If anything, the 20-year Nasdaq chart has a clear rising channel; it enables investors to project the Nasdaq trading range for 2025 2026.

RELATED – InvestingHaven’s Pick of Historical Charts for Long-Term Investors

Historical charts can help investors tremendously. The current environment is characterized by:

Too much information. Too many cards, most of them useless (illustration). Financial content and services focus on real-time price changes. As a result, investors are automatically pushed into the lower time frames.

It is essential to choose a time frame that illustrates the long-term trend.

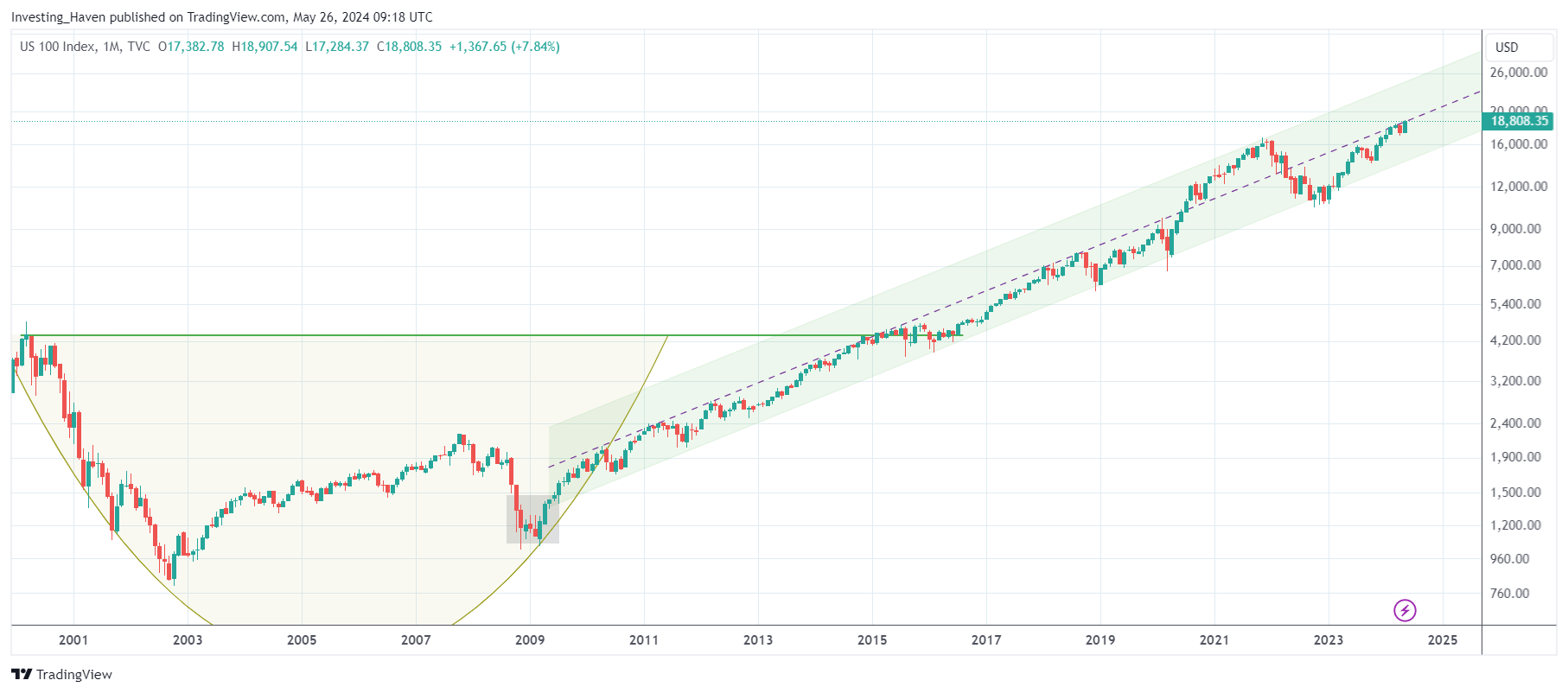

For the Nasdaq, it is clear that the 20-year chart provides a good baseline, illustrating the dominant trend.

The 20-year Nasdaq chart

The 20-year Nasdaq chart provides a panoramic view of the index’s evolution. You don’t need a PhD to understand the Nasdaq in 20 years: it’s been trending upward since 2013, after completing a consolidation that took more than a decade to complete.

