[ad_1]

Despite the growing popularity of cryptocurrencies and blockchain, the complexity of the technology can make it difficult for average users to understand, adding a barrier to more people entering the space.

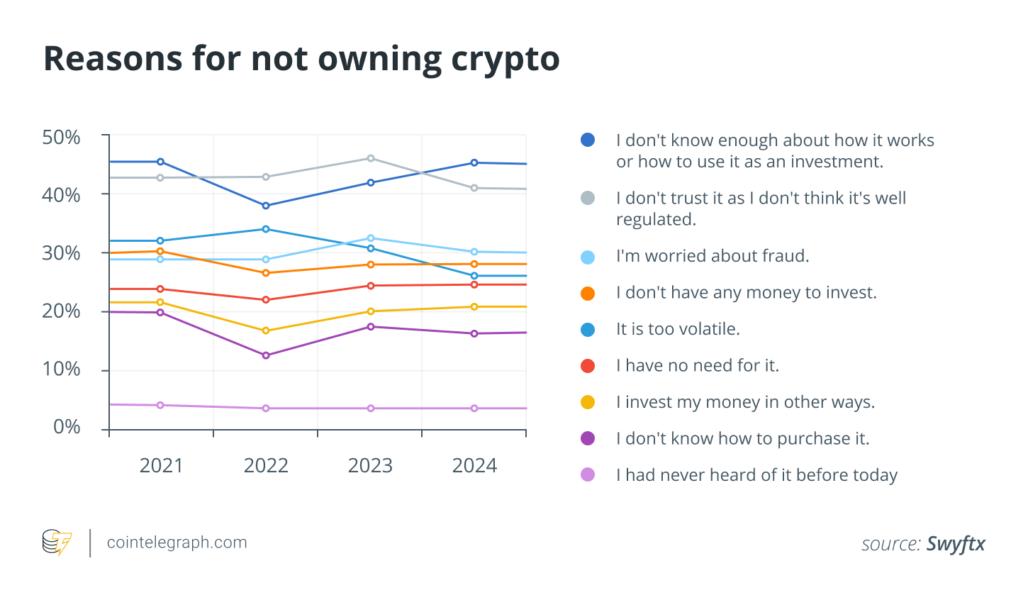

According to an August survey conducted by Australian crypto exchange Swyftx, 43% of 2,229 respondents said they did not use the technology because they were unsure how it worked.

Similar data from the 2023 Crypto Literacy Survey found that at least 28% of 3,000 respondents worldwide shared the same sentiment.

In 2023, the UK’s Financial Conduct Authority (FCA) published a research note which found that at least 30% of 2,337 respondents listed a lack of understanding as a reason for not entering the space.

Lance Morginn, president of analytics and market risk management firm Blockchain Intelligence Group, told Cointelegraph that the crypto market can “frighten people away with the plethora of unfamiliar terms.”

“At first impressions it may appear too technical and irrelevant to traditional money. Words like blockchain, tokens and technology can lead to a sense of intimidation, discouraging people from checking out crypto,” he said.

“I hear comments like ‘I don’t know what crypto is to use it,’ and ‘I feel ignorant when it comes to crypto.’ Questions like ‘How do I use it? What can I do with it?’ is commonly asked.”

In its fifth annual Global Crypto Adoption Index report, blockchain intelligence firm Chainalysis said that the launch of spot Bitcoin BTCUSD exchange-traded funds (ETF) in the United States in January was the main cause of a massive surge in crypto usage throughout the year.

Investors can now buy and sell certain types of ETF shares at market prices on stock exchanges without a high level of technical knowledge.

According to Morginn, the industry should try to attract users with a focus on the easier aspects of crypto, rather than trying to wow them with jargon.

“The cryptocurrency industry needs to create simplified educational resources and user-friendly platforms to help the average user warm up to cryptocurrencies,” he said.

“As the industry addresses the complexity issues head-on, cryptocurrencies and digital assets will reach a wider audience, encouraging more partnerships between financial institutions, service providers and more users to own cryptocurrencies.”

