Charles Edwards, founder of the Bitcoin and digital asset hedge fund Capriole Investments, has published a detailed examination of Bitcoin’s current market phase that suggests a bullish trajectory that may reach the $100,000 mark. The analysis depends on the identification of a Wyckoff ‘Sign of Strength’ (SOS), a concept derived from the century-old Wyckoff method that studies supply and demand dynamics to predict price movements.

Understanding the Wyckoff ‘SOS’: Bitcoin to $100,000?

The Wyckoff Method, developed by Richard D. Wyckoff, is a framework for understanding market structures and predicting future price movements through the analysis of price action, volume and time. The ‘Sign of Strength’ (SOS) within this methodology indicates a point where the market is showing evidence that demand is overwhelming supply, indicating a strong bullish outlook.

Edwards’ observation of an SOS pattern in Bitcoin’s recent price movements suggests that the market is at a pivot point, where sustained upward momentum is highly likely. In Capriole’s latest newsletter, Edwards presented a precise depiction of Bitcoin’s market behavior, highlighting a period of volatility and consolidation in the $60,000 to $70,000 range.

This phase was anticipated by the hedge fund. Currently, as Bitcoin ventures above its last cycle’s all-time highs, it is aligned with the predicted zig-zag SOS structure. Edwards explained, “It would not be surprising to see liquidity at/to all-time highs […] All consolidation above the Monthly level at $56K is extremely bullish. It would be unusual (but not impossible) for price to continue in a straight line.”

The “zig-zag” phase also aligns perfectly with the halving cycle, as BTC tends to consolidate “both months on either side of the Halving”. Edwards added that “the reality of a much lower supply growth rate + unlocked pent-up trade demand will then kick in and begin 12 months of historically the best risk-reward period for Bitcoin.”

From a technical perspective, Bitcoin’s foray into price discovery territory is above $70,000 without significant resistance levels. This opens a path to psychological and Fibonacci extension levels, with Edwards identifying $100,000 as the next major psychological resistance.

The 1.618 Fibonacci extension from the 2021 high to the 2022 low is noted at $101,750, which serves as a technical marker for potential resistance. Reflecting on investor sentiment, Edwards says, “You can also imagine quite a few investors would be happy to see six-figure Bitcoin and profit in that zone,” acknowledging the psychological impact of such milestones.

BTC Fundamentals support the Bull case

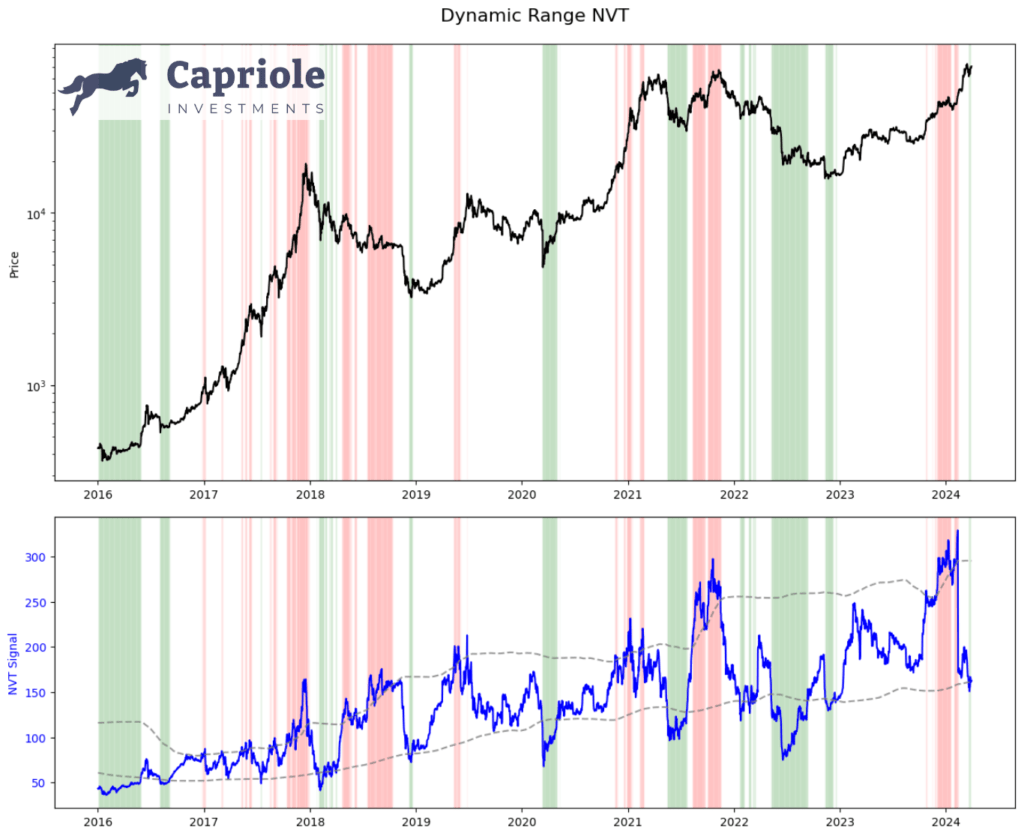

Edwards also delves into the importance of fundamentals, highlighting their role in providing a bullish backdrop for Bitcoin. The introduction of the Dynamic Range NVT (DRNVT), a metric unique to Capriole, indicates that Bitcoin is currently undervalued. Edwards describes DRNVT as “Bitcoin’s ‘PE ratio,'” which assesses the network’s value by comparing the throughput of transactions through the chain to market capitalization.

The current DRNVT readings indicate an attractive investment opportunity, given Bitcoin’s undervaluation at all-time price highs. “What is fascinating at this point in the cycle is that DRNVT is currently in a value zone. With price at all-time highs, this is a promising and unusual reading for the event ahead in 2024. That’s something we didn’t see in 2016 and we haven’t seen in 2020,” Edwards noted.

With both technical indicators and fundamental analysis pointing to a bullish future for Bitcoin, the anticipation surrounding the upcoming Halving event adds further momentum to the positive outlook. Despite the expectation of near-term volatility and consolidation, Edwards says confidently, “probabilities are starting to shift to the upside again.”

At press time, BTC was trading at $69,981.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news