[ad_1]

MiCA will finally give crypto firms in Europe clear rules of the road to follow – but it could potentially threaten the dominance of the world’s largest stablecoin issuer.

December 30 is shaping up to be a big day in the crypto calendar.

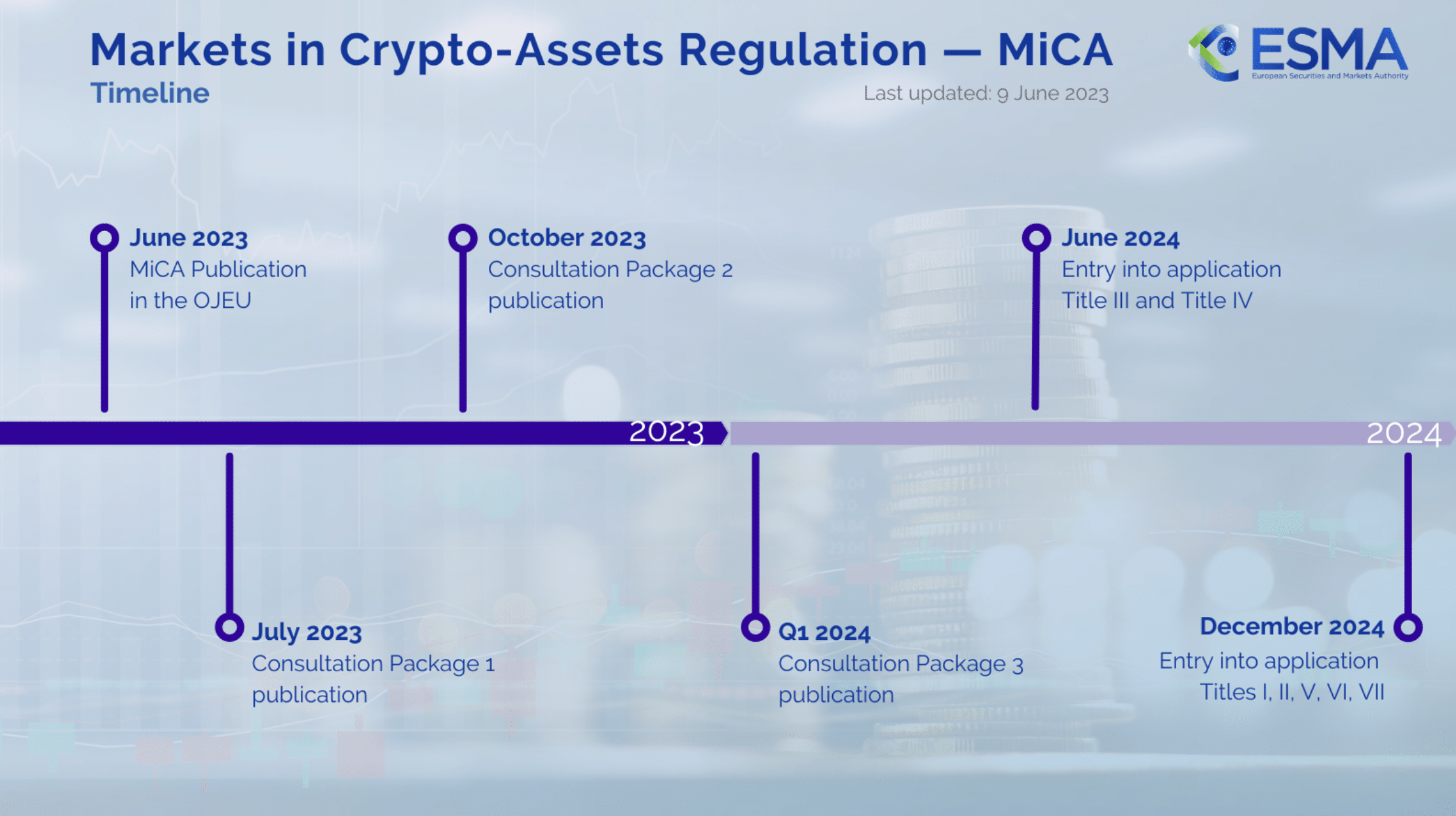

This is when the EU’s long-awaited regulation of markets in crypto-assets, otherwise known as MiCA for short, will come into effect.

The aim is to create consistent rules for the industry across the trading bloc, while providing greater protection for consumers.

