[ad_1]

Leading on-chain analyst James Check, commonly known as Checkmatey, recently delved into the intricacies of Bitcoin’s market dynamics, providing a detailed on-chain data analysis that sheds light on the forces driving Bitcoin prices. His latest insights highlight a period he describes as “quiet and trending”, suggesting robust fundamentals despite significant sell-side pressure and shifts in volatility.

Bitcoin follows the staircase-step-rally-consolidation-rally pattern

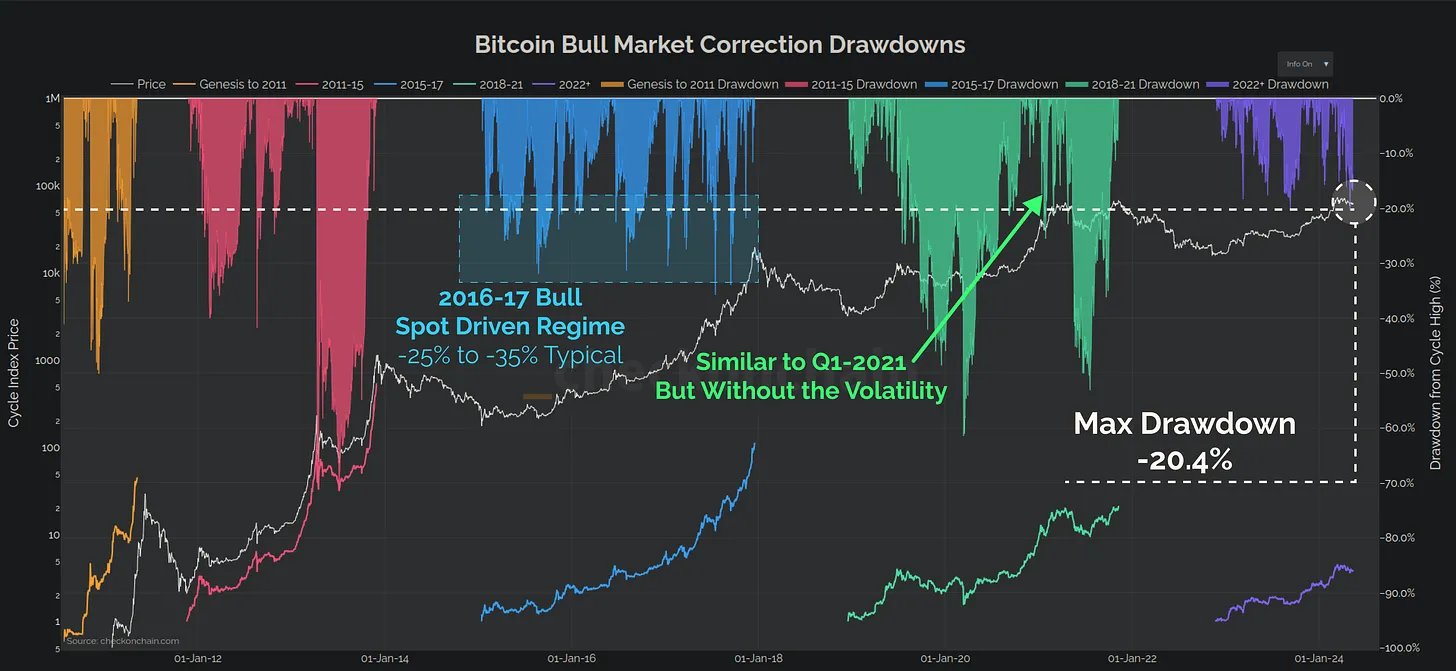

Since December, Bitcoin has experienced significant sell-side pressure, with more than 1.5 million BTC being sold. “About 30% of this came from GBTC, but the rest of it was good old fashioned profit taking,” Check explains. Despite such significant market sell-offs, Bitcoin has shown resilience with a relatively modest price correction of just -20%. This suggests that the fundamental support levels for Bitcoin are stronger than surface level market movements might imply.

