Bitcoin price ended the month of October with a higher high on the close of the candle, a feat that has historically always led to a renewed bull run and additional all-time highs.

Along with November’s monthly opener, here are ten bullish Bitcoin price charts that suggest bullish continuation is ahead — but also warn that the eventual end of the market cycle is also near.

Ten Bullish Monthly Bitcoin Price Charts

The leading cryptocurrency by market capitalization made a higher high on the highest time frames – a clear sign that the trend is not over yet. By pure definition, an uptrend is a series of higher highs and higher lows. The two boxes have been checked by Bitcoin, and it’s time for the market to react.

Below you will find ten monthly Bitcoin price charts and the bullish factors they display. For all the bullish technicals, there are two important things to note. When the move forward seems so obvious and the crowd expects it to happen, the market often does the opposite. Also, such overheated monthly technical indicators – as bullish as they may be – indicate that the end is near as well.

Relative Strength Index (RSI)

The relative strength index measures the strength of an asset’s underlying price action and can tell analysts when an asset is overbought or oversold. A reading below 30 indicates oversold conditions – something that has never happened on monthly time frames when the first cryptocurrency is traded.

Above 70 usually indicates that an asset is overbought and that it is time to sell. But on monthly timeframes in Bitcoin, it has only indicated in the past when FOMO is at its highest, and buying is in a frenzy. There is no telling when the top may form based on the monthly, only that a high is near and will happen closer to the previous RSI top set in April this year.

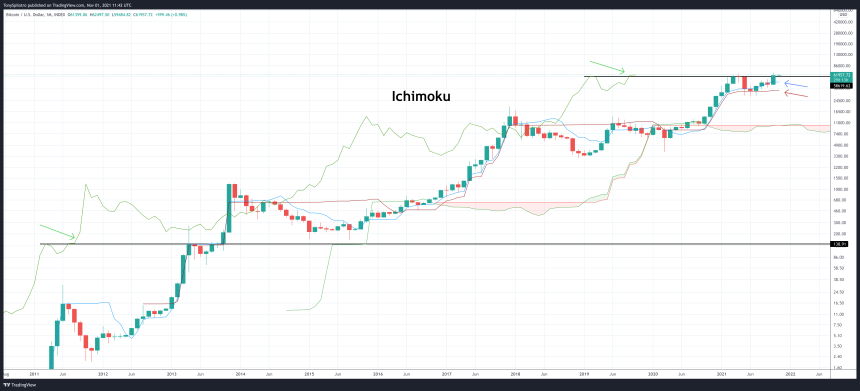

Ichimoku

The Ichimoku can be a confusing tool to look at if you don’t know how to read it. But in the right hands (or with the right set of eyes), the instrument gives the clearest signals of all. Notice how the trailing span, projected backwards behind price in green – used to highlight support and resistance – sets a higher high similar to the 2013 mid-cycle peak. The 2013 final or the 2017 cycle stop did not.

Bitcoin price is also above both the reversal line and the baseline, which in itself is a bullish signal. These lines are also crossed bullishly, and the cloud has a small bullish twist suggesting a short pulse of bullish momentum ahead.

Parabolic SAR

Before we get into more complex signals and technical indicators, we’ll make a quick stop (pun intended) at the Parabolic SAR, created by J. Welles Wilder, one of the pioneers of technical analysis.

Related Reading | Bitcoin Price Prepares To Blow Back To RSI “Bull Zone”

SAR stands for “stop and reverse” and it tells an analyst when a trend has done so. Note that at the mid-cycle peak in both 2013 and 2021, the rally then resumed after just four months of downtrend according to the Parabolic SAR.

