[ad_1]

Chainlink (LINK) could move towards $100 if (a) crypto markets experience strong bullish momentum (b) LINK moves past $30-33, which is its 38.2% Fibonacci level (c) LINK experiences strong adoption. Once these conditions are in place, LINK can clear former ATH at $52 and move to $100.

RELATED – Chain Link (link) Price Prediction 2025

Chainlink (LINK) is an oracle-based network with a large number of partnerships. We recommended LINK to subscribers in 2020 before an epic price increase.

We remain firmly bullish on LINK, even more so once the $16.91 price point is breached. It was in a established consolidation zone for more than 80 days and currently testing the top. The lows and highs have been tested on numerous occasions. The Chainlink (LINK) price will likely go to $100 in 2025.

September 15, 2024 – As 2025 approaches, there are interesting evolutions in the crypto space: from continued accumulation of Bitcoins by MicroStrategy to the proverbial ‘herd is enough’ when it comes to political influence in the decentralized blockchain space. 2025 will be a fascinating year for blockchain, crypto is not dead, on the contrary. How great will 2025 be for crypto markets, and especially for Chainlink?

The majority of analysts are positive on Chainlink

Many align with this view on Chainlink:

Chainlink is one of the most underrated protocols in crypto.

Horribly underrated.

Whore.

$LINK

The question arises – when is a blockchain protocol undervalued?

In other words, what is the most objective valuation methodology in the absence of a standard valuation methodology?

You got our point.

While Chainlink may be experiencing adoption, which we can clearly see is true, the point remains that LINK needs a bullish momentum environment to perform well in terms of price.

One angle we really like, as we look at the concept of appreciation and acceptance, is the forward-looking angle.

As explained in this crypto narrative from 2025, the #tokenization could be the next big thing… maybe. Chainlink is positioning itself in this space, and hitting the next story will ultimately be the main driver for success in LINK’s token price.

Is tokenization a “giant leap” for securities? As the NY Fed asked the question, Brazil, China, Germany, India and the UAE have seen positive blockchain developments. Additionally, Swift outlined plans for settling digital asset transactions.

This week’s onchain finance news ↓… pic.twitter.com/FemJeM6MYz

— Chainlink (@chainlink) September 13, 2024

The LINK price forecast to $100 loosely matches Ethereum’s price forecast to $10,000, both are roughly a 5x increase. These are reasonable price targets at the heights of the next crypto bull market, unlike Bitcoin’s $1 million price.

We believe, from a relative perspective, that LINK’s price target of $100 is reasonable if it succeeds in achieving the right narrative(s).

Note – Be careful with the ‘over the top’ price predictions that characterize social media. Convincing views like “the price of LINK will explode to $1,000” are based on sentiment and a need to collect subscribers and likes. There is no real information to suggest that LINK will reach $1,000, or even $250. However, a price of $100 is possible with time, a breakout and support for the broader market and the specific industry.

Our view of Chainlink (LINK) price to $100

We take a top-down approach to address the question of whether LINK will reach $100 sooner or later.

