[ad_1]

Chainlink (LINK), ImmutableX (IMX), NEO, KAVA and MultiversX (EGLD) are all altcoins that have interesting developments in December, which may affect their price.

The month of November was positive for the cryptocurrency market. This was especially visible in the first half of the month. The five altcoins below could garner even more attention in December.

Chainlink (LINK) Strike Allows Early Access

Price: $14.79 Market Cap: $8.235 billion Rank: #12

Chainlink Staking v0.2 was launched this year. The priority migration was on November 28, only available to existing v0.1 LINK players. Addresses eligible for early access will be able to play on December 7th while strike will open to the public on December 11th.

Strike v0.2 will build on the existing foundation from v0.1, offering greater flexibility, improved security, a dynamic reward mechanism and modular architecture.

The LINK price has fallen since hitting a high of $16.58 on November 11th. The decline led to a low of $12.86 six days later.

The price has since increased in a move supported by the Relative Strength Index (RSI). Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, while readings below 50 suggest the opposite.

The RSI jumped at 50, creating a hidden bullish divergence (green), which is considered a sign of trend continuation.

If the LINK price continues to rise, the next resistance will be at $18.30, created by the resistance trend line of an ascending parallel channel. An upward movement of 22% is needed to achieve this.

Despite this bullish LINK price forecast, a close below the November 17 low of $12.86 (red) would invalidate the bullish score. In that case, the LINK price can drop by 27% to the channel’s support trend line.

Read more: Best Upcoming Airdrops in 2023

ImmutableX (IMX) releases new mainnet

Price: $1.28 Market Cap: $1,606 billion Rank: #39

ImmutableX launched its zkEVM Testnet in August, aiming to become the home of games on Ethereum. More than 50 games have already committed to building on the zkEVM. The Testnet upgraded from Polygon Edge to Geth in November, and the mainnet will launch in December.