Politicians have raised hopes that it will make the “Wild West” of crypto a distant memory — and it has been welcomed by firms in the space that have long craved clear rules of the road to follow.

In the past, crypto was often regulated through the prism of existing securities laws, some of which were written many decades ago.

In contrast, MiCA adapts this legislation and introduces measures specific to emerging digital assets, such as stablecoins linked to the value of fiat currencies.

It is these rules in particular that will send shockwaves through the industry, potentially threatening the dominance of the world’s largest stablecoin issuer.

Tether (USDT) is currently streets ahead of the competition with a $119.7 million market cap, and it is nearly four times larger than its closest competitor USD Coin (USDC).

But there’s a problem: Tether currently lacks the e-money license needed to operate in the EU, and it’s unclear whether its digital assets are MiCA compliant.

Meanwhile, Circle – which issues USDC as well as its euro-focused counterpart EURC – managed to achieve compliance after securing a license in France.

Complicating matters for Tether relates to how achieving compliance would mean holding a much larger portion of the reserves in traditional bank accounts rather than treasuries, potentially eating into the company’s profit margins.

In July, the company revealed that its direct and indirect exposure to Treasuries stood at $97.6 billion – far larger than major economies including Germany and Australia. This led to a falling net profit of $5.2 billion between January and June.

Coinbase has previously confirmed that it will delist non-sufficient stablecoins across Europe before this December 30 deadline, in what could be a major blow to Tether unless it gets its paperwork in order.

But that’s just one facet of how Europe’s crypto industry is evolving as MiCA looms.

The winners and losers of MiCA

Marina Markezic is the co-founder and executive director of the European Crypto Initiative, which aims to help industry players make their voices heard in Brussels. She told crypto.news that MiCA is an important step forward that positions the trading block favorably compared to other markets, saying:

“There is a vibrant crypto industry in the EU, with stable, growing companies serving EU citizens for years now. Compared to other markets, the crypto industry in the EU is not a homogenous concept due to of the fragmented regulation coming from member states. Before MiCA, there was no unified understanding of what a cryptoasset is, let alone what a cryptoasset service is and how it should be regulated.”

Markezic explained that there is “a trend of consolidation in the crypto sector due to these new regulations.” Not only have we seen some high-profile acquisitions, with Robinhood acquiring Bitstamp, but “extensive legal obligations and formal requirements” mean many businesses operating in the region are now the same.

“As we have expected since we saw the first draft of MiCA in 2020, the incumbents and the big players will benefit the most from MiCA, with the burden being too great for smaller entities, effectively crippling their operations and forcing them to to fundamentally rethink. their services and overall existence.”

The European Crypto Initiative believes that greater levels of clarity are needed on some of MiCA’s requirements – and question marks remain for stablecoin issuers and exchanges.

“There is also a lot of uncertainty around the basic principles, such as which activities are regulated and therefore within the scope of MiCA. One such example is projects that offer services in a decentralized manner without any intermediaries.”

But despite all this, Markezic maintains that the EU is blazing a new trail for crypto – and is not suffering from the paralysis seen across the Atlantic, with the Securities and Exchange Commission accused of running a adopt “regulation by enforcement” approach.

“Currently, the EU offers much more clarity in terms of its regulatory approach to crypto compared to many other jurisdictions, and especially compared to the US. The ongoing uncertainty about whether or not assets such as Ethereum and Bitcoin will be considered securities, is a brilliant example of this – in the EU these questions are answered thanks to MiCA.

Markezic says applications around the tokenization of real assets are currently a particularly hot-button topic in the EU – and this emerging technology, along with stablecoins, amounts to the most compelling use cases for crypto across the region.

Of course, the likes of Tether and Circle may soon have competition in the form of an EU-wide central bank digital currency. Brussels is still considering whether to start one, and as in other jurisdictions, concerns have been raised that such a CBDC could harm consumer privacy and be used as a tool for surveillance.

“The digital euro topic is incredibly politically charged, so it’s unlikely to be resolved anytime soon. What is clear, however, is that blockchain will not be used in the development and execution of the project, significantly reducing the broader interest in it from the crypto industry.

The next two-and-a-half months are shaping up to be fast and furious as crypto firms gear up for MiCA – and as the EU is home to 450 million people, the regulation will have an indelible impact on investors from Croatia to Cyprus, Spain to Sweden, and Germany to Greece.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news