Lack of expertise with hardware can also be a roadblock

Aside from not understanding how crypto and blockchain technology work, another barrier can be a lack of understanding about some of the hardware involved, such as how to securely store individual assets such as Ether (ETH).

Kadan Stadelmann, a blockchain developer, industry security expert and Komodo Platform’s chief technology officer, told Cointelegraph that storage can be a minefield for some users.

“The industry can always use more education, especially free technical information for the unbanked,” he said.

“If we confuse people with overly complicated security setups, they will be driven to custodial exchanges, which defeats the whole purpose of Bitcoin.”

According to Stadelmann, additional technical complexity can also “make things less secure rather than more secure” because systems that are too complex put users at risk of making mistakes and losing their coins.

“The vast majority of digital asset holders lack the technical expertise to use highly complex storage strategies,” he said.

“A big risk of loss is storing your Bitcoin too technically. Each individual must determine what is practical and safe,” Stadelmann added.

Chainalysis estimated that 17% to 23% of the total Bitcoin supply could be lost through private key compromises, people using the wrong network to send, damaged wallets and more.

Cryptocurrency can appear complex to the average person, often due to its association with advanced technology and sometimes complicated user interfaces, Alicia Kao, managing director at crypto exchange KuCoin told Cointelegraph.

However, she says the industry is actively working on a solution to the problem, with a shift in focus from just catering to traders, and trying to reach the general population as well.

“The key is to strike a balance — to maintain the innovative essence of cryptocurrency while making it more accessible,” Kao said.

“By simplifying complex concepts, providing user-friendly interfaces, and offering comprehensive educational resources.”

While she says it’s an ongoing process, she thinks it’s crucial to the “widespread adoption and success of this revolutionary technology.”

Phillip Lord, president of crypto tap payment app Oobit, believes many people view crypto as too complex, which has created roadblocks to mass adoption.

“For the average user, the complicated jargon, the need to understand unfamiliar concepts like wallets, keys and decentralized networks, and the fear of losing assets due to usage error create significant friction,” he told Cointelegraph.

“The sheer complexity of understanding blockchain technology and how it fits into daily life has deterred many.”

A Feb. 22 survey report from key management network Web3Auth, which had 3,378 responses from Web3 users, developers and decision makers worldwide, found the learning curve and complexity to be among the top five reasons cited for avoiding the technology.

According to Lord, while early adopters and tech enthusiasts are comfortable diving into these complexities, he thinks the everyday user finds them overwhelming and unfamiliar.

Without a streamlined onboarding experience, he says many users opt out before they even get started.

“The crypto space has traditionally catered to tech-savvy individuals, leaving the average person feeling left out. This perception needs to change if the industry is to achieve widespread adoption,” Lord said.

“Crypto should not feel like a foreign concept – it should be as simple and intuitive to use as any other financial asset, and naturally integrate into users’ daily lives without requiring extensive education.”

Additional complex regulatory environments can also be a barrier

Saad Naja, CEO and founder of Web3 games and EdTech ecosystem PiP World, told Cointelegraph that some progress has been made to simplify the technology for users, with easy on and off from crypto to fiat – currencies.

However, he thinks in some areas it remains “complex and less accessible, especially onchain activities,” and the industry needs to simplify the understanding of crypto and make it more accessible to a wider audience.

“Concepts like navigating different blockchains, bridging assets and interacting with DeFi are not something the average person encounters in traditional finance, making them more challenging to grasp,” Naja said.

Naja says a lack of clear regulations can also cause confusion, with some users choosing to stay on the sidelines until the rules around the market are clearer.

In May 2023, the European Council adopted the first comprehensive legal framework for the crypto industry. Other countries and jurisdictions have been slower to create a framework for crypto.

“Regulatory environments in some regions still pose significant challenges, particularly when it comes to integration with traditional banking systems,” Naja said.

“Simplifying these processes can pave the way for smoother user experiences. Ultimately, as people encounter better technologies and more efficient solutions, natural adoption will follow.”

Naja says education will play a crucial role, but it must go beyond long tutorials and dense documentation. Instead, the focus should be on engaging and fun interactive learning experiences.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news