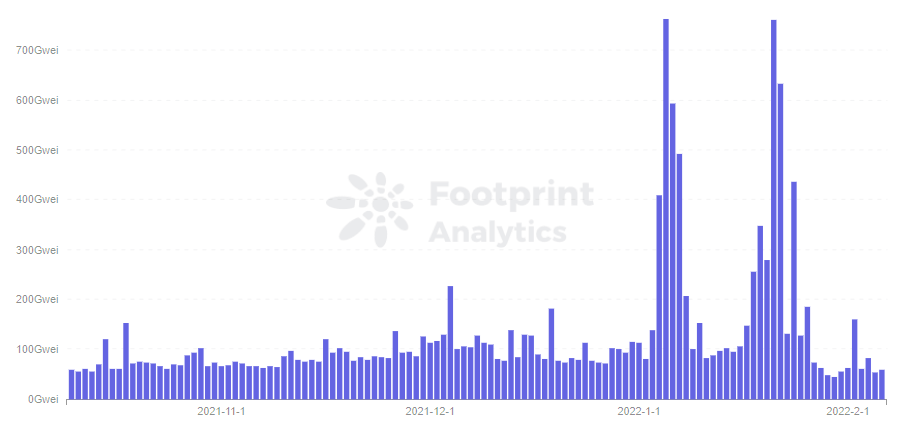

However, Polygon experienced a gas fee crisis at the beginning of January, which caused some validators to fail to submit blocks. An NFT game called Sunflower spiked gas fees, with 40% of the chain’s gas fees coming from this game. The average price of gas on January 5 was 763 Gwei.

The benefit that Polygon claimed when it went live is shrinking compared to the average gas fee of only about 10 Gwei at the start of the year.

On January 18, Ethereum co-founder Vitalik Buterin tweeted about the paper, Empirical analysis of EIP-1559: transaction fees, waiting times and consensus certainty, jointly published by Peking University and Duke University. This confirmed that EIP-1559 did indeed improve user experience – which can be seen as the shift to the left on the graph, indicating that wait times decreased.

Based on the results of the Ethereum London upgrade, Polygon hopes to bring improvements to everyone in the ecosystem with EIP-1559.

Effects of Polygon’s upgrade

Polygon believes the London upgrade will have far-reaching implications.

For Token Holders: Since MATIC is a fixed supply, the burning mechanism will contribute to deflation. According to simulations, the annual burned MATIC will be 0.27% of the total supply.For users: Enjoys lower gas fees than Ethereum, while allowing for better fee prediction in the future.For Validators: Future return will be priority fees only, but the return will benefit from MATIC’s deflation. This will make both spam transactions and network congestion better in the future.

Here’s how the Polygon London upgrade actually works.

Average gas price

Transaction fees are determined by supply and demand, the introduction of EIP-1559 will not result in a significant improvement in the price of gas. It is true that after the upgrade the price did not drop significantly, but slightly increased. The average price remained above 200 Gwei per day after update, with some decline at the end of January.

