Bitcoin has been on an upward trend since hitting a local low below $25,000 on September 11. Yesterday’s rally to $27,435 marked a 10% increase from the recent low. As NewsBTC reported, the rally was largely led by the futures market and a massive increase in open interest of more than $1 billion, more than half of which was washed out as BTC fell back below $27,000. Despite this, BTC is about 7.5% higher than last week’s low. A reason to be bullish?

Glassnode report sheds light on market sentiment

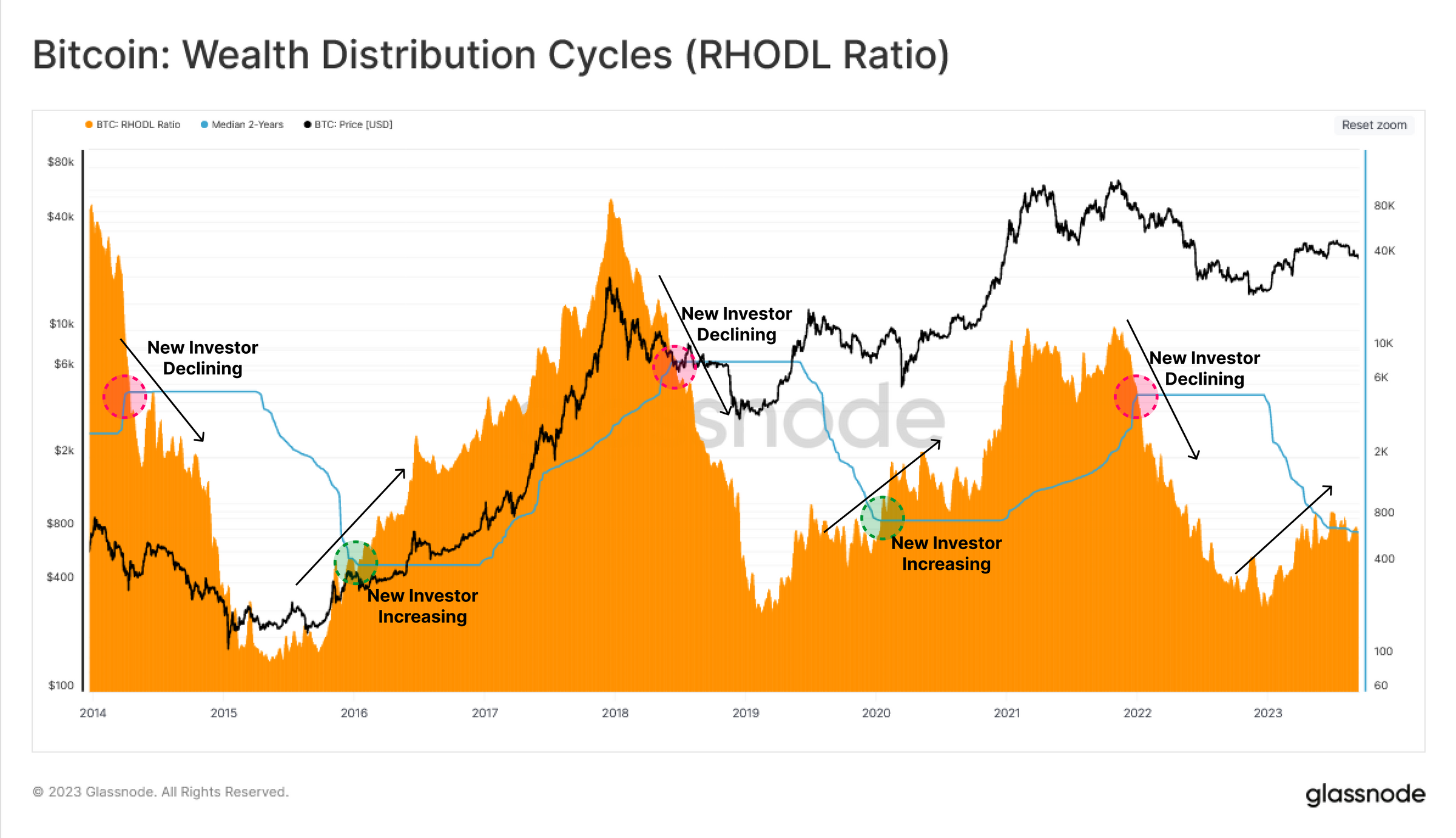

According to Glassnode, the realized HODL ratio (RHODL) serves as an important market sentiment indicator. It measures the balance between investments in recently moved coins (those held for less than a week) and those in the hands of long-term HODLers (held for 1-2 years). The RHODL ratio for the year 2023 flirts with the 2-year median level. Although this indicates a modest inflow of new investors, the momentum behind this shift remains relatively weak.

