[ad_1]

Disclaimer: The text below is a press release not written by Cryptonews.com.

If you’ve been following blockchain, you’ve probably heard of the recently emerging industry called DeFi (decentralized finance). Perhaps not surprisingly, this market has experienced significant growth and is now worth over $4 billion.

So what exactly is DeFi and why is it important? In short, Decentralized Finance (DeFi) is one of the latest innovations to emerge from the blockchain-powered, decentralized economy. It follows the idea of rebuilding the infrastructure of financial services and moving it to decentralized networks to take the operation from a centralized system full of monopolies to a trustless and transparent world that runs without intermediaries. DeFi applications, primarily built on the Ethereum network, offer users traditional financial services, but in a decentralized, borderless way that allows anyone around the world with an Internet connection to access financial products and services.

This growth couldn’t be at a weirder time. A pandemic has swept the world, and while the global economy is forced to a standstill, the world of decentralized finance continues to be populated by new projects from teams around the world. There are currently more than 100 projects tackling various DeFi solutions.

Below is the list of top five DeFi protocols to watch in 2020.

1. Any exchange

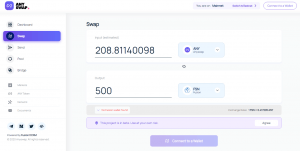

Anyswap is a fully decentralized cross-chain exchange protocol, based on Fusion DCRM technology, with automatic pricing and liquidity system. Anyswap enables exchange between any coins on any blockchain that uses ECDSA or EdDSA as a signature algorithm, including BTC, ETH, USDT, XRP, LTC, FSN, etc.

Why is Anyswap the best DeFi token to watch in 2020?

Anyswap is the first completely decentralized exchange that allows the user to exchange any coin or token (ECDSA and EDDSA as signature algorithms – 98% of all blockchains) with each other, without any third party risk.

Anyswap was released in July and already has over $6.58M USD in their pool. To make it all even better; they offer an annual rate of return of 430%. The ANY token issued is a management token, which allows voting rights for holders to choose which coins will be listed next. No ICO, no fundraising, and no airdrop! The price rose to $1.82 USD within the first two weeks of its release. If the project can go this far this fast, then the sky is the limit for its future.

One of its most striking features is its low cost. Anyswap charges a low fee of only 0.4% for each swap, of which 0.3% goes to liquidity providers and 0.1% goes to Anyswap Company.

Anyswap protocol also supports the following features:

Decentralized cross-chain bridge — Users can deposit any coins into the protocol and mint wrapped tokens in a decentralized way. Cross-chain exchanges — Users can instantly exchange from one coin to another. Programmed Pricing and Liquidity — Liquidity providers can add and withdraw liquidity in exchange pairs. The programmed pricing system is based on the liquidity provided.

2. MakerDAO

With more than $1 billion in assets committed, Maker is by far one of the most recognized decentralized finance applications in the market. It has a market dominance of around 60%, and around $600 million worth of digital assets are currently locked up in Maker protocol smart contracts.

What makes MakerDAO deserve the position as one of the top DeFi projects?

The decentralized credit platform supports DAI, a stablecoin whose value is pegged to USD and one of the most widely used stablecoins in the cryptocurrency industry. Maker DAO allows anyone to open a vault, lock up crypto collateral, and generate DAI against that collateral. Unlike other dollar-pegged stablecoins, Dai does not hold dollars in a bank. Instead, the Maker protocol uses smart contracts and collateral in the form of ETH to maintain the price peg.

Dai can be used to lend (earn interest), make payments, trade or invest in other Ethereum-based assets.

What sets MakerDAO apart from other projects is the way they work and are managed. Its management and automation system uses Ethereum smart contracts to perform lending and stabilization functions without a central identity.

The Maker Foundation is directing its efforts to prepare the voting community to control the Maker protocol after decentralization. The three key elements of self-sustaining DAO (technical, human and procedural) will enable the community to administer a complete decentralized token protocol that takes care of every sphere of DAO.

MakerDAO is reported to be voting on whether or not to expand the collateral they currently accept for loans to real assets, and not just cryptocurrencies. This exciting proposal, if accepted, would be a major development for space as a whole.

3. Synthetics

Synthetix is an Ethereum-powered decentralized investment platform that allows users to create and trade so-called “Synths,” which provide on-chain exposure to tokenized, synthetic versions of real-world assets. It allows users to bet on crypto-assets, stocks, currencies, precious metals and other assets in the form of ERC20 tokens. Trades take place on a peer-to-peer basis and on a non-custodial basis. Currently, Synthetix has more than $140.6 million in its liquidity pools.

Why is Synthetix one of the top DeFi projects?

