Taking into account the Pi Cycle Top Indicator, the ETH price analysis suggests that Ethereum could see more corrections before trying to reach the $4,000 mark again. Moreover, the net unrealized profit/loss (NUPL) indicates that it is still far from the euphoria zone, indicating a possible period of consolidation in the near future.

Furthermore, the exponential moving average (EMA) lines show prices converging now, suggesting that there is strong support at the current levels, which could stabilize ETH prices before any significant upward movement.

Ethereum Pi cycle shows an important scenario

ETH trajectory on the Pi Cycle Top Indicator indicates a brewing consolidation phase, as evidenced by the gap between the 111-day moving average and the 350-day moving average times two.

Currently, the indicator’s upper limit is set near $4,231, while the lower limit rests around $2,750, a spread that allows for a respite indicating market stabilization rather than a peak. It is within this bandwidth that the ETH price can form a foundation for its next rise.

Pi Cycle Top Indicator works on the principle that when the price exceeds the longer-term average (350 days multiplied by 2), a market top may be imminent, suggesting an overheated market ready for a downturn. When it is below the short-term average, it may indicate that the asset is undervalued.

ETH price between these averages and the parallel trajectory of the lines without a crossover event imply that although the heights of market euphoria are yet to be reached, the foundation is being laid for a robust support level. This lack of convergence, combined with the current price activity, lends weight to the argument that ETH may be entering a consolidation phase.

Read more: Ethereum ETF Explained: What it is and how it works

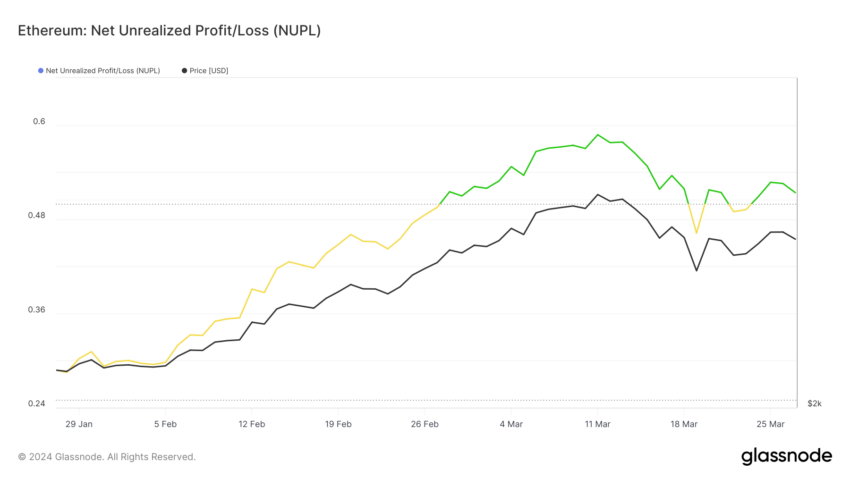

ETH is still far from euphoria

ETH Net Unrealized Profit/Loss (NUPL) has consistently fluctuated between “Optimism – Anxiety” and “Faith – Denial,” a pattern indicative of the market’s indecision. Such a rhythmic shift between sentiment zones suggests that investors are alternating between cautious optimism and a stronger belief in the asset’s potential, but without fully committing to an overarching trend. This back and forth movement, or ‘going and coming’, implies a potential consolidation phase for Ethereum.

The NUPL’s mandate remains in “Belief — Denial” to prevent market overheating. The sentiment suggests that a market is stabilizing, avoiding large sell-offs or sell-offs.

This sentiment balance could prepare ETH’s price for steady climb. Without strong greed or fear, a gradual rise is more likely than erratic swings.

ETH Price Forecast: Consolidation Before New Surges

ETH exponential moving average (EMA) lines on the 4-hour price chart provide valuable insight into the asset’s price action. The EMA lines follow closely together, indicating that there is little volatility and the price is experiencing a consolidation phase.

EMAs are a type of moving average that gives more weight to recent prices, making them more responsive to new information. When EMA lines converge, as they do on the chart below, it often means that a strong trend is not in place, and prices can move sideways for some time.

The price of ETH moves around these lines, representing an equilibrium between buyers and sellers. If an uptrend is to begin, a decisive break above these intertwined EMA lines could propel ETH’s price towards the $4,100 resistance level. An emerging ETH ETF could help this uptrend appear.

Read more: Ethereum recycling: what is it and how does it work?

If the consolidation phase turns bearish, ETH could drop to $3,200 support. A deeper slide to $2,900 is possible under broader negative sentiment. Currently, clustered EMA lines indicate continuous range-bound trading for Ethereum. Any decisive move out of this band is likely to define its next major price trend.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news