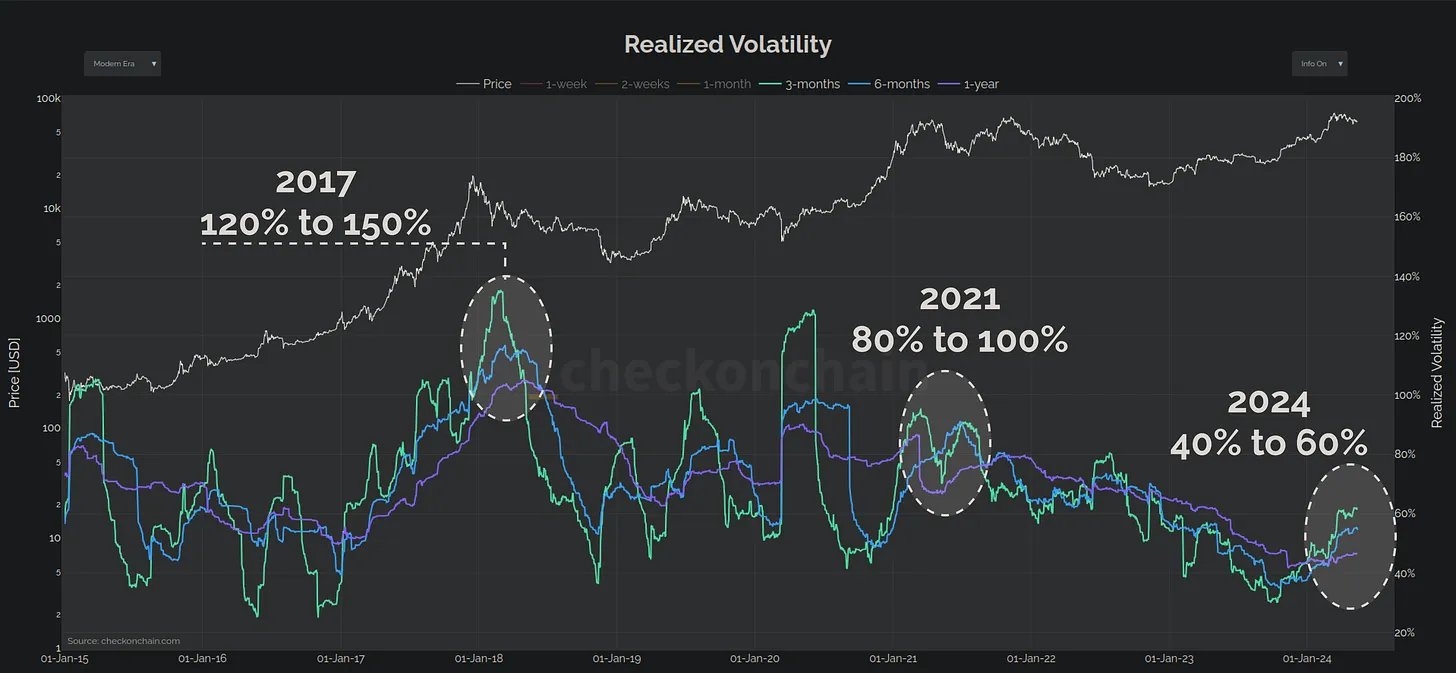

A striking aspect of Check’s analysis is the transformation in Bitcoin’s volatility profile. “The overall realized volatility profile for Bitcoin is half of what it was in 2021, and 3x smaller than 2017,” Check says. This trend indicates a growing maturity within the Bitcoin market, reflecting its evolution into a more stable asset over time compared to its early years.

Check contradicts the typical narrative surrounding Bitcoin’s volatility: “However, what many people forget is that Bitcoin is volatile. Volatility to the upside is good!” He claims that the current increase in volatility is moderate and suggests that the market is still in the early stages of a bull run, rather than nearing its end.