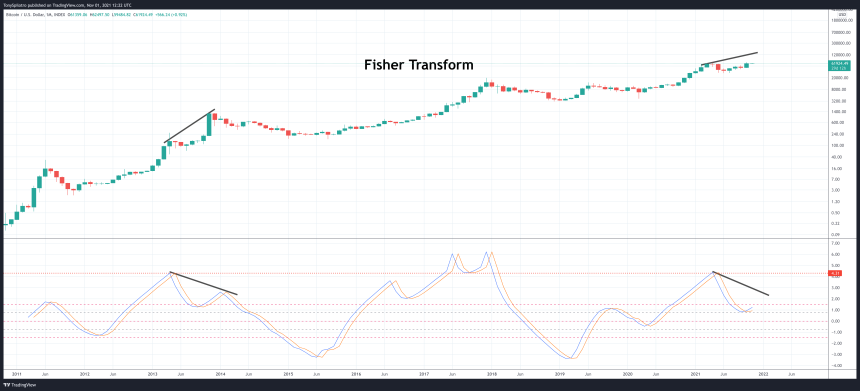

Fisher Transform

The Fisher Transform is a tool that normalizes price movements to filter out noise and make reversal points or price extremes easier to spot, based on standard deviations.

The Fisher Transform is a tool that normalizes price movements to filter out noise and make reversal points or price extremes easier to spot, based on standard deviations.

The mid-cycle pullback in Bitcoin price coincidentally reached the same standard deviation as the 2013 bull cycle, a level that also briefly held as support in 2017. A bearish divergence with a lower high on the indicator while price pushes higher would be a signal that the bear market is here.

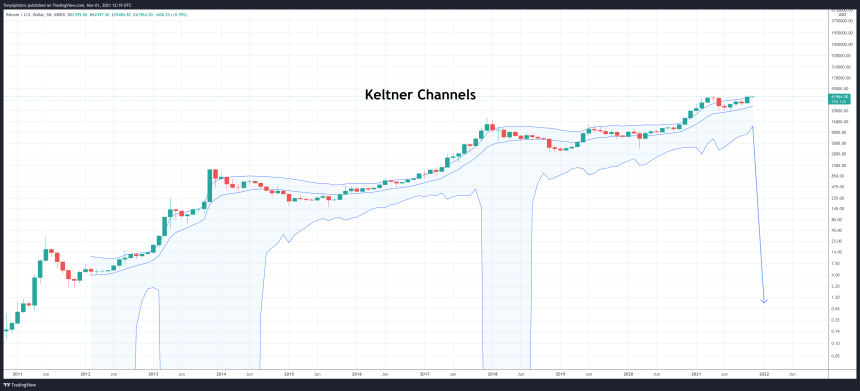

Keltner channel

No, it’s not the Bollinger Bands, but the Keltner Channel is another volatility tool designed to help spot trends and reversals, according to Investopedia.

The biggest factor that suggests that a climax of the cycle is on its way is the lack of the lower band dropping out as it has in previous cycles when they have reached a conclusion. The market has not seen anything in terms of volatility this cycle.

Super Guppy

This ribbon made of exponential moving averages (EMAs) makes it very clear when an asset is trending. On the monthly time frame, this was about the only direction the cryptocurrency has ever known.

However, there is no compression of the ribbon as shown by previous bearish phases, and Bitcoin price closed a monthly candle above all the EMAs indicating that a strong trend is forming.

Williams Alligator

The Williams Alligator was created by early market psychology pioneer Bill Williams. It consists of three smooth moving averages based on the Fibonacci sequence: 5, 8, 13. The three averages are called the instrument’s jaw, teeth and lips.

The instrument currently shows that the Alligator is entering the trend, with the moving averages diverging and moving upwards – a clear sign of continuation.

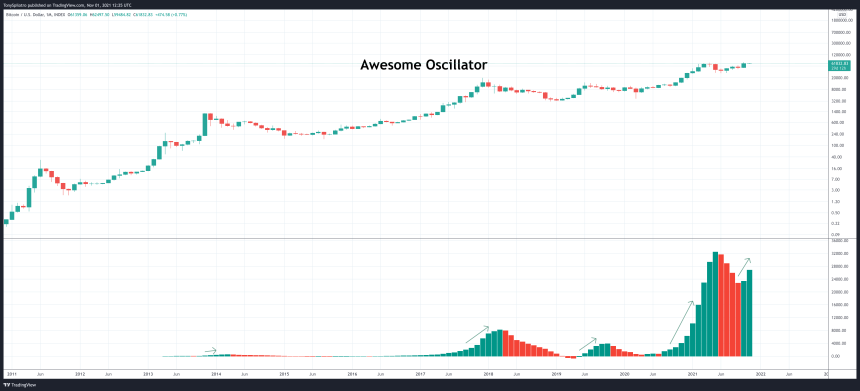

Awesome oscillator

The Awesome Oscillator is great because it gives simple signals. According to MoneyControl, the momentum measurement tool can help confirm trends and prevent market swings.