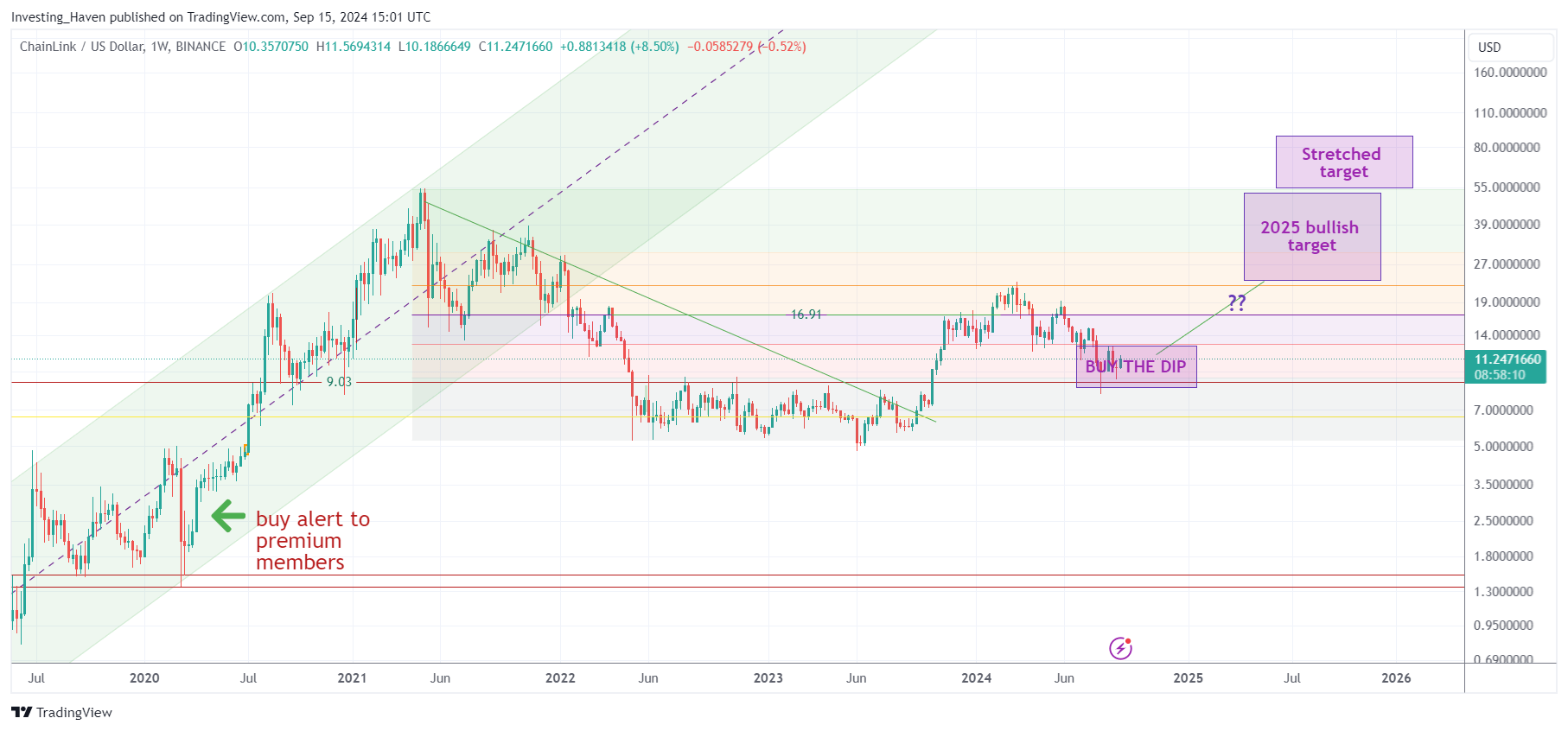

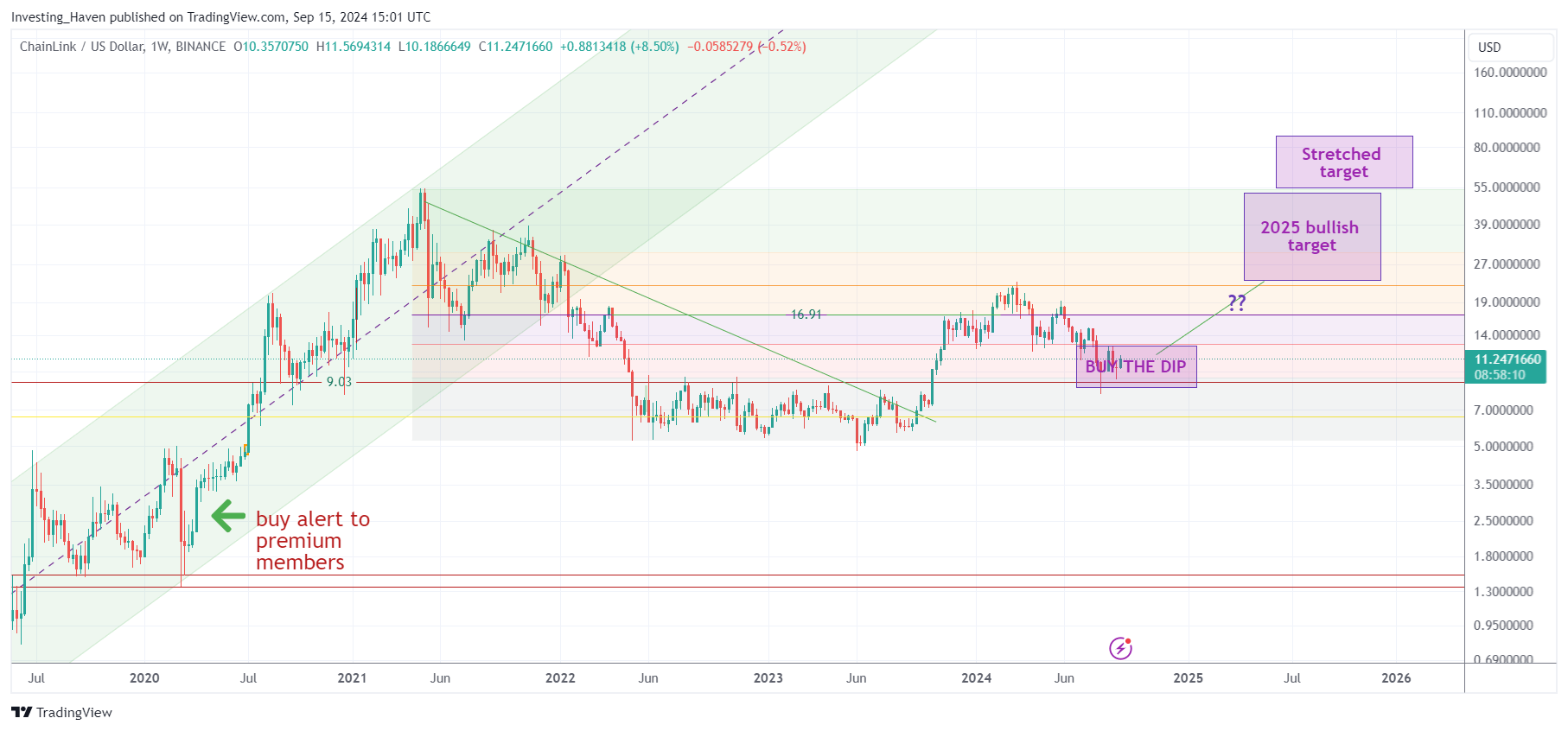

The weekly chart below indicates an ABCD pattern (AB 2019-2021, BC 2021-2023, CD 2024-2026). It is important to note that $16.91 is likely to be rested in 2024 after the breakout. In other words, it’s not going to simply shoot to $100 in a straight line.

Although it may seem obvious, new investors can sometimes expect to make ‘straight-line’ returns without adjusting to the market and without specific entry/exit positions.

