In a recent interview, BlackRock CEO Larry Fink discussed the future of cryptocurrencies, specifically Bitcoin and Ethereum, and their role in the financial system.

His insights provide a clear perspective on the future of digital currencies and tokenization.

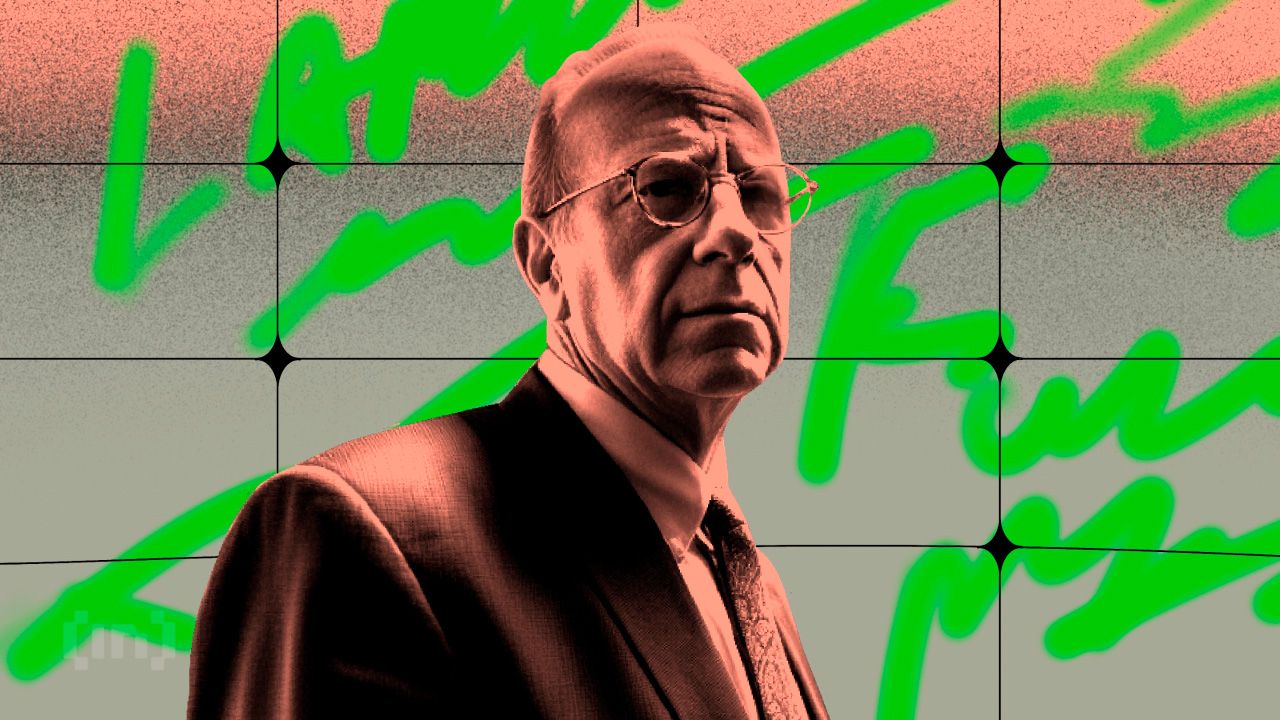

Larry Fink, CEO of BlackRock, talks about Crypto

Larry Fink, who previously expressed skepticism about Bitcoin, has acknowledged a significant shift in his stance. About two years ago, he became a firm believer in Bitcoin as an alternative source of wealth.

Despite this, he does not see Bitcoin or other cryptocurrencies as currencies per se, but rather as asset classes. Fink emphasized the finite nature of Bitcoin and drew a parallel with gold, a traditional safe-haven asset. In his view, Bitcoin, like gold, serves as a protective asset class, especially in times of geopolitical risk.

“I am a believer because I believe it is an alternative source of wealth. I do not believe [Bitcoin] will ever be a currency. I believe it is an asset scratch. But we will create digital currencies and we will use the blockchain,” Fink said.

The BlackRock CEO also discussed the recent launch of Bitcoin ETFs, describing them as crucial steps towards broader adoption and integration of digital currencies in the financial markets. The ETFs, he believes, are just the beginning of a technological revolution in financial markets.

Fink’s vision extends to the idea that ETFs will eventually transform every asset class, with the ultimate step being the tokenization of assets.

According to Fink, tokenization is a significant technological advance that could revolutionize how assets are handled. It involves converting rights to an asset into a digital token on a blockchain. Therefore, he sees it as a future where transactions are recorded instantly, and ownership can be transferred seamlessly, improving efficiency and transparency in the financial system.

“We have the technology to draw today. Having a signed security and identity creates it all together when you buy or sell an instrument on a general ledger. You want to talk about money laundering issues. It eliminates all corruption by having a tokenized system,” Fink explained.

Bitcoin ETFs and Ethereum ETFs

In addition, BlackRock aims to embed ETFs deeply into its operations, viewing it as the first step in a broader technological revolution. Fink commented positively on the inflows seen with the launch of Bitcoin ETFs, indicating strong interest from investors.

Indeed, he sees it as an indication of a growing market and the potential for new customer bases interested in digital currencies and asset classes.

Addressing the competition with other funds such as Greyscale, Fink highlighted the fee differential, suggesting that over time people will gravitate towards more cost-effective options. This is a crucial point in the broader context of investment strategies, where fees play a significant role in long-term returns.

Read more: This is how to invest in Spot Bitcoin ETFs

When asked about the possibility of other cryptocurrency ETFs, such as Ethereum, Fink acknowledged the potential but refrained from making definitive statements. He highlighted the regulatory challenges and the need for approvals from bodies such as the SEC. However, he sees these developments as a step towards a more defined future.

“I see value in having Ethereum ETFs. These are stepping stones in the direction of tokenization. And I really believe that’s where we’re going,” Fink said.

In conclusion, Larry Fink’s insights reveal a significant shift in the financial industry’s approach to cryptocurrencies. With a focus on technological advancements such as ETFs and tokenization, BlackRock’s vision under Fink’s leadership is set to play a pivotal role in shaping the future of digital currencies and asset management.

Disclaimer

In compliance with the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news