A closer examination of this chart reveals several notable aspects that provide valuable insights for investors.

First, the chart shows the Nasdaq’s remarkable ability to recover from significant downturns. Over the past two decades, the index has weathered several crises, including the bursting of the dot-com bubble and the global financial crisis. In each case, the Nasdaq not only recovered, but rose to new heights. This resilience highlights the underlying strength of the technology sector and its ability to lead market recoveries.

Furthermore, the chart reveals clear bullish trends characterized by consecutive higher highs and higher lows. These trends reflect sustained periods of investor optimism and buying interest, often driven by groundbreaking technological advances. Investors can take advantage of these trends by identifying entry points during pullbacks, in line with the overall upward trajectory.

Chart patterns on the 20-year Nasdaq chart

We turn our attention to the chart patterns visible on the 20-year Nasdaq chart by adding and analyzing our chart notes.

The Nasdaq chart over 20 years shows 2 distinct periods:

The period between 2002 and 2012 marked by wild swings. This period turned into a long-term chart pattern that took the form of a W reversal, a powerful bullish pattern. The period between 2012 and 2024 characterized by an upward trend. The chart pattern is the ascending channel.

Moreover, the dominant pattern in the last 10 years, since 2012, highlights the importance of pivotal moments, such as the COVID-19 pandemic. The sharp decline in early 2020 followed by an equally rapid recovery shows the Nasdaq’s ability to respect the ascending channel on its 20-year chart.

This adaptability is rooted in the resilience of technology companies that can pivot quickly in response to changing consumer behavior and market dynamics.

Dual participation in the Nasdaq

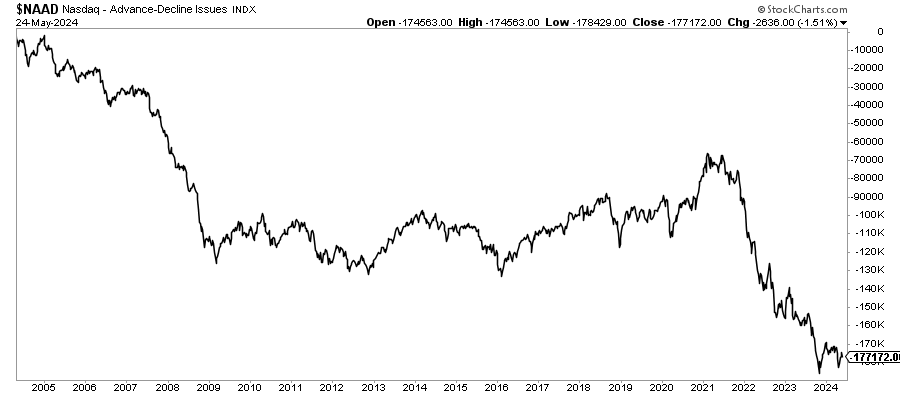

The ascending channel visible on the 20-year Nasdaq chart indicates a steady and predictable increase in the index’s value, which may lead some to believe that all technology stocks have performed well during this period. This perception is wrong, even dangerous.

Although the overall index performed well, it is important to understand that not all technology stocks shared in this success. The rising channel of the NASDAQ can create the illusion that the entire sector is thriving. In reality, the performance of individual technology stocks has varied widely. Some tech stocks have seen tremendous growth, while others have struggled or even fallen.

Several tech giants have led the charge as their stock prices rise dramatically. For example, companies such as Apple, Google and Tesla have benefited from strong earnings, innovative products and strong market demand. These success stories had a significant impact on the NASDAQ’s rising channel.

However, not all tech stocks have enjoyed such positive results. Many technology companies have faced significant challenges. Some have struggled with profitability, faced intense competition or failed to meet investor expectations. As a result, their stock prices stagnated or even fell, despite the overall upward trend in the NASDAQ index.