The histogram adding two green ticks as the price moves up is a sign that the cycle is probably not over, and is about to get a lot more awesome.

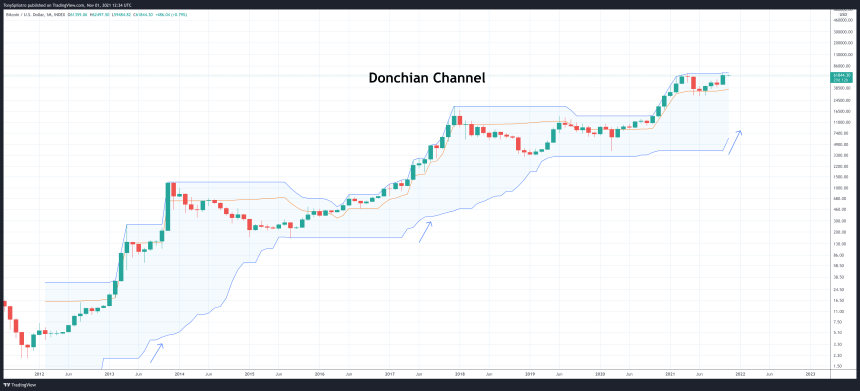

Donchian channel

Another Bollinger Band looks, but this one works very differently. The Donchian channel is based on Bitcoin’s average true range, and is depicted by the lower and upper bands. The center line is the market median, or what is probably a fair price for the cryptocurrency.

Passing above or below the media indicates the direction of the trend, which is still moving. Further confirming this is the fact that the upper and lower bands are starting to move up, showing that the Average True Range of Bitcoin is forever moving away from low prices established at the bottom of the bear market.

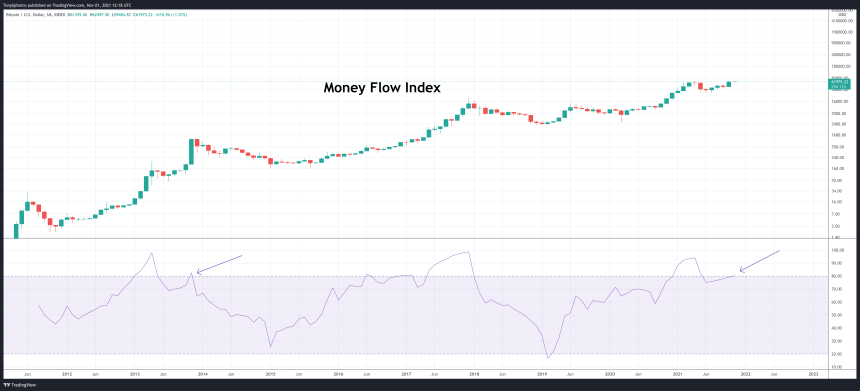

Money Flow Index (MFI)

The Money Flow Index indicates when an asset is overbought or oversold similar to the RSI, but also takes into account volume data.

Adding volume makes it easier to find divergences. Compared to the RSI at the top of the article, the second top of the 2013 double top on the indicator has been significantly truncated on the MFI. The short, sharp spike had an impact during the 2013 finale, and may indicate that there is not much time left in the current bull cycle.

Related Reading | Want to learn how to read Bitcoin price charts? click here

(Cycle) Conclusion

There are a lot of bullish signals in Bitcoin price action right now on the higher time frames. Elliott Wave Theory also provided the roadmap for a potential wave 5 situation. However, the macro situation is bleak, and the cryptocurrency asset class remains speculative and extremely sensitive to things like regulation or Black Swan events.

There is also no telling where the music stops. Bitcoin price could fall short of expectations of $100,000 or higher, triggering a sharper selloff and more severe bear market. The cryptocurrency could blow way past that barrier and more. What is guaranteed is that what goes up must come down, and after the bull cycle parabola has completely broken down, the leading cryptocurrency by market cap is likely looking at a roughly 80% drop to the bottom.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, charts from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news