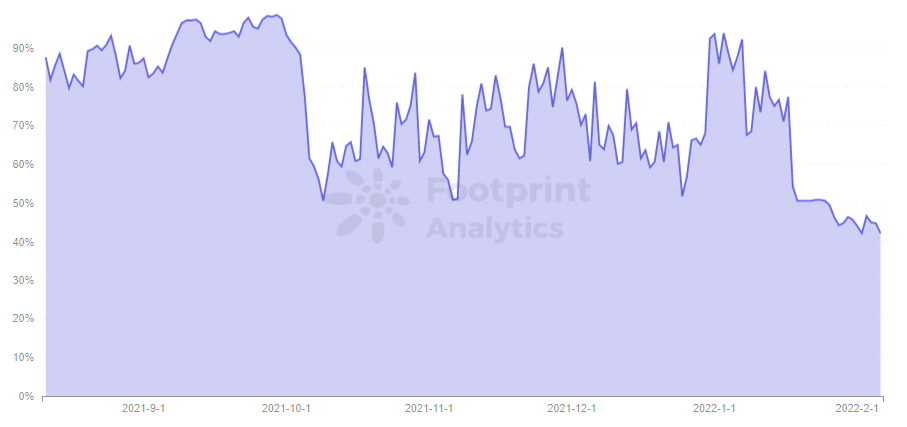

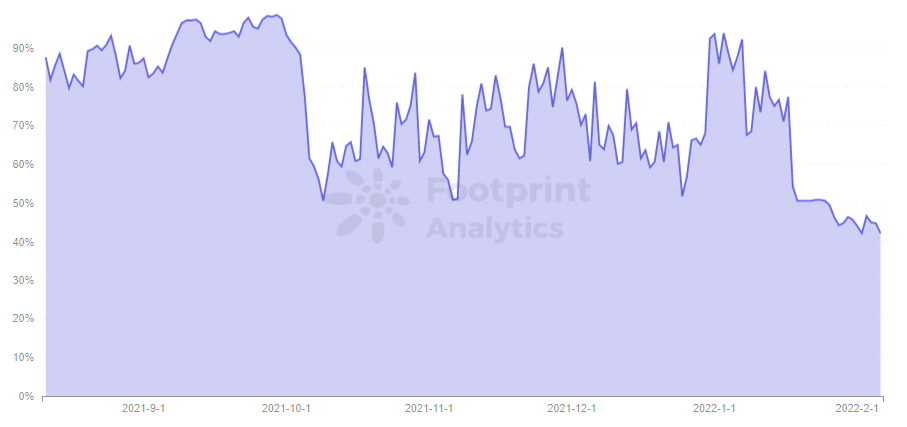

Network usage

Although there is no reduction in the price of gas, the London upgrade will make the base charge more predictable. Gas fees increase in price as block usage increases and decrease in price as consumption decreases.

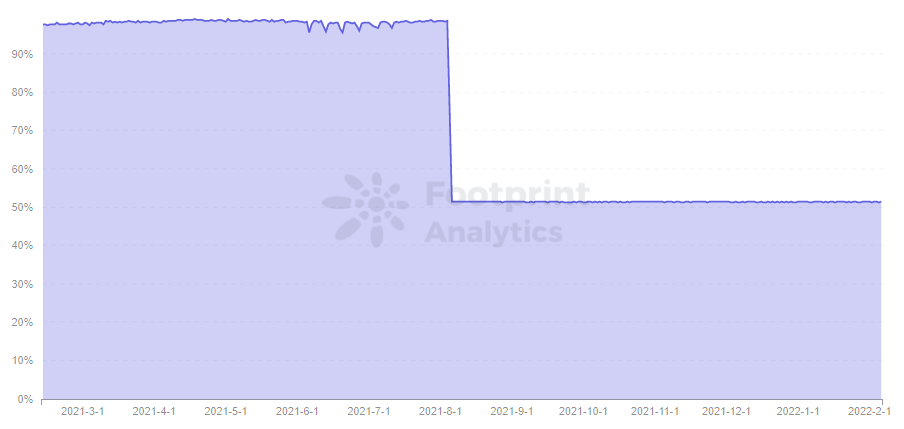

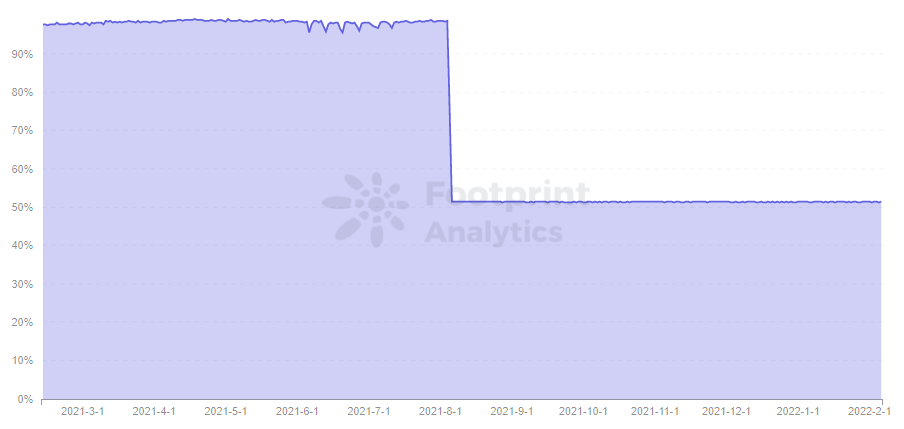

Looking back at Ethereum since the London upgrade, there has been a huge drop in network usage. From about 97% down to 51%, and the utilization rate is very stable, and does not fluctuate more than 1%.

