[ad_1]

Despite the wild price action the cryptocurrency market went through today – where bitcoin saw its value jump above $9,000 before quickly falling to $8,000 – the charts can help determine where some of the highest market cap altcoins are headed road is

Dash

Dash went through a month-long consolidation period from April to May. During this time, it traded within a $21 range between $112 and $133. A bullish impulse allowed DASH to break above this range and rise to $177.

On the 3-day chart, dash found resistance around $172 and could not move higher than this level. If it can break above that, the bar could rise to the next resistance point around $210. If you don’t trade above $172, it may reduce speed to find support at $153 or $133.

Dash can be seen trading above the 7-day MA on the 1-day chart, which is a bullish sign. If it continues to trade above this moving average, the bullish trend will continue.

A break below the 7-day MA could take a dash to test the 30 or 50-day MA, between $145 and $135.

There is a bearish engulfing pattern developing on the 12-hour chart on the upper Bollinger Band, which is a bearish sign. A drop to the middle (21 MA) or lower band can be expected based on this time frame. The bearish formation will be invalidated if dash trades higher than $176.

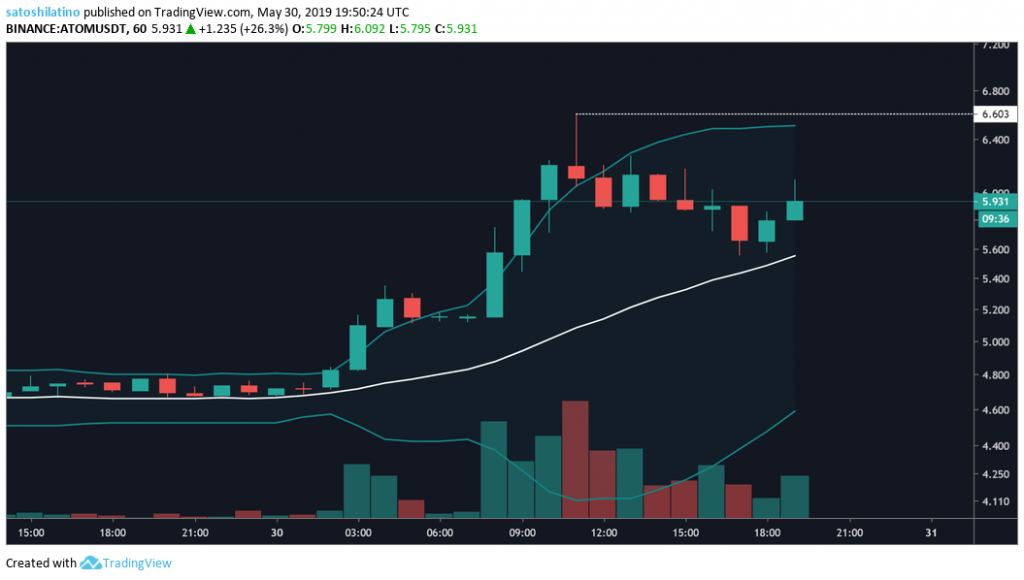

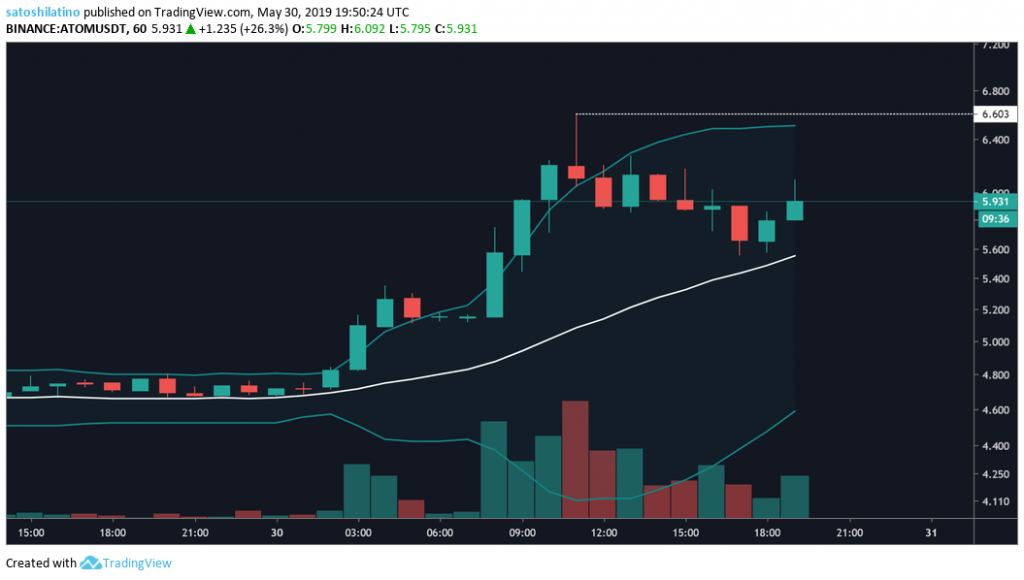

Cosmos

Cosmos was released in the market at the end of April, so there is not enough data for a long-term analysis. However, based on the 4-hour chart and the 1-hour chart, a short-term forecast for this cryptocurrency is possible.

A bull flag could form on ATOM’s 4-hour chart. The bullish pattern predicts a 22 percent move down once the flag is broken, which is given by the length of the flagpole.

Nevertheless, the bull flag will be invalid if Cosmos moves below $5.2.

On the 1-hour chart, after reaching the upper Bollinger band, Cosmos returned to the middle band and took off. Now that the price is moving upwards again and a double top can be expected which could send the market valuation of ATOM back to $5.4 or $4.8.

However, if this cryptocurrency can break above $6.6, the bullish trend could strengthen and push it to higher highs.

NO

After a bullish engulfing candlestick formed around $0.047, NEM bounced and reached the $0.1 resistance level. A move above this level could take it to $0.12 or $0.15, based on the 3-day chart.

To the downside, XEM could find support between $0.08 and $0.072 or continue to decline to $0.056.

A double top can be formed on the 1-day chart. This is considered a bearish reversal pattern that developed after NEM reached a high of $0.1 two consecutive times. A pullback to the 50-day moving average can be expected, but if the bearish trend is strong, XEM may drop to the 200 or 100-day moving average.

