[ad_1]

Understanding the activity of whalers is crucial in analyzing market dynamics and predicting future price movements of major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP).

Whalers’ material influence can significantly affect supply, demand and overall market sentiment.

Bitcoin Whale Accumulation: Upward Pressure on BTC Price

The consistent accumulation of Bitcoin by whales indicates a bullish outlook for the asset’s price in the coming month.

Large holders continue to buy and hold significant amounts of Bitcoin, reducing the available supply on the market. The reduced supply, combined with steady demand from institutional investors due to ETF approvals and retail purchases from short-term holders, is creating upward pressure on the price.

Bitcoin’s price may stabilize or even rise if the current accumulation trend continues. Whales show confidence by holding their positions.

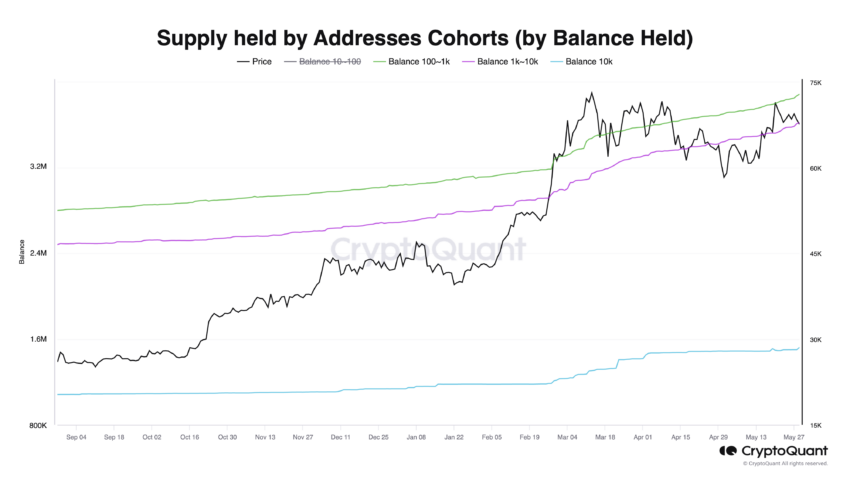

The chart from CryptoQuant shows that wallets holding between 100 and 10,000 BTC have consistently accumulated and reached new all-time highs in stock.

Read more: How to get paid in Bitcoin (BTC): Everything you need to know

Despite slight fluctuations and occasional profit-taking during peak prices, these medium-sized holders keep up with their Bitcoin stacks. This accumulation pattern indicates a strong belief in Bitcoin’s future value among whales, as they continue to buy more BTC even during market volatility.

Ethereum Whale Movements: Key Insights from Major Holder Activity

Ethereum presents some unique challenges in whale analysis. DeFi and staking tokens can skew data by breaking up large wallets into smaller addresses. This can make large containers appear to be less active than they really are.

However, we can uncover valuable insights by combining the joint holding of wallets with at least 10,000 Ethereum.

Wallets with more than 100,000 ETH have increased their holdings by more than 4% of the total circulating ETH supply over the past 4 months, showing strong accumulation and confidence in the asset.

Read more: How to invest in Ethereum ETFs?

The whale holdings reached a new high by the end of May, reflecting strong confidence among major investors in Ethereum’s long-term potential.

A significant price increase occurred in late May, coinciding with a significant increase in large container holdings. This suggests that the accumulation by large holders may have positively affected the price.

XRP Whale Activity: Accumulation Trends and Market Impact

The chart shows the dynamics between XRP whale ownership and the XRP price over the past few months. In particular, it tracks two important cohorts of large holders: addresses with more than 1 million XRP and those with 100 million to 1 billion XRP.

The blue line, which represents the holding of addresses with more than 1 million XRP, shows a gradual increase in their percentage of the total XRP supply. This stability suggests that the largest whales are confident in their long-term positions and maintain a steady accumulation pattern.

In contrast, the red line tracks the holdings of addresses with 100 million to 1 billion XRP and exhibits more variation. There are noticeable fluctuations, especially around early February and mid-March, but overall this group has shown an upward trend in their holdings.

This suggests that medium-sized whales have been actively accumulating XRP.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

XRP whales, especially those in the 100 million to 1 billion XRP cohort, have been actively buying and accumulating XRP. This buying activity positively impacted the XRP price, with periods of accumulation corresponding to price increases. Meanwhile, the largest holders (1 million+ XRP) have shown steady confidence in XRP’s long-term potential.

The behavior of these whale cohorts indicates a bullish outlook for XRP, with continued accumulation likely to support future price growth.

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news