[ad_1]

Bitcoin (BTC) experienced a significant decline, reaching as low as $56,700 on Thursday. This price level has not been seen since May 1st as Bitcoin faces several challenges, including US political uncertainties and the ongoing sale of BTC seized by the German government. These factors have contributed to a nearly 20% price correction for Bitcoin, causing concern among investors.

Unraveling the Bitcoin Price Drop

According to a recent Bloomberg report, investors are considering possible scenarios if President Joe Biden decides to withdraw his US re-election bid. One possibility is the emergence of a stronger Democratic challenger who could pose challenges to Republican Donald Trump, whose agenda favors the crypto industry.

Richard Galvin, co-founder of hedge fund Digital Asset Capital Management, highlights the likelihood of a “stronger Democratic candidate” who may not support cryptocurrencies as a factor influencing Bitcoin’s short-term weakness.

In addition, the overhang of the collapsed Mount Gox Bitcoin exchange case, which plans to start refunds, has affected customers from the alleged hack that suffered nearly 10 years ago, and the US and German government sales are contributing to the current weakness in the Bitcoin market.

Traders are closely monitoring the risk of Bitcoin alienation by both the US and German governments, which are seizing BTC. Recent data from Arkham Intelligence reveals that a wallet associated with the German state is worth approximately $75 million BTC to exchanges on Thursday, adding to a series of similar transfers.

Meanwhile, administrators of the failed Mount Gox exchange are gradually returning a significant amount of Bitcoin to creditors, leaving speculators uncertain about the potential impact of the $8 billion draw on the market.

Miners’ response and market impact

On the other hand, Bitcoin miners who are responsible for the computing power that supports the Bitcoin blockchain continue to financial consequences of the Halving event, which reduces the number of new tokens they receive as a reward.

In response, some miners are selling a portion of their token supply, adding to the selling pressure on Bitcoin. This ongoing battle with selling pressure from miners is affecting Bitcoin’s price performance, as highlighted by Noelle Acheson, author of the Crypto Is Macro Now newsletter.

However, Acheson notes that sentiment in the crypto market can change quickly, especially if it is weaker US economic data raising expectations of looser monetary policy from the Federal Reserve.

Additionally, the possible approval of US exchange-traded funds (ETFs) to invest in Ethereum could lift overall market sentiment. Furthermore, the interpretation of American political developments may shift over time.

Matt Hougan, Chief Investment Officer at Bitwise, suggests that potential changes at the top of the Democratic ticket are likely to settle in an improved position for cryptocurrencies. He emphasizes that Washington’s attitude towards digital assets has changed positively in the past year.

Glassnode predicts retest of previous all-time highs

Despite the negative price performance and uncertainty surrounding BTC’s price, Jan Happel and Yan Allemann, founders of blockchain analytics platform Glassnode, maintain their target for Bitcoin, declare that BTC is expected to reach the $110,000 area before the market peak.

In particular, Allemann and Happel see the current consolidation as a retest of the previous all-time high. However, for this to happen, Bitcoin will need to cross key levels at $64,000 and later $70,000, which will require further market development and price action.

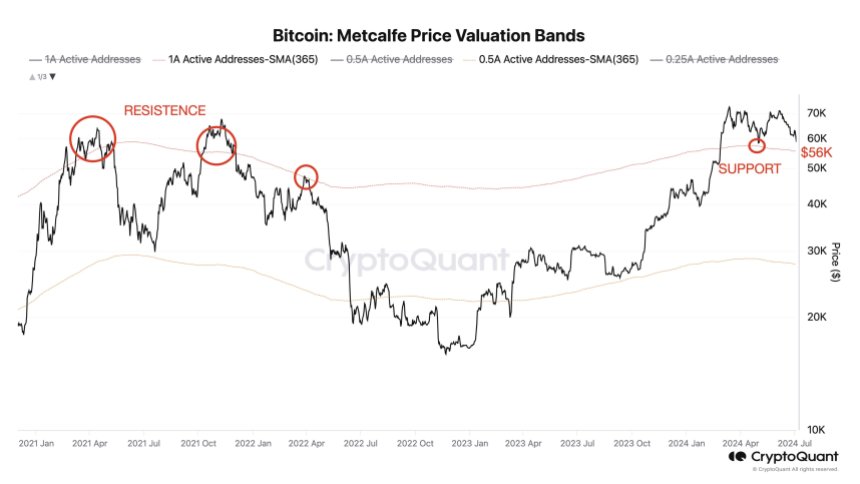

According to to Julio Moreno The Metcalfe price valuation provides insight into the potential support level for Bitcoin’s price. Moreno suggests that $56,000 should be a key support level for Bitcoin based on this valuation.

Moreno concluded that if the Bitcoin price does not hold this key level of $56,000, the correction could potentially deepen, leading to more serious consequences for the market.

BTC regained the $57,300 level; however, the cryptocurrency is down 5% in the past 24 hours, with no signs of short-term bullish catalysts to climb above $60,000.

Featured image of DALL-E, chart from TradingView.com

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news