The bearish pattern will be invalidated if NEM trades higher than the most recent high of $0.123.

On the 12-hour chart, the major resistance point is at $0.1. Since XEM could not close above this level, a pullback to the 50-MA, which sits around $0.0.74, can be expected.

Nevertheless, if the volume starts to increase and this cryptocurrency is able to break past resistance, it could reach new yearly highs.

Bitcoin Diamond

Over the past two days, bitcoin diamond has surged more than 80 percent, from $0.99 to $1.8 breaking past three levels of resistance. The significant rally experienced by BCD could see it drop back to $1.4 or $1.2 to consolidate before the bullish trend continues, based on the 3-day chart.

An ascending triangle formation appears to have developed on the 1-day chart. BCD was able to move higher than the 40 percent target given by the bullish pattern. Now this cryptocurrency may find a trading range before its next big move.

Digibyte

Digibyte has been trading within a massive rising parallel channel since December 2018, hitting higher highs and higher lows which is a bullish sign. Currently, this cryptocurrency is trading at the top of the channel, so a move to the middle or bottom of the channel can be expected. The most likely retracement point could be $0.014. However, if DGB can break above the parallel channel, it could experience a strong bullish impulse.

The TD Sequential Indicator gave an imperfect green nine candlestick, which is a bearish signal. If confirmed, digibyte could drop to test the support trendline at $0.012. The sell signal will be invalidated if a green two trades above a green one candlestick on the 1-day chart, which could take DGB to new yearly highs.

On the 12-hour chart, digibytes can be seen trading below the 7-moving average indicating that a correction could be coming. If DGB continues to move down, it may try to test the 30 or 50-MA, between $0.0145 and $0.013. Conversely, if this cryptocurrency can trade above the 7-MA again, the bullish trend will continue.

Overall sentiment

The market may undergo a sustained correction after the significant rise in prices that most cryptocurrencies have had. The pullback can be viewed as a profit period that has the potential to open the doors to a stronger bullish trend.

It is worth noting that in 2015, bitcoin went through a bull fall that took its price down to test its previous low. This is a bearish pattern that misleads investors into believing that a new bullish trend has begun, when in fact, after reaching a certain high, the market goes back to test new lows.

[ad_2]

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news