[ad_1]

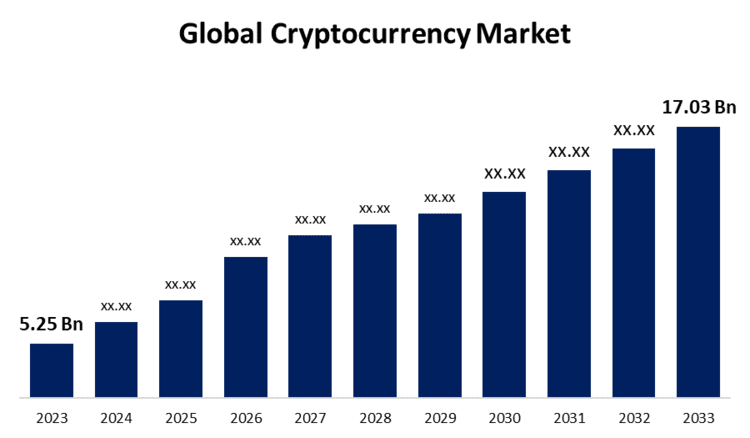

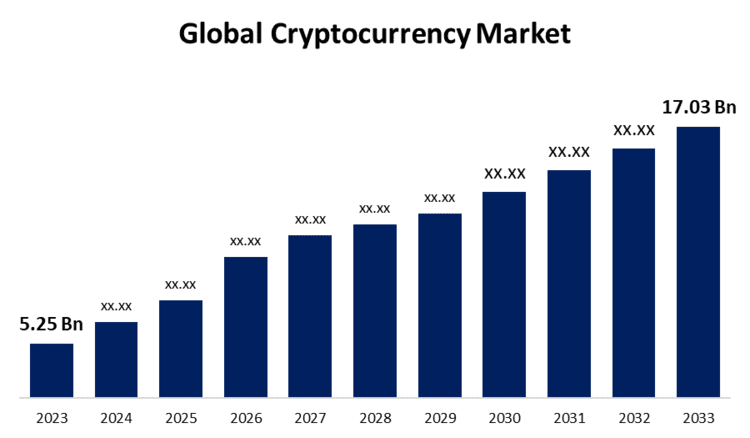

The global cryptocurrency market size was valued at USD 5.25 billion in 2023 and the global cryptocurrency market size is expected to reach USD 17.03 billion by 2033, according to a research report published by Spherical Insights & Consulting. Companies covered: Advanced Micro Devices, Inc., Binance, Bit Fury Group Limited, Bit Go, Inc., Bit Main Technologies Holding Company, Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, Xilinx, Inc., Ledger SAS, Ethereum Foundation, Coinbase, Alchemist, Others

New York, United States, June 26, 2024 (GLOBE NEWSWIRE) — The global cryptocurrency market size will grow from USD 5.25 billion in 2023 to USD 17.03 billion by 2033, at a compound annual growth rate (CAGR) of 12.49 % during the projected period.

Get a sample PDF brochure: https://www.sphericalinsights.com/request-sample/4628

Cryptocurrency, also called virtual currency, exists digitally and has no regulatory authority. Cryptocurrency uses distributed ledger technology such as blockchain to allow transactions. The increasing implementation of distributed ledger technology is estimated to drive the development of the cryptocurrency market during the forecast period. Furthermore, the increasing number of cryptocurrency customers for cross-border settlements is predicted to enhance market growth due to the reduction in customer fees and exchange costs. The major factor fueling the market’s growth is the development of distributed ledger technology and increasing digital investments in venture capital. Developing countries have started to use digital currency as a financial medium of exchange. The development of the cryptocurrency market is defiantly driven by the increasing demand for transparency and efficiency in financial payment systems. This increasing requirement corresponds to the increasing Internet saturation in many regions of the world. In addition, the development of technology companies’ contribution to accessible trading platforms through smartphones and computers has become a prominent trend in recent years. However, one of the crucial limitations opposing the cryptocurrency market is the lack of regulations governing the formation and valuation of these digital assets. This regulatory loophole gives certain users permission to manipulate the value of cryptocurrencies, targeting individuals with insufficient knowledge about these assets.

Browse key industry insights spread across 231 pages with 120 market data tables and figures and charts from the report on the “Global Cryptocurrency Market Size, Share and COVID-19 Impact Analysis, by Component (Hardware and Software), by Type (Bitcoin) (BTC), Litecoin, Ether, Ripple, Ether Classic and others), by end use (commerce, e-commerce and retail, peer-to-peer payment and remittance), and by region (North America, Europe, Asia Pacific Ocean, Latin America, Middle East and Africa), Analysis and Forecast 2023 – 2033.”

Story continues

Buy full report now: https://www.sphericalinsights.com/checkout/4628

The hardware segment is expected to hold the largest share of the global cryptocurrency market during the projected timeframe. Based on the components, the global cryptocurrency market is segmented into hardware and software. Among these, the hardware segment is expected to hold the largest share of the global cryptocurrency market during the projected timeframe. This is attributed to the hardware segment is again classified based on platform forms such as graphics processing unit (GPU), field programmable gate array (FPGA), application-precision integrated circuit (ASIC), and others. The hardware segment embraces hardware exported for crypto mining and exchange such as Bitmain Antminer S9i, Halong Mining DragonMint T1, Pangolin Whatsminer M3X and Avalon6, among others.

