[ad_1]

The current on-chain dynamics for Bitcoin set up a potentially bullish scenario.

Following last week’s insights, Bitcoin has shown strength and is currently trading between $67,500 and $70,000 USD. Investors are eagerly expecting this upward trend to continue to reach a new all-time high. Let’s examine why this might happen.

This decrease in sell-side pressure, combined with modest but consistent capital inflows, suggests that the market is preparing for a significant upward move.

Bitcoin Technical Outlook

Bitcoin’s price found support on the red descending trend line, indicating profit taking. The price seems poised to test the daily Ichimoku cloud, which would be a major support level.

If the price breaks below the cloud, sentiment could shift to neutral, possibly causing Bitcoin’s price to trend towards $64,000 (Red Tenkan Line).

Let’s examine some important Bitcoin On-Chain Metrics

During Bitcoin bull markets, long-term holders usually sell some of their holdings as prices rise.

This pattern was evident from early 2024 through April, with significant declines in supply last active for more than 1-year and 2-year cohorts. However, the supply held in UTXOs (unspent transaction outputs) for more than 3 years continues to increase. This indicates a long-term bullish sentiment.

More than half of the total BTC supply has not moved in the chain in more than one year, reflecting strong belief of the holders.

Read more: How to get paid in Bitcoin (BTC): Everything you need to know

With the price recovering from the $56,000 correction, we can observe that these cohorts have stopped the spread of Bitcoins. Both the 1-year+ and 2-year+ cohorts stopped selling, indicating a shift to holding rather than dispersing their BTC.

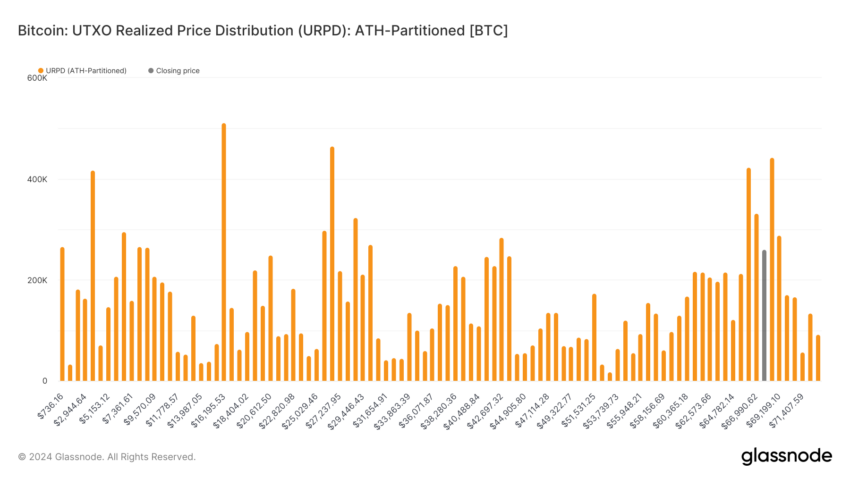

Understanding Bitcoin’s On-chain Support and Resistance Levels with the URPD

The URPD (Unspent Realized Price Distribution) metric provides valuable insights into where Bitcoin is held at different price levels. Think of it as a map showing the prices at which most people bought their BTC.

A significant portion of Bitcoin is held at prices within the current trading range of $67,500 to $70,000 USD. Specifically, 6% of Bitcoin’s total supply is held in this price range. This concentration of holdings suggests that many buyers bought BTC at these prices.

These holders are likely to hold their positions rather than sell quickly, creating a robust support level that helps prevent sharp price declines.

Only 1.1% of Bitcoin’s total supply exceeds the price level of $70,000. This small percentage indicates that very few people bought BTC at prices higher than today’s price. As a result, there are not many sellers who want to sell their Bitcoin for a quick profit, as they will either be at a loss or break even.

This lack of selling pressure above the current price creates a favorable environment for potential upside as there is less resistance to profit taking.

Read more: Bitcoin Price Prediction 2024/2025/2030

Strategic Recommendations

This setup is good news for Bitcoin because it suggests two things:

Strong Support: The large amount of Bitcoin held just below the current price acts as a safety net. If the price drops a little, many buyers are likely to jump in and buy more, preventing the price from falling too much.

Room for growth: With very little Bitcoin held above the current price, there aren’t many holders looking to sell quickly. This means that if more entities start buying Bitcoin, the price could quickly rise to $73,000 because there is not much resistance from sellers.

Despite the bullish signals, investors should also be prepared for a potential price reversal. If Bitcoin breaks below the daily Ichimoku cloud, sentiment could shift to neutral, and the price could head towards $64,000.

It is essential to have a risk management strategy in place to deal with such scenarios, including setting stop loss orders and being ready to adjust positions accordingly.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news