Posted Jun 6, 2024 at 6:45 am EST.

Investing in cryptocurrencies can often seem like a gamble, given their extreme volatility and how unforeseen events, such as a viral moment on X (Twitter), can move prices in different directions. On these occasions, especially amid the sudden rise of memecoins, this market may appear to have little or no fundamentals to those unfamiliar with it. But due to the public nature of blockchains, which host these coins and tokens, a multitude of insights about these assets can be gathered and used by investors.

“Onchain data is like understanding the physical supply and demand of an asset,” Philip Gradwell, chief economist at blockchain data firm Chainalysis, told Unchained in an email. “If you traded natural gas, you would want to know how much gas is being produced from wells, how much is in storage and how many households and factories are using it.”

Here are the top four statistics every crypto investor should know, according to experts.

Metric 1: Distribution and Balances of Whale Holdings

Understanding who the largest holders of a particular cryptocurrency are — a group commonly referred to as “whales” — can be essential to understanding the asset itself.

One of the best ways to investigate whaling activity is to look at “top container balances and distribution,” which blockchain analytics firm Nansen lists as a key onchain metric to track in its 2023 onchain data report.

For investors who want to decipher the “whales” of a particular token, they can rely on blockchain data platforms such as Nansen. On Nansen, users can use “token god mode” and the balance tab to sort wallet addresses by percentage of ownership, the balance of the asset held and other relevant factors.

Users can also use blockchain explorers such as Etherscan and Block chairwhich typically lists the top addresses for that respective network’s native token.

Identifying whales can help assess the quality of a project; if the addresses with the largest amounts of a certain crypto are associated with reliable investors or entities, this can be a good sign for those interested in the asset, according to Nansen’s report.

Looking at how concentrated the asset is in the hands of whales is also important. If a token’s supply is mostly held by just a few, it puts the asset at risk of price manipulation.

An analysis of token concentration can be especially valuable when looking at “low float” coins, which have a small amount of tokens available for trading. The greater the share of these cryptocurrencies owned by whales, the greater the ability to manipulate the price. It can also be important for investors who are “short-term trading in assets with little liquidity,” Gradwell said.

“If a whale sends a lot of assets to an exchange or liquidity pool, then expect the price to drop as they can sell an amount that will overwhelm the market,” he added.

Learn more: What is Tokenomics? A Beginner’s Guide

Metric 2: Daily active addresses

One of the most important onchain metrics for investors is tracking the activity of blockchain users and what they’re paying for, says Thomas Dunleavy, partner at crypto investment firm MV Capital. He believes the best way to do this is by looking at the daily active addresses get involved in a project or blockchain.

Daily active addresses, meaning unique addresses that send or receive a particular crypto within 24 hours, can be used to conduct fundamental analysis of cryptocurrency projects by measuring the growth of user activity, analysts said in Nansen’s report, and can in turn specifically helps investors understand the growth of user activity for a specific digital asset.

Another common metric used for this type of analysis is the number of trades, but this is not a good method because they can often be faked, Dunleavy said, adding that automated trades generated by bots and algorithmic trading tools made, can make it difficult to determine actual interactions.

Number of addresses should also be taken with a pinch of salt, Chainalysis economist Gradwell said.

“To identify bots, you have to look at behavior: does this address hold assets for a short time, does it make transfers really fast, how many counterparties does it have, how much does it pay in fees, are those fees paid in an illiquid asset, so maybe it doesn’t actually cost as many dollars as you think?” he said.

Advanced tools like Chain analysis and Elliptical can be used to gain insights into patterns and behavior of transactions. In addition blockchain explorer Etherscan offers advanced filters when browsing wallets such as high transaction speed, large fees and numerous counterparties.

Metric 3: MEV (Maximum Extractable Value)

MEV has become a hot topic in crypto, with some describing it as a major threat to the Ethereum blockchain. MEV is a practice in crypto where validators reorder transactions to maximize profit, through methods such as forward running and arbitrage, which can sometimes lead to higher fees for the end user. MEV practices have become popular and as a result data from these types of transactions can play to the benefit of investors.

Learn more: What is MEV in Crypto?

The amount of MEV present on a blockchain can be an indicator of what people are willing to spend on it, said Dunleavy, who has a TradFi background from his time working in fixed income at financial services firm State Street.

MEV activity resembles co-location and high-frequency trading in traditional markets, Dunleavy said, adding that “MEV can be used as a proxy for the financialized value that people actually have as their expressed preference for the blockchain.”

“Solana’s valuation is really not driven by dollar amount or transaction fees like it is on Ethereum, but is actually empowered by something like MEV as fees are compressed to zero,” he added.

To gather statistics that will shed light on MEV activity, Dunleavy suggests investors turn to blockchain data platforms such as Defy Flame, Token Terminaland knife.