Much of Synthetix’s recent success can be attributed to its innovative token incentive model. SNX holders hold SNX in exchange for fees from the Synthetix exchange and rewards from the system’s inflationary monetary policy. To create a new Synth, more than 750% of the value of the Synth must be put in as SNX. The more SNX is pledged and locked as collateral, the less is available in the market and the more valuable the token becomes. The proof is in the price. The SNX token made a dramatic rise in 2019 and is predicted to continue this success in 2020.

Synthetix uses a multi-token infrastructure based on a system of collateral, staking, inflation and fees. The system uses two types of tokens – the main Synthetix Network Token (SNX) and Synths. The system is similar to MakerDAOs where ETH is locked up to create DAI; In Synthetix, SNX is locked to create sUSD (synthetic USD). The sUSD acts as debt while SNX acts as the collateral. SNX is used as collateral to potentially create any synthetic asset – not just sUSD.

One of the core requirements of the Synthetix system is the ability to get accurate information from the outside world, such as the price of the Japanese Yen – and ultimately the price of stocks like Tesla. Synthetix has partnered with ChainLink to reliably bring information to the blockchain without trusting a central party – very DeFi.

Synthetix started 2020 by demonstrating the “money lego” qualities of DeFi by integrating the sUSD stablecoin with the margin trading platform bZx. But the big feature most have been waiting for is the ability to trade stocks like Tesla and Apple on top of Ethereum – an absolute game changer for DeFi believers everywhere.

4. dYdX

dYdX is an Ethereum-powered non-custodial trading platform that allows crypto traders to go long and short digital assets on margin. Currently, traders can trade ETH using the stablecoins DAI or USDC with up to 5x leverage. Additionally, it allows users to borrow and lend crypto. Lenders can earn up to 5.10%, while borrowers can pay as little as 0.51% interest p.a. (depending on the asset). More than $19.4 million of Ethereum-based tokens are currently locked in the dYdX protocol.

Why is dYdX included in the list of top DeFi projects?

As a pure trading platform, dYdX is quite limited, but as a completely open and non-custodial financial protocol, it is one of the most advanced. It is a trustless trading service with minimum counterparty risk. It is non-custodial, so the user keeps control of the assets. The platform offers instant access without logging in. It uses the Ethereum Blockchain for smart contracts and security.

Its features are currently limited to basic trading between three simple assets (ETH, DAI and USDC), lending assets to collect interest, and two types of margin trading: isolated margin trading and cross margin trading. While these are simple tools for the veteran trader, they are a huge leap forward for the fledgling DeFi ecosystem.

Unlike margin trading, lending on dYdX is considered low risk and passive. With dYdX, lenders automatically earn interest every time a new block is mined. Any funds deposited on the platform will continuously earn interest at each block and can be withdrawn at any time with no minimum requirements. Because all loans are guaranteed and face the threat of liquidation, the borrower will always be repaid.

5. Uniswap

Uniswap is a decentralized exchange protocol that allows users to exchange Ethereum-based ERC20 tokens in a private, secure and non-supervisory manner via an extremely easy-to- user interface to use. Instead of using order books, Uniswap makes use of so-called liquidity pools that help boost the protocol’s exchange liquidity.

Why do we think Uniswap is one of the top DeFi projects this year?

Uniswap is one of the driving forces behind the current DeFi bull run. Acting as a fully decentralized exchange, Uniswap differs from other DEXs because it uses incentivized liquidity pools instead of order books. Users who decide to provide liquidity are rewarded with a percentage of the fees incurred on each Ethereum-powered transaction.

Currently, Uniswap has more than $100 million locked up in liquidity pools and hundreds of new listings per week. For novice cryptocurrency users, there is a learning curve to using Uniswap, as it operates from external ERC-20 wallets that are connected and used to trade assets and provide liquidity. There are also considerations around slippage and volatility that need to be studied before using Uniswap.

Uniswap is going places, and the project’s statistics are the proof. On August 10, 2020, Uniswap powered $250 million in daily trading volume, making it the protocol to beat right now in Ethereum’s booming DEX scene. Uniswap’s great trading UI and cryptonative earning opportunities combined with the protocol’s proven track record make it one of the top DeFi projects. As such, it is well poised to be a dominant project for years to come.

Closure

DeFi is believed to be the future of the financial services industry; however, there is still a long way to go. Freedom from the monetary control of centralized institutions is the ultimate vision of this movement. In the long term, the institutions and FinTech innovators need to work together to efficiently build on traditional markets while leveraging the innovations in DeFi.

Without a doubt, there are a host of promising and exciting DeFi projects out there that will gradually grab the spotlight they deserve, but for now, we believe the above five are likely to stand out from the rest and have enormous potential.

{no_ads}

Disclaimer: The text above is an advertorial article that is not part of Cryptonews.com editorial content.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news