All of the above is reflected in another view on the Nasdaq over 20 years, ie progress minus declining issues within the Nasdaq index:

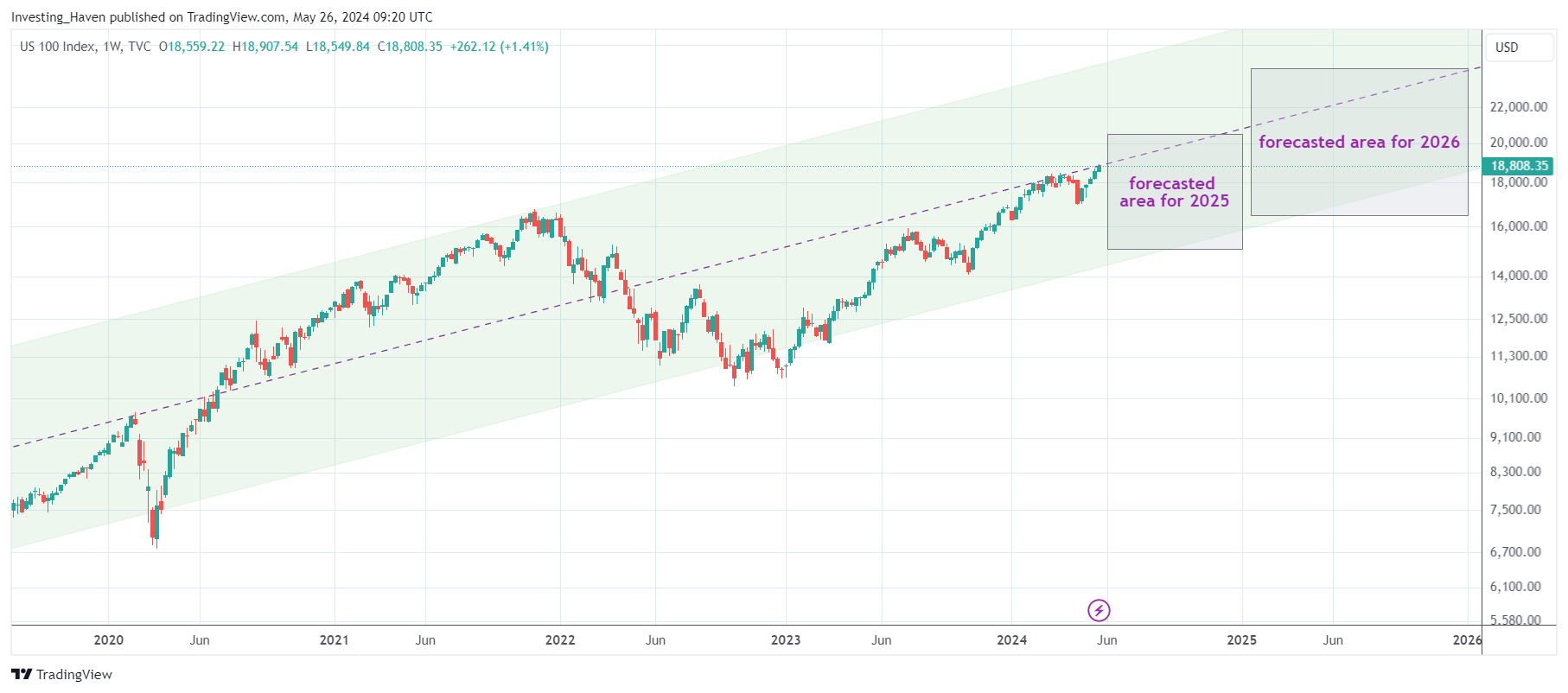

What’s Next for the Nasdaq in 2025 and 2026?

Examining support and resistance levels is essential when analyzing long-term charts. These levels provide critical insights into price behavior and potential turning points. The Nasdaq’s historical data shows recurring patterns where certain price levels act as significant barriers or launches for the index.

On the following chart view, we look at projected outcome for the Nasdaq, in 2025 and 2026, using the ascending channel insight visible on the 20-year Nasdaq chart.

The takeaway – assuming and assuming the Nasdaq remains within this long-term rising channel:

The projected trading range in 2025 will be 15,000 to 19,000 points. The projected trading range in 2026 will be 16,500 to 23,000 points.

The only prerequisite is that support from the rising channel applies whenever markets will come under pressure!

Long-term investment strategies

Long-term investment strategies thrive on a thorough understanding of historical patterns and future projections.

Armed with insights from the Nasdaq’s long-term chart, investors can make informed decisions that align with their risk tolerance and financial goals.

The ability to identify trends, potential entry points and emerging sectors positions investors for success in a rapidly changing market environment.

Closure

The Nasdaq’s long-term chart serves as a treasure trove of insights for savvy investors. The historical trends matter today and in the future, and recognize the technology sector’s dominance.

Henceforth, investors can define and design well-informed strategies as long as they respect the dominant market trend visible on the long-term chart(s).

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news