Metric 4: Market Value to Realized Value (MVRV)

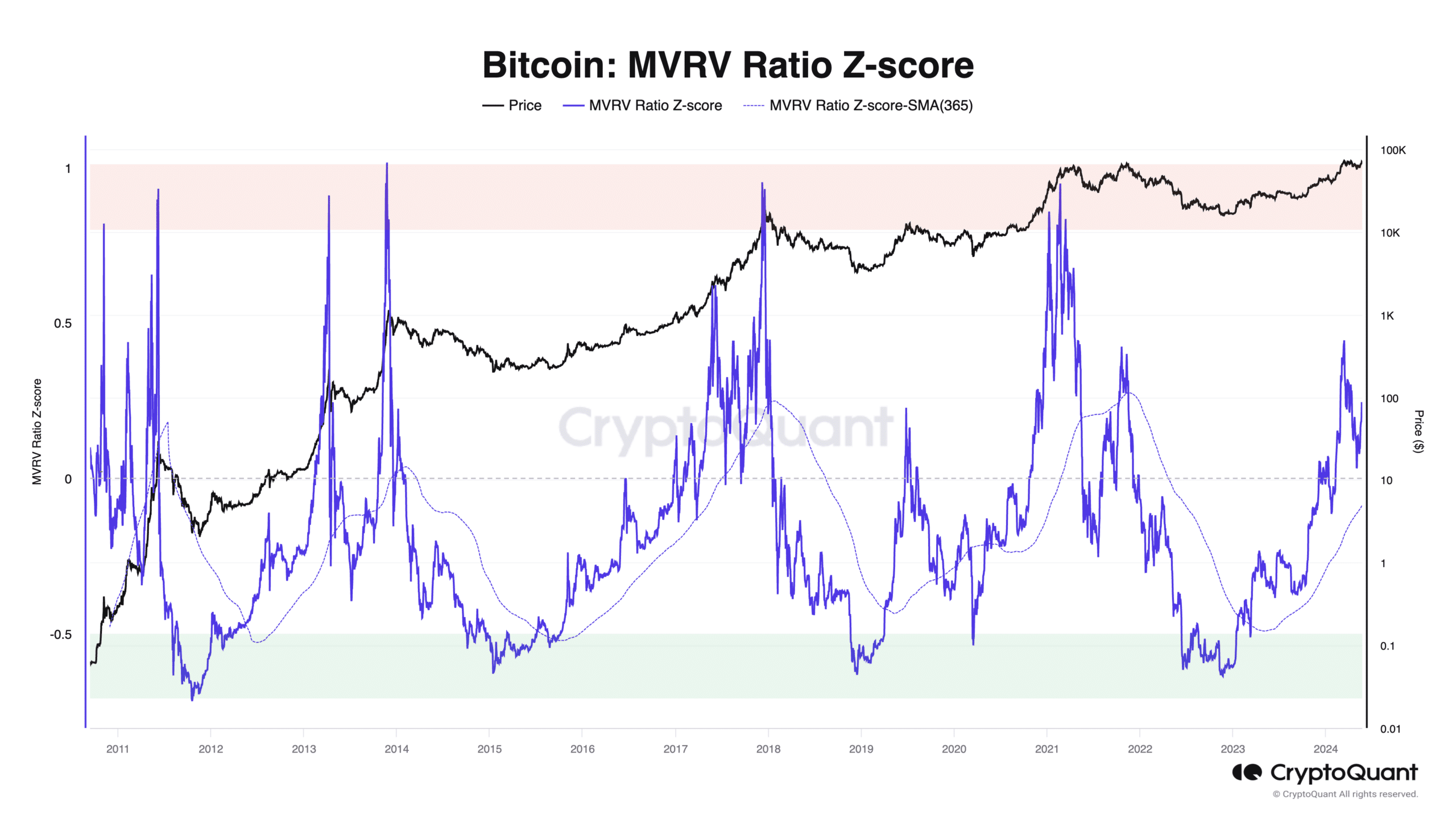

Another important measure for traders is a cryptocurrency MVRV ratio, especially for those interested in bitcoin. MVRV is calculated by taking the current market capitalization and dividing it by the average purchase price, known as the realized capitalization. MVRV is primarily used for bitcoin due to the asset’s stability and multi-year trading history. Since the metric is used to analyze long-term cycles, it is less reliable when analyzing datasets belonging to newer and more volatile cryptocurrencies.

The benchmark was particularly useful for determining whether bitcoin was undervalued or overvalued at a given time, Julio Moreno, head of research at onchain and market analysis firm CryptoQuant, told Unchained in an email.

For example, Moreno said that the MVRV is currently at .2 and is above its 365-day moving average (illustrated in the purple dashed line), indicating that bitcoin remains in an upward cycle. If the ratio were to fall below the 365-day moving average, it would mean that bitcoin has entered a bear market.

This particular benchmark “was very good at calling the bottom,” said MV Capital’s Dunleavy. But he has concerns about the metric’s reliability as a new wave of institutional investors enter the bitcoin market.

He said that after the approval of spot bitcoin ETFs in the US and the more than $15 billion inflows into those products, “you’re going to have these price-agnostic buyers every two weeks going forward buying it in their 401ks or with the market. .I think it really distorts the previous signal of momentum and bullishness that you would have from actual transaction prices of bitcoin in that relationship.

With renewed investor interest in cryptocurrencies following the mock approval of bitcoin ETF, combined with bitcoin peaking earlier this year, investors in the crypto space need to understand all the data and tools available.

“The communication gap for the everyday investor is still really, really big because it’s really hard to communicate why these things are still valuable,” Dunleavy said.

Learn more: How token supply affects the price of a cryptocurrency

June 6, 2024, 10:18 am ET: Thomas Dunleavy’s title has been updated within the article.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news