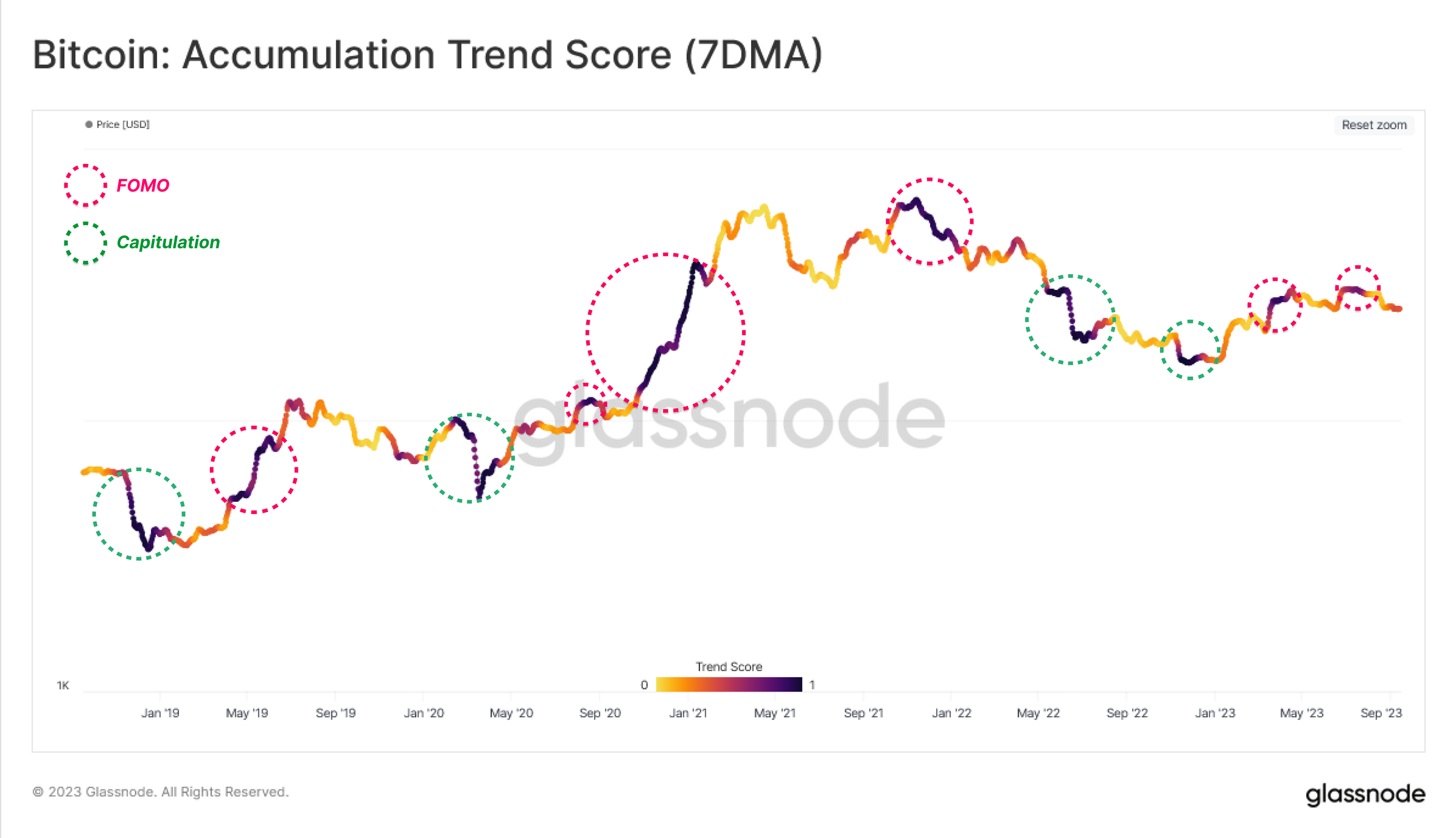

Glassnode’s accumulation trend statement further expands on this trend. This shows that the current recovery rally from 2023 has been significantly influenced by investor FOMO (Fear of Missing Out), with noticeable accumulation patterns around local price tops above $30,000. This behavior contrasts sharply with the latter half of 2022, where newer market entrants showed resilience by accumulating Bitcoin at lower price levels.

The realized profit and loss indicators also reveal a complex picture. These metrics measure the change in value of used coins by comparing the acquisition price to the selling price. In 2023, periods of intense coin accumulation were often accompanied by increased levels of profit-taking. This pattern, which Glassnode describes as a “convergence,” is similar to market behavior seen in peak periods of 2021.

