[ad_1]

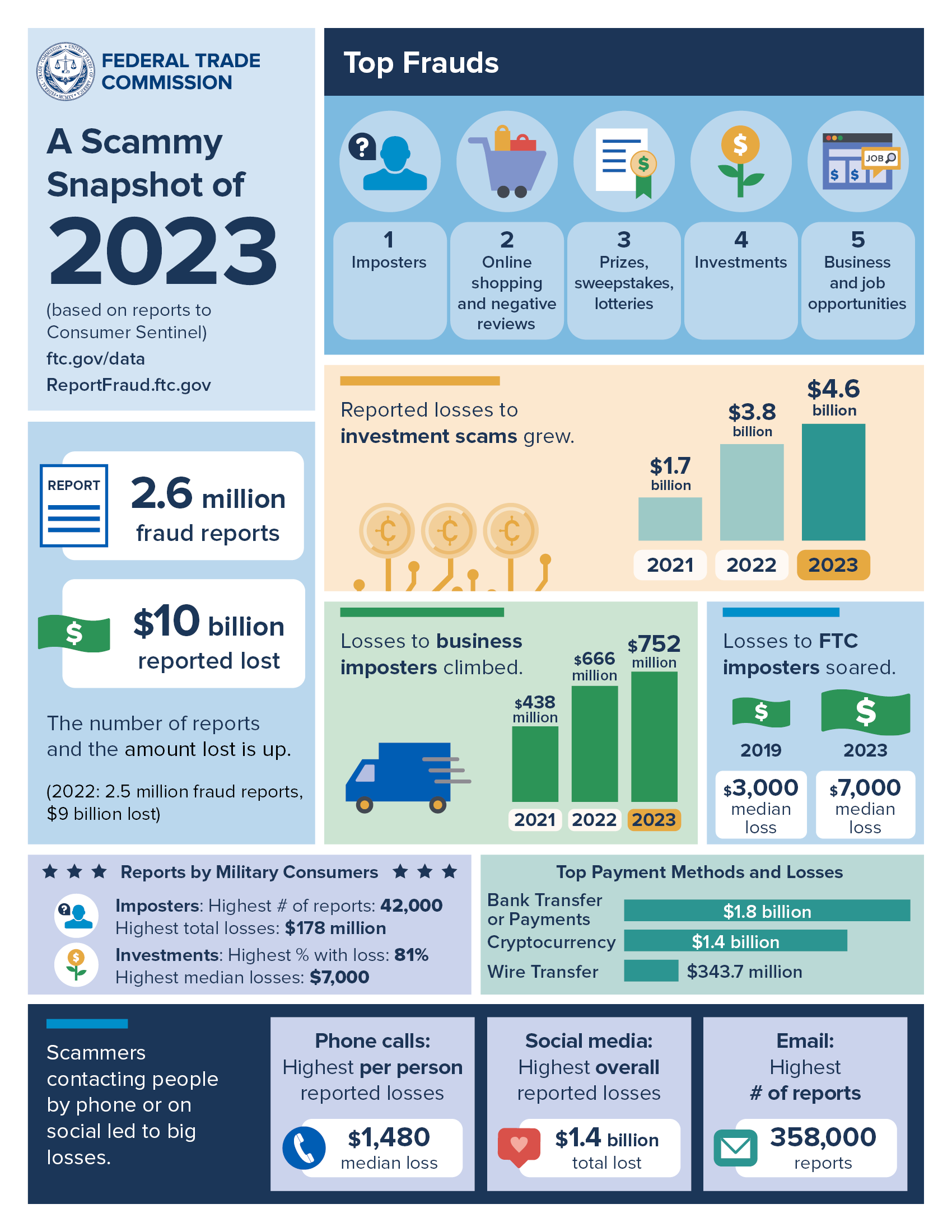

Newly released data from the Federal Trade Commission shows that consumers lost more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached that benchmark. This represents a 14% increase over reported losses in 2022.

Consumers reported losing more money to investment scams—more than $4.6 billion—than any other category in 2023. That amount represents a 21% increase over 2022. The second highest reported loss amount came from fraudsters scams, with losses of nearly $2.7 billion reported. In 2023, consumers reported losing more money to wire transfers and cryptocurrencies than all other methods combined.

“Digital tools are making it easier than ever to target hard-working Americans, and we’re seeing the effects of that in the data we’re releasing today,” said Samuel Levine, director of the FTC’s Bureau of Consumer Protection. “The FTC is working hard to crack down on those scams.”

The FTC received fraud reports from 2.6 million consumers last year, nearly the same amount as in 2022. The most commonly reported scam category was phishing scams, which saw significant increases in reports from both business and government impersonators.

Online shopping issues were the second most commonly reported in the fraud category, followed by prizes, sweepstakes and lotteries; investment related reports; and business and employment scams.

Another first is the method scammers are said to be using to reach consumers the most in 2023: email. Email is displacing text messages, which took the top spot in 2022 after decades of phone calls being the most common. Phone calls are the second most common contact method for fraud in 2023, followed by text messages.

The Commission is closely monitoring these trends and is taking a comprehensive approach to detect, stop and deter consumer fraud, including in 2023 alone:

Lead the Largest-ever Crackdown on Illegal Telemarketing: The FTC joined more than 100 federal and state law enforcement partners nationwide, including the attorneys general of all 50 states and the District of Columbia in Operation Stop Scam Calls, a crackdown on illegal telemarketing calls involving are more than 180 actions targeting operations responsible for billions of calls to American consumers. Proposes Impersonation Fraud Ban: The FTC is in the final stages of a rulemaking process targeting business and government impersonation scams. multiple cases against investment and business opportunity schemes, including Wealthpress, Blueprint to Wealth, Traffic and Funnels, Automaters and Ganadores. Confront emerging forms of fraud: The FTC has taken steps to listen to consumers and build knowledge and tools to fight emerging fraud. For example, the FTC announced a challenge in 2023 to help advance the development of ideas to protect consumers from the misuse of artificial intelligence-enabled voice cloning for fraud and other harm. the CAN-SPAM Act to curb illegal conduct, including in cases against Publishers Clearing House and Experian. Reaching Every Community: The FTC has expanded its ability to hear directly from consumers in multiple languages through the Consumer Sentinel Network.

The FTC’s Consumer Sentinel Network is a database that receives reports directly from consumers, as well as from federal, state and local law enforcement agencies, the Better Business Bureau, industry members and non-profit organizations. More than 20 states contribute data to Sentinel.

Sentinel received 5.4 million reports in 2023; this includes the fraud reports outlined above, as well as identity theft reports and complaints related to other consumer issues, such as problems with credit bureaus and banks and lenders. In 2023, there were more than 1 million reports of identity theft received by the FTC’s IdentityTheft.gov website.

The FTC uses the reports it receives through the Sentinel Network as the starting point for many of its law enforcement investigations, and the agency also shares these reports with approximately 2,800 federal, state, local and international law enforcement personnel. While the FTC does not intervene in individual complaints, Sentinel reports are an important part of the agency’s law enforcement mission and also help the FTC alert consumers and identify fraud trends it sees in the data.

A complete breakdown of reports received in 2023 is now available on the FTC’s data analysis website at ftc.gov/exploredata. The data dashboards there break down the reports across a number of categories, including by state and metropolitan area, and also provide data from a number of subcategories of fraud reports.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news