Today’s on-chain analysis by BeInCrypto looks at three indicators that are currently at key support levels. Their holding could be a strong signal of Bitcoin (BTC) hitting a bottom, recovery and ending the downtrend.

Dormancy flows

The Entity-adjusted dormancy flow is the ratio of current market capitalization and annualized dormancy. It is expressed in USD. The indicator can be used to try to determine the bottom of the BTC price when it enters the green area below $250,000.

The current value of the Entity Adjusted Dormancy Flow has just entered the green area and is at $242,000 today. Apart from the present time, this area has only been reached twice during the last 2 years (green circles).

In both historical cases, this coincided with a macro bottom in the BTC price. The first time Bitcoin reached the $4,000 area was during the COVID-19 crash in March 2020. The second time Bitcoin reached a low of $29,000 in July 2021 and a 55% correction from the high of all times completed in April 2021.

Today Bitcoin is at the $42,000 level and Dormancy Flow is giving the same signal. If the level is defended and the indicator bounces off the green area, a violent continuation of the BTC price rise is possible. This is what happened in the two previous cases.

Reserve Risk

The Reserve Risk Indicator is defined as the price / HODL Bank. It is used to determine the confidence of long-term hodlers in relation to the price of Bitcoin at any given time. When confidence is high and the price is low, there is an attractive risk/reward ratio for the investment (reserve risk is low). When confidence is low and the price is high, the risk/reward ratio is unattractive (reserve risk is high).

The current Reserve Risk value reaches – similar to the Dormancy Flow – the upper part of the green area, with a value of 0.0027. This has historically marked good areas to buy Bitcoin where the risk/reward ratio has been favorable.

Interestingly, these values served as support during the 2012-2013 bull market (green ellipse). A pullback at this level was a signal for subsequent parabolic increases in the BTC price.

However, there is also another interpretation of this chart that depicts a decidedly bearish scenario. Well, in the previous two cycles, Reserve Risk respected the rising support line (red). At that time, Bitcoin reached peaks without breaching this line. When support was lost (red circles), it was a signal for a bear market.

It appears that such a support line was also in place for this cycle and was already broken early in December 2021. If we interpret this event similarly to the previous two cycles, Bitcoin has already entered a bear market.

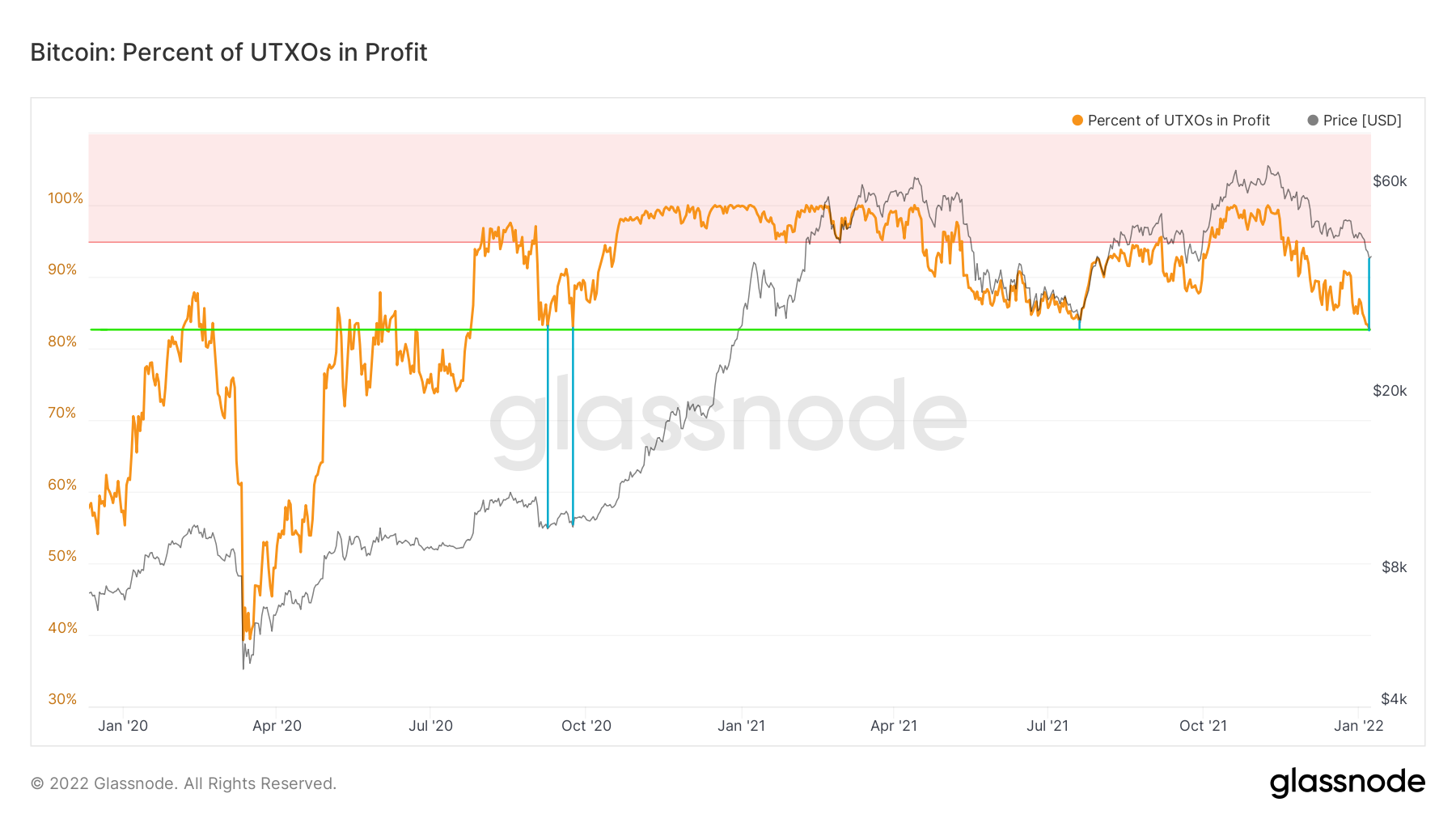

UTXOs in profit

The final indicator for today’s on-chain analysis is UTXOs in Wins. It indicates the percentage of unspent transaction output whose price at the time of creation was lower than the current price. In other words, it is one of the indicators that let you tell what percentage of BTC holders are in profit.

As with the two indicators described above, UTXOs in Profit are also at a critical point today, pointing to the 83% area (green line). This level served as support during the BTC price correction in September-October 2020, just before the parabolic rally. Bitcoin was then in the $10,000 area.

In the second case, this support held at the end of July 2021, after the aforementioned correction of the ATH in April 2021. At that time, the Bitcoin price dropped to $29,000.

Today the indicator is in a similar area. Its holding could be another signal that the $40,000 – $42,000 area will serve as BTC’s next macro bottom before the upside continues.

Click here for BeInCrypto’s latest Bitcoin (BTC) analysis.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news