[ad_1]

Unlike Web 2.0, the current iteration of the World Wide Web, Web 3.0 will be less controlled by large companies, allowing content creators to use decentralized social networks to benefit more directly from their works. These works will often be paid in cryptocurrency, their ownership verified by public entries on a blockchain.

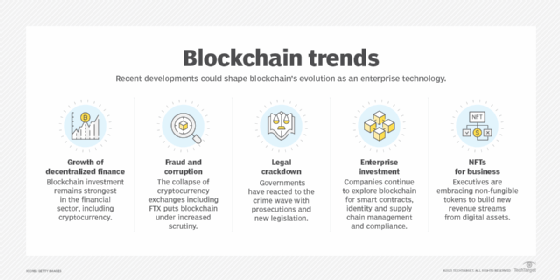

At least that was the vision of Web 3.0 proponents. This year, after a year and a half of blockchain hacking, cryptocurrency scams, and lawsuits that shook confidence in Web 3.0’s technical underpinnings, Web 3.0 adoption hasn’t exactly accelerated, but it’s continuing.

The following are eight Web 3.0 trends and predictions to watch:

1. Tokenization of real assets. This includes real assets such as real estate and agriculture and the use of blockchain technology to track them. “One of the great innovations of Web3 is tokens – both fungible and non-fungible assets that are inherently unique – and the ability to program them with smart contracts that track them,” said Avivah Litan, vice president and principal analyst at Gartner. Litan is seeing a lot of movement around the world, including in Abu Dhabi in the United Arab Emirates, where agricultural company Silal is working with nearly 1,000 farmers to track food.

2. More failures in the cryptocurrency industry. After a heady 2022 for blockchain, cryptocurrency and other Web 3.0 technologies, Litan predicted at least one more cryptocurrency failure. Indeed, in early 2023, one of the largest crypto lenders, Genesis Global Capital, filed for bankruptcy and then sued its former partner Gemini for nearly $700 million. Amid the human bad actors corrupting the crypto landscape, there is still a need for regulators to establish clear new regulations they can enforce, Litan said.

3. Enterprise use of tokenization. Gartner sees increasing use of tokenization for supply chain monitoring and financial applications, Litan said. As a foundational technology of Web 3.0, blockchain continues to power many of its key features, such as the ability to “tokenize” assets and digitally exchange them into non-fungible tokens (NFTs).

As a foundational technology of Web 3.0, blockchain will drive many of its key features, such as cryptocurrency and decentralization.

4. Web 3.0 adoption slower than predicted. Gartner has revised its estimates and now predicts that 25% of enterprises will use centralized services wrapped around decentralized Web 3.0 applications by 2027 – three years later than the previous forecast. Many Gartner clients have reported that their AI efforts are now taking precedence over Web 3.0, and that will remain true for the next few years, Litan said.

5. Convergence of simulated and real worlds. “Web 3 technologies improve the way people interact with each other and increase the ability to create immersive experiences,” said Scott Likens, global AI and US innovation technology leader at consulting firm PwC. Although not strictly identical, the metaverses intersect with Web 3.0 technologies, expanding the possibility of a virtual world of social networks where individuals create and then own their works, as opposed to Web 2.0, where there tends to be centralized ownership of digital content.

6. Ethics will be established for Web 3.0, increasing trust. The development of enforceable regulations will increase trust in new environments such as the metaverse and those created by Web 3.0, according to Likens. But trust is created by human emotions, so technical provisions by themselves – in blockchain, for example – will not carry the day. The idea behind the Bitcoin cryptocurrency at its inception was that trust was built into the technology. There is transparency because everyone can see the transactions. But people seem to need more reassurance than that. “As businesses, we need to create a trusted environment where people are in charge from the start, so our consumers know they can use this technology in a reliable way,” Likens said. “We need to be people-led and technology-driven to ensure we continue to be leaders of technology and not just allow ourselves to be led by it.”

7. Blockchain costs haven’t fallen — yet. Besides the built-in costs of storing information on a server, there are additional costs specifically related to blockchain. “Gas fees” refer to money paid to people who verify the addition of content or the additional transactions in the distributed ledgers that exist on a public blockchain. These fees did not fall as much as expected. But as the technology takes off, costs will likely begin to level off as more competition enters the market, says Tom Taulli, author of How to Create a Web3 Startup: A Guide for Tomorrow’s Breakout Companies.

8. High profile consumer plays. Web 3.0 technologies continue to transform customer loyalty programs. Major companies in a variety of sectors are showing their “cool factor” by creating consumer experiences based on NFTs and cryptocurrency. For example, GQ released an NFT-linked magazine subscription in February 2023, while Sports Illustrated released an NFT ticket program that May. Meanwhile, Starbucks launched its Odyssey Web 3.0 loyalty program in beta in October, rewarding its most loyal coffee drinkers for digital engagement.

Lauren Gibbons Paul has covered technology topics for IT publications including CIO, CSO, Computerworld, Network World and eWEEK for over 20 years. She specializes in the application of technology to drive business value.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news