Similarly, Polygon’s network utilization was between 60% to 90% before January 18, and immediately after the upgrade dropped below 50.7%. The stability of fluctuating utilization rates kept the overall network stable and transaction fees relatively stable.

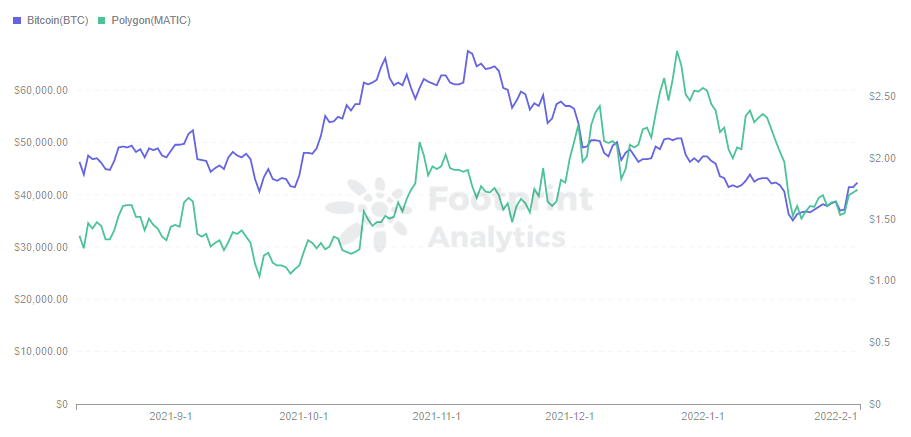

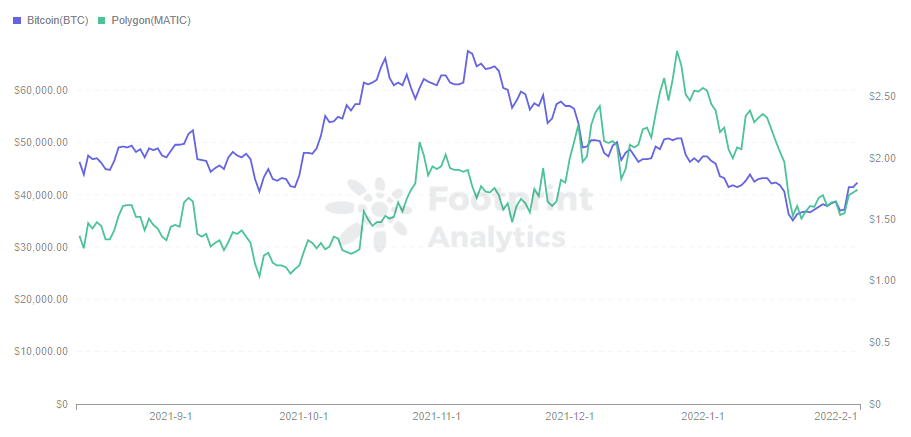

Token price

The price of ETH increased after the London upgrade, while MATIC decreased rather than increased. This is mainly because MATIC’s price is more influenced by the overall blockchain market. The price is highly correlated with BTC, whose price has fallen below $40,000 due to various factors.

Recently, the ESMA (European Securities and Markets Authority) called for a ban on PoW mining and the Bank of Russia published a report recommending a ban on cryptocurrencies. Countries have introduced policies that are not conducive to the development of cryptocurrencies. At the same time, the Federal Reserve is expected to raise interest rates in March and funds are expected to start moving, which is also somewhat negative for blockchain. Many reasons have contributed to the recent turbulent downward movement of cryptocurrencies.

Summary

Polygon has received a lot of attention because it is a sidechain of Ethereum, and has become the third largest blockchain by number of protocols after Ethereum and BSC. However, its market share has been gradually compressed since August, and TVL ranking has dropped from 3rd to 8th.

Without Ethereum’s first-mover advantage, this upgrade and optimization is essential for Polygon to stand out among so many up-and-coming chains.

Although MATIC hasn’t been revived yet, the new fire mechanism could rekindle Polygon.

Date and author: February 17, 2022, [email protected]

Data source: Footprint analysis

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform to visualize blockchain data and discover insights. It cleans and integrates chain data so users of any experience level can quickly start exploring tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Mentioned in this article

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news