Related reading

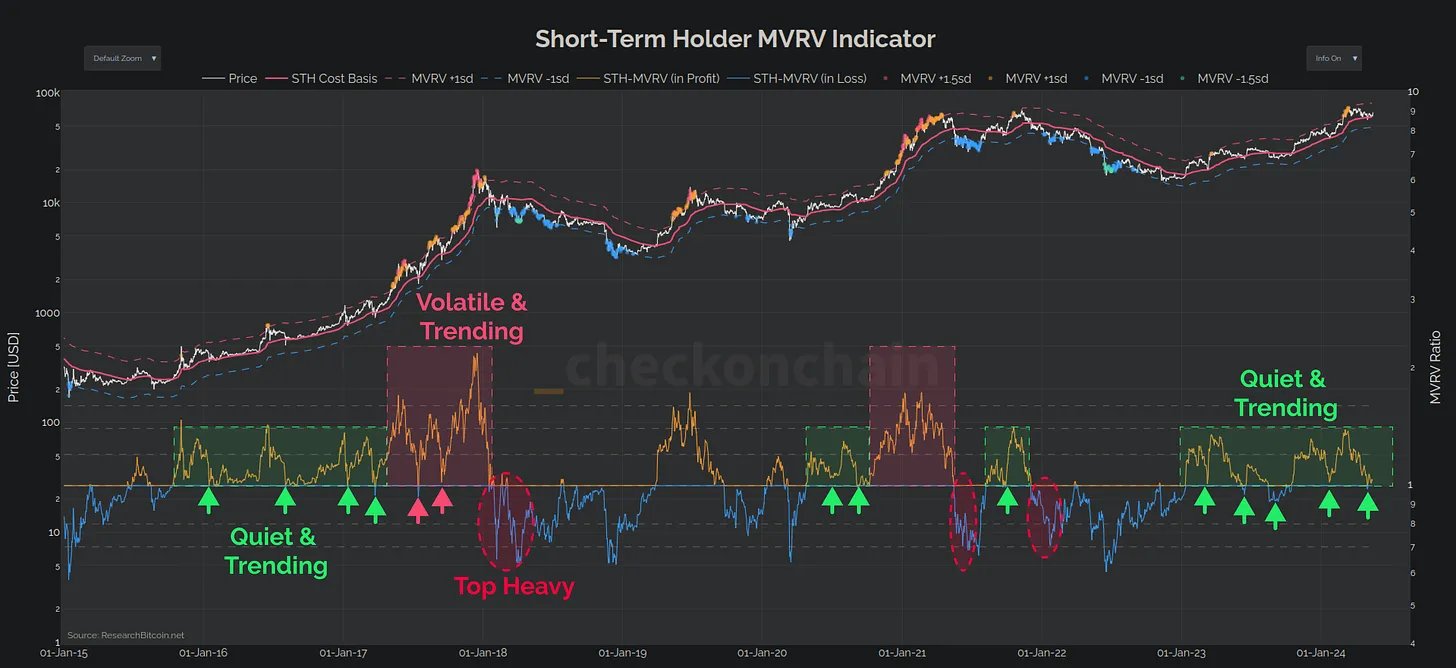

A critical tool in Check’s analysis is the Short-Term Holder MVRV (STH-MVRV) ratio, which he uses to measure market sentiment and phases. According to Check, this ratio consistently finds support at 1.0 and resistance at 1.4 during stable uptrends. Stability is maintained as long as the ratio remains within these limits. “Only when it breaks above this ceiling do things become unstable,” Check notes, which could signal a transition to bearish conditions.

Despite the selloff that brought Bitcoin to $57,000, Check notes that it did not significantly hurt the profitability of short-term holders. “The magnitude of unrealized loss was very much in line with bull market corrections, calming fears of a top-heavy market.”

Related reading

He further emphasizes that several of the local top buyers panicked and sold their Bitcoin at the lows, an action he interprets as beneficial for the correction phase, which serves to stabilize the market by shaking out weak hands.

Expanding on his analysis, Check refutes the criticism that Bitcoin’s volatility makes it a less viable asset. He points to a chart comparison of Bitcoin’s 30-day volatility against top-performing US stocks, showing that Bitcoin’s volatility is within a manageable range.

Furthermore, he discusses the lower realized volatility of the SPY index, attributing it to the “out-of-size performance of the Magnificent-7,” which is balanced by the weaker performance of the other components.

By highlighting the structural aspects of the current “Quiet and Trending” market phase, Check offers a refined perspective on how Bitcoin is navigating its maturation path, balancing between its speculative origins and its potential as a mainstream financial asset.

