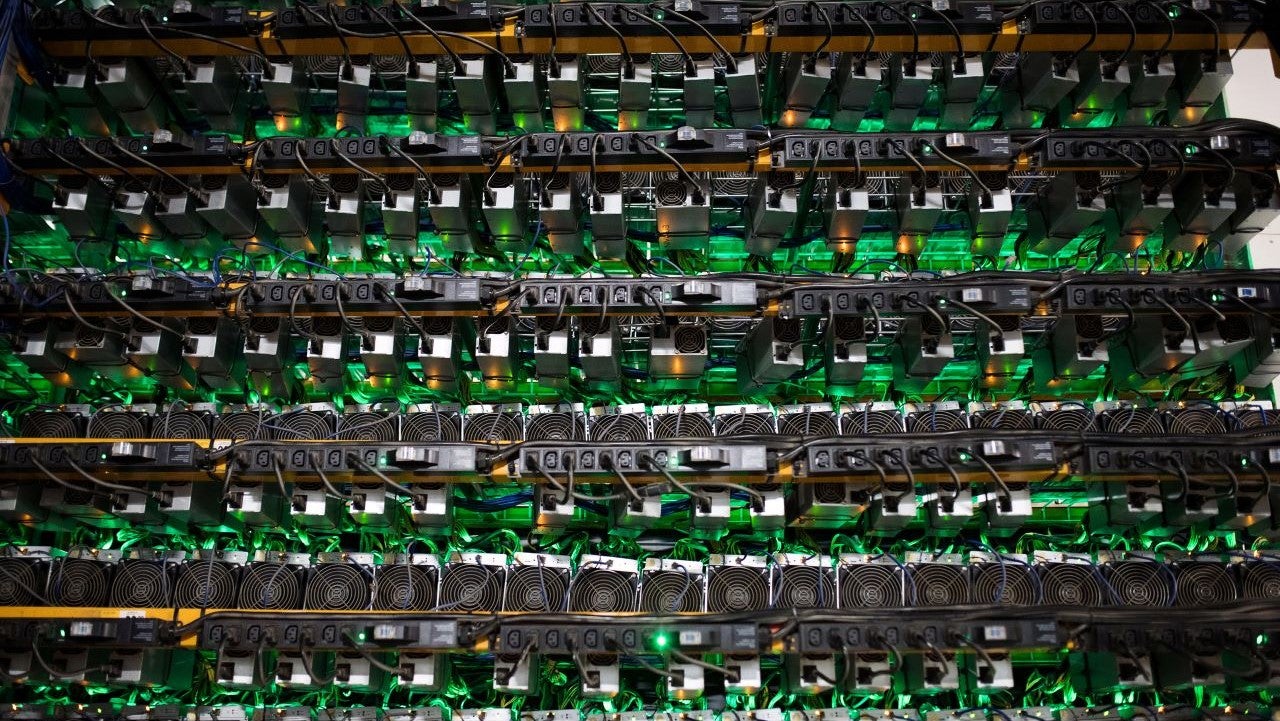

Bloomberg Creative Photos/Getty Images

Bitcoin mining is the process of creating new bitcoins by solving extremely complicated math problems that verify transactions in the currency. When a bitcoin is successfully mined, the miner receives a predetermined amount of bitcoin.

Bitcoin is a cryptocurrency that has gained a wide following due to its wild price fluctuations and rising value since it was first created in 2009.

As prices of cryptocurrencies and especially Bitcoin have skyrocketed in recent years, it is understandable that interest in mining has also increased. But for most people, the outlook for Bitcoin mining is not good due to its complex nature and high cost. Here are the basics on how Bitcoin mining works and some key risks to be aware of.

The Basics of Bitcoin, Explained

Bitcoin is one of the most popular types of cryptocurrencies, which are digital means of exchange that exist only online. Bitcoin runs on a decentralized computer network or distributed ledger that tracks transactions in the cryptocurrency. When computers on the network verify and process transactions, new bitcoins are created, or mined. These network computers, or miners, process the transaction in exchange for a payment in Bitcoin.

Bitcoin is powered by blockchain, which is the technology that powers many cryptocurrencies. A blockchain is a decentralized ledger of all the transactions across a network. Groups of approved transactions together form a block and are joined together to create a chain. Think of it as a long public record that functions almost like a long-running receipt. Bitcoin mining is the process of adding a block to the chain.

How Bitcoin Mining Works

To successfully add a block, Bitcoin miners compete to solve extremely complex math problems that require the use of expensive computers and enormous amounts of electricity. To complete the mining process, miners must be the first to arrive at the correct or closest answer to the question. The process of guessing the correct number (hash) is known as proof of work. Miners guess the target hash by randomly making as many guesses as fast as they can, which requires huge computing power. The difficulty only increases as more miners join the network.

The computer hardware required is known as application-specific integrated circuits, or ASICs, and can cost up to $10,000. ASICs consume large amounts of electricity, which has drawn criticism from environmental groups and limits the profitability of miners.

