In this comprehensive analysis, we delve into Polkadot’s recent price rally, driven by both technical and on-chain indicators

Penetrating the daily Ichimoku cloud could indicate a continued price appreciation towards $8.

Polkadot Technical Outlook: Understandingthe boom

Polkadot (DOT) broke above the 4-hour Ichimoku cloud. Returning to the cloud in the 4-hour time frame could indicate a trend reversal. On the daily time frame, the price of Polkadot is approaching the lower boundary of the Ichimoku cloud.

Polkadot On-Chain Data: A Deep Dive

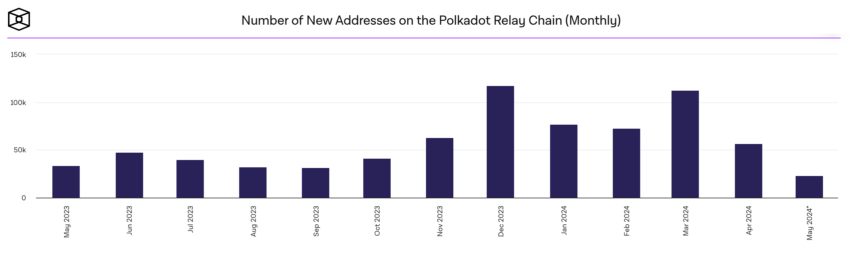

The graph illustrates that the number of new addresses on the Polkadot relay has experienced two consecutive monthly declines. This trend is a bearish indicator. Polkadot is currently struggling to attract new entrants to the network.

A sustained reduction in the number of new addresses may affect the overall health and expansion of the Polkadot ecosystem.

Read more: What is Polkadot (DOT)?

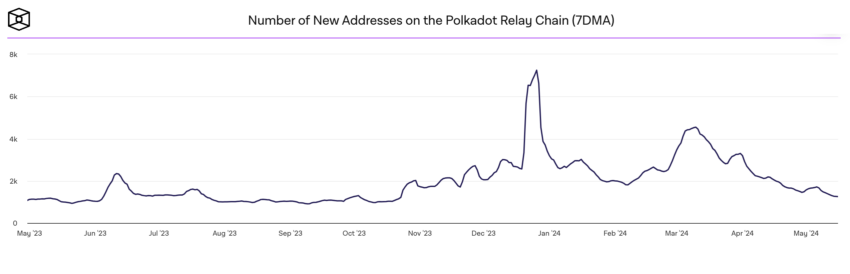

Active addresses are a key indicator of user engagement and network health. In the context of Polkadot, this decrease can mean several things:

First, it may indicate that existing users are less active, possibly due to a lack of compelling projects, updates or incentives to maintain engagement. Second, it could reflect broader market trends affecting the entire cryptocurrency space, where users are becoming more cautious or shifting their focus to other platforms. Third, a decline in active addresses on a blockchain focused on interoperability may imply challenges in maintaining its unique value proposition compared to other Layer 0 or Layer 1 solutions.

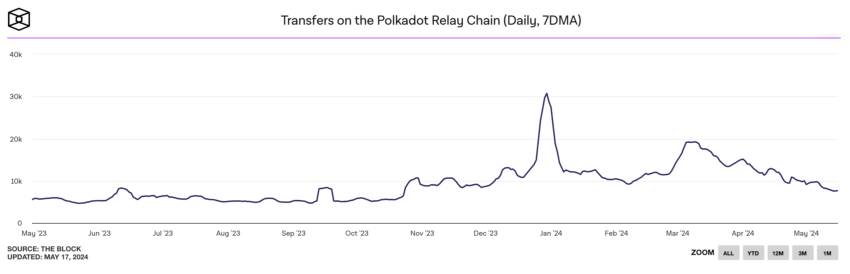

The chart below illustrates the 7-day moving average (7DMA) of daily transfers on the Polkadot Relay Chain. This highlights a significant downward trend. After a peak in January 2024, where daily transfers reached almost 40,000, the number of transfers gradually decreased.

This decrease in transfer volume could have several implications for Polkadot’s price. Reduced transfer activity often correlates with lower overall network usage and reduced demand for the native DOT token (in the mid-term).

Strategic recommendations and future price implications

Neutral outlook

Polkadot (DOT) showed an uptrend, breaking the 4-hour Ichimoku cloud to the upside. This technical pattern indicates potential bullish momentum. Traders should be cautious, however, as a pullback to the cloud in the 4-hour time frame could signal a trend reversal. The recent upward trend in Polkadot’s price is strongly influenced by the broader market movements, especially the rise in Bitcoin’s price. In addition, speculative activity around Polkadot’s derivative contracts on centralized exchanges contributed to the price increase. While the technical indicators point to bullish momentum, the on-chain data highlights potential risks. The decline in new and active addresses and reduced transfer volumes indicate a decline in user engagement and network activity.

Read more: Polkadot (DOT) Price Prediction 2024/2025/2030

Access points and risk management

Traders should consider entering long positions on Polkadot if it successfully penetrates the 4H Ichimoku cloud to the downside, with a move to $8. However, monitoring Bitcoin’s price movements is crucial, as a test of the $61K level by Bitcoin could lead to a sharp correction in DOT’s price. Although the probability of such a correction has decreased, it remains a risk, especially in the case of macroeconomic or geopolitical factors. In the mid- to long-term, traders should use risk management strategies, including setting stop-loss orders below key support levels (6 – $6.4) to mitigate potential losses.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news