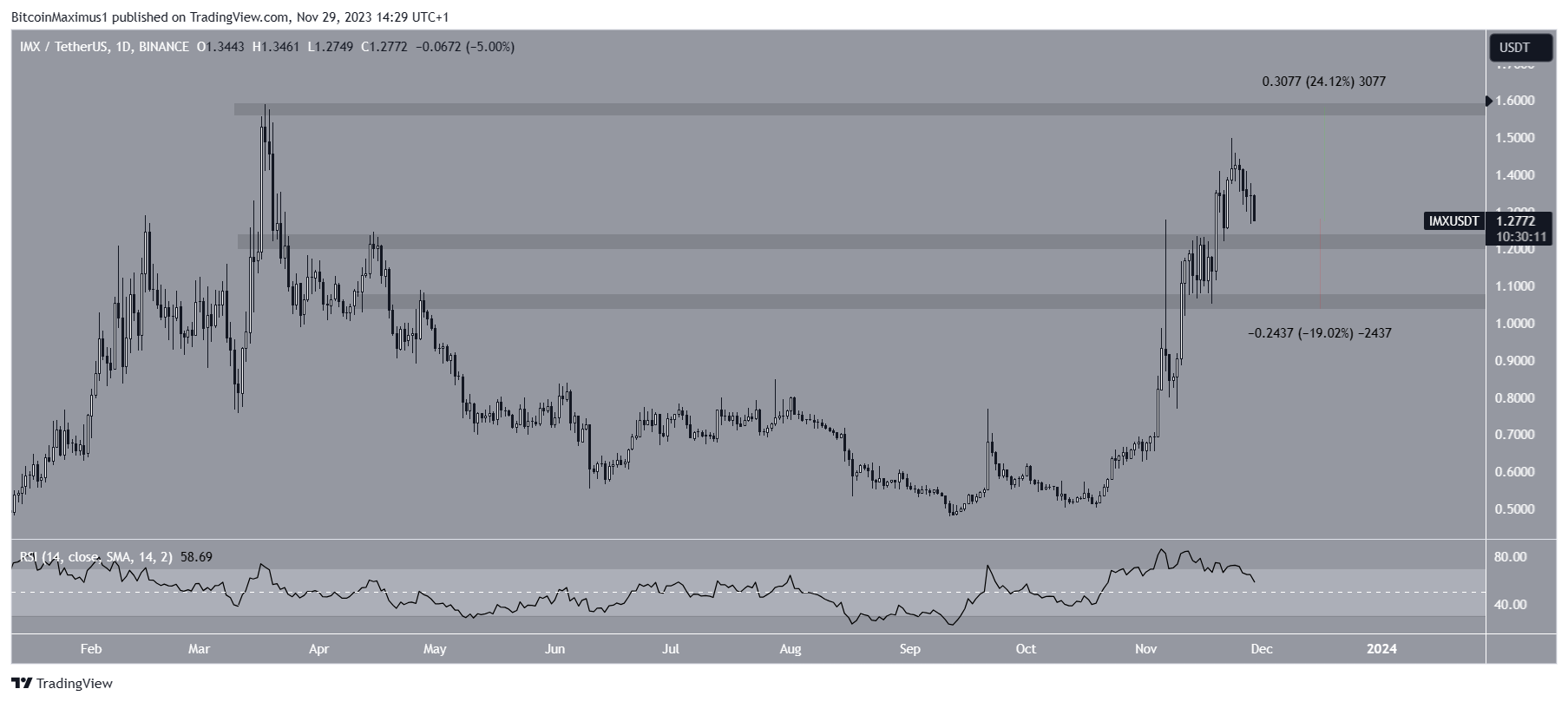

The IMX price has risen rapidly since the beginning of November. The price surge culminated on November 23 with a high of $1.50.

While the price has since fallen slightly, it is trading above the $1.20 horizontal area, which is now expected to provide support.

If the IMX price bounces, it could rise 24% to the next resistance at $1.60.

Despite this bullish IMX price forecast, a daily close below the $1.25 area could lead to a 20% drop to the next closest support at $1.

NEO Upgrades Mainnet

Price: $10.84 Market Cap: $764.286 million Rank: #65

NEO upgraded its testnet on November 21st and will upgrade its mainnet on December 4th. The new upgrade will provide several improvements and optimizations.

The NEO price has been increasing rapidly since the breakout of a descending resistance trendline on October 26. The upward movement peaked at $15.46 on November 5.

However, the price could not sustain its upward movement and created several long upper wicks (red icons), which are considered signs of selling pressure.

Despite the decline, the NEO price is trading above the main horizontal support area at $10. If it bounces, it could move up by 35% and reach the resistance area of $14.50.

Despite this bullish NEO price forecast, a close below the $10 area could trigger a 30% drop to the next support at $7.50.

Read more: Best Crypto Signup Bonuses in 2023

MultiversX (EGLD) Strikers Vote for Management Proposal

Price: $43.36 Market Cap: $1,138 Billion Rank: #50

EGLD supporters vote for the first protocol management proposal. Voting began on November 23 and will continue until December 3. So far, nearly 98% of participants have voted in favor of the Sirius 1.6 protocol upgrade, which includes improvements such as optimized consensus signature checks, advanced voting, and multi-key support for chain shards.

The EGLD price broke out of a long-term descending resistance line in October, peaking at $53.45. While the price has subsequently declined, it is still trading within the $43 horizontal support area. As long as this happens, the trend remains bullish.

If the price resumes its rise, it could rise by 45% and reach the next resistance at $63.

On the other hand, if EGLD closes below the $43 area, it could drop by 25% and confirm the long-term descending resistance trendline.

Read more: 9 Best Crypto Demo Accounts for Trading

KAVA Closes Out December Altcoins to Watch

Price: $0.765 Market Cap: $747.165 Million Rank: #68

The final December altcoin is KAVA. KAVA 15 will be launched on December 15. While there isn’t much information about its upgrades, the team held an AMA on November 29 to discuss new developments.

The KAVA price broke out of a descending resistance trendline on October 20. It has increased rapidly since then. The upward movement led to a high of $0.87 on November 11.

Although the KAVA price subsequently declined, it is still trading above the $0.70 horizontal support area. As long as this happens, the most likely future prospect is a 30% increase to the next resistance at $1.

Despite this bullish KAVA price forecast, a close below the $0.70 area could lead to a 25% drop to $0.57.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Click here for BeInCrypto’s latest crypto market analysis

Disclaimer

In accordance with the Trust Project Guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimers have been updated.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news