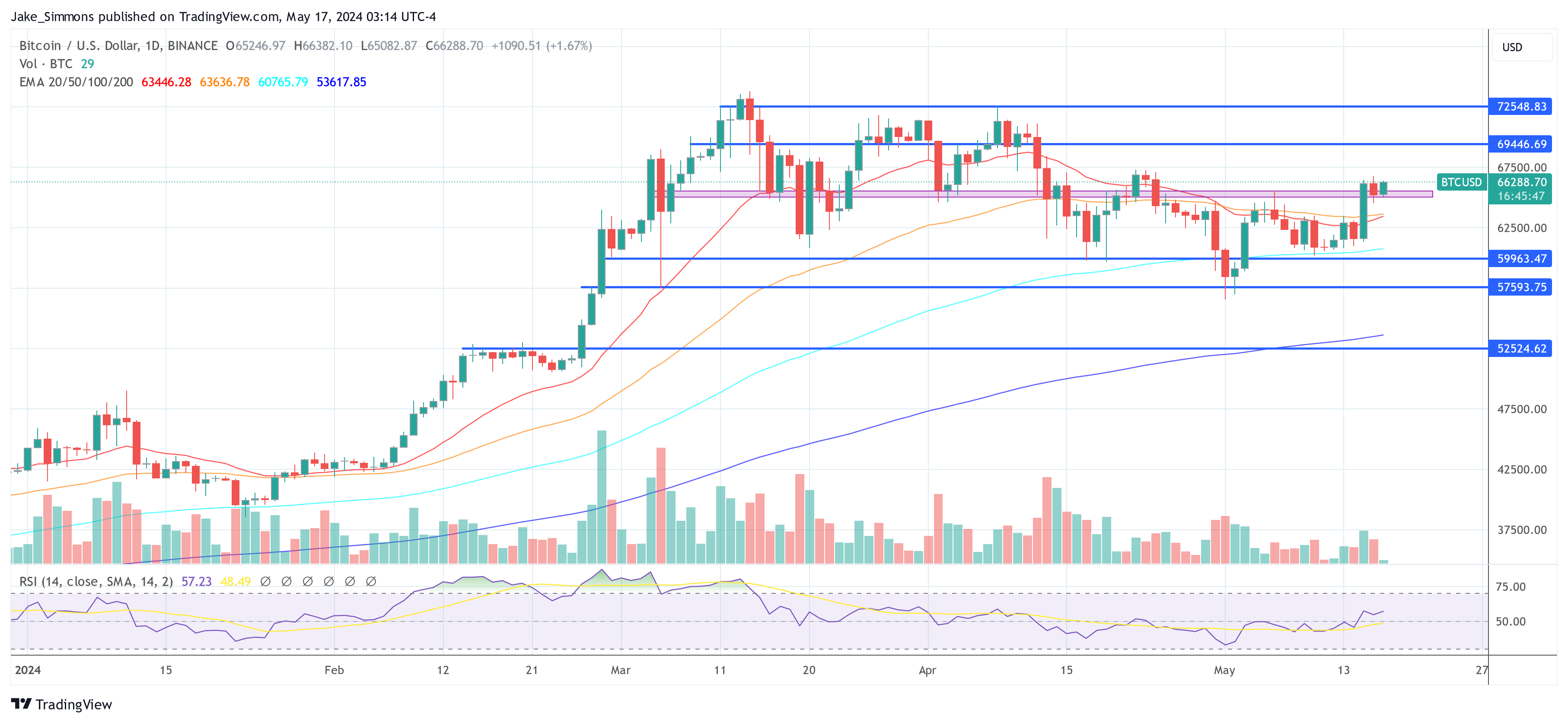

He concludes: “Overall, the Bitcoin uptrend in 2023-24 looks quite structured, following a step-step-rally-consolidation-rally pattern. However, as the charts above show, volatility tends to increase during ‘ pick up a consolidation, and that can lead to instability.”

At press time, BTC was trading at $66,288.

Featured image created with DALL·E, chart from TradingView.com

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news