Stock market chart with Bitcoin sign and red arrows. Cryprocurrency crash concept.

The recent decline in Bitcoin (BTC) has raised concerns among market participants as the largest cryptocurrency struggles to maintain its upward momentum.

Losing key moving averages and the $27,000 level, BTC’s sharp decline was exacerbated by negative market sentiment and delays in the approval of mock Bitcoin Exchange-Traded Funds (ETFs) by the US Securities and Exchange Commission (SEC).

Contributing to the bearish outlook is the analysis of on-chain data, which indicates a lack of strong support below the $25,400 mark.

Noted crypto analyst Ali Martinez highlighted these concerns and highlighted the potential for a quick correction to $23,340. However, the volatile nature of the Bitcoin market means that the outcome remains uncertain.

Bitcoin is facing an extended downtrend

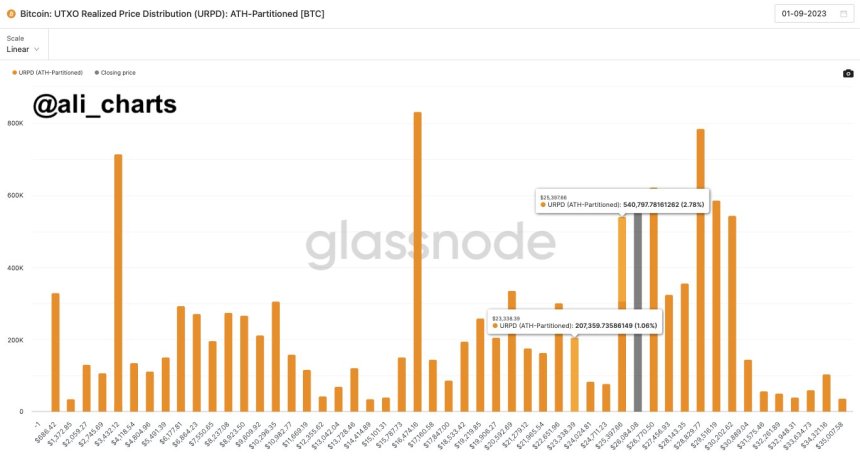

Ali Martinez’s recent Postal on X (formerly Twitter) shed light on the on-chain data analysis for Bitcoin. Martinez points out that BTC currently lacks robust support below the $25,400 level.

This observation is based on BTC’s UTxO Realized Price Age Distribution, which provides insight into different cohorts’ holding behavior by overlaying a range of realized prices along with age groups.

The analysis points to a vulnerability in BTC’s price structure, suggesting that a break below the $25,400 threshold could trigger a quick correction downwards to $23,340.

In addition, the negative sentiment in the market, along with regulatory delays in the approval of mock Bitcoin ETFs by the SEC, contributed to the bearish outlook for Bitcoin.

Many market participants expected the introduction of Bitcoin ETFs to act as a catalyst for a potential recovery in the near term. However, the prolonged delay in their approval dampened investor sentiment and increased uncertainty surrounding the cryptocurrency’s future price trajectory.

The lack of a favorable regulatory framework further contributed to the extended downtrend and increased market volatility.

That said, if Bitcoin breaks below the critical support level at $25,400, as suggested by the on-chain data analysis, it could lead to a quick correction to $23,340. Such a significant drop would increase concern among investors and potentially cause further selling pressure.

Healthy BTC correction?

In addition to analyzing the Bitcoin market, crypto analyst Egag Crypto offers a broader context by emphasizing the probability of the closing of the CME (Chicago Mercantile Exchange) gap and the importance of the $23,000 level as strong support.

According to Egrag Crypto, even if BTC comes back to this point, it should be seen as a natural correction within the framework of an ongoing bull market.

Egrag Crypto suggests that the closing of the CME gap is a phenomenon where the price of Bitcoin fills the price gap created between the closing and opening prices of the CME futures market over the weekend.

In this case, the gap exists around the $23,300 level, indicating a potential area of strong support. This observation is consistent with the idea that Bitcoin tends to fill these gaps over time.

While a pullback to $23,300 may cause concern among investors, Egrag Crypto emphasizes that it should be viewed as a healthy correction within the broader context of a bull market.

Corrections are a normal part of any market cycle, and Bitcoin has historically experienced periods of consolidation and pullback before continuing its upward trajectory.

Currently, Bitcoin is trading at $25,990, representing a 4% drop within the 24-hour period and a significant 11% drop over the past 30 days. Despite these recent losses, the flagship cryptocurrency has successfully maintained its year-to-date gains, with a remarkable gain of over 29% since September 2022.

Featured image from iStock, chart from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news