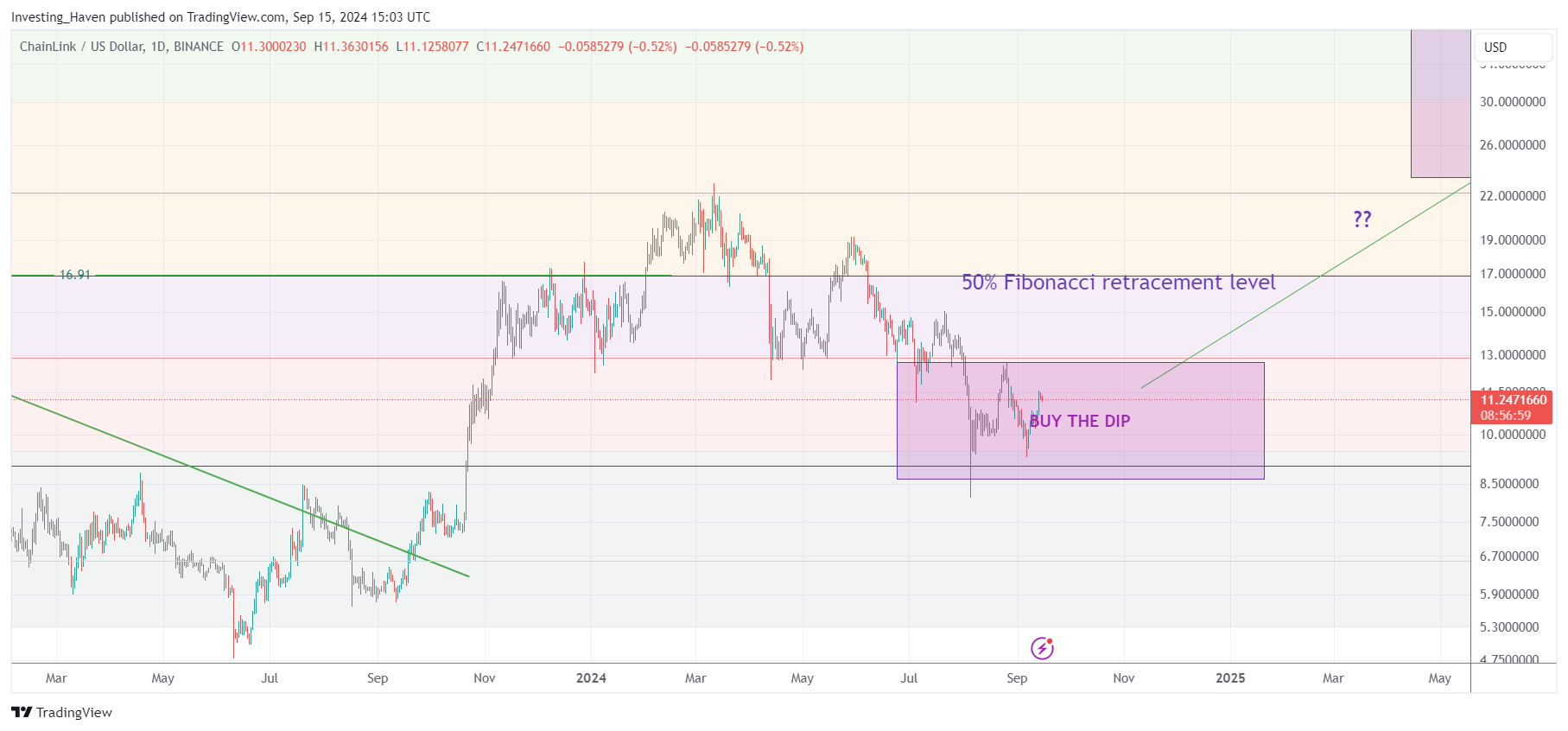

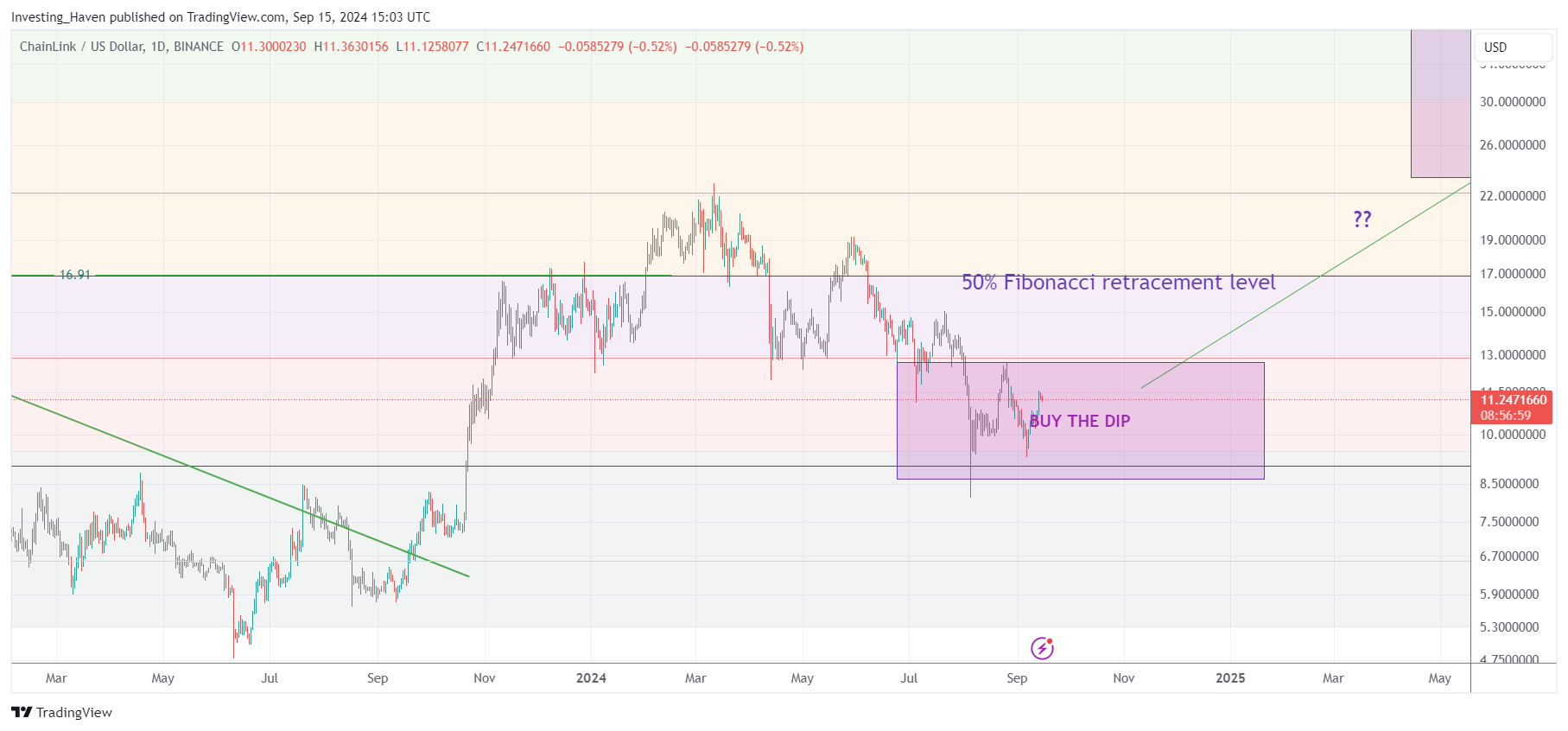

September 15, 2024 – The ABCD pattern we identified when we first wrote this article, in February 2024, is still in the charts. We’d even say that the case for an ABCD is stronger than ever! LINK consolidates exactly in our forecast buy the dip territory. It may gather strength in this area to attack its 50% and 38.2% Fibonacci levels.

The horizontal range is part of a much larger 18-month consolidation range when you zoom out. This broader view is more relevant as it can lead to a more sustained outbreak.

We think that once the $16.91 figure is breached, $22.6, $29.9 and $54.0 will be tested.

September 15, 2024 – The previous points were written in February 2024. Interestingly, that analysis is still highly accurate as markets go through the seasonally weak period of Aug/Oct 2024.

Another point worth mentioning is the invalidation criteria. In this case, LINK below $12 will invalidate the prediction. However, the possibility of this happening is small in our opinion. The market as a whole is currently bullish, the segment is coming up, and the coin is approaching the top of the horizontal trading zone, not the bottom.

Chainlink (LINK) price to $100? Quite possible

The IH analyst team believes that LINK could reach $100 by late 2025 or early 2026.

LINK has been trading in an established zone between $13 – $16.91 for over 80 days. It is in a good segment/sector (oracles, data) that we are very bullish on. And 2025 is going to be a great year for altcoins.

September 15, 2024 – The crypto market is on track to consolidate in 2024, thus gathering strength for 2025. A crypto bull market can reasonably be expected in 2025. LINK is well positioned to capitalize on the next phase of the crypto-secular bull market.

Buy and hold LINK is a good option – but you may also want to consider high ROI tokens in winning sectors, with precise entry/exit positions. LINK delivered 10x to our premium members in 2020 when we recommended it, and we feel that we have equivalent 10x tokens on hand. Check out our record hitting crypto multi-baggers.

Disclaimer: This is not financial advice. Please consult a licensed financial advisor before making any investments.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news