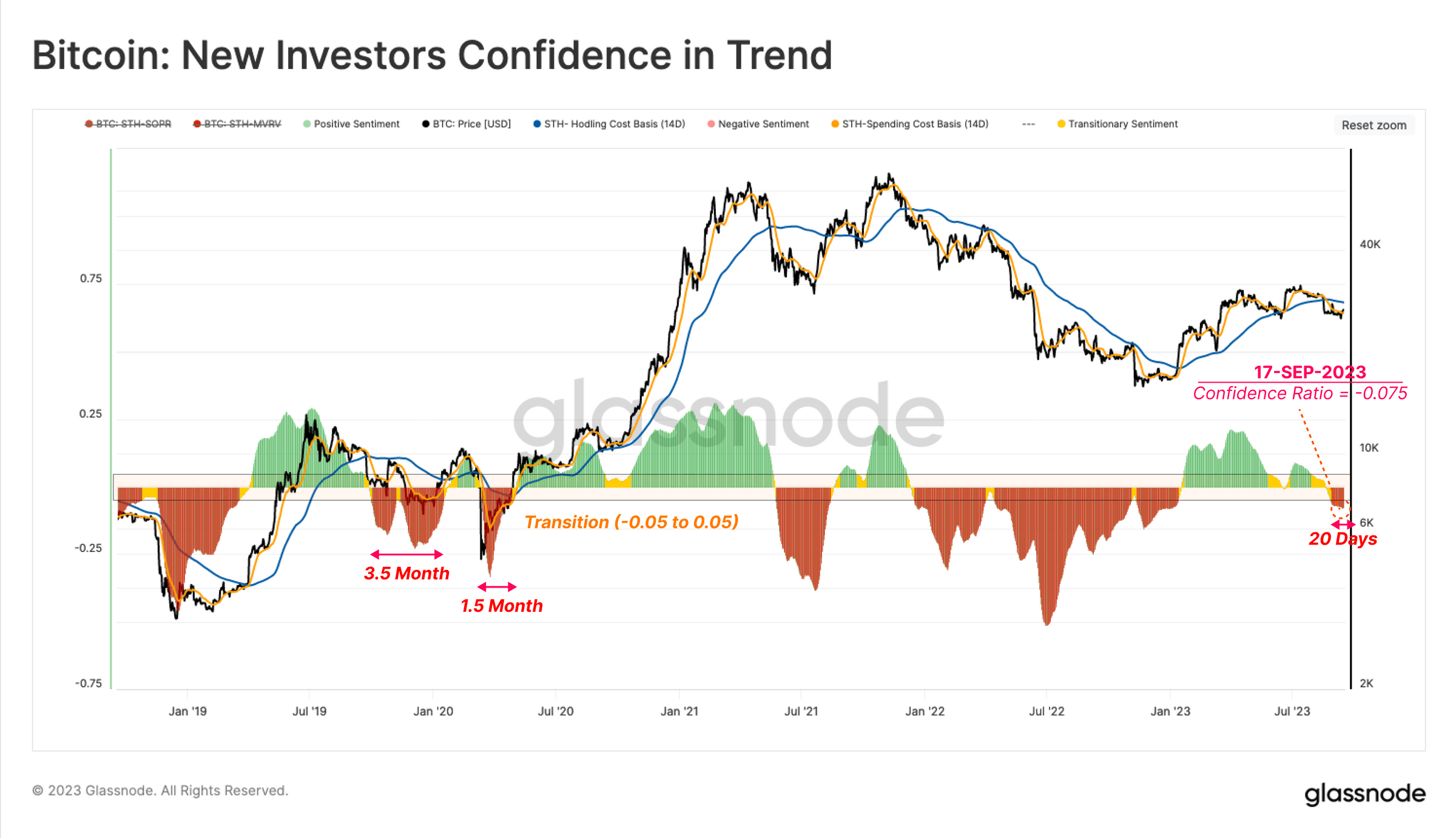

An assessment of Short Term Holders (STH) reveals a precarious situation. A staggering majority, over 97.5% of the supply sourced by these newcomers, are currently operating at a loss, levels not seen since the infamous FTX debacle. Using the STH-MVRV and STH-SOPR metrics, which quantify the extent of unrealized and realized gains or losses, Glassnode explains the extreme financial pressures recent investors have grappled with.

Market confidence remains low

The report also delves into the area of market confidence. A close examination of the difference between the cost base of two investor subgroups – spenders and holders – provides an indication of the prevailing market sentiment. As the market dropped from $29k to $26k in mid-August, an overwhelmingly negative sentiment was evident. This manifested as the cost base of spenders fell sharply below that of holders, a clear sign of prevailing market panic.

To provide a clearer visualization, Glassnode has normalized this metric relative to the spot price. An important observation is the cyclical nature of negative sentiment during bear market recovery phases, which usually last between 1.5 and 3.5 months. The market recently plunged into its first negative sentiment phase since 2022’s close.

Currently, the trend lasts 20 days, which could mean that the end has not yet been marked by the recent rally, if history repeats itself. However, if there is a sustained bounce back into positive territory, it could be an indication of renewed capital inflows, indicating a return to a more favorable attitude for Bitcoin holders.