The bitcoin (BTC) segment is expected to hold the largest share of the global cryptocurrency market during the projected timeframe. On the basis of type, the global cryptocurrency market is segmented into bitcoin (BTC), litecoin, ether, ripple, ether classic and others. Among these, the bitcoin (BTC) segment is expected to hold the largest share of the global cryptocurrency market during the projected timeframe. This is attributed to the bitcoin is a highly implemented digital currency in the market. Bitcoin is a virtual currency that works as a distributed alternative payment method. The influx of Bitcoin exchange-traded funds (ETFs) is expected to increase the volume of global bitcoin transactions during the forecast period.

The trading segment is predicted to hold the largest share of the cryptocurrency market during the estimated period. On the basis of end use, the global cryptocurrency market is segmented into commerce, e-commerce and retail, peer-to-peer payment, and remittance. Among these, the trading segment is predicted to hold the largest share of the cryptocurrency market during the estimated period. It is attributed to the cryptocurrency trading that allows users to buy, sell and inspect asset balances and get deposit addresses. Common browser technology benefactors are focusing on forming alliances with blockchain technology firms to allow their clients to easily trade cryptocurrencies.

Inquire before buying this research report: https://www.sphericalinsights.com/inquiry-before-buying/4628

Asia Pacific is expected to hold the largest share of the global cryptocurrency market over the forecast period.

Asia Pacific is expected to hold the largest share of the global cryptocurrency market over the forecast period. The drive is attributable to the adoption of cryptocurrencies in countries such as South Korea, Japan and India. In addition, it is projected that the existence of cryptocurrency mining companies such as Ebang International Holdings, Inc., Bitmain Technologies Limited., Canaan, Inc. and will provide other market growth in the region. Moreover, leading players in the region are entering corporations to address the competitive market.

North America is predicted to grow at the fastest rate in the global cryptocurrency market during the projected timeframe. This is attributed to the use of cryptocurrencies in NFTs in the region and the increasing adoption of cryptocurrencies as a type of store of value is fueling the regional market’s growth. In addition, the region is noticing crucial investments in companies developing blockchain technology and radical solutions for cryptocurrency mining systems that have higher hashing rates and better power efficiency.

Competitive Analysis:

The report provides the appropriate analysis of the key organizations/companies involved in the global market along with a comparative evaluation based primarily on their product offering, business overviews, geographical presence, business strategies, segment market share and SWOT analysis. The report also provides an extensive analysis focusing on the current news and developments of the companies, which include product development, innovations, joint ventures, partnerships, mergers and acquisitions, strategic alliances and others. This allows for the evaluation of the overall competition within the market. Major vendors in the global cryptocurrency market include Advanced Micro Devices, Inc., Binance, Bit Fury Group Limited, Bit Go, Inc., Bit Main Technologies Holding Company, Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, Xilinx, Inc. , Ledger SAS, Ethereum Foundation, Coinbase, Alcheminer, and others.

Get discount @ https://www.sphericalinsights.com/request-discount/4628

Recent developments

In December 2023, Bitfinex Securities Ltd. Secured USD 5.2 million in USDT using its tokenized bond ALT2612. The fundraising initiative was made possible by the assistance of ALTERNATIVE, a securitization endowment based in Luxembourg, and accomplished by Mikro Kapita, a prominent microfinance company.

Market Segment This study forecasts revenue at global, regional and country levels from 2020 to 2033. Spherical Insights has segmented the Global Cryptocurrency Market based on the below segments:

Global cryptocurrency market, by component

Global Cryptocurrency Market, by Type

Bitcoin (BTC)

Litecoin

Ether

Ripple

Ether Classic

Other

Global cryptocurrency market, by end use

Trade

E-commerce and retail

Peer-to-peer payment

Overpayment

Global Cryptocurrency Market, Regional

North America

Europe

Germany

UK

France

Italy

Spain

Russia

Rest of Europe

Asian Pacific Ocean

China

Japan

In the

South Korea

Australia

Rest of Asia Pacific

South America

Brazil

Argentina

Rest of South America

Middle East and Africa

Browse related reports

Global Trade Surveillance Market Size, Share and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premises, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End-User (Banks, Institutional) Brokers, Retail Brokers, market centers and regulators, others) and by region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share and COVID-19 Impact Analysis, by Payment Type (Domestic Payments and Cross-Border Payments), by Payment Method (Bank Transfer, Card and Online Payments), by Vertical Type (BFSI, IT) and ITES, Retail and E-Commerce, travel and hospitality, healthcare, media and entertainment, transportation and logistics, and others), and by region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2023 – 2033

Global Trade Finance Market Size, Share, and COVID-19 Impact Analysis, By Finance Type (Structured Trade Finance, Supply Chain Finance, and Traditional Trade Finance), By Service Provider (Banks, Financial Institutions, Trading Houses, and Others), By Product Type (Letters of Credit , export factoring, insurance, bill of lading, guarantees and others), and by region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2023 – 2033

Global inverse factorization market size, share and COVID-19 impact analysis, by category (domestic and international), by financial institution (bank, and non-bank financial institution), by end use (manufacturing, healthcare, transportation and logistics), Information Technology, Construction and others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2023 – 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm that provides actionable market research study, quantitative forecasting and trend analysis, providing forward-looking insight specially designed for decision-makers and helping ROI.

Which caters to different industries such as financial sectors, industrial sectors, government organizations, universities, non-profit organizations and corporations. The company’s mission is to partner with businesses to achieve business goals and sustain strategic improvements.

CONTACT US:

For more information about your target market, please contact us below:

Phone: +1 303 800 4326 (US)

Phone: +91 90289 24100 (APAC)

Email: [email protected], [email protected]

Contact us: https://www.sphericalinsights.com/contact-us

Follow us: LinkedIn | Facebook | Twitter

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news