[ad_1]

Amid Bitcoin’s slide from $70,000 to $64,000, AVAX has fallen 28% since June 7, reaching a crucial support level at $25.

In this analysis, we will cover both the technical and on-chain aspects of Avalanche (AVAX) and provide you with a detailed price forecast.

AVAX Price Forecast and Outlook

After the price drop of Bitcoin from $70,000 to $64,000, AVAX experienced a staggering 28% drop from June 7th to today. This significant drop pushed AVAX to test an important support level at $25.

Additionally, the daily chart’s RSI has reached 28, indicating an oversold environment.

In a previous BeInCrypto analysis, we predicted that AVAX could fall to $25 in a bearish scenario if Bitcoin’s price continues to fall. To reduce risk exposure, we advised traders to wait until the price drops below $30 before buying. Suggest that the ideal buying range would be around $25-$27 for an optimal entry position.

Read more: How to buy Avalanche (AVAX) and everything you need to know

The price followed our Avalanche forecast and hit a local low of $25 today, a level not seen since December 2023. It then bounced back 6% to $26.50. Confirming our forecast and underlining the importance of the $25 price level mentioned in our previous analysis.

Currently, the price is displaying a bearish scenario as it is trading below all major technical analysis indicators on the daily timeframes. It is below the Ichimoku cloud, the baseline of the cloud, and the exponential moving averages, which are all strong bearish signals.

The analysis of the total addresses that AVAX holds and profitability

Total number of addresses that AVAX holds

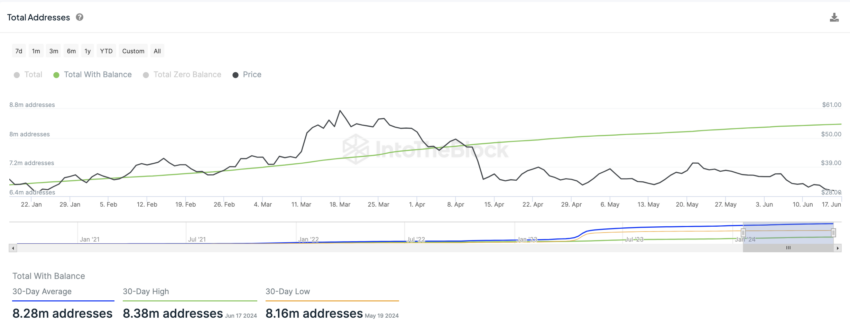

Total addresses with balance measures the number of unique addresses on the blockchain that contain some AVAX. Each address represents a user or entity capable of sending, receiving and holding cryptocurrency, as well as interacting with decentralized applications (dApps) on the network.

The number of addresses increased by 41,316.85 from June 3 to June 10 and by 22,060.86 from June 10 to June 17. This data shows steady growth in new addresses, with a greater increase in the first week compared to the second.

Read more: Avalanche (AVAX) Price Prediction 2024/2025/2030

This trend indicates rising user adoption and network expansion, but slower growth in the latter period. So, we need to keep an eye on potential changes in user engagement or market sentiment.

Historical profitability of addresses Holding AVAX

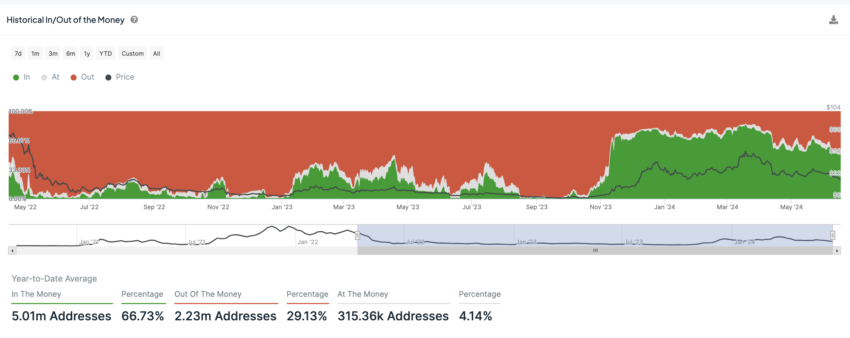

The analysis of the historical profitability of addresses with AVAX shows a shift in participants’ economic sentiment. The Out of the Money area (red) in the chart shows the percentage of AVAX addresses at a loss. The At the Money area (gray) shows the percentage of AVAX addresses at breakeven. The In the Money area (green) represents addresses in profit.

As of May 31, 2024, 36.69% of active addresses were Out Of The Money. This percentage increased to 49.94% by June 17, 2024, reflecting a growing number of participants holding unrealized losses. The proportion of Break-Even addresses (At the Money) started at 5.89% and decreased to 0.78% by June 17, 2024.

This decrease in At the Money addresses indicates that fewer participants are on their cost basis. As more of them are now experiencing losses. Initially, 57.42% of addresses were in the money (In the Money), which decreased to 49.28% by the end of the period.

Additionally, the upward trend in the Out Of The Money category from 36.69% to 49.94% underlines a growing bearish sentiment among holders. The consistent decline in addresses At The Money indicates that the price movements have pushed most participants away from their cost base and into loss territory.

Read more: 11 Best Avalanche (AVAX) Wallets to Consider in 2024

This situation is bearish because it could trigger a wave of selling pressure as participants seek to cut their losses. Lowering the price further and increasing the oversupply of the market.

If the price of Avalanche (AVAX) falls below $25, it is likely to quickly decline to the strong support level at $20. This $20 level should serve as important and solid support.

For long-term holders, buying AVAX at these prices presents an excellent opportunity. The price of AVAX is stabilizing around $26, up 7% from the $25 low, and indicating a potential local bottom.

Indeed, if Bitcoin falls below $65,000, this scenario may become invalid. Conversely, if Bitcoin rebounds to $68,000-$69,000 in the mid-term, AVAX is likely to climb above $30.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news