Finally, Glassnode’s on-chain data reveals a Bitcoin market currently in a state of flux. Although new capital entered the market in 2023, the influx does not have strong momentum. Market sentiment, especially among short-term holders, is decidedly bearish. These findings suggest that caution remains the watchword, with underlying market sentiment offering mixed signals about the sustainability of the current Bitcoin rally.

At press time, BTC was trading at $26,846 after rejecting the 23.6% Fibonacci retracement level (at $27,369) in the 4-hour chart.

Featured image from iStock, chart from TradingView.com

Disclaimer for Uncirculars, with a Touch of Personality:

While we love diving into the exciting world of crypto here at Uncirculars, remember that this post, and all our content, is purely for your information and exploration. Think of it as your crypto compass, pointing you in the right direction to do your own research and make informed decisions.

No legal, tax, investment, or financial advice should be inferred from these pixels. We’re not fortune tellers or stockbrokers, just passionate crypto enthusiasts sharing our knowledge.

And just like that rollercoaster ride in your favorite DeFi protocol, past performance isn’t a guarantee of future thrills. The value of crypto assets can be as unpredictable as a moon landing, so buckle up and do your due diligence before taking the plunge.

Ultimately, any crypto adventure you embark on is yours alone. We’re just happy to be your crypto companion, cheering you on from the sidelines (and maybe sharing some snacks along the way). So research, explore, and remember, with a little knowledge and a lot of curiosity, you can navigate the crypto cosmos like a pro!

UnCirculars – Cutting through the noise, delivering unbiased crypto news