If a miner can successfully add a block to the blockchain, they will receive 3,125 bitcoins as a reward. The reward amount is cut in half approximately every four years, or every 210,000 blocks. As of April 2024, Bitcoin was trading at around $63,000, making 3,125 bitcoins worth $196,875.

Is Bitcoin Mining Profitable?

It depends. Even if Bitcoin miners are successful, it is not clear that their efforts will be profitable due to the high upfront cost of equipment and the ongoing electricity costs. The electricity for one ASIC can use the same amount of electricity as half a million PlayStation 3 devices, according to a 2019 report from the Congressional Research Service.

As the difficulty and complexity of Bitcoin mining has increased, so has the computing power required. Bitcoin mining consumes about 176 terawatt-hours of electricity each year, more than most countries, according to the Cambridge Bitcoin Electricity Consumption Index. You would need 9 years of electricity from the typical American household to mine just one bitcoin as of August 2021.

Source: Cambridge Bitcoin Electricity Consumption Index

One way to share some of the high cost of mining is by joining a mining pool. Pools allow miners to share resources and add more capacity, but shared resources mean shared rewards, so the potential payout is less when working through a pool. The volatility of Bitcoin’s price also makes it difficult to know exactly what you’re working for.

How to start Bitcoin mining

Here are the basics you need to start mining Bitcoin:

Wallet. This is where any Bitcoin you earn as a result of your mining efforts will be stored. A wallet is an encrypted online account that allows you to store, transfer and accept Bitcoin or other cryptocurrencies. Companies like Coinbase, Trezor, and Exodus all offer wallet options for cryptocurrency. Mining software. There are a number of different providers of mining software, many of which are free to download and can run on Windows and Mac computers. Once the software is connected to the necessary hardware, you will be able to mine Bitcoin. Computer equipment. The most cost-prohibitive aspect of Bitcoin mining involves the hardware. You need a powerful computer that uses an enormous amount of electricity to successfully mine Bitcoin. It is not unusual for the hardware cost to be around $10,000 or more.

Risks of Bitcoin Mining

Price volatility. Bitcoin’s price has fluctuated greatly since it was launched in 2009. Since just November 2021, Bitcoin has traded for less than $20,000 and more than $73,000. This kind of volatility makes it difficult for miners to know if their reward will exceed the high cost of mining. Regulation. Very few governments have embraced cryptocurrencies like Bitcoin, and many are more likely to view them with skepticism because the currencies operate outside of government control. There is always the risk that governments may completely ban Bitcoin or cryptocurrency mining as China did in 2021, citing financial risks and increased speculative trading.

Taxes on Bitcoin Mining

It is important to remember the impact that taxes can have on Bitcoin mining. The IRS has been looking to crack down on owners and traders of cryptocurrencies as asset prices have soared over the past year. Here are the main tax considerations to keep in mind for Bitcoin mining.

Are you a business? If Bitcoin mining is your business, you may be able to deduct expenses you incur for tax purposes. Income will be the value of the bitcoins you earn. But if mining is a hobby for you, it’s not likely that you’ll be able to deduct expenses. Mined bitcoin is income. If you are successfully able to mine Bitcoin or other cryptocurrencies, the fair market value of the currencies at the time of receipt will be taxed at ordinary income rates. Capital gains tax. If you sell bitcoins at a price above where you received them, it qualifies as a capital gain, which will be taxed in the same way as for traditional assets such as stocks or bonds.

Check out Bankrate’s cryptocurrency tax guide to learn about basic tax rules for Bitcoin, Ethereum and more.

Bitcoin mining statistics

A miner currently earns 3,125 Bitcoin (about $196,875 as of April 2024) for successfully validating a new block on the Bitcoin blockchain. Creating Bitcoin consumes 176 terawatt-hours of electricity each year, more than is used by the Netherlands or the Philippines, according to the Cambridge Bitcoin Electricity Consumption Index. It will take nine years of household-equivalent electricity to mine a single bitcoin as of August 2021. The price of Bitcoin has been extremely volatile over time. In 2020, it traded as low as $4,107 and reached a high of $73,750 in March 2024. As of April 2024, it was trading for around $63,000. Although it depends on your computing power and that of other miners, the odds of a modestly powered solo miner solving a Bitcoin hash in January 2023 were about 1 in 26.9 million. The United States (37.8 percent), China (21.1 percent) and Kazakhstan (13.2 percent) were the largest bitcoin miners as of January 2022, according to the Cambridge Electricity Consumption Index.

Bottom line

While Bitcoin mining sounds enticing, the reality is that it is difficult and expensive to actually do profitably. The extreme volatility of Bitcoin’s price adds more uncertainty to the equation.

Keep in mind that Bitcoin itself is a speculative asset with no intrinsic value, meaning it will not produce anything for its owner and is not tied to anything like gold. Your return is based on selling it to someone else for a higher price, and that price